10 practical advice in the field of investment psychology

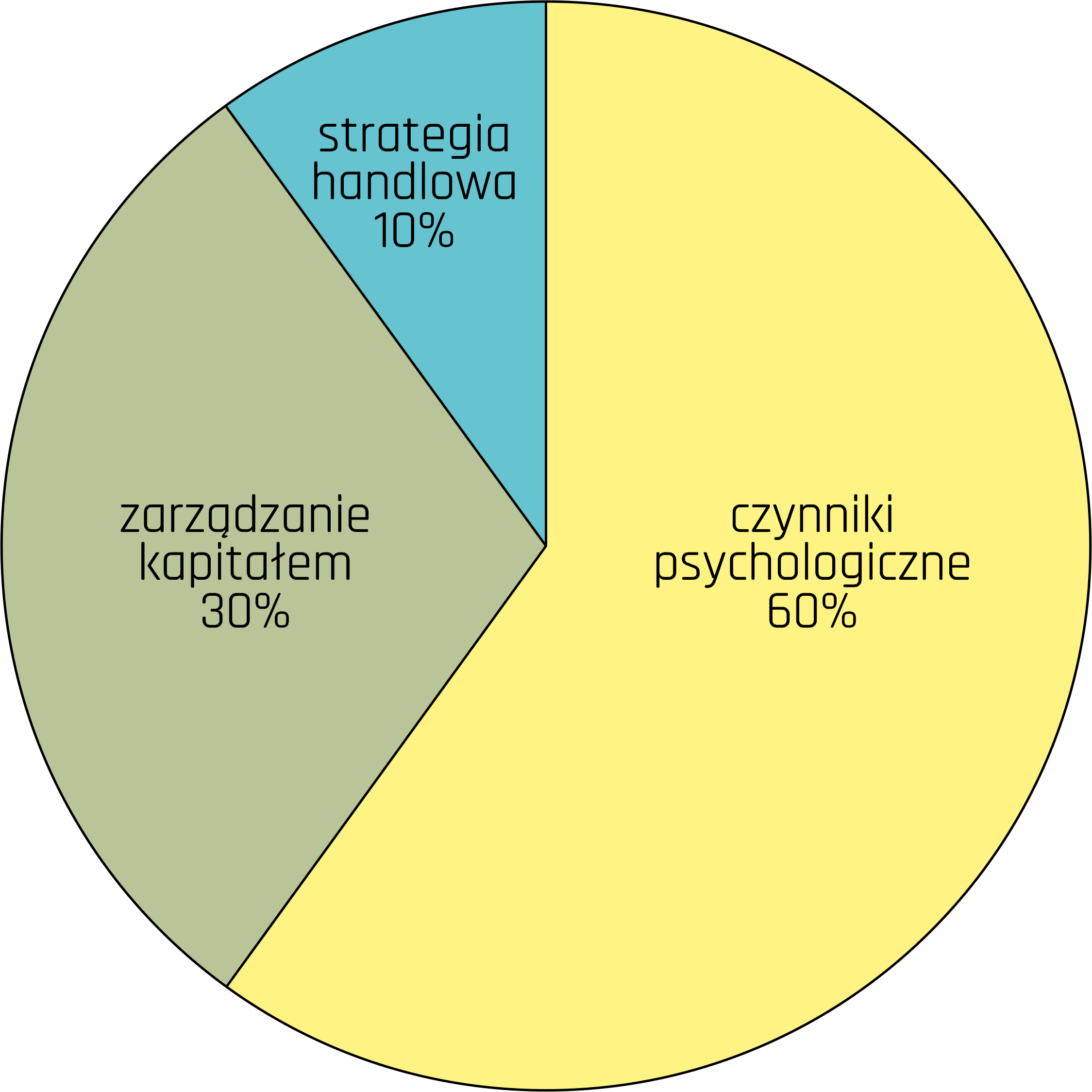

Different authors, players or trainers give different percent estimates of how much psychological factors influence the process of making investment decisions. Almost no one "values" this impact at less than 60%. Let me therefore consider these estimates as the starting point for this article.

Many famous speculators in granted interviews or biographies, each time mentioning the extraordinary role that their own psyche played in the career of a speculator. This leads us to the thesis that working on yourself and on your psychological comfort has a considerable impact on a game called Forex, for investing or speculating. Without peace of mind, without putting our thoughts in a coherent system, we can almost be sure that we will fail rather than succeed in this extremely difficult and demanding market.

Many famous speculators in granted interviews or biographies, each time mentioning the extraordinary role that their own psyche played in the career of a speculator. This leads us to the thesis that working on yourself and on your psychological comfort has a considerable impact on a game called Forex, for investing or speculating. Without peace of mind, without putting our thoughts in a coherent system, we can almost be sure that we will fail rather than succeed in this extremely difficult and demanding market.

Although the development of mental skills alone will not bring financial benefits in itself, it will undoubtedly protect us from losses and, in the long run, will protect against typical mistakes. When it comes to finances, the best teacher should not be your own experience. Reading the books, articles and investment logs of other players will allow us to avoid the unpleasant consequences of a lack of discipline.

So let's start now.

Lack of faith

It is amazingly amazing how many traders open their positions without full conviction as to the methodology by which they make their decisions. Do you sometimes think that you are theoretically convinced that your strategy is working, but there is always an element of uncertainty that does not give you peace? Have you tested your strategy (manually or automatically) even in the last year? Have you considered all the possibilities? Have you tried to look for confirmations for your strategy or have you been looking for a situation where it will not work in the second test? The research method that I mean here, in philosophy of science called falsificationism.

According to the basic definition, this is belief that for scientific theories one should not look for confirmation (verification), but counter-cases, which may be denied to the theory under examination. One should therefore strive to falsify the theory (to demonstrate its incompatibility with experience), and if the attempt fails, consider temporarily the theory until the next attempt at falsification, which for the theory can end with the overthrow. In our case, of course, we will not look for counter-examples for scientific theories, but for our investment systems. Therefore, when we go through this path, there will no longer be room for doubt.

Be sure to read: When trading turns into gambling

Flexibility

In spite of having a specific action plan, you should be able to be quite flexible within it. If, for example, you are a day-trader, the basis for starting each day should be for you to choose the markets that have the greatest potential for traffic, implementation of the targets, or filling in the appropriate formations. However, after all, if during the day something that escapes the morning plan of the day becomes something, you should fast be able to reorganize and adapt to the new situation, of course as part of its investment system. If there is relevant information for a pound and you set yourself up to play on a eurodarner, do not be afraid to change your decision. Do not fight with yourself and do not blame yourself for the fact that the market has behaved not as it is You come up with morning.

Theory and practice

"Paper plans"is a bane for us traders who build their trading strategy. Building a profitable strategy on paper is very easy, but putting it into practice virtually always meets with more or less disappointment. The problem is that when testing such strategies, the very important question of time is missing.

For example, when a certain test comes out of the test Drawdown, eg at the 15-20% level and the overall capital growth curve is satisfactory, then we accept this level of subsidence. However, the trouble arises when such a strategy is implemented and a series of losses occurs for days or weeks. When our account is literally it melts in the eyes, doubts start to appear and this is very serious.

We must always be aware that the losing days and weeks that we test underway a few moments, in fact, will be associated with a very large and long-term mental strain.

A lot or not at all

There are days or weeks when you do not see any opportunity to trade or you have big doubts as to whether and which position to open. Your decisiveness is disturbed and as a result you have two ways to choose: open the position or wait.

Sometimes fear paralyzes our mind to such an extent that we can not rationally make any decision. Admitting emotions to the decision-making process at this moment will result in losses.

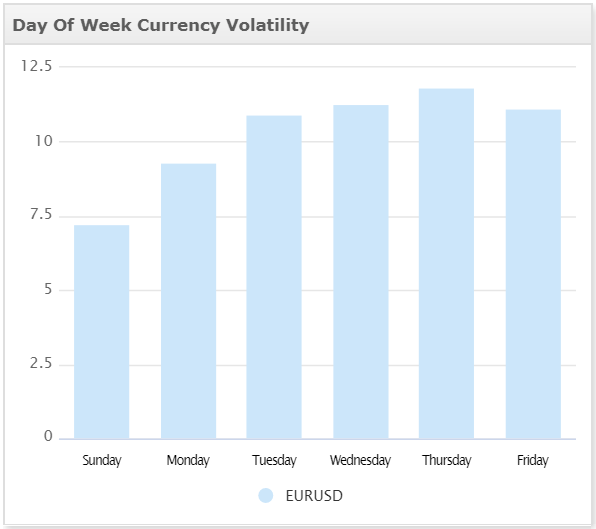

Volatility of the EURUSD currency pair on specific days of the week. Source: Myfxbook

There are times when nothing happens on the markets (most Mondays). There are also days when the movements are very big (Thursdays, Fridays). Expecting that on Monday Eurodollar market will move by 90 pips is within the limits of statistical error and opening positions with such expectations is an irrational action.

We need to adapt to the market and use its potential when it is possible. We should beware of trading based on our mood (eg boredom) or the status of the wallet (e.g. forge).

Betting with the market

How many times have you said to yourself - "5 more pips and I'm closing"? And how many times right before the assumed one take profit there was a correction and you you begged the market to come back to the last summit? Now you do not count on his raise, but let it be at least a triple peak?

Yes, I think everyone knows it and everybody will like it this way we talked with the market. The trouble is, not much when we stayed heard. Therefore, the main trade rule is "play what you see and not what you want to see". If the market does not definitely beat the last summit, do not curse him, just take what he gave you and then watch him from afar. If this peak, however, is later pierced, you will enter again in the correction.

There is another example giving the market time - "If it does not rise in an hour, I'm leaving." Whether we like it or not, sometimes such thinking appears in us. Although verbalizing such thoughts sounds like a child talking with a cup of tea, yes - every trader once tried to conjure reality in this way. Yes, I know you never did that. Me too, word!

Enough for today

How many times, seeing a satisfactory result on an open transaction, have you thought to yourself - "All I have to do is close my position and take what is"? Speculation is about always playing with risk. This occupation is highly uncomfortable for the primary parts of our brain. Man is looking for order and stability by nature. So if we have decided that we want to trade by taking risks on a daily basis and losing comfort in favor of potential profits, then let's stick to this approach to the end.

Let us trust our strategy. If we did not get the exit signal, let's not leave.

A small loss

If your market positions are too big, then despite the previously assumed stop loss, it may happen that you close your position much earlier for fear of greater losses. If you have a problem with that, then you should think about it capital management system.

Loss that is growing

If you have ever had a loss in spite of the signals to close it, you must start using it stop loss.

Taking no responsibility for trade

Assigning all credit to yourself in case of success and making excuses in case of failure is not a professional quality. We cannot excuse ourselves from work, school, home trouble or illness. These things should absolutely be taken into account when building your strategy. We will not be able to react to every signal that appears on the market - that's for sure. However, we cannot look to blame outside. The investment account belongs to us and we are fully responsible for it. After all, it is not without reason that the profession of a trader is demanding. So, if you don't draw conclusions after failure, but just look for the guilty party, change it. Nobody is to blame here. The circumstances are what they are, and we either use them or not.

Re-testing

You've created a great strategy, but you decide sleep with her. The next day you come to the conclusion that you can improve something in it and if you can, you need it. Now you give yourself time again to rethink whether you have missed something.

The problem is that some of us are so perfectionists that they can fine-tune a strategy that works for weeks.

I want to notice here that if the example strategy brings a profit of 5% per month and you have not traded for the third week because you spend time optimizing it, then this de facto optimization has brought you a loss of a few percent (no profit from trading strategy).

I am striving to make you realize that if the strategy works and brings profits, it should be implemented now. You can work on future improvements. If the work on improvement lasts a month and improve the percentage point by 1, then the balance is negative.

Another thing is that optimizing your strategy indefinitely can end with the so-called over-optimizing on historical data. And in accordance with the basic principle of investing Past performance is not a reliable indicator of future results.

Read: How to set about optimizing the machines (Expert Advisors)

I hope that the above advice will be helpful. Very often we do not realize certain things until we come in contact with them. I believe that a thorough analysis of your psyche will allow you to avoid losses in your trade.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Jason Zweig "Your brain, your money" [REVIEW] jason zweig your brain your money](https://forexclub.pl/wp-content/uploads/2022/02/jason-zweig-twoj-mozg-twoje-pieniadze-300x200.jpg?v=1644579798)

![Choose and win a book by Andre Kostolany - "Psychology of the Stock Exchange" [Competition] Stock market psychology contest](https://forexclub.pl/wp-content/uploads/2021/12/psychologia-gieldy-konkurs-300x200.jpg?v=1639400692)

Leave a Response