Adam Neumann – the man who screwed up Softbank [WeWork, part AND]

Fast growth, huge capital for growth, famous personalities from the world of finance "on board". All these factors seem to create the perfect environment to create a great company that can dominate its industry. However, what is often most important is what is invisible from the level of reports and PR messages: corporate culture, the personality of the boss, as well as the market itself and its specificity. A two-part summary of the story will be published in Forex Club WeWork and Adam Neumann. The company was supposed to revolutionize the real estate rental sector for companies and freelancers. For many years, it seemed that the company's CEO's crazy expectations for future growth were beginning to materialize. But within a few years, its value dropped from $47 billion to almost zero. What was the reason? Is it really an eccentric boss and his entourage, or maybe it is simply one of the victims of the drying up of the source of cheap money after interest rate increases in the US. We invite you to read the first part dedicated to Adam Neumann. In the next article, we will present the anatomy of the collapse of WeWork.

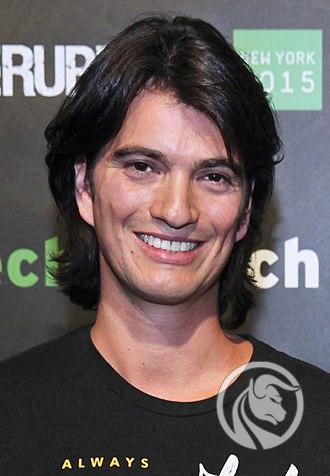

Adam Neumann and his story

In an article about a Japanese billionaire, Masayoshi Son, we mentioned that he believed much more in people than in numbers. This was also the case when Sona was convinced by the personality of Adam Neumann to invest. As it turned out later, it was one of the biggest investment mistakes made by the Japanese. This is interesting because Son has had thousands of conversations with entrepreneurs. Therefore, he should distinguish the wheat from the chaff without any obstacles. However, this time it didn't work out. Who was Adam Neumann and what impact did he have on the development of WeWork? Adam is an eccentric personality who said he wanted to live forever and become the president of the whole world in the future. He had no shortage of ambition.

Dyslexic, illiterate and a kibbutznik

Adam Neumann was born in 1979 in the Israeli city of Beersheva. For those interested in football, the name is rather known because Haopel plays there, having played in the European Conference League with Śląsk Wrocław and Lech Poznań a few years ago. Neumann had a difficult childhood. His parents divorced when he was 7 years old, and the boy had problems with his education. He couldn't read and write until the third grade, which was explained by severe dyslexia. In his youth, he lived on a Kibbutz in the southern part of Israel. He later recalled that Judaism had a significant influence on him in his professional and personal life. Well, he certainly took a nap while learning the 10 commandments.

What Neumann's strong point was was his entrepreneurial spirit and high risk tolerance. Adam is not the type of person who makes decisions slowly after thoroughly analyzing the problem. He often listened to his intuition and was able to infect others with his enthusiasm. As it later turned out, this was an ace in the hole, thanks to which there were no closed doors for him... at least for a while.

The United States rewards the brave

Finally, Adam realized that he would have a chance to develop in the United States. As a result, he moved to New York. There he attended the Zicklin School of Business. He came up with an idea WeLive, i.e. apartments for rent with shared spaces for cooking, washing and cleaning. However, the idea presented in the entrepreneurship competition was eliminated in the second round because the jury believed it would be difficult to change the way people live. Neumann did not complete his studies immediately. He did it... only after 15 years, i.e. in 2017, when he was the CEO of an admirable company WeWork.

Zicklin logo. Source: wikipedia.org

In the USA, Neumann founded a company Krawlers, which produced children's clothing. The company offered high-quality products for children, which provided Neumann with funds to implement other business ideas. It was also a strong argument when looking for people willing to invest in the idea of his life. VC firms and business angels are much more willing to listen to people who have already created a profitable company. For an institution, such a story is the best confirmation that it is worth the risk.

How did Adam come up with the idea for WeWork? It started by accident. Krawlers was headquartered in Brooklyn, more specifically Dumbo (close to the Brooklyn Bridge). There he met a famous architect Miquel McKelvey, who also had an office there. The two became friends enough to share their life stories and business ideas. In 2008, they noticed that there was a lot of unused space in the building they were renting. They decided that they could set up a company that would rent premises at a good price (it was a time of major slowdown on the market) and then rent the space at a higher price for a short period of time. In one sentence it was the idea to take on long-term liabilities that would be repaid by short-term space rental. Risky? Surely. But back then, rental prices in the US were very low because the market environment was downright terrible. Companies went bankrupt, people lost their jobs, and many financial institutions found themselves in real trouble. It was born from the idea of two friends Green Desk, which was the progenitor of WeWork.

At the beginning of its construction, limited capital resources, the oboe spent a long time looking for a suitable building that would have everything they were looking for: location, price and high functionality. They finally found an interesting building, which was an empty warehouse on Water Street in New York. Adam immediately fell in love with this place. In turn, the warehouse owner was skeptical because he was afraid that the new tenant did not have enough experience and capital. According to his memories, he allegedly asked Adam:

“You produce children's clothes, what do you know about the real estate market?”

To this Neumann was supposed to answer:

“Your building is empty. What do you know about the real estate market?”

Ultimately, the tenant signed the contract and Neumann's adventure on the real estate market began.

Neuman as CEO of the company: a time of development and events

Adam Neumann. Source: wikipedia.org

In 2010, WeWork was established and raised capital from Brooklyn real estate developer Joel Schreiber. The investor paid $15 million for 33% of the shares in the company. The developer was convinced by the vision of a refined office space that was to have a uniform standard regardless of the city or country. In addition, WeWork planned to build a community “WeWorkers” and monetize them with additional services.

The first premises became a real hit on the market. The reason was that they were well designed and the company had a very good marketing department. The company's offer met the expectations of people just like Adam, i.e. young entrepreneurs who wanted to conquer the world. Such people did not want to read long contracts for renting space that were not flexible enough. Another disadvantage of many offices was that... they were not aesthetic, which discouraged young entrepreneurs from renting them. Therefore the first WeWork buildings became iconic objects. People competed for an empty seat. This was also due to the specific atmosphere prevailing in those places. The gathering of many people who had similar views on the world created great conditions not only for running a business, but also for building a network of contacts. You could say it was like that “stationary LinkedIn”.

After the initial success, Adam wanted to develop the business further. Very quickly he decided to expand his business to the largest cities in the United States. The problem was the lack of money, which resulted from the company's business model. Initially, WeWork incurred huge costs related to adapting the building. Then it took from several to a dozen or so months to fill the building. Therefore, the repayment period was initially 18 months. Customers usually did not pay "in advance" for several months, but settled their obligations on an ongoing basis. This means that initially the company lost money, which it was supposed to recover with interest "in the future". Capital, specifically hundreds of millions of dollars, was needed to realize Neumann's vision. How to convince investors that WeWork is a great investment idea, completely different from the "boring" real estate industry? Adam came up with a brilliant idea: WeWork works as a SaaS, i.e Space as a Services. It was a reference to SaaS (Software as a Service) companies, which were very fashionable in the second decade of the 21st century. WeWork didn't rent space, no. It offered work space combined with plenty of amenities and the potential to monetize customers. The client didn't rent a desk, other boring companies did that. At WeWork, this was the person he was becoming member of the community, which was unique. Many investors bought this vision, including Softbank, and not just anyone. This Japanese investment holding company was known for having a keen eye for many successful startups. As the saying goes, Softbank has entered “roughly”. In 2017, Softbank and Vision Fund invested $4,4 billion in WeWork. After a dozen or so months, he paid another $2 billion, at a valuation of... $47 billion. For the record - At that time, the company did not even generate $3 billion in revenues.

Investors were certainly convinced by Neumann's enormous self-confidence. He was the type of showman who could captivate crowds of people. Secondly, it worked FOMO effect. In the years 2010 - 2019, many start-ups were created that achieved billions of capitalizations. The golden children include: Uber, airbnb, Shopify. Each of them started operating as a start-up and, even though they were not initially profitable, they gave shareholders huge profits in subsequent financial rounds. Many VC funds were desperately looking for companies with at least a moderate probability of success. For Neuman, this market environment was a godsend. He could easily find investors willing to invest in his technology real estate company. Having Softbank on board since 2017 only facilitated the increase in the company's valuation, which peaked in 2019.

Unfortunately, although Neumann was a great salesman and speaker, he was not very good at scaling the company and managing employees. His behavior towards his subordinates became legendary. Some investors did not like the corporation's extravagant management style. For example, several employees were to be fired because Neumann's partner did not like them after a few minutes of conversation "aura". Also, not everyone was happy with the fact that when the company announced a 7% reduction in jobs, Adam Neumann organized an integration meeting.

Gulfstream GS650. Source: wikipedia.org

Neumann was the undisputed star in the following years, but in 2018 the first cracks in his image began to appear. In 2018, he traveled from the United States to Israel on a chartered Gulfstream G650 jet. According to The Wall Street Journal, Neumann and his friends spent the flight smoking marijuana. The plane's crew found a box with green herbs, and the owner of the jet decided to return to the USA. As a result, Adam Neumann reportedly had to book a separate flight from Israel to the United States.

Ultimately, Neumann was asked to resign from his position because some investors did not like the "baby" position as CEO. On September 29, 2019, The Wall Street Journal reported that some WeWork directors (linked to financial investors) asked Adam Neumann to step down as CEO.

The problem was also that when carrying out IPO In 2019, various interesting things came to light. For example, some of the properties rented by WeWork belonged to... our hero. Is this a theoretical conflict of interest? Not necessarily, but the disgust still remained. However, the real hit was the creative extraction of money from the company. For example: WeWork was to change its name to We, the rights to the name and logo were purchased from We Holdings for $5,9 million. The whole matter is made more interesting by the fact that the owner of We Holdings was, among others,… Neumann. Now let's think about it: you are a millionaire, maybe even a billionaire. Do you really need to take out money this way? Can't you just ask the supervisory board for a raise or a performance award? Ultimately, the CEO was forced to reverse the transaction. Finally, on September 24, 2019, Adam Neumann resigned and was succeeded by Artie Minson and Sebastian Gunningham.

Sick leave and a new life

However, it is not easy to fire a person who has a large share of voting rights (Neumann had voting preference shares). Ultimately, the departure of WeWork's founder cost a lot. Pursuant to the agreement, he received almost $300 million (including, among others, for consulting services). In addition, Softbank agreed to buy back part of Neumann's shares in the event of an IPO. This happened in 2021. He received over $480 million in cash for the block of shares. According to Bloomberg calculations, After leaving the company, Adam Neumann earned approximately $770 million. Not bad for a company that became worthless just two years after its IPO. Therefore, it can be said that the former CEO of WeWork negotiated hard with Softbank and managed to earn more from the company than the Japanese investment holding company. This is quite an achievement.

After his adventure with WeWork, Adam Neumann did not stop looking for investors who would believe in his skills and want to start cooperation with him. Quite interesting information appeared on the Internet in 2022. Then Andressen Horowitz (a very famous fund) invested in Neumann's new company. It was him Flow, which was active in the real estate market. In the same year, information appeared that Adam was behind Flowcarbon, which is a startup operating as a platform dedicated to tokenizing carbon credit trading. Will the new projects turn out to be another flop? Or will Neumann prove that the WeWork story is an accident at work? We'll see in a few years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework.jpg?v=1711728724)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] forex loss series](https://forexclub.pl/wp-content/uploads/2019/04/seria-strat-forex-102x65.jpg)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] Swiss franc](https://forexclub.pl/wp-content/uploads/2020/01/frank-szwajcarski-102x65.jpg?v=1579947471)

Leave a Response