National Investor Survey 2023. How does Kowalski invest?

Once again, the results of the National Investor Survey, organized every year by the Association of Individual Investors, were presented. 4546 people took part in the study, and the report itself provided us with a lot of information regarding the preferences and characteristics of the Polish investor.

The investor profile remains unchanged

Over 92% of respondents are men, nearly 80% have higher education, on average they are about 40 years old, work full-time (62%) or run their own business (23,8%). Experience? Half of them have not been investing for longer than 5 years, and in this respect there has been an upward trend since the trough marked in 2017 (i.e. there are more and more new, less experienced investors).

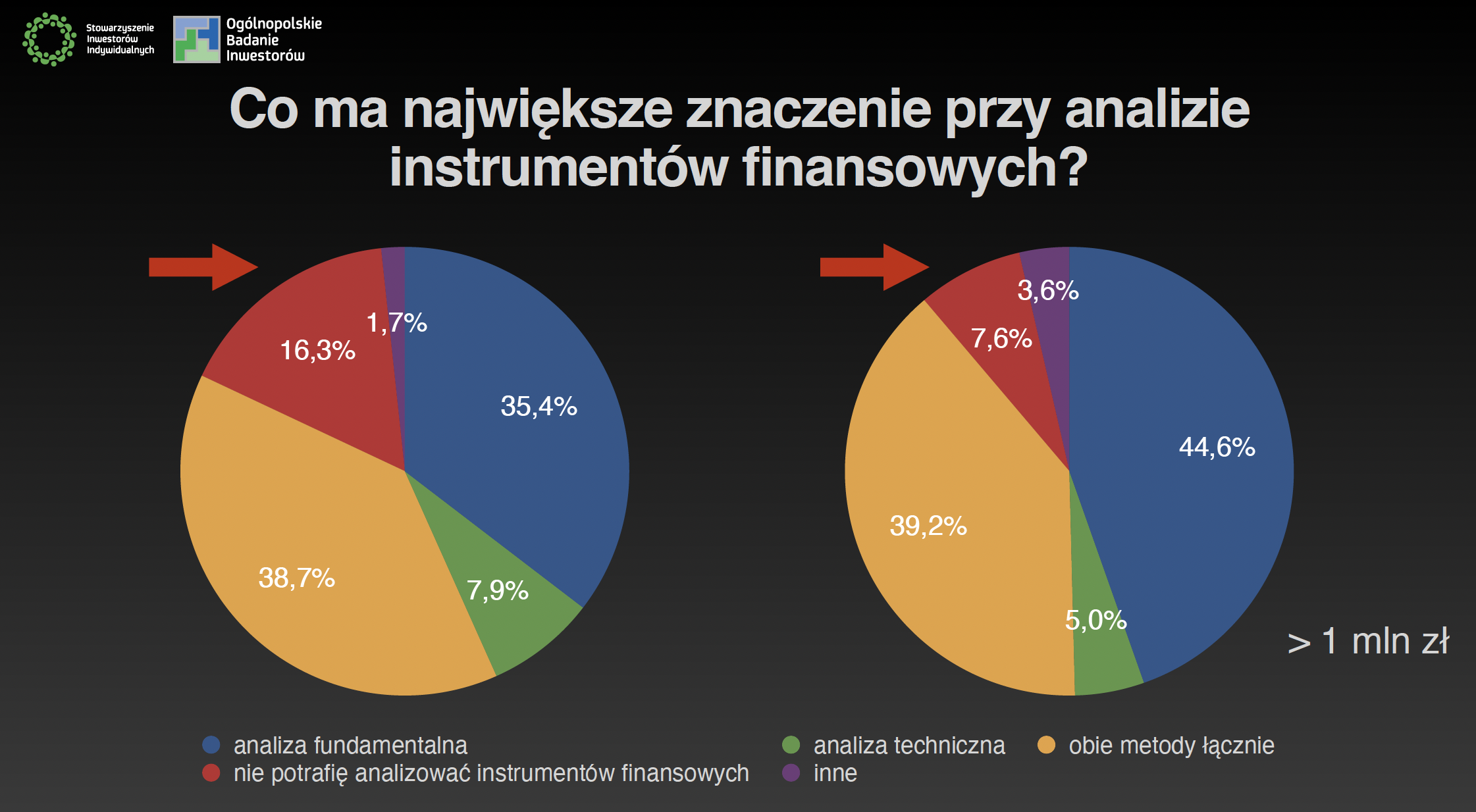

Technical or fundamental analysis?

This is an eternal dilemma for investors. However, contrary to appearances, the survey results show that AT has become a thing of the past and is, at best, treated as a supplement to AF. What's even more interesting is that more respondents admit that they cannot analyze instruments than that they use technical analysis alone.

Additionally, it is clear that AT has been steadily losing popularity over the last decade. In 2015, 21,4% of people used it, now it is only 7,9%.

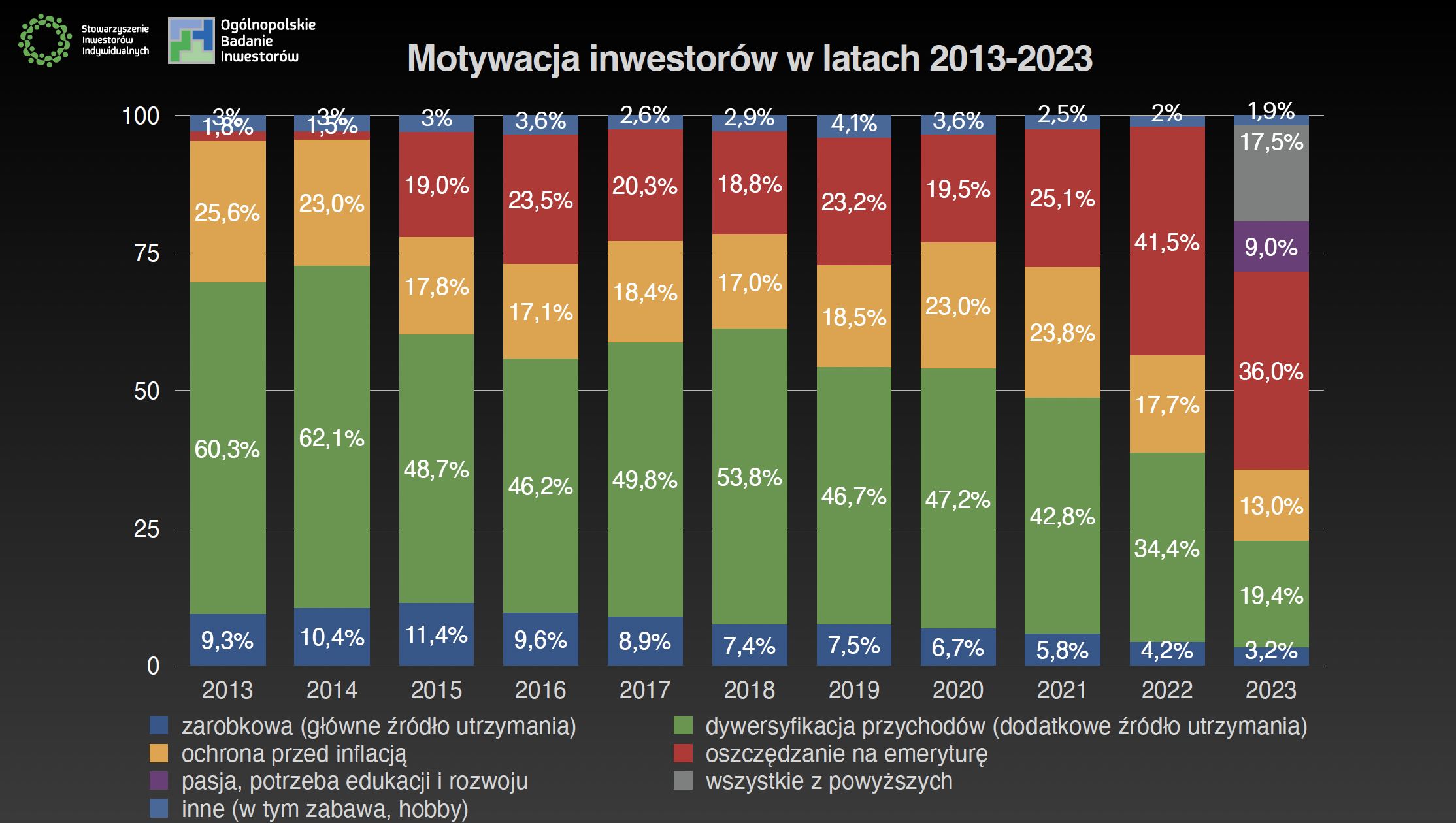

Why do we invest?

The main investment motivation of respondents turned out to be retirement (36%), while revenue diversification accounts for only 19,4%. Does the Polish investor not believe in the Polish pension system? 🙂 And this is also confirmed by data from previous years, where exactly 10 years ago, revenue diversification accounted for over 60%, and the retirement goal was less than 2%.

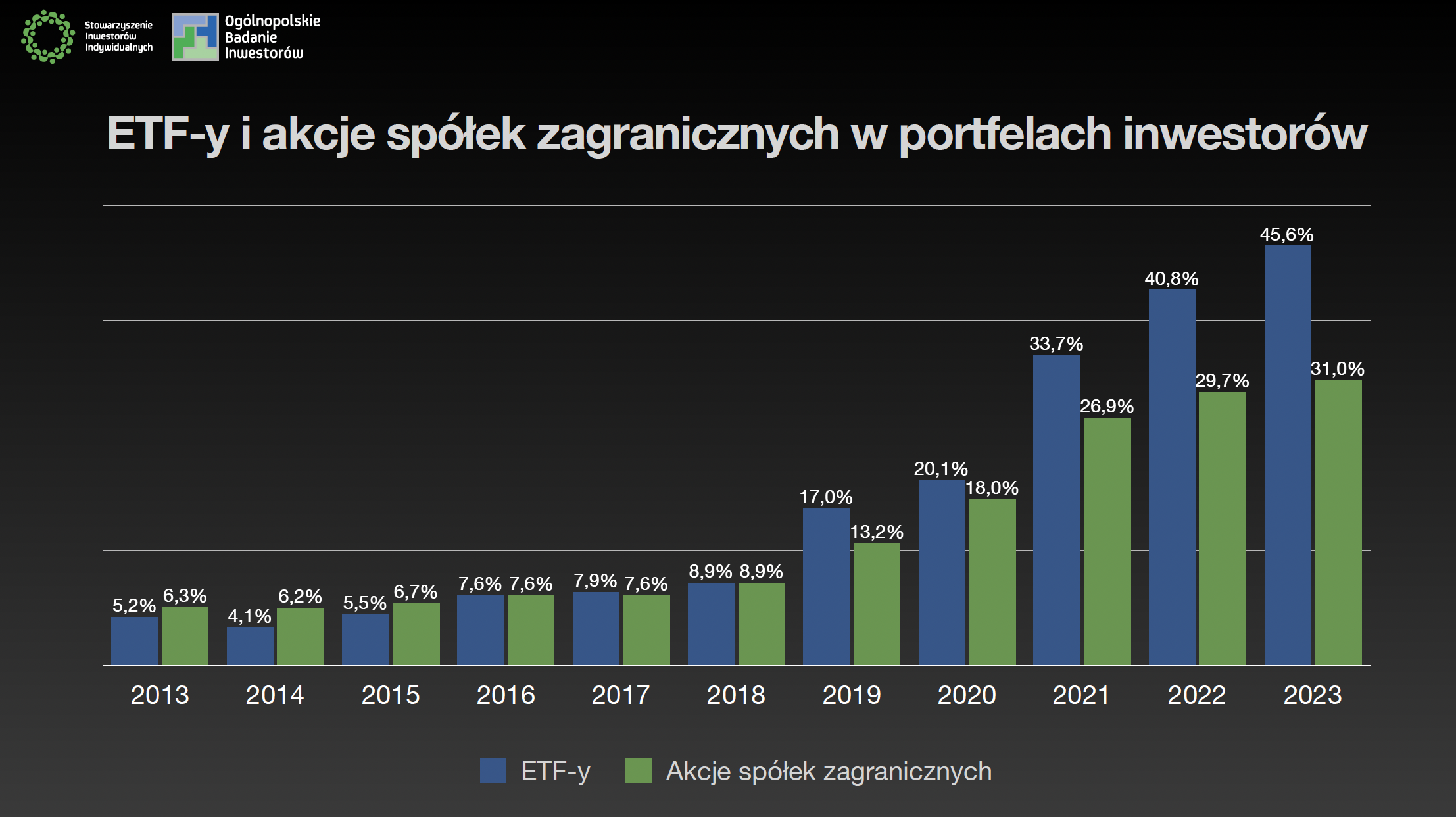

It is also worth noting that the investment portfolio is "swelling". Years ago, portfolios worth up to PLN 50 dominated. zloty. Now it is in the range of 100-500 thousand. zloty. The effect of experience gained, or maybe inflation? Of course, the most popular instrument are shares, but there is an incredible tendency to increase market involvement through ETF instruments. The passive revolution is in full swing. 50% of respondents declared that they had 2-3 ETFs in their portfolio.

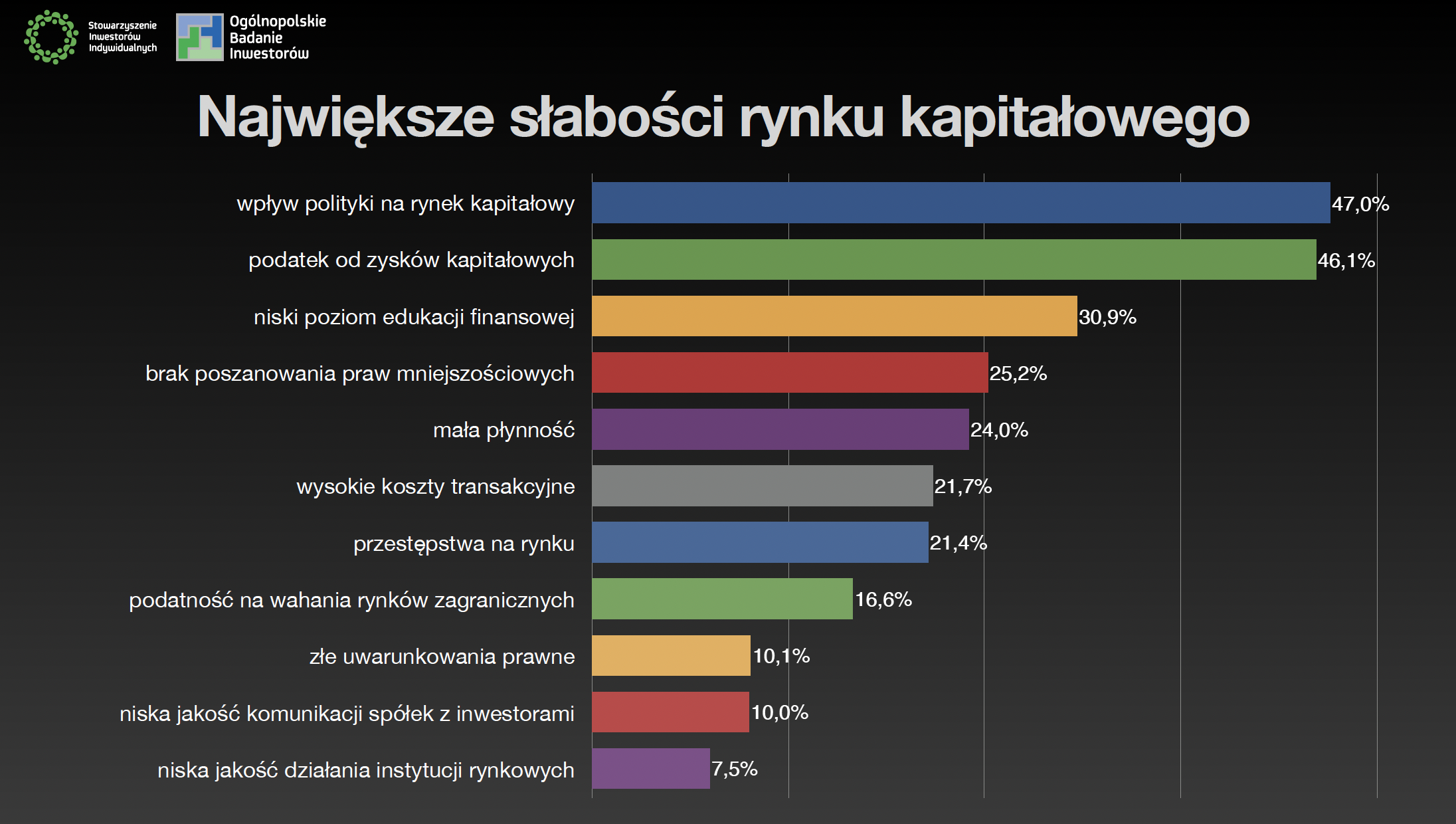

What do we complain about the most?

As usual, there was also a question about the greatest weaknesses of the domestic capital market. Two results dominate here: influence of politics and Belka tax. We also complain about the low level of financial education, low liquidity and high transaction costs. When it comes to ESG factors, as many as 80% declared that they do not take them into account at all for various reasons.

Summation

Looking at the whole picture, it is clear that the typical Polish investor is maturing. He increasingly combines various analysis techniques, increases the value of his portfolio, thinks more long-term, and tries to diversify his portfolio. There are also fewer experienced investors. However, some things do not change - mainly men with higher education are still investing, and we consider the actions of the Polish government to be the biggest drawback of our market.

You can download the whole thing presentation of OBI 2023 results from here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response