WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II]

In the first part we described the history of Adam Neumann and the beginnings of the company WeWork. However, it is worth tracing the fall of this great company. It was spectacular. With a capitalization of approximately $47 billion, the company went into deep restructuring with shares worth cents. Why did a company that initially created iconic workspaces become worth almost nothing? Bankruptcies and deep restructurings do not happen by accident. So let's look at the last years of WeWork's activity. We will focus on the period from 2017 to 2023, where we will briefly present the reasons that brought WeWork to the brink of collapse.

Years 2014 - 2018: WeWork grows like weed

WeWork's headquarters was in New York. No wonder that this is where the business model initially developed, which involved long-term rental of office space and transforming it into jobs for freelancers, start-ups and still small enterprises. The company was to support the development of the so-called gig economy, i.e. the work of freelancers who do not have one place of employment.

It is worth noting when the company began its operations. It was 2010, so the American economy was just recovering bursting of the subprime bubble. Due to the still difficult economic situation, WeWork was able to choose among vacant buildings in good locations. By signing long-term contracts on favorable terms, he could rent space with a good margin. Unfortunately, the market eldorado did not last long and subsequent buildings were rented at increasingly higher prices. Despite this, the company focused on business growth by quickly signing contracts for the lease of additional properties. Low interest rates also helped, allowing WeWork to cheaply finance its expansion. The company developed not only in the largest US cities, but also looked for opportunities in foreign markets. WeWork did well in marketing, where it tried to present its boring rental business as a new solution that was supposed to revolutionize this branch of the economy. What was to distinguish the company from the competition was a uniform standard of service and a wide selection of additional services.

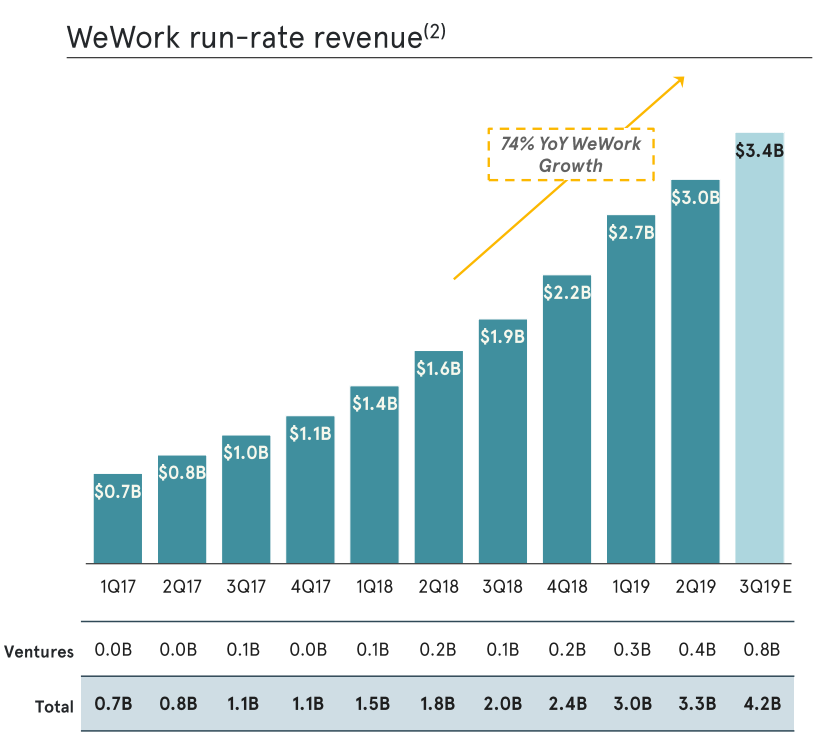

WeWork in the years ahead of schedule IPO it grew very fast. In 2014, its revenues amounted to $75 million, while in 2018 it was already $1,8 billion.. Such dynamic growth can be admirable. This is a pace that many technology companies can envy. How was this possible in a "boring" real estate market? According to WeWork's operating model, there were only three ways to grow:

- increasing the filling capacity of rented buildings,

- better monetization of existing customers (e.g. cross-selling),

- acquiring more buildings for rent.

The first two strategies are the most difficult. It is often very difficult to achieve maximum building filling. As a rule, a level above 80% is considered optimal. Of course, top buildings may have an average occupancy of over 95%, but not all buildings can boast a high standard and a great location. In turn, better monetization of customers and the sale of additional services (subscriptions, insurance, medical packages) is very difficult. Why would WeWork have a broader and cheaper offer than companies specializing in this?

Therefore a rapid growth rate was most easily achieved by increasing the number of properties owned. More real estate is more “desks for rent”, which quickly increases revenues. As it later turned out, WeWork probably did not take economic considerations into account when choosing a location. The dynamic growth in revenues was very nice “story”, which could be sold to investors.

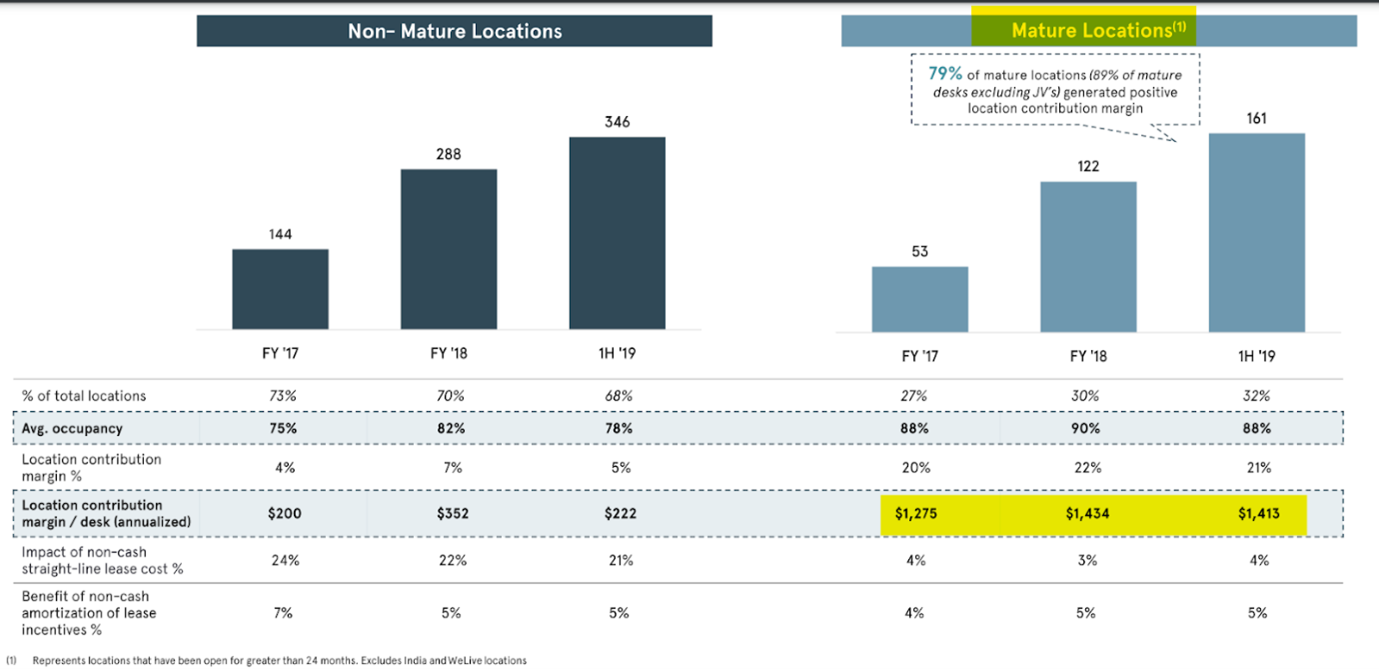

Source: WeWork

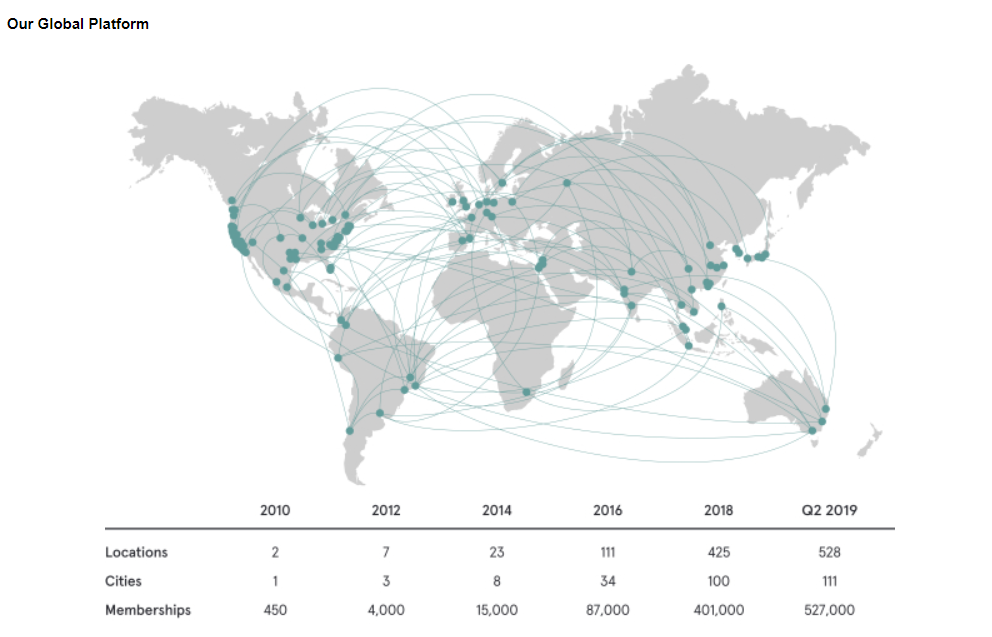

The image below shows the dynamic growth in the number of buildings rented by WeWork. Between 2012 and 2018, the company increased the number of locations four times every two years. This is a big challenge for any company, and for a company with a rather eccentric CEO it was downright deadly. Such rapid growth in business can be compared to driving a car for more than 180 km. Any larger error or the sum of smaller errors can have serious consequences.

Source: WeWork

WeWork business model

A great read showing how the company positioned itself on the market and what the effect was was WeWork's presentation from November 2019 (after Newmanngate). The company itself said that it could offer lower rental prices and still receive 2 to 2,5 times the payment to the owner of the facility because:

- bought at wholesale prices,

- used space more effectively thanks to a team of great architects and interior decorators,

- receiving reimbursements of part of the costs from landlords (building owners).

The company itself boasted that in 2019 it had only 4% churn (customer losses), but after taking into account the development of existing customers (an increase in the company's scale means a greater demand for office space), net retention was 121%. It is worth noting, however, that the revenue run-rate was already lower and amounted to 106%% y/y and reached the level of $4,4 billion. Such a weak run rate compared to net retention suggests that profitability per desk has decreased, which was also negative news.

At the end of October 2019, the company operated in 34 countries, where it had over 600 locations. The sheer scale showed that without proper supervision, many projects had poor prospects. This was partly due to the fact that the real estate market is specific. You cannot quickly enter the institutional rental market. This is because most of the best locations are closely guarded because three things count in this market: location, location and location. If WeWork wanted to grow quickly, it had to accept two alternatives:

- look in worse locations,

- overpay for top seats.

In both cases, this was supposed to result in a decline in investment profitability. Lower profitability also means a longer payback period. In this business, costs are incurred first (renovations, adaptation, promotion). Revenue trickles down over the long term as customers fill the space. Therefore, deterioration in profitability means that costs do not change, while future FCF (free cash flow) already yes. This was one of the reasons why WeWork could not find buyers for its shares at a valuation of $40 billion. Revenue and profit forecasts were significantly reduced by those participating in the IPO.

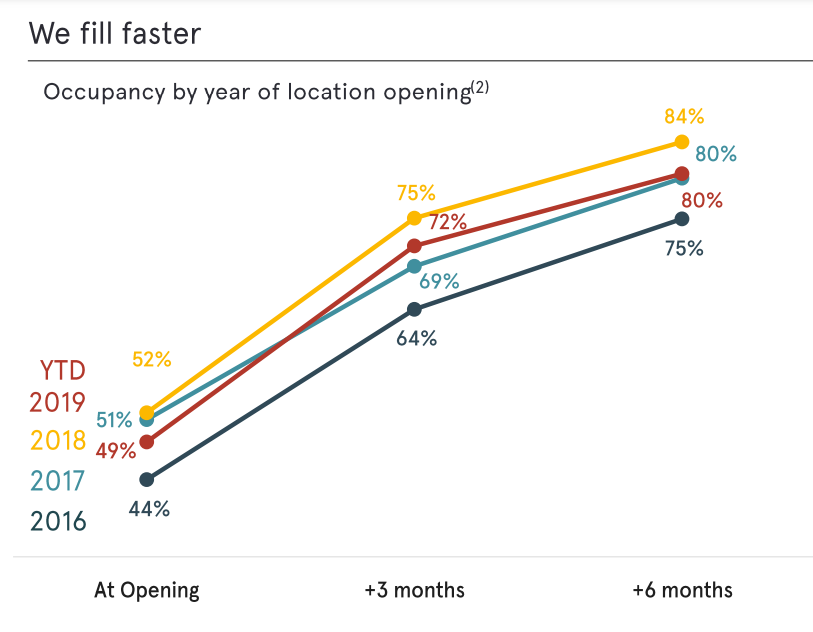

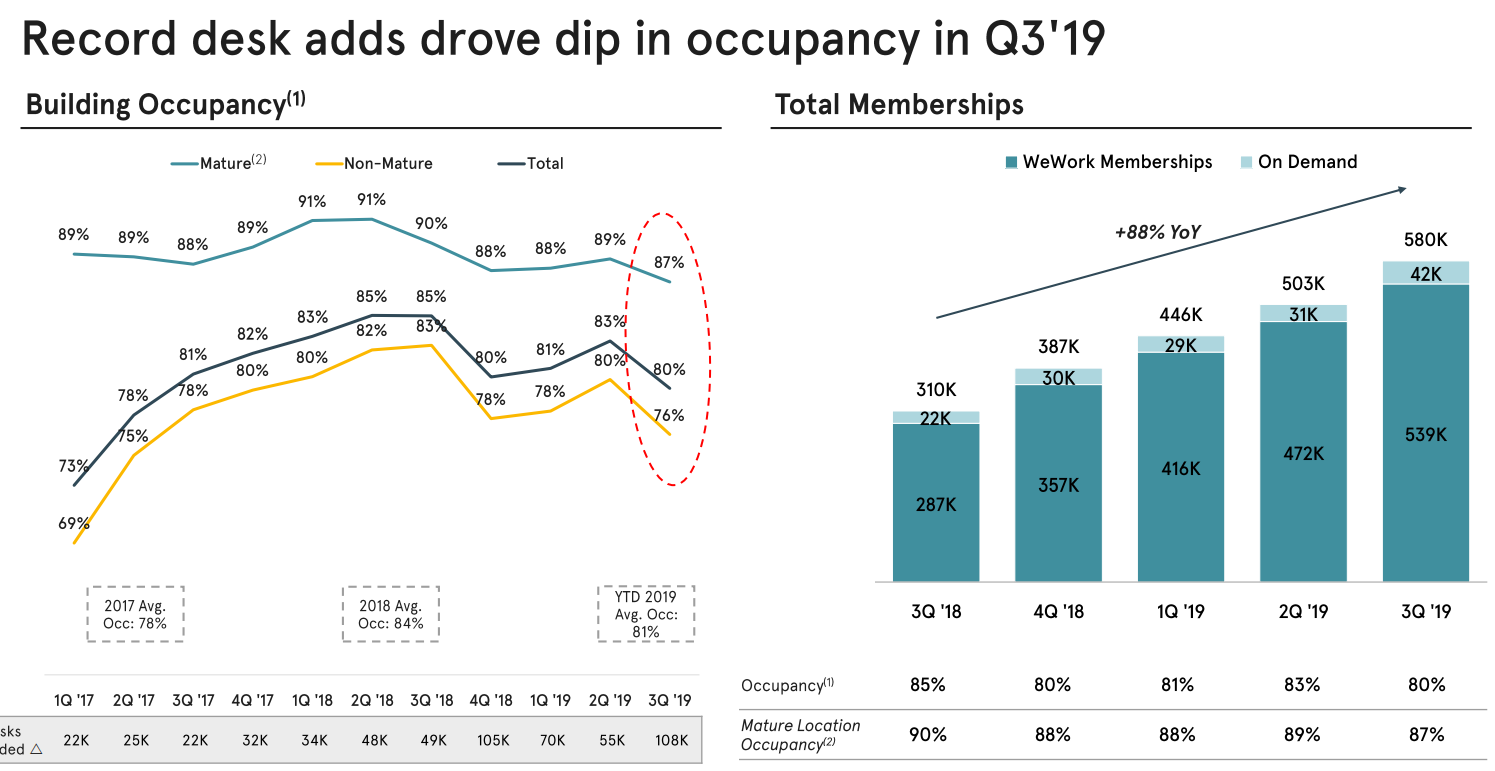

Another problem was also visible in 2019: slowdown in filling the building. The year 2019 is not accidental, because it was then that a slight slowdown in the American economy began. The institutional rental market is very sensitive to economic fluctuations. This was not visible in the years 2010-2018, because then the American economy was in a long period of economic expansion. It was only in 2019 that the market started talking "checking". 2020 was a blow, but let's not anticipate the facts.

Space rent rate. Source: WeWork

Another problem was the decline of the so-called “location contribution” in the most mature premises. Theoretically, such buildings should already have a mature customer base, and “social benefits” will be developed enough that rental profits should increase (greater monetization per customer). The problem, however, was what I mentioned. "New" mature facilities had higher rental rates than those leased between 2010 and 2015. The greater WeWork's expansion, the more difficult it was to obtain higher rental yields.

The next problem was the desire to grow quickly at any cost. As a result, we see that while in 2017 the quarterly increases in the number of desks amounted to (20-30 thousand), since mid-2018 the increases ranged from 50 thousand. up to 100 thousand According to the business model, the first 6 months involve high costs and low revenues from each new desk. This means that it could be expected that the investments would start paying off after 2020. It is worth paying attention to another small detail. In Q2019 87, the occupancy rate for mature premises was 2017%, which was the lowest in 2019-XNUMX. One of the problems was the Pacific region (in this case, South Korea and Australia) and the weakness of leasing in mainland China.

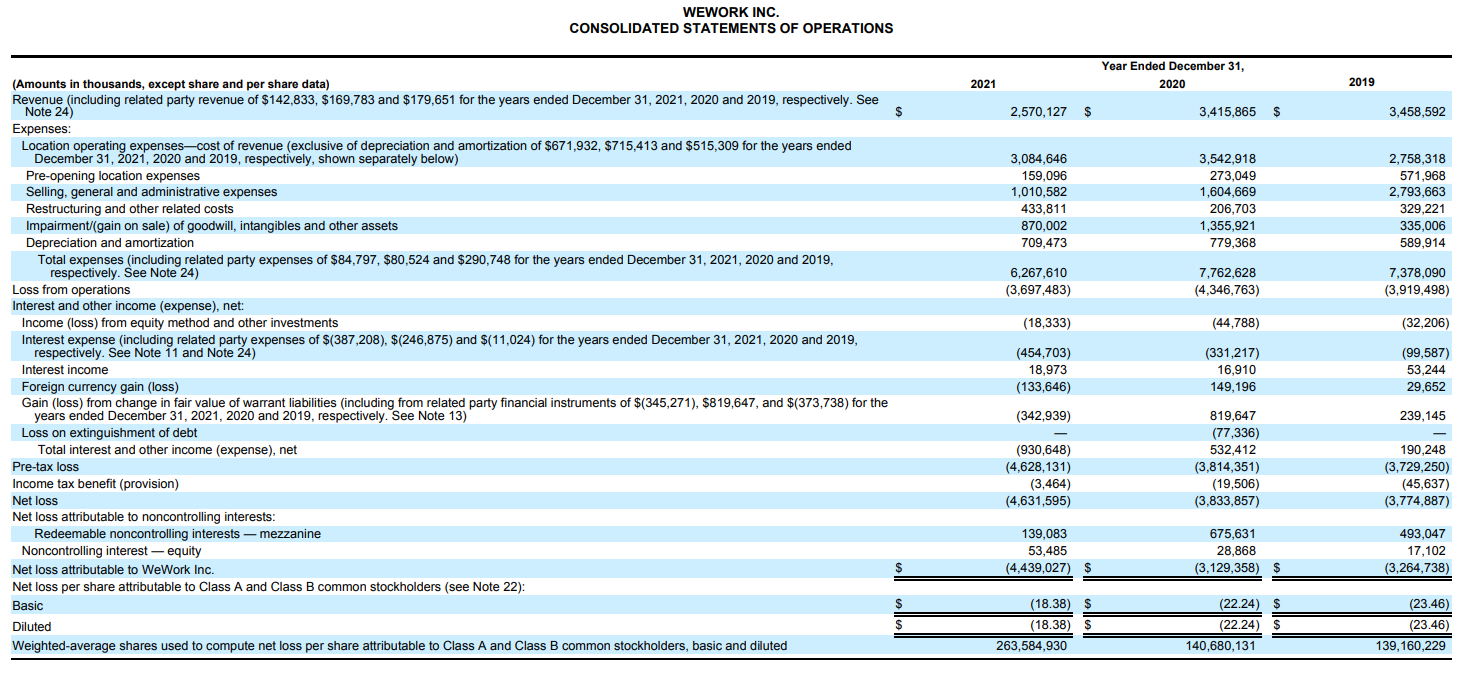

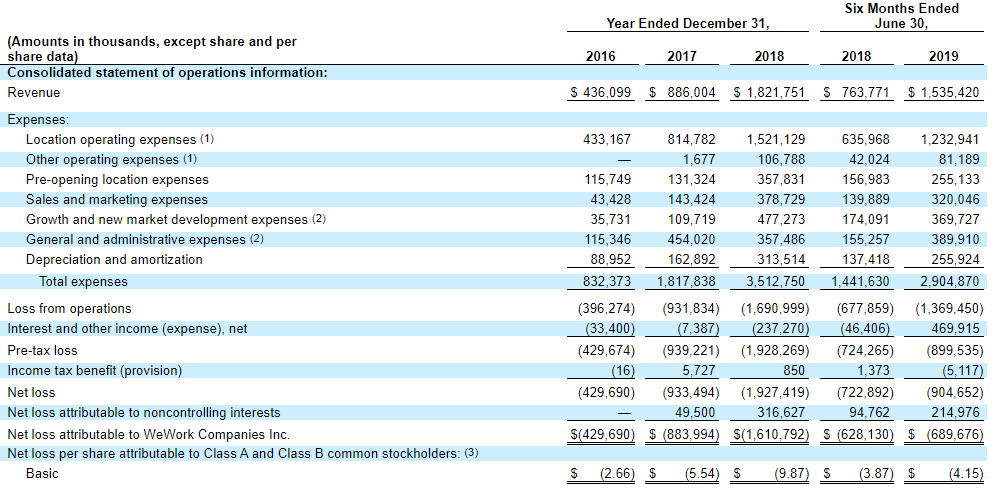

Let's take a look at the company's results before its stock exchange debut. In short, it wasn't good. How else to explain the results from 2018, when revenues amounted to $1,8 billion and operating expenses amounted to a staggering $3,5 billion? The largest costs were those related to buildings ($1,5 billion) and costs related to openings $0,35 billion. In addition, there are, among others: costs related to increasing the scale of operations and conquering new markets ($0,48 billion). This business model was unsustainable in the long term. The strategy would work if there was a strong relationship on the line WeWork – customers. This means that companies and gig workers couldn't imagine renting desks in buildings other than WeWork. Well, quite a breakneck narrative.

Let's take a look at the cash flow statement. It was just as bad there. While cash flows from operating activities amounted to -PLN 2018 million in 176 (not that bad), cash flows from investing activities amounted to as much as -$2,48 billion (mainly expenses for the purchase of real estate). Negative operating and investment cash flows were financed by the issuance of debt and shares. This once again confirms our thesis - the company should slow down its growth rate and reduce costs. The activity was tailored to... “eternal boom and abundance of capital”. Eventually, the market had to happen checking. And so it happened.

The market stopped believing in WeWork

As long as there was a lot of free capital on the market willing to invest in start-ups, the company's valuation grew like a weed. Softbank encouraged WeWork to go public because it wanted to take advantage of the market sentiment. When the IPO began, the company's valuation was over $40 billion. And then a sequence of events occurred that led to a sharp decline in the company's value. The debut on the stock exchange was supposed to take place in 2019. At the same time, it was supposed to be the second largest IPO on the American stock exchange that year (after Uber). However, the more investors looked at the prospectus data, the more questions arose about the company's business model. The CEO and founder of WeWork was also controversial - adam neumann.

The company was supposed to debut in 2019, but despite good market conditions, WeWork was unable to find enough buyers for its shares. According to the market, a valuation of over $40 billion for a company that is still losing money is too much. It was a cold shower for the company. Without the debut, it would not be possible to finance development projects and secure enough capital to cover losses generated by operating activities. No wonder that in November 2019, after a failed debut, the company decided to lay off 20% of its staff. She explained it by wanting to become more efficient, but no one believed it anymore. Such explanations can be used to reduce employment by 1-2%, while the dismissal of one fifth of the staff indicates problems in scaling the business and the desire to cut costs "to the bone".

Earlier, there was also a change in the ownership structure and a change in the CEO position. The founder of WeWork was removed from the above-mentioned position and took his place Marcelo Claure, who previously worked in senior managerial positions at Softbank. The Japanese investment holding company also provided further financing to help the company survive difficult times.

Softbank is trying to save the company

For many commentators, WeWork was a real estate business disguised as technology. After all, renting space to other companies is not unheard of. WeWork, however, has tried to sell its business model as “disruption” the entire industry.

Softbank decided to provide financial assistance to WeWork in 2019. It acquired new shares for $5 billion and purchased shares from some shareholders for $3 billion. Moreover, he provided the company with financing for $1,5 billion. The cash injection was intended to ensure financial liquidity and help restructure the business. After the transaction, Softbank owned approximately 80% of the shares in WeWork, but under the agreement it did not have a majority of voting rights. Softbank's condition was that Neumann be fired as CEO of WeWork. His place was taken by Marcelo Claure - Softbank's chief operating officer.

However, when it seemed that WeWork had a chance for successful restructuring, 2020 came. The company was hit hard by COVID-19, which interrupted the company's recovery process. The shutdown of the economy has made remote work more popular. As a result, many companies resigned from renting space. As a result, WeWork experienced liquidity problems as revenues declined. The pandemic also hit the second base of business, i.e. gig workers who stayed at home. In both 2020 and 2021, the company experienced reduced revenues and huge losses. WeWork has still failed to demonstrate its ability to improve the profitability of its business.

Click to zoom. Source: WeWork

The company decided in 2021 that it would debut on the stock exchange. She moved then“debut through the back door”, i.e. it used a solution that was fashionable in 2021, which was SPAC. However, the valuation at the debut was not impressive - it was $9 billion. Investors who bought the company's shares in private placements at a valuation of $2019 billion in 47 now did not believe in the company's value even at the level of $10 billion. The discount was caused by many factors. These include: skepticism about the business model, discounting greater business risk, high level of debt. The last factor was particularly disturbing as it could be fatal in the event of an increase in interest rates. While in 2021 some people believed that low interest rates could stay with us "forever", that is, it will come true Japanese model. As it turned out later, the low interest rates ended very quickly, as a result of high inflation that resulted, among others, as a result of Russia's aggression against Ukraine in 2022.

Raising interest rates in the US, the Eurozone and other economies meant that the company had to refinance its liabilities at higher prices. Moreover, lease agreements were often signed with a clause that the rent rate was indexed for inflation. As prices rose in the economy, WeWork had to pay more in rent. Of course you can say:

“What's the problem, let WeWork raise their rates!”

However, the increase in interest rates caused many start-ups to have problems raising additional capital. As a result, such clients cut costs and reduced the space they previously rented at WeWork.

The company's problems were getting bigger with each quarter. In the second half of 2023, the company took advantage of the famous Chapter 11, which was intended to help restructure the company. Some creditors agreed to convert debt into shares, while some building owners agreed to renegotiate rent rates. Ultimately, investors who lost out on this since the (already low) debut they lost 99% of their invested capital. Currently, Adam Neumann, who now has more wealth than when he left WeWork, is trying to buy out some of the assets of his former company.

Summation

WeWork is a story about the fact that when analyzing a company, you should not only believe the story that the company's CEO wants to sell you, but also carefully examine the business model and check the financial statements. The company was engaged in the usual business of subletting office buildings. Of course, they were nice and spacious places to work, but they competed with price and location. The problem was the ambition of the CEO and the main shareholders who believed in growth at all costs. As a result, the company signed long-term contracts and believed that the good economic situation and low interest rates would last for decades. Unfortunately, as the economy deteriorated and the pandemic took hold, leverage sank the company.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-300x200.jpg?v=1711728724)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wall street, risk aversion](https://forexclub.pl/wp-content/uploads/2020/07/wall-street-wyniki-finansowe-102x65.jpg?v=1594710076)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] AUD and NZD banknotes, currencies of the Antipodes](https://forexclub.pl/wp-content/uploads/2020/01/Banknoty-AUD-i-NZD-102x65.jpg?v=1579151223)

Leave a Response