Bankruptcy of Lehman Brothers - The story of a spectacular bank collapse

On September 15, 2008, it happened Lehman Brothers bankruptcy, it was a shock to many investors, financial journalists and the public. The aforementioned company survived the Civil War, the First and Second World Wars. At the time of bankruptcy, it was the 4th largest investment bank in the United States (after Goldman Sachs, Morgan Stanley and Merrill Lynch). At that time, it employed around 25 workers. Employees dealt with investing in the stock market, debt securities and derivatives. In addition, the bank was also involved in investment management and private equity investing. The bankruptcy of Lehman Brothers was a symbol of the sub-prime crisis in the US real estate market. The consequences of the fall resulted in political support for the supporters of the doctrine TBTF ("too big to fail"). It was the biggest collapse in US corporate history. In today's article, we will present the history of the rise and fall of this investment bank.

1850 - 1969: Under the Lehman family

In 1844, the son of a Jewish cattle trader, Henry Lehman, emigrated from Rimpar in Bavaria to the United States. Immediately after arriving in Montgomery, Alabama, Henry set up a "dry-shop" under the name "H. Lehman". Dry-shop was a concept of stores very popular in the XNUMXth century in the United States. You could buy clothes, tobacco, sugar, flour and coffee there. After three years, due to the arrival of Emanuel Lehman, the company changed its name to "H.Lehman and Bro". In 1850, the name Lehman Brothers first appeared. This was due to the addition of a third brother, Mayer Lehman.

Alabama in the 50s was dominated by cotton plantations, where most of the workforce was made up of slaves. According to the 1860 census, about 45% of the state's population were slaves. Interestingly, one of brothers owned as many as 7 slaves (according to the census, 3 men and 4 women).

Cotton was one of the most important raw materials in the United States. It was used by the dynamically developing textile industry. Many growers did not always have the cash available to purchase goods at the Lehman Brothers store. The brothers came up with the idea that customers could pay for their goods with cotton. The idea was so successful that it was necessary to secure "cotton money". The cotton trading business was becoming an increasingly important part of operations. After Henry's death (he died of yellow fever in 1855), the brothers focused on trading. In addition to cotton trade, investment and brokerage activities on other raw materials were started.

In 1858, the cotton trade moved from the South to New York. The reason was that it was in the north of the United States that there were the most cotton factories and warehouses. Due to the change of place of trading, the brothers opened an office at 119 Liberty Street in New York. Emanuel Lehman was delegated to work there.

Emmanuel Lehman. Source: encyclopediaofalabama.org

In 1862, the company had to merge with a cotton merchant: John Durr. The result was Lehman, Durr & Co. The reason for the connection was Civil Warthat has broken supply chains in the cotton market. The company permanently moved its headquarters to New York. In 1870, he co-founded the New York Cotton Exchange (NYCE). In the 1883s, the company began investing in the booming railroad bond market. In addition, the financial advisory business was developed. At that time, there was a dynamic development of other business segments. Lehman became a member of the Coffee Exchange in 1887 and the New York Stock Exchange in XNUMX.

One of the breakthrough moments was advising on the IPO of the International Steam Pump Company. Since then, the company has focused on the development of investment advisory activities. In 1906, under the leadership of Philip Lehman (Emanuel's son), he began cooperation with Goldman, Sachs & Co. and Sears, Roebuck and Company. Lehman gained such a good reputation that there was no shortage of customers. The company has participated in the debuts of such companies as Woolworth Company, RH Macy & Company and May Department Story.

An important date was 1924, when the first non-family member joined the company - John M. Hancock. From then on, partners in Lehman could be outsiders. This made it possible to employ talented financiers and facilitated the scaling of the business. The company was also not afraid to react to market problems. This was the case, e.g. during the Great Depression, where the lull in the IPO market caused Lehman to focus on Venture Capital activities. However, with the economic recovery brought about by the New Deal the stock market recovered. Lehman participated in the IPO of the first television manufacturer - DuMont Laboratories. In addition, the consulting firm helped secure funding for the Radio Corporation of America (RCA). Gaining such clients boosted Lehman's prestige. This made it easier to find new customers.

1969–1984: Growth outside the Lehman family

In 1969, Robert Lehman, who had been in charge of the company for 44 years, died. As a result, none of the members of the Lehman family actively participated in the company's activities. The company's existence was threatened due to the economic crisis of the 70s. The fight against inflation and weak economic growth made it more and more difficult to find customers. In 1973, Pete Peterson (chairman of Bell & Howell) decided to buy Lehman. Two years later, Peterson decided to acquire Abraham & Co., which was also active in the financial industry. In 1977, there was a merger with Kuhn, Loeb & Co. which created Lehman Brothers, Kuhn, Loeb Inc. It was the 4th largest investment bank in the United States. Salomon Brothers, Goldman Sachs and First Boston were bigger than Lehman at that time.

Under the leadership of Pete Peterson (1973 – 1984), Lehman changed from a loss-making company with no idea for itself into a profitable company (increase in profits 5 years in a row). In addition, Lehman was at the forefront of the investment sector in terms of ROE (return on equity).

Merger with American Express (1984–1994)

Source: wikipedia.org

Shearson/American Express, a subsidiary of American Express, acquired Lehman for $360 million. The acquisition was to allow for the extension of the offer to include advisory activities. Previously, Shearson was focused on the brokerage business. The combined company was called Sheson Lehman Hutton. The last segment appeared after the $1 billion acquisition of EF Hutton. In 1993, the new CEO of American Express decided to simplify the organizational structure. As a result, he sold the retail broker business and asset management to Promerica. At the same time, a spin-off of the rest of the former Sheerson Lehman Hutton was carried out. Lehman Brothers Holding Inc., which debuted in 1994, was spun off from the structures of American Express.

1994 - 2007: Dick Fuld's rule - Lehman Brothers flourished

The CEO of the company was Dick Fuld, who worked in the organization for many years. As an employee, he still remembered the times of the merger of Lehman Brothers with Kuhn, Loeb & Co., the subsequent acquisition by American Express and the merger with EF Hutton. Fuld stayed on as CEO of Lehman Brothers until 2008. He was the longest-serving chief executive officer (CEO) during the 2007-2008 financial crisis.

At the time of assuming the position in the spun-off company, the loss in the organization was $102 million. Since Dick Fuld became CEO, a period of 14 years of net profit in a row began. The company made profits despite the Asian crisis, the collapse of LTCM or the terrorist attack on the World Trade Center. The profits did not arise only as a result of the company's organic growth. The main source of the company's growth was high financial leverage. This increased the risk of operating activities, but in quiet times it had one advantage - it was able to meet Wall Street expectations. Fuld himself was the beneficiary of this practice. Between 1993 and 2007, he received nearly $500 million in salary and bonuses. In 2007 alone, he received $22 million from the bank ($5 million in cash, the rest in shares).

On September 11, 2001, one of the planes crashed into the first tower of the World Trade Center. As a result of the terrorist attack, one of the bank's employees was killed. In turn, the company's headquarters was located in the Three World Financial Center and as a result of the attack it was unusable. This forced the company to redeploy 6500 employees. Trading activity was moved to Jersey City, New Jersey. Six days after the attack, trading on the capital market was restored. The remaining employees were moved to 40 temporary locations in New York City. For example, the investment banking department occupied 665 rooms at the Sherathon Manhattan Hotel. In addition, in October 2001, the bank bought a 32-story office building for $700 million. The office building was located at 745 Seventh Avenue. After the terrorist attacks, Lehman Brothers developed a plan to continue operating in the event of renewed attacks. The branch in Jersey City, which served as a role, was to help maintain business continuity "backup trading".

In 2001, Lehman Brothers acquired PCS (private-clinet services) from Cowen & Co.. This allowed the company to enter the segment of advisory services for wealthy clients. In addition, in 2003 the bank returned to the asset management market, from which it "exited" in 1989. The reason was the acquisition of Crossroads Group (belonged to Lincoln Capital Management), which operated on the debt securities market. These companies, combined with a private equity arm, created the IMD (Investment Management Division), which generated approximately $3 billion in revenues annually.

In June 2003 US Securities and Exchange Commission (SEC) and the Office of the New York State Attorney General, along with several smaller regulators, began to inspect 10 companies in the financial industry. One of those inspected was Lehman Brothers. The regulators looked at the relations within the companies. The question was whether the market research department was under pressure from the investment banking departments. 10 companies had to pay $1,4 billion in fines due to unfair practices. Lehman Brothers was fined $80 million. Moreover, the investment bank had to completely separate its investment banking and analytics departments.

In June 2003 US Securities and Exchange Commission (SEC) and the Office of the New York State Attorney General, along with several smaller regulators, began to inspect 10 companies in the financial industry. One of those inspected was Lehman Brothers. The regulators looked at the relations within the companies. The question was whether the market research department was under pressure from the investment banking departments. 10 companies had to pay $1,4 billion in fines due to unfair practices. Lehman Brothers was fined $80 million. Moreover, the investment bank had to completely separate its investment banking and analytics departments.

The end of the El Dorado of 2006-2007

Richard Fuld was also a financial celebrity. He liked to give interviews where he boasted about his achievements and ensured that the company was focused on achieving long-term goals. In 2006, he was interviewed by The Wall Street Journal where he mentioned:

"As long as I live, this company will not be sold."

Fuld was liked by the media, who valued his honesty and the fact that he "delivered results." In 2006, Institutional Investor magazine awarded Dick the title "America's Top Chief Executive in the Private Sector". Two years later, the respected magazine Barron's named Fuld one of the top 30 CEOs and nicknamed him "Mr. Wall Street".

The reason for the good results was a change in the investment strategy. The bank was not interested in investing in the treasury securities market. Instead, instruments such as MBS (mortgage-backed securities) and CDOs (collateralized debt obligations) were popular. These instruments were supposed to provide a higher rate of return with a similar risk as safe government bonds. The reason for this confidence was that the real estate market in the United States had performed very well since 2002. Low interest rates, rising real estate prices and easy access to capital made residential mortgages look like a safe instrument. For this reason, institutions emerged that "turned" mortgages into financial instruments that were traded by investment banks, hedge funds and even pension funds.

Despite a difficult 2007 for the sector, Fuld was not fired and kept his position as CEO. It is worth mentioning that at that time, as a result of the subprime crisis, the CEOs of such companies as Bear Stearns, Merrill Lynch and Citigroup lost their jobs. At the end of 2007, Warern buffett and Korea Development Bank were interested in acquiring Lehman, but Dick Fuld believed that the company had much more value than competitors' offerings. As it turned out later, Dick's stubbornness meant that the bank did not survive the trouble. Already at the end of 2007, Lehman had to close its subprime division (BNC Mortgage). As a result of the closure of the company, 1200 employees lost their jobs.

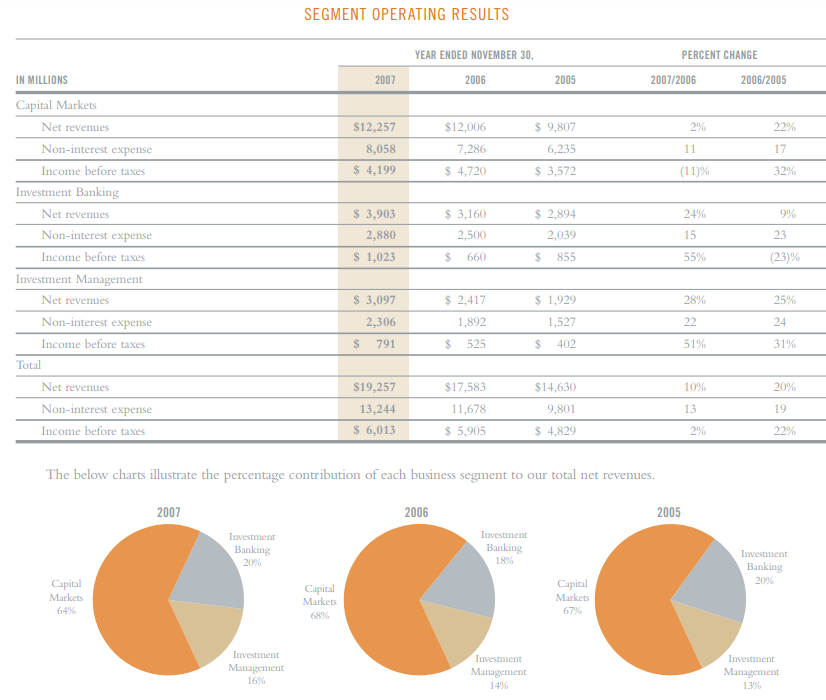

Source: Annual Report 2007

Causes of the crisis in the financial market

To understand why the bank collapsed, it is necessary to know what exactly financial instruments based on the real estate market were. The main "actors" in this spectacle were MBSs, CDOs and synthetic CDOs.

MBS

Simply put, these are mortgage loans that have undergone the process of securitization, i.e. conversion into securities. In practice, it consisted in the fact that a special purpose vehicle (SPV) purchased loans and mortgage loans from banks or other companies operating on the mortgage market. Then the credits were combined into "bundles", which were then converted into MBS. The SPV then looked for investors who wanted to acquire this type of asset. MBSs were divided into RMBSs (residential mortgage-backed security) and CMBSs (commercial mortgage-backed security).

CDO

CDOs first appeared on the financial market in 1987. It was created by employees of the investment bank Drexel UBurnham Lambert, where the famous "king of junk bonds" worked: Michael Milken. An investment bank created the first CDO based on a basket of junk bonds (non-investment grade issuers). The CDO was supposed to provide greater investment security, because the probability of insolvency of several or several dozen debtors was lower than that of a single issuer of bonds. Over time, CDOs expanded into other markets. Bonds secured by student debt, credit card receivables, bank loans and aircraft leasing appeared. At the turn of 2003 and 2004, CDO issuers turned their attention to the dynamically developing American real estate market.

The subprime loan market seemed particularly attractive. These were more expensive loans with theoretically lower repayment rates. Importantly, these loans paid off better than, for example, consumer loans. In addition, the increase in the value of real estate meant that people could increase their debt by refinancing their mortgages (they usually took more loans because the value of the collateral increased). As a result, the segment of CDOs based on MBS, i.e. securities based on real estate, began to grow dynamically. In just 3 years, the number of issued CDOs increased almost 10-fold from $30 billion in 2003 to $225 billion in 2006. The collapse of the US real estate market caused two things to happen simultaneously: a fall in property values and a deterioration in mortgage repayments. This led to a sharp decline in the value of CDOs. This, in turn, resulted in multi-billion losses for financial institutions.

CDOs are characterized by tranches that are based on the credit risk of the underlying instrument (e.g. MBS). The lower the tranche, the greater the investment risk. At the same time, the potential profits from the transaction increased in tandem with the risk. It was the lowest tranches that first assumed the risk of mortgage loan default (principal and interest installments). In the case of liquidation of collateral (real estate), the lowest tranches received funds only after investors were repaid from more secure tranches. As a rule, the tranches were called: Senior AAA ("super senior"), Junior AAA, AA, A, BBB and Residual. The safest were referred to as "super senior". Initially, CDOs were characterized by relatively good-quality assets, with the development of the market, products with increasingly worse quality parameters began to dominate (borrowers with low FICO, low-income immigrants, etc.).

Synthetic CDOs

This is a separate group of financial products, which is not based on real assets (bonds, mortgages, student loans) like CDOs, but on derivatives such as CDS (credit default swaps), options, etc. Synthetic CDOs are also divided into tranches, which have different levels of credit risk acceptance. Profits from the synthetic CDO were contingent on the performance of other real estate asset-based products. Synthetic CDOs were simpler to create because they did not require prior mortgage backing. Thanks to this, they could be created very quickly. In 2005, synthetic CDOs worth USD 15 billion were issued, and a year later the issues amounted to USD 61 billion. At year-end 2006, the nominal value of synthetic CDOs was estimated at approximately $5 billion.

Reasons for the collapse of the bank

Lehman Brothers' bankruptcy was not the result of a single mistake or accident. Problems in the bank were growing, but they were masked by theoretically good financial results. Activity of the investment segment in products based on the real estate market. The history of this department is very long and dates back to 1997. Then Lehman bought it Aurora Loan Services. It was a lender that focused on Alt-A mortgages. These loans were riskier than "prime" but less than "subprime". Very often, these loans did not have full documentation, but customers had high FICO scores.

The appetite for increasing shares in the mortgage debt market was growing. In 2000, Lehman acquired a subprime lender that operated on the West Coast of the United States. The acquired company was BNC Mortgage LLC. As a result, Lehman quickly became an important player in the subprime loan market. Subprime loans were for borrowers who had historically had trouble paying their debts on a regular basis. As a rule, these were debtors with a FICO of less than 600 points. Of course, the higher the risk, the higher the interest rate.

If the bank had mechanisms to "screen" unpromising customers from those with temporary problems, then this type of loans could be a "gold mine". This required a large selection of customers. This, in turn, prevented them from quickly gaining market shares. Already in 2003, Lehman Brothers made $18,2 billion worth of mortgage loans. As a result, it took only 6 years for the bank to become the number three in the sector of loans with a lower rating. In 2004, both acquired institutions provided loans for 40 billion dollars. In 2006, however, Aurora and BNC sometimes extended loans worth $50 billion in a month. With such dynamic growth, it was hard to believe that credit procedures would be strictly followed. In 2008, Lehman had assets worth $680 billion and had equity of $22,5 billion. This meant that the financial leverage (ratio of assets to equity) was over 30.

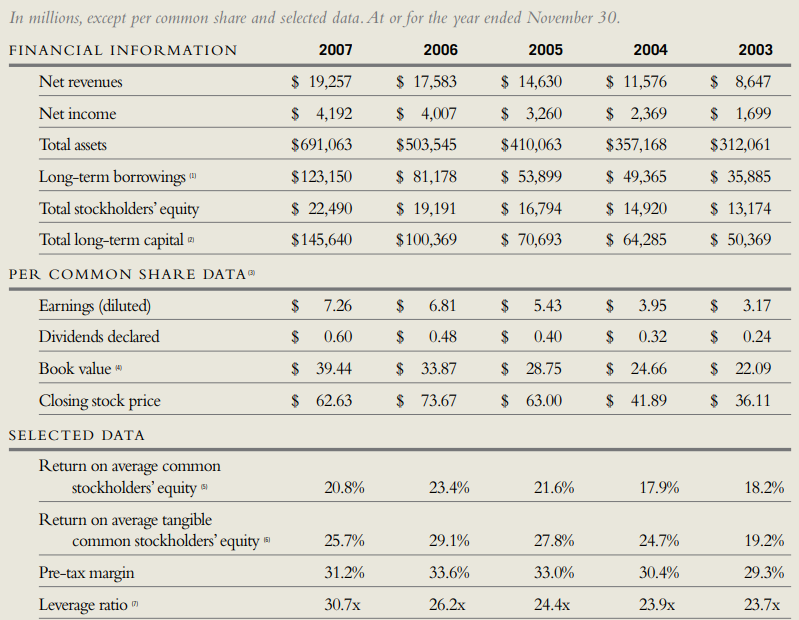

Source: Lehman Brothers Annual Report

Initially, a very good economic situation meant that “problematic” borrowers had no problems finding a job and servicing their liabilities. Thanks to this, alt-a and subrpime loans ensured high profits. The situation began to deteriorate in 2007, when the real estate market was breathless. This, in turn, resulted in a decrease in speculative demand, which was based only on the strategy of "buying more expensive and selling even more expensive". The pressure to sell meant that even borrowers classified as NINJA (No Incom, No Job, No Assets) were getting mortgage loans. These were borrowers in a very difficult financial situation and it was almost certain that in the near future they would have problems with debt servicing. Historically, subprime mortgage loans accounted for approximately 8% of the market. As a result of a number of factors (low interest rates, sales policy, activities of state agencies supporting the mortgage market), the share of this type of loans increased to 20% in 2006.

READ: Black Thursday and the Great Depression in 1929-1933

As a result, the housing market was much more vulnerable to price drops in the event of a recession in the economy. This is because subprime loans were taken by those most at risk of losing their jobs during the recession. At the same time, such borrowers did not have significant savings to be able to survive several months without work.

Speculative demand also contributed to the increase in house prices. This can be seen in the statistics of real estate owners. In 2000, approximately 20% of households had more than one house/apartment. After 6 years, this percentage increased to 35%. Flips, i.e. buying a flat in order to resell it in a very short time, were very popular. Pinballers operated at very high leverage in order to maximize their return on equity (ROE). When the demand for housing decreased and prices began to fall, such investors found themselves in a difficult situation. They either had to agree to sell at a loss or find a way to finance the principal and interest installments.

Another problem posed by the boom in the real estate market was the feeling of wealth among property owners. Many of them used the price increase to refinance the loan, taking a higher one. Thanks to this, they could consume more (e.g. buying a new car, holidays), but this resulted in an increase in debt in relation to the generated income. This ratio (debt to disposable personal income) increased from 77% in 1990 to 127% in 2007. This meant that the average household was much more exposed to the risk of rising interest rates and a downturn than 17 years earlier.

The fall in prices worsened mortgage repayments, causing MBSs and mortgage-backed CDOs to depreciate. What's more, there was a shortage of people willing to buy more securitized mortgage loans. Some financial institutions found themselves in a difficult situation because they had a lot of mortgages that they could not securitize. This, in turn, exposed them to risks they did not want to take. Exposure to the subprime mortgage market meant some losses. In addition, issuers of CDSs for MBSs or CDOs had a problem. As early as at the end of 2007, write-downs began to appear on products related to the mortgage market.

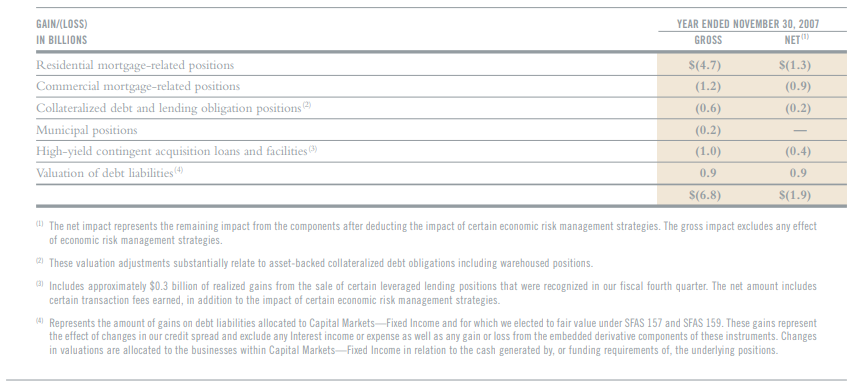

Source: Lehman Brothers Annual Report

Last moments of Lehman Brothers

In 2008, Lehman generated huge losses due to the housing crisis. Moreover, the bank was left with a large amount of loans, which it was unable to sell to other market participants. In the second quarter of 2008, the net loss was $2,8 billion. Looking at all the assets held by the bank, the loss might seem small. Given the huge leverage on which the bank operated, the situation was becoming very difficult. It was necessary to restructure the business and look for additional capital. The bank was desperately looking for someone willing to issue new shares, despite the fact that such a move diluted existing shareholders. Dilution was due to the fact that the share price fell by more than 8% in the first 70 months. Potential applicants quickly resigned due to the market environment.

On August 22, the bank's shares rose 5% on rumors of a potential takeover of Lehman by Korea Development Bank. Growth quickly evaporated after a potential buyer mentioned regulatory issues and a lack of willing partners to join the deal. Already on September 9, Korea Development Bank withdrew from the transaction, which caused the Lehman Brothers share price to fall by 45%.

On September 10, the bank reported a $3,9 billion loss and announced its intention to sell a majority stake in the investment management business (together with Neuberger Berman). The situation became increasingly tense as the collapse of the bank could disrupt the liquidity of the US financial sector. On September 12, Timothy F. Geithner called a meeting with financial institutions to resolve the Lehman Brothers situation. Geithner mentioned that the bank might need to be liquidated. Wall Street companies were looking for a solution not to force government intervention. Talks between Lehman Brothers and Bank of America and Barclays have begun.

The takeover of Lehman Brothers by Barclays was vetoed by the Bank of England and the British regulator. Solutions were sought until the night of September 14, unfortunately there was no one who had sufficient financial resources to save one of the oldest investment banks. On September 15, the world learned that Lehman Brothers had filed for protection from creditors.

Consequences of the collapse of Lehman Brothers

Initially, the collapse of Lehman Brothers did not cause a cataclysm on the market. Dow Jones Index it fell by 4,4%. In terms of points, it was the biggest drop since 2001 (attacks on the WTC). Looking at the long-term consequences, the index drop on September 15 itself seems very benign. It was just the beginning.

The bankruptcy of Lehman Brothers put the MBS market under supply pressure. The market feared that the portfolio of $4,3bn of assets based on the mortgage market would be quickly liquidated. Given that there are no buyers on the buy side and market participants are heavily flooded, the MBS market has become very nervous. At the same time, the spot real estate market feared that Archstone (the 2007rd largest REIT in the US) purchased in 3 would be for sale, which would put downward pressure on real estate prices. Lehman Brothers acquired the company together with Tishman Speyer for $22,2 billion. Six years after the transaction, the company was bought for $6 billion by Equity Residential and AvalonBay.

The bankruptcy of Lehman Brothers caused confusion even in the money market. Evergreen Investments asked Wachovia Corporation (the parent company) to provide liquidity to money market funds. The collapse of the investment bank had repercussions in Asia. Losses of Japanese banks and insurers lost about $2,4 billion. Mizuho Trust & Banking, which had a large exposure to Lehman Brothers-related assets, suffered the most. There were also problems in Hong Kong. There, individual clients have invested HK$15,7 billion in "guaranteed mini-bonds" from Lehman. Many customers resented the bank's employees for not presenting a full risk profile. 43 customers were affected by the mini-bond scandal.

In the second half of September 2008, the Paulson plan was developed. The main objective of the program was the purchase of toxic assets, which was to ensure the financial stability of the American financial market. Purchased, among others MBS, which allowed to restore liquidity on this market and stop potential losses of other financial institutions. After the plan was rejected by the House of Representatives, a modified plan called TARP was introduced and passed on October 3, 2008.

The bankruptcy of Lehman Brothers highlighted the problems faced by the American financial sector. Institutions such as AIG, Washington Mutual or Merrill Lynch. The slowdown in the real estate market and the decline in lending affected the condition of the entire economy. Within a year, the number of unemployed in the United States increased from 7 million to 15 million people. The unemployment rate rose to 10%. It took the economy several years for the unemployment rate to return to pre-recession levels.

Summation

The history of Lehman Brothers shows how close the company is to bankruptcy if it takes on too much risk. The only thing left of the investment bank with over 150 years of history is the name, which is now one of the symbols of the 2007-2009 crisis. At the time of its collapse, the bank had assets worth over $600 billion. The bankruptcy of Lehman Brothers was a symbol of the end of the era of deregulation in the financial market. In the following years, stricter regulation of both investment and commercial banks was introduced. The idea of self-regulation of the financial market, which was pushed by such personalities as Alan Greenspan (former president FED) has become unpopular in the mainstream media.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-300x200.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-300x200.jpg?v=1711728724)

Leave a Response