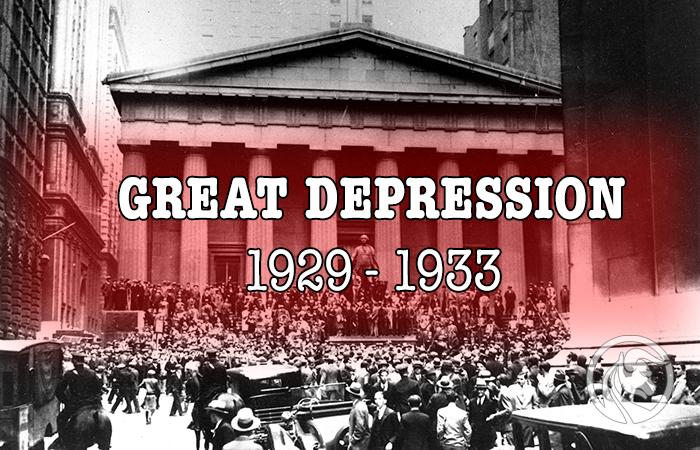

Black Thursday and the Great Depression in 1929-1933

It is one of the most famous economic crises in human history. Great Depression was the greatest economic crisis of the 1929th century. In the years 1933 - XNUMX, there was a collapse in international trade, numerous bank and enterprise bankruptcies, and a significant increase in unemployment. In many countries, the crisis triggered an increase in populist sentiment. IN Germany was one of the factors of the growing popularity of the Nazis and Communists. The crisis also changed the role of the state in crises forever. In front of The Great Depression governments most often acted as passive observers who tried to keep the budget balance. After the 1929 crisis, governments began to respond actively to the contraction of the economy. Aid programs and financing of public works began to emerge. The article will present the causes, course and consequences of the Great Depression. We invite you to read.

The economic situation before the crisis

The first symptoms of economic problems were already visible in 1928. Problems with unsold inventory began to accumulate. It froze the working capital, which caused liquidity problems for companies. The worse the financial situation of enterprises, the more difficult was the situation of banks. In addition, weaker economic conditions in the construction market were noticeable, which indicated a worse condition of households and companies. The downturn in the construction market caused a decline in demand for building materials and construction workers.

In the XNUMXs, American capital invested heavily in the European market. It concerned both economic investments (financing factories, reconstruction after war damage) as well as the debt of companies and countries. The United States, through loans and investments, financed, among others, the war repatriations which the defeated Germany was burdened with. It was peculiar "Gold flow triangle". The loans were used by the Germans to pay off their war contributions. In turn, Great Britain and France, thanks to the received war indemnities, were able to pay off the loans taken out in the United States to finance the war effort. In 1928, American capital began to flow out of the European markets and was invested on Wall Street, which provided very high rates of return.. The economic downturn, combined with the tightening of monetary policy by the Federal Reserve, contributed to the economic downturn.

The situation on the stock exchange in 1929-1932

The period after the First World War was often referred to as the "crazy twenties". There was a great boom on the stock exchanges. Markets moved to foxtrot, swing, jazz and Charleston.

It was very popular to use financial leverage by investors. As a rule, for $ 1 of capital, brokerage firms provided credit for $ 9. Demand fueled by cheap credit was pushing up prices. At the same time, the end of the war in Europe allowed the United States to increase exports to recovering economies. However, the first symptoms of the slowdown were visible in the late twenties.

The first of the teasers was the weaker performance of the American stock exchange in March and May 1929. However, the market quickly forgot about the signals from the real economy. Between June and September 1929 DJIA index increased by over 20%. On September 3, a peak of 381,17 points was established. Some market participants feared that the optimism among investors was too high. Examples include the words of the investor, entrepreneur and economist Roger Babson. On September 5, 1929, he said, "sooner or later the crash will come and it can be terrible."

The Great Depression started in the so-called black thursday in the american stock market. On October 24, 1929, the Dow Jones Industrial Average fell 11% in one session. Financial institutions began to organize liquidity assistance to stabilize share prices. The second panic hit came on Monday 28 October. Many investors were asked to supplement their deposits (the so-called margin call). Due to the lack of additional funds, investors began to reduce their positions, which triggered a sharp sell-off. October 28 ended with a decline of 12,8%. The next day the declines continued. October 29 was very emotional. Investors generated a volume in excess of 16 million shares. The Dow Jones Industrial Average fell by more than 11,7%. The DJIA ended the day at 230,07 points. Such strong drops in less than a week caused a reaction of "thick wallets". William C. Durant and members of the Rockefeller family began the share buyback. The actions were announced to the public to calm the market sentiment.

There was a day of rebound on October 30, the Dow Jones ended the day with an increase of 12,3%, closing the session at 258,47 points. However, the increases in the market were temporary. The next falling wave lasted until November 13 and led to a drop in the index below the level of 200 points. However, despite the worsening economic situation, the stock market continued its path. In April 1930, the index returned to pre-panic levels. On April 17, 1930, the DJIA reached 294,07 points. However, with the continuation of banking crises, problems with the liquidity of enterprises and investors, the mood on the stock market began to deteriorate. The bear market lasted from April 1930 to June 1932. At the height of the bear market, the Dow Jones Industrial Average fell to 41,22 points.

Industrial production

Unsold product stocks and difficulties in obtaining financing resulted in the reduction of production by industrial companies. At the same time, the desire to get rid of surplus stocks put pressure on lower prices. Companies limiting their activities limited employment and contacts with suppliers. Banks also had problems as they were more cautious about granting new loans, which created problems with debt rollover by enterprises. A downward spiral in production began, coupled with an increasing number of bankruptcies. It was very visible in the car industry. In 1929, 5,3 million cars were produced in the United States. In 1932, production was only 1,3 million. The 1929 production level was not reached by the American auto industry until 1949. Overall industrial production rates were just as weak in the United States as in other countries included in the capitalist commodity exchange system. If we assume that the value of world production was 100 in 1928, then in 1932 industrial production was 67. In the United States and Poland, the decline in production between 1928 and 1932 was 54%, in Czechoslovakia 60% and in Germany 43%.

Unemployment

Limiting employment by industrial companies had an impact on the condition of the labor market. There was an oversupply of workers who could not find a stable job. Both unskilled workers and "white collar workers" (white-collar workers) had problems. The loss of jobs impoverished families, radicalized public mood and increased the number of strikes. The scale of unemployment was enormous and lasted much longer than it was during previous crises. In Germany in 1932 unemployment was 43%, while in the United States in 1933 there were 27% of the unemployed. This meant that several million workers were constantly unemployed in the USA. In those days, the "social net" was very weak. As a result, the unemployed could only count on small benefits, charity or families. Since there was an oversupply of workers, employers could dictate prices for work. This led to a significant drop in wages. Both nominal and real.

The tragic situation on the labor market resulted in a loss of faith in the effectiveness of the recipes of the "classical school of economics", which believed that the market would find a new equilibrium point and return to the path of growth. A new school of economics, later called Keynesianism, began to emerge. The leading figure in this movement was M. Keynes.

Price scissors and the agricultural crisis

There was price deflation in the market. However, the prices of individual products fell with a different force. As a result of the concentration of enterprises, industrial products were falling much slower than in the case of the prices of food products. The monopolies that could dictate higher prices were in the best position because they did not have to be afraid of strong competition.

This market environment contributed to the crisis in agriculture. In the 60s, many farmers used investment loans to modernize their households. The repayment was to be guaranteed by higher yields. However, as a result of the fall in agricultural prices (over 1929% between 1933 and XNUMX), many farmers ran into liquidity problems. Many farms have been taken over by banks and other creditors. The price squeeze has also impoverished farmers in both the United States and other countries hit by the Great Depression.

The Great Depression and the Gold Standard

As theories that advocated active monetary policy grew in popularity, there was a revolution in the monetary system. Many countries began to abandon the gold-based system in favor of more flexible solutions. To understand the importance of this event, one must go back to the years before the First World War.

While gold has taken place on the map of the European monetary system for centuries, it was not a gold standard. Silver was an equally important source of minting coins. The beginnings of the formation of the world gold standard took place at the end of the first half of the XNUMXth century. In 1844 Great Britain passed the "Banking Act" which obligated the Bank of England to exchange its banknotes "on demand" for gold. Some look for the origins of the gold standard in 1821, when the minting of the sovereign coin began in Great Britain.

Due to the fact that in the nineteenth century London was the financial center of the world, the gold standard was adopted in more and more areas. Other countries began to shift from silver currency or bimetalism. The rapid weakening of the value of silver helped in the second half of the 1854th century, which forced currency reforms in many countries, where it was decided to introduce the gold standard. This was the case, among others, in Canada (1873), Germany (1873), Italy (1873) and France (1896). The Russian Empire also joined the gold standard (XNUMX). The gold standard facilitated international trade and performed a stabilizing function (outflows and inflows of gold). It also required a sound budgetary and monetary policy.

The gold standard was interrupted by the First World War. The war effort forced states to increase budget spending, which made it impossible to maintain the convertibility of paper currency into gold. The number of money in circulation increased, which was one of the causes of inflation. After the war, some countries returned to the gold standard. This was the case of Germany (1924) and Great Britain (1925). In the latter case, it was decided to return to the pre-war rate, which was impossible to achieve. Gold-based currencies have also introduced new countries on the map of Europe. An example is Poland, which joined the system after Władysław Grabski's reforms.

The period of the 20s was the stabilization of the macroeconomic environment and the slow reconstruction of Europe from the devastation of the war. Under these conditions, the gold standard (except in a few countries) fulfilled its function. However, the economic crisis forced states to become more active in fiscal policy. Some countries have denominated their currencies quite quickly in order to get out of the crisis faster. This was the case of Great Britain (1931) and the United States (1933). However, some countries remained faithful to theories of "strong currency", grouping themselves in the so-called "Golden Block". These countries emerged much more slowly from the crisis than the countries abandoning the gold standard. The Gold Block included countries such as France, Belgium, Switzerland, Luxembourg, Italy and Poland. It is worth noting that only Poland was a debtor country. As a result, the deflationary policy applied by the Polish government resulted in an even longer recovery from the crisis. The Golden Block actually ceased to exist in 1936 with the devaluation of the French franc.

Foreign trade crisis

The Great Depression also had a negative impact on international trade. In the XNUMXs, there were local customs wars (e.g. Polish-German customs wars). It was a marginal phenomenon. A fairly free movement of goods and capital prevailed. However, with the crisis, in order to protect their own industry, governments tried to raise duties and encourage the use of price dumping in exported goods (sales below cost of production). Dumping resulted in higher duties, which in turn most often resulted in the imposition of retaliatory duties. The most important moment in the tariff wars was the announcement Smoot-Hawley Tariff Act. This document raised the level of customs duties on more than 20 goods that were imported into the United States. The law entered into force in 000. The result was a drastic reduction in trade. Between 1930 and 1929, trade decreased by 1933% from its 64 level. The trade restriction prolonged the crisis as most countries began to introduce mechanisms to "protect" the domestic market. Tariffs were raised, and import limits were introduced. Many economists believe that the Smoot-Hawley Tariff Act aggravated the Great Depression. Freedom of trade has declined in popularity. The time of protectionism has come.

Banks' problems

When the economy shrinks, unemployment rises and companies face liquidity problems, the risk of a banking crisis increases. This was the case at the time of the Great Depression. Many loans to businesses and households were not paid on time. As a result, banks had a problem with paying off their liabilities to their clients (paying out deposits) and creditors (e.g. to buyers of bonds). There was a situation where the quality of assets was deteriorating (credit write-offs) but the liabilities remained the same. This threatened the banks' liquidity. The state authorities, which passed laws on a compulsory moratorium on paying off debts, also did not help. Bailiff auctions have been banned in dances such as Wisconsin, Minnesota and South Dakota.

Banks operating with high financial leverage were in a particularly bad condition. The problems of banks increased the nervousness of customers who, wanting to protect their savings from loss (there were no government deposit guarantees), withdrawn money from "troubled banks". This in turn made many of them insolvent overnight. This entailed panic from other people who "infected" other banks with panic. Phenomenon run on the bank means that the bank has to satisfy the payments of many customers at once. Banks had little stocks of cash to meet customer needs on a day-to-day basis, as most invested either in the capital market or extended loans to businesses and individuals. If the bank did not liquidate the assets quickly, then it could not withdraw funds to clients. Half of the banks in the United States collapsed. For example, in the years 1932-1933 over 5400 commercial banks went bankrupt. This has led to a greater concentration of the banking sector.

Panic at the American Union Bank in New York (June 30.06.1931, XNUMX). Source: federalreservehistory.org

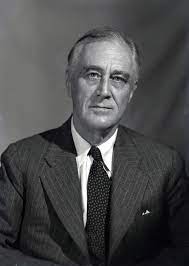

The problems of the banking sector encouraged state governments to pursue "banking holidays." During the holidays, the banks were under no obligation to conduct business. As a result, they did not have to withdraw money, which was to reduce the risk of spreading the run to banks. One of such states was Nevada (October 1932) and Louisiana (February 1933). President Roosevelt introduced national banking holidays between March 6 and 13, 1933.

In turn, the banking crisis in Great Britain, Austria and Germany broke out in 1931. One of the biggest failures of that crisis was the bankruptcy of the Austrian Osterreichische Credit Anstalt. In order to counteract the banking crisis in Europe, a moratorium was announced on the payment of German war contributions. The memorandum was signed in the second half of 1931 despite France's objections.

The Great Depression and the US economic policy

Contrary to popular belief, it was not Franklin Delano Roosevelt who started fighting the crisis with increased government spending. The first attempts at intervention were introduced by the administration of the previous president - Hoover. At that time, a number of infrastructure projects were launched, the most famous example being the Hoover Dam, which was built between 1931 and 1935. It is also worth mentioning that shortly after the crisis broke out, the president encouraged companies to refrain from reducing workers' salaries. He believed that the crisis of 1929 would be of a similar nature to that of 1920-1921.

In 1930, he persuaded Congress to spend $ 100 million on continuing the Federal Farm Board program. He was also a supporter of an increase in customs duties on agricultural goods so that, as a result of higher prices, farmers would be able to pay off their debts.. Hoover, however, was opposed to departing from the gold standard. To finance government spending, taxes were raised for the richest during the Hoover administration and companies were taxed more heavily. The tax for the best earners increased to 63% (at the beginning of the president's term it was 25%), while the corporate tax to 13,75% (from 12%). Opponents Hoover believed that the aid prepared by the American government was insufficient. Opponents pointed out, inter alia, passivity towards the situation of the homeless. the makeshift shelters they built were called Hooverville.

Due to public discontent, Hoover lost the 1932 election. They were won by the governor of New York - Franklin Delano Roosevelt. It was the beginning of the dominance of the Democrats, who "had" the president until 1953, and control of Congress until 1947. Democrats started preparing a new economic program - New Deal.

The New Deal was a state intervention program designed to lift the United States out of the crisis. A group of advisers known as the "Brain Trust" launched a series of projects to reduce poverty, unemployment and raise the agricultural sector. Many government agencies have been established. The best known are FSA (Farm Security Administration), SSA (Social Security Administration) or CCC (Civilian Conservation Corps).

Under the New Deal, an extensive public works program was carried out, employing more than 8 million workers. Extensive infrastructure projects have improved the quality of roads, developed the airport network and developed the network of hospitals and educational institutions. Between 1933 and 1935, the PWA (Public Works Administration) agency implemented over 34 projects worth 000 billion dollars.

New Deal is also the introduction of new regulations. In 1933, the Securities Act was passed, which required publicly traded companies to publish financial reports to be verified by independent auditors. A year later, the SEC (Securities and Exchange Commission), whose task was to supervise the capital market.

Another pillar of the New Deal was also the monetary reform, which led to the devaluation of the US dollar. With the introduction of the Gold Reserve Act in 1934, the face value of gold was raised to $ 35 from $ 20,67. This was to help break the deflationary spiral.

Economic interventionism in Poland

After the death of Marshal Józef Piłsudski, supporters of state intervention began to gain voice. High unemployment, shortages of domestic capital and poverty continued to be a problem for Poland. Only the state had sufficient potential to create a broad project for the development of Polish industry. However, the old administration was conservative and reluctant to "economic news". Around 1935, the interventionist party, whose face was Eugeniusz Kwiatkowski, began to come to the fore.

The "Four Years Plan" was announced and was to run from July 1936 to June 1940. One of the flagship projects was the Central Industrial District. As part of the COP, a number of investments were carried out, such as Zakłady Lotnicze in Mielec, Huta Stalowa Wola, Lublin Truck Factory, Starachowice and Radom's arms factory. The implementation of the entire COP plan was interrupted by the outbreak of World War II.

The Great Depression and its effects

The Great Depression affected many levels. First, he undermined faith in the "invisible hand of the market." Voices began to be heard that the state should stop being a "night watchman" and be more active in the economy. Economic interventionism began to gain voice, which triumphed until the end of the XNUMXs. At the same time, the gold standard began to be abandoned, allowing for a "temporary" suspension of the exchange of currencies into gold.

Another effect was the rise in nationalist sentiment in Europe, which affected the results of the elections in Germany and the rise of the NSDAP to power. The second strong group that came to the fore were the communists, because unemployment and falling real wages radicalized the mood of workers.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)