How to transfer shares to another brokerage office [Procedure description]

When you choose a broker, you are not stuck with him for life. Offers change over time, just like our expectations, which is why we invest for years to come. If you are wondering how to transfer shares to another brokerage house, how long it takes and how much it costs, in this article we will present you the entire path for this process. You will also learn in which cases it is possible and in which it is not, and whether the transfer of securities will require inclusion in the tax return. We invite you to read.

Transferring shares to another broker – why?

First, let's answer the question why we would transfer our assets to an account with a company other than the one from which we acquired them.

There may be at least several reasons:

- Security – The brokerage office sector is considered rather stable, and the brokers themselves are either large companies or part of large capital or banking groups. There have been no reports of scandals or financial problems involving them in recent years, but of course it cannot be ruled out that they will not occur one day. Therefore, in the event of, for example, the deteriorating financial situation of the broker with whom we invest, we may want to transfer our assets to another, more stable company.

- Changes in the offer, e.g. lower commission – Brokerage offers can change dramatically over the years. Starting from commission rates, through the functionality of the platform, to the number of available markets and instruments. Over time, the offer we initially selected may no longer meet our expectations (e.g. lack of access to the exchange we are interested in) or the commissions themselves may lag behind the competition and turn out to be unfavorable for us. And then transferring our assets may turn out to be extremely beneficial.

- diversification – By building our investment portfolio over many years, it can grow to really large sizes (which is what we wish you!). And the old trading adage says:"Don't put all your eggs in one basket". So if we did not foresee this in advance, we may decide to transfer some of the already acquired assets to another company.

Of course, there may be more reasons, but these three key factors most often motivate investors to change their broker.

Shares, ETFs, CFDs – What assets can we transfer?

Some people may be surprised by the fact that not all assets will be possible to transfer to an account in another brokerage house. In the case of stocks, ETFs, options or futures, there is no problem with this. However, the problem is the instruments CFDs, i.e. contracts for differences e.g. for currencies, commodities, indices or cryptocurrencies. Of course, CFDs are rarely purchased for years, let alone decades. However, in the event of unforeseen, sudden circumstances (e.g. suspicion of the onset of insolvency of our broker), we are not able to transfer them to another brokerage house. This is primarily due to the lack of standardization of these instruments (their entire specification, from trading hours to the underlying instrument, may be different). The situation is different in the case of a regulated market, where instruments are standardized by the stock exchange on which they are listed.

| What instruments can be transferred to another brokerage office | |

| Can be transferred | Cannot be transferred |

| domestic stocks foreign shares ETF options debentures Investment funds futures |

contracts for difference (CFDs)

binary options |

Remember that the broker to whom we plan to transfer the assets must also have them in his offer!

How to transfer securities to another broker

Now let's get to the point, i.e. explaining how to transfer shares to another brokerage house. First of all, let's not be afraid of the whole process. It is not overly complicated and does not require much effort or paperwork, and taking advantage of the offer, e.g. with lower commissions, can quickly pay off.

However, assuming that it is possible, the best form of transfer is the so-called method in kind. This process means that the securities we choose are transferred 1:1, and only the place where the assets are stored changes. This way, there is no obligation to settle tax on the entire operation, regardless of whether our positions currently generate a loss or a profit.

Even though from the customer's point of view the process itself looks very simple and quick transferring assets may take at least several business days, so you need to be patient. It is also worth checking our instruction carefully before sending it to the broker (if it does not contain any errors) and after the transfer itself, check whether all the indicated assets have been transferred.

Due to the fact that each broker may have its own variant of the procedure enabling the transfer of securities, for the purposes of our article we will use an example and describe what it looks like in X-Trade Brokers (XTB). The scheme itself works quite similarly everywhere, but in one company it may be done via a form or online platform, and in another it is necessary to submit a paper order with our signature.

How to transfer assets to XTB – Procedure

XTB has been the most frequently chosen broker on the Polish market in recent years. No wonder. XTB clients receive access to a modern and functional platform, many exchanges and instruments from around the world and, above all, 0% commission up to the turnover of EUR 100 per month. And it is this last factor that makes such a transfer profitable, because even on previously purchased assets, we will not incur commission costs when they are sold.

1) Opening an account

To start the process, we first need to have one open real account at XTB. Just fill out the form and then upload the required photos of your documents.

2) Filling out the form

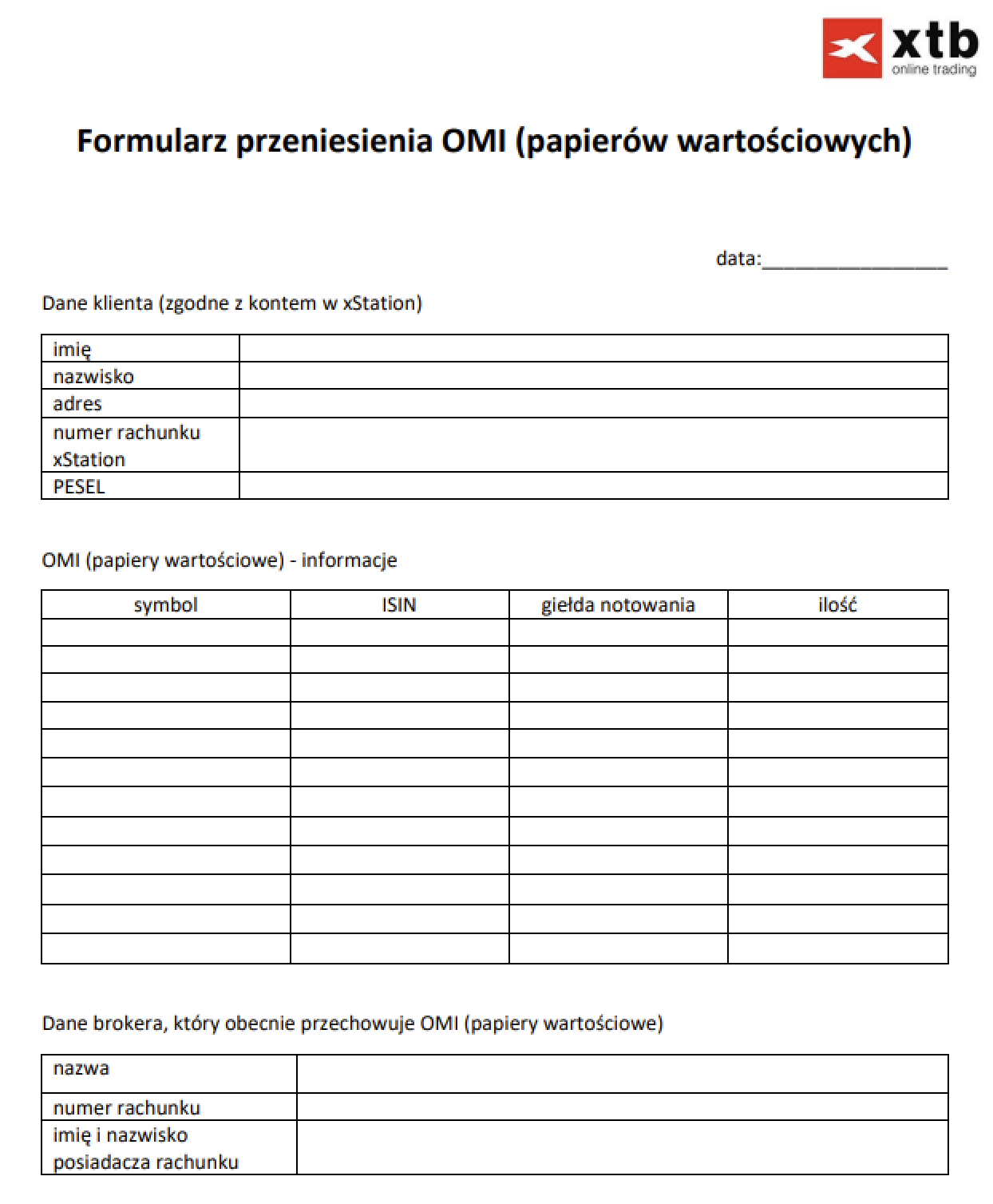

The next step is to determine what specific securities we want to transfer to the new account and complete the paper form that we will receive from customer service. It looks like this:

Securities transfer form. Source: XTB

The following data must be completed:

- first name and last name,

- address,

- Social Security,

- brokerage account number at XTB,

- financial instrument symbol,

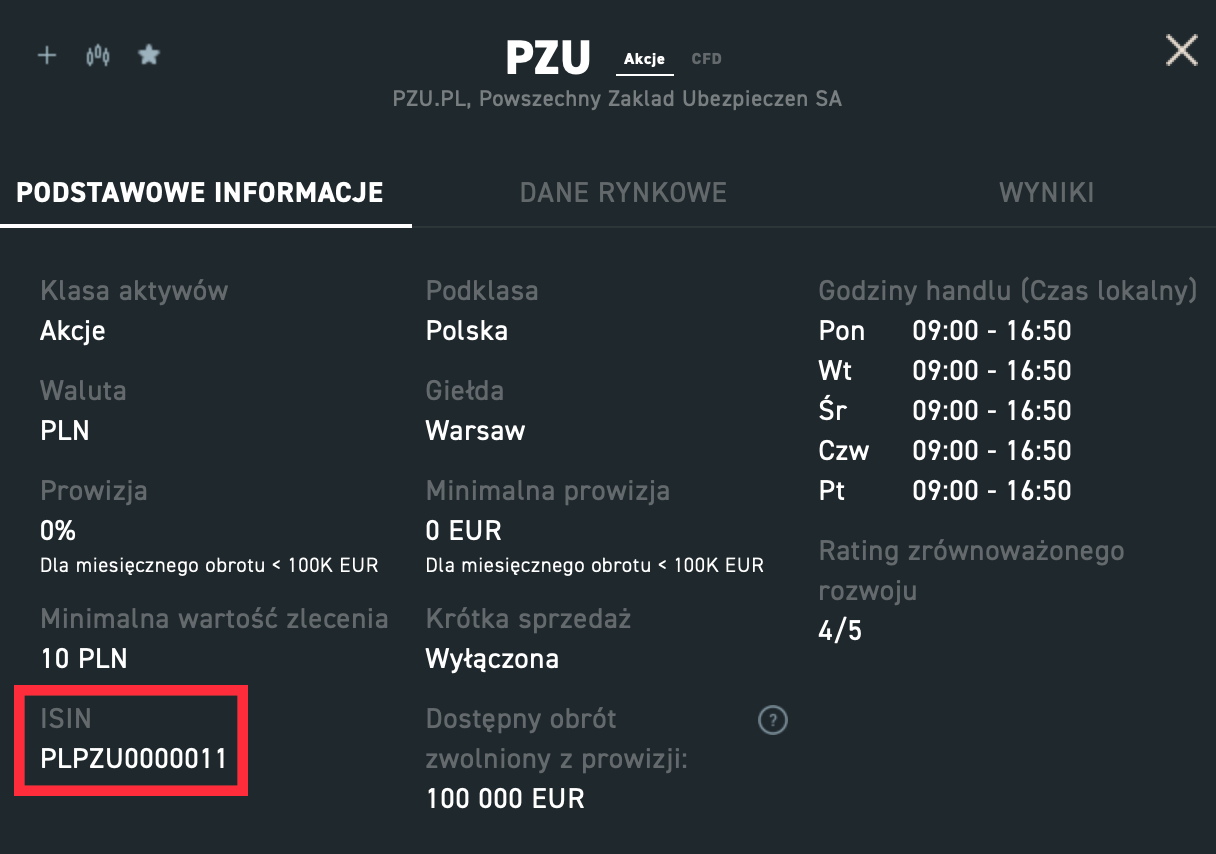

- International Securities Identification Number code (ISIN)*,

- the stock exchange where the instrument is listed,

- number of shares/contracts/units to be transferred,

- name of the broker and account number where the indicated assets are currently stored.

*ISIN number can be found on the xStation platform in the details of a given instrument.

ISIN code on the example of PZU shares. Source: xStation XTB.

The XTB form for transferring assets has only 12 free positions for instruments, so if we plan to transfer more of them, it is necessary to send several forms. For example, if we want to transfer securities of 30 companies, it will be necessary to submit 3 forms.

3) Sending the form

After completing the form, it should be delivered to both XTB customer service and our current brokerage house. And this completes the procedure on our side.

Note: It is necessary to check the correctness of all entered information and make sure that the XTB offer includes the instruments that we want to transfer. If they are not there, we can send a request to XTB to add them to the list (to e-mail: support@xtb.pl). These requests are considered individually within 14 days, and adding a new value takes up to 30 days from the moment of sending the inquiry).

How long does it take and cost?

It is also worth mentioning the time and costs of financing such an operation. The asset transfer time is up to several business days but in exceptional cases may take much longer. Additionally, if our form turns out to be illegible or contains errors, everything may take longer.

As for cost, yes in the case of XTB, this procedure is free of charge. However, this does not mean that the entire process will be free. To check this, first contact our current brokerage house or check the current table of fees and commissions yourself. For example, in BOŚ DM, the commission, depending on the type of instrument, may be zero or amounting to 0,5% of the market value (or not less than PLN 125) of the transferred assets.

Transferring securities to another broker – does it make sense?

It all depends on our individual motives and the situation on the investment account. If we are wondering how to transfer shares to another brokerage house and whether it will be profitable for us, we must define exactly what we want to achieve. If the goal is to choose an offer that is more attractive in terms of commission, we must take into account the difference in the rates of both companies, our turnover and the current balance of these items. Additionally, you should take into account the possible cost of transferring securities, which may result from the commission charged by our current brokerage house. In some situations, it may turn out that a better solution is to simply cash in the assets and transfer the cash, and then purchase them again (e.g. when we are in a loss and do not pay Belka tax on them), rather than transferring them to another account.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego.jpg?v=1709556924)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to transfer shares to another brokerage office [Procedure description] fed - dot plot](https://forexclub.pl/wp-content/uploads/2021/01/fed-eurpln-102x65.jpg?v=1611749950)

![How to transfer shares to another brokerage office [Procedure description] fomc usd](https://forexclub.pl/wp-content/uploads/2019/02/fomc-usd-102x65.jpg)