The price of cocoa is breaking records. The cocoa problem of stock market tycoons

Producing sweets seems to be a good business because a large part of society likes to consume sweets. Chocolate and products containing it are one of the most popular sweets. It was a profitable business for many years because the market was mature and growing steadily. Raw material prices were low for many years, which allowed the margin to be monitored. But there has been a sharp increase in cocoa prices in recent months, which recently exceeded the level of $10 per tonne - which is higher than the current level copper price. It is worth mentioning that during the year the price of this raw material increased by over 230%. The reason was a very poor harvest in Ghana, Cameroon and Ivory Coast. One of the largest chocolate producers, that is Barry Callebaut estimates that the shortage of cocoa on the market is currently approximately 10% of annual consumption, or 500. tone.

Cocoa is one of the key raw materials for the production of chocolate and chocolate candies. Their production requires cocoa mass or cocoa fat. The more expensive cocoa is, the higher the production costs, which leads producers to an important question: how to defend the margin?

Why is the price of cocoa rising?

The price of cocoa is rising because harvests in West Africa have fallen dramatically. But what caused this situation? The main reason was a weather phenomenon El Nino, which led to increased rainfall in December 2023. As a result, the fungus spread and attacked the plantations. Then the harvest was hit by a major drought, which significantly reduced the cocoa harvest. The dry and harsh weather environment meant farmers had to increase prices due to weaker harvests. Another problem was the aging of cocoa trees, which began to produce slightly worse harvests and increased the costs of their cultivation. Of course, this was not a key factor, but it had a negative impact on the supply of raw materials. It doesn't help either mining development, which destroys forests and lowers the groundwater level. Due to this environment, it is not surprising that cocoa production has decreased by several dozen percent. In Ghana, harvest forecasts for 2024 have decreased by over 20%, while in the case of Côte d'Ivoire by over 30%.

An interesting fact is that in Ghana and Côte d'Ivoire, the selling price by farmers is regulated and is currently $1600 per tonne. Middlemen and traders make money. This also discourages growers from increasing production. The situation is different in South America, where prices are determined by the market. As a result, in countries such as Brazylia or Ecuador they intend to increase production. Unfortunately, the supply increases over time as it takes 3 years for the trees to mature enough. So you can expect that at the latest In a few years, the price on the cocoa market will normalize.

The increase in cocoa prices affects the costs of chocolate production. An average bar of milk chocolate (30% cocoa) contains approximately 20% cocoa butter. Manufacturers of chocolate products sometimes decide to replace butter in whole or in part with substitutes (e.g. palm oil). Producers of such substitutes benefit from this, one of them is the Swedish company AAK AB, which is listed on the Stockholm Stock Exchange. Most often, however, this applies to products where chocolate itself does not play the most important role. An example of this is chocolate coating in candies or lower quality chocolate (where consumers focus more on the sweetness of the product than on the depth of flavor). Of course, not all companies do such practices. Nestlé in February 2024 mentioned that it did not intend to change the regulations due to changes in product prices. According to him, in the long term, such action would be a shot in the foot, because Nestlé customers expect a certain quality.

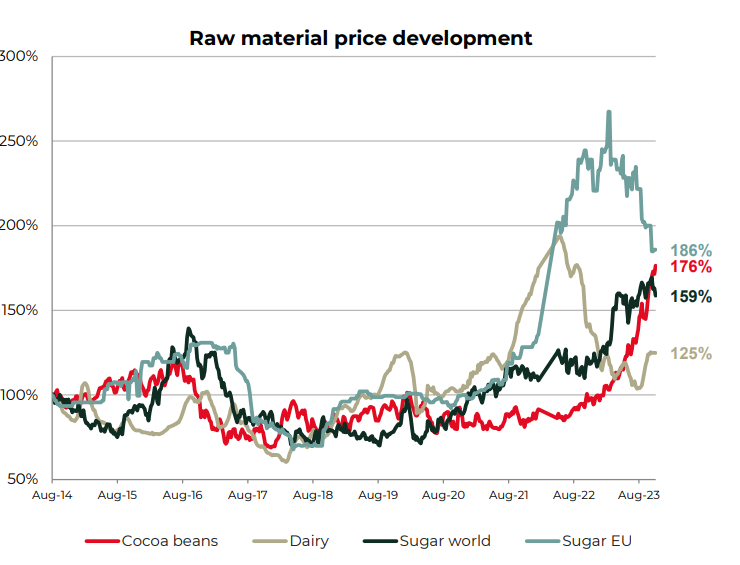

It is worth adding that not only the price of cocoa is increasing. The problem also concerns milk or sugar. This means that confectionery producers have experienced an increase in the prices of many key raw materials for the production of confectionery products. This can be clearly seen in the chart presented by Barry Callebaut.

Source: Barry Callebaut

Expensive cocoa is a problem for chocolate giants

Cocoa consumers have trouble finding substitutes for cocoa. You can of course reduce your cocoa consumption by increasing sugar, “fillers” or reducing the weight of final products. The price increase worries chocolate makers because none are “Chocolate Hermes”. This means that product recipients are price sensitive. For this reason, they cannot accept any increase in the prices of finished products. At the same time, producers themselves cannot take on the entire increase in raw materials because it would hit their financial results too hard. The increases are therefore guaranteed and have already been achieved by, among others, Lindt, Mondelez or Hershey. There is also a strategy of hidden price increases by reducing the weight of finished products. Potential solutions to the problem of falling margins include:

- increasing the price of products,

- application shrinkflation,

- change of product composition,

- cost restructuring,

- hedging a position on cocoa.

Raising prices is not an easy strategy because the market is very competitive. People are sensitive to price changes, and listed producers do not have a strong enough brand to raise prices without fear of losing market share. Producers of chocolate for the mass market (Mondelez, Hershey) or premium brands (Lindt) dominate. It is worth remembering that premium brands are not luxury brands, therefore they must set goals based on market data.

Similarly, it is difficult to reduce the grammage because in the age of social media such information spreads very quickly. Of course, customer outrage is often only temporary and they tend to return to their shopping habits after some time. However, many companies have already decided to take such a step. Chocolate is an example frond, which reduced the weight for some products from 100 grams to 80-90 grams (depending on the type of chocolate).

Another solution to the problem of rising cocoa prices is to expand the portfolio of products with lower cocoa content. These include jellies, cookies, ice cream, dragees and fruit candies. A big problem for chocolate producers is that it is not a first-need product. Therefore, when products become too expensive, consumers will look for substitutes (instead of chocolate, they will buy jellies or cookies). Another strategy is to change the "inside" of bars and chocolates. For this purpose, more dried fruits, fruit caramel or jellies are added. This allows you to reduce the consumption of cocoa in the finished product without having to reduce the weight of the product.

However, it can be concluded that the difficult market situation will force companies to review costs and conduct cost optimization. One of them may be the automation of production or back office activities. This will allow for better allocation of funds in the company in the long term, which will translate into higher operating profitability.

Another issue is that many chocolate producers hedged themselves against price increases. The problem will be the rollover of positions when chocolate producers will no longer be able to benefit from lower cocoa prices. This will lead to a “next hit” in average production costs within 6-12 months. Therefore, it is possible that only in 2025 will the results of chocolate producers begin to improve.

CHECK: How to invest in cocoa? [Guide]

Restructuring as a plan for difficult times?

The problems in the industry are already visible. In the fourth quarter of 2023, Hershey reported a 6,6% decline in revenues, which is the result of consumers' sensitivity to price increases. Another problem is general inflation, which affects the purchasing power of consumers. As a result, spending on less necessary goods is reduced. Hershey decided to introduce a savings program of $300 million. This will partially affect the staff, which will be reduced by approximately 5%.

Also one of the largest chocolate producers, the Swiss Barry Callebaut, announced plans to restructure its debt. According to the announcements, about 500 employees in Belgium are to lose their jobs. The total savings plan is expected to reach €250 million in two years. As a result of the savings, approximately 2 employees are to be dismissed. For comparison, the company's employment is approximately 500 people. The restructuring is intended to improve the company's profitability in a difficult market environment. At the same time, the funds are to be redirected into new investments, which are expected to reach approximately €13 million.

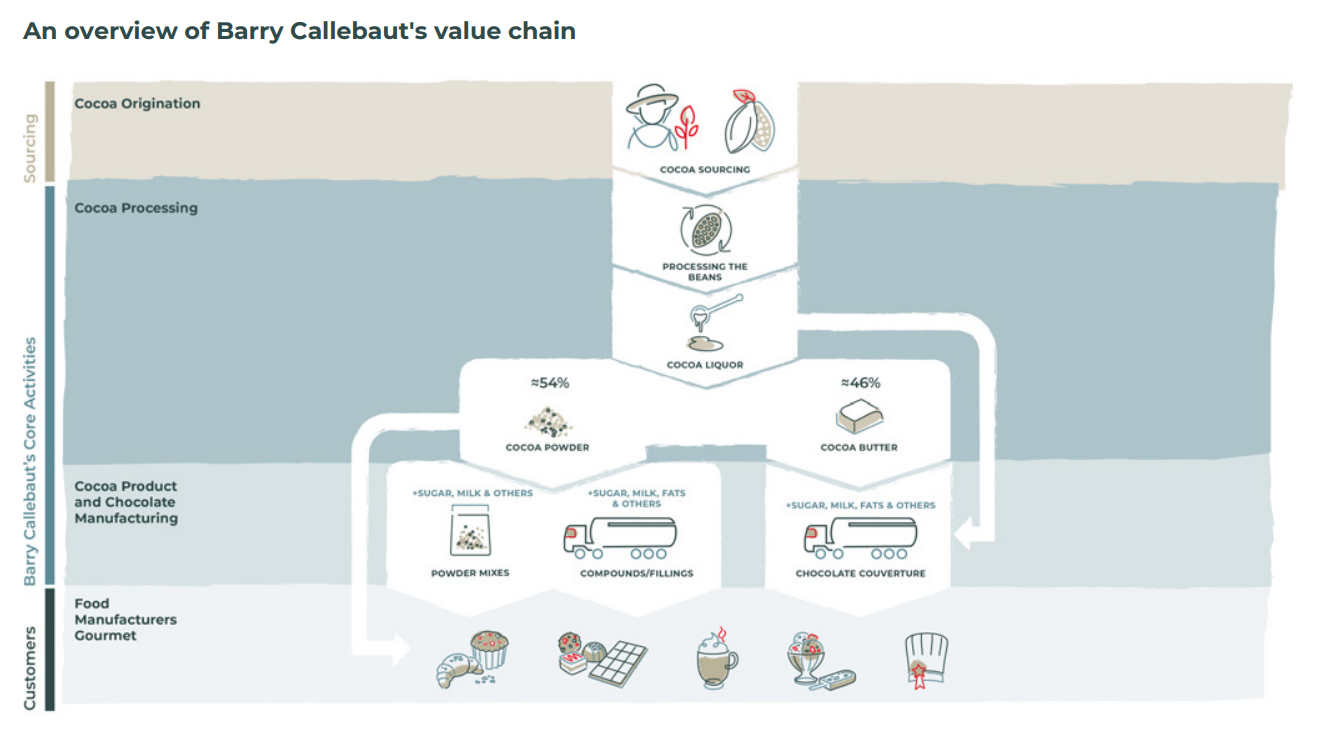

This is interesting because Barry Callebaut has a diversified business where he produces both cocoa, cocoa butter and powder. In addition, it has a business producing chocolate to order. On the other hand, the situation can be explained by the fact that less consumption means less production. Therefore, manufacturing activities will experience a decline in volumes.

Summation

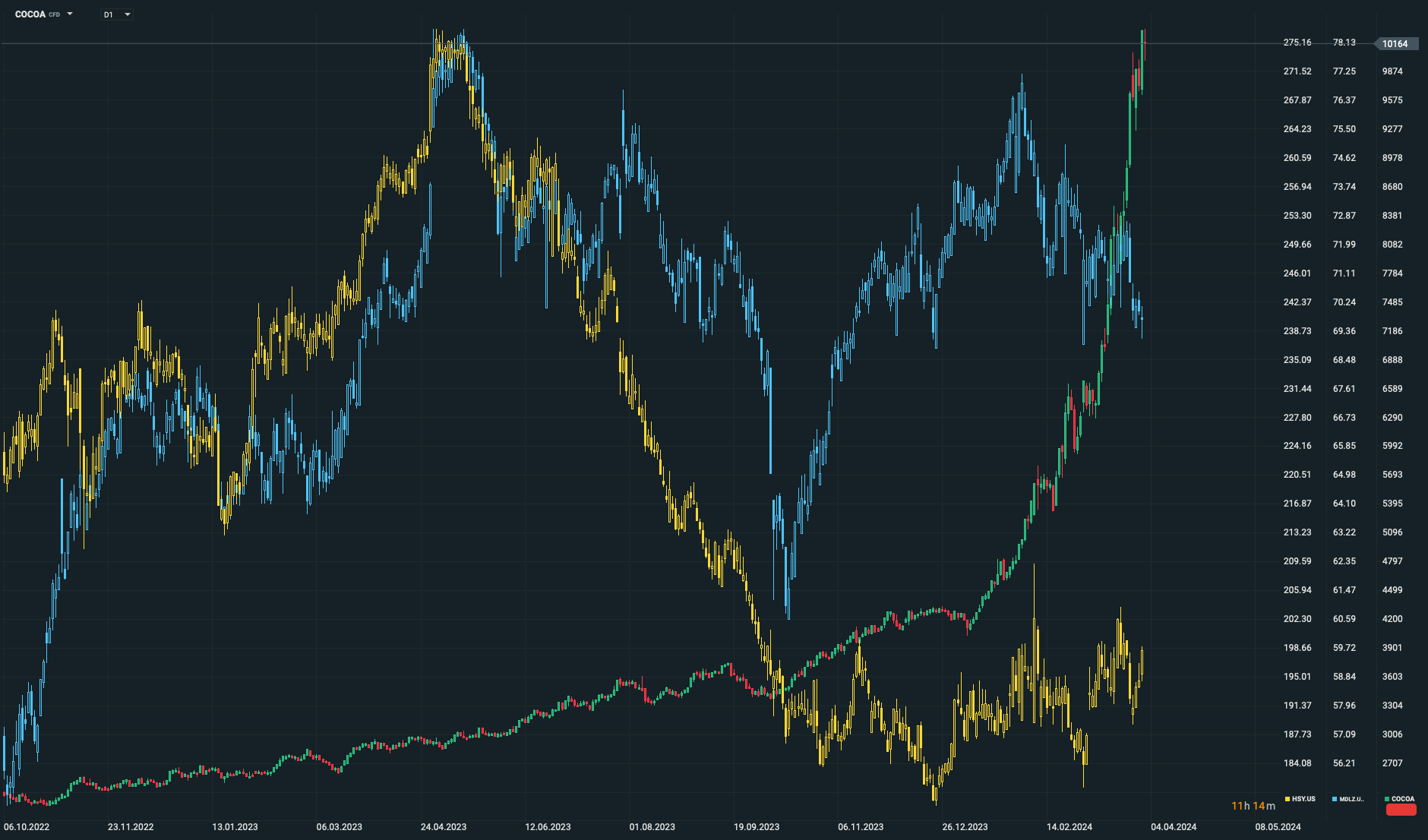

Companies related to the confectionery industry are having difficult times, especially companies specializing in the production of chocolate products. Over the last year Hershey's stock dropped over 20%, in turn, the advantages of Swiss Barry Callebaut dropped by 33%.

Shares of Hershey (yellow) and Mondelez (blue) against the background of the cocoa price index (green-red). Source: XTB xStation

The current imbalance is temporary (the probability of such a large El Nino every year is negligible), but it will take from several quarters to even 3 years to rebuild production (the growth cycle of a tree bearing fruit). The advantage is certainly the expanded production in Latin America, which will allow the supply of raw materials to be stabilized in the coming years. However, in the next few months, high raw material costs can be expected to translate into slightly worse margins or a decline in sales volumes. Of course, in the future, people will get used to higher nominal prices, which will allow companies to expand their margins. In addition to the uncertainty related to raw material prices, it is worth mentioning potential changes in eating habits. If Ozempic reduces global chocolate consumption, producers of such products will need to significantly restructure their operations. However, for now, long-term demand for products seems unthreatened.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response