Copper - How to invest in copper? [Guide]

Probably copper was the first metal used by humans. The history of its use by humans goes back to 10,000 years BC, nowadays it is used in many industries. You can also use this strategic metal for investment purposes. How? We check!

Chart - Copper

Characteristics of copper

Red, slightly shiny metal. The name of copper copper, in Latin cuprum) comes from the island of Cyprus, which was initially mined in significant amounts of copper.

Copper is characterized by high electrical and thermal conductivity and high plasticity. Can be hardened by adding a tin blend to form bronze.

Copper is 100% recyclable with no loss of quality, just like aluminum. It is estimated that the share of recycled copper will increase in the coming years due to the declining natural resources.

The use of copper

Copper and iron have played a huge role in the technological advancement of mankind. Today, copper is used in the production of electric cables, roofing and plumbing, and industrial machinery. Copper is used in integrated circuits, heat sinks and heat exchangers. Lightning conductors are also made of copper.

Metallic copper, like metallic silver, has antibacterial properties. Vessels are clad with a thin layer of brass composed of 60% copper and 40% zinc. This protects the surface of the vessels from the adverse effects of crustaceans and algae. Due to its biostatic properties, copper works well in the production of water pipes and door handles. According to a study published in 2011, copper coating of surfaces in ICU rooms in hospitals reduces the amount of pathogens on these surfaces by 97%.

| trade | Application |

| architecture | Waterproof roofing, pipelines, electric cables, gutters, |

| Transport | Car electric motors, ship structural elements |

| Electronics | Integrated circuits, electromagnets, picture tubes, magnetrons |

| Utility products | Covering usable areas, kitchen accessories, door handles |

| Industry | Distillers, glass engraving equipment |

Copper mining in the world

Chile, Peru and China can boast the largest copper mining in the world. Large amounts of this metal are also mined in the United States, Congo and Australia.

The table below presents the volume of copper extraction in the world in 2019.

| End | Production in thousands of tons |

| Chile | 5,600 |

| Peru | 2,400 |

| China | 1,600 |

| United States | 1,300 |

| Congo | 1,300 |

| Australia | 960 |

| Zambia | 790 |

| Meksyk | 770 |

| Russia | 750 |

| Kazakhstan | 700 |

Poland extracts approximately 430 tonnes of copper annually. We export copper mainly to Germany (144 tons) and China (95 tons). The other major partners in the copper trade are France, Italy and Turkey.

Copper deposits in the world

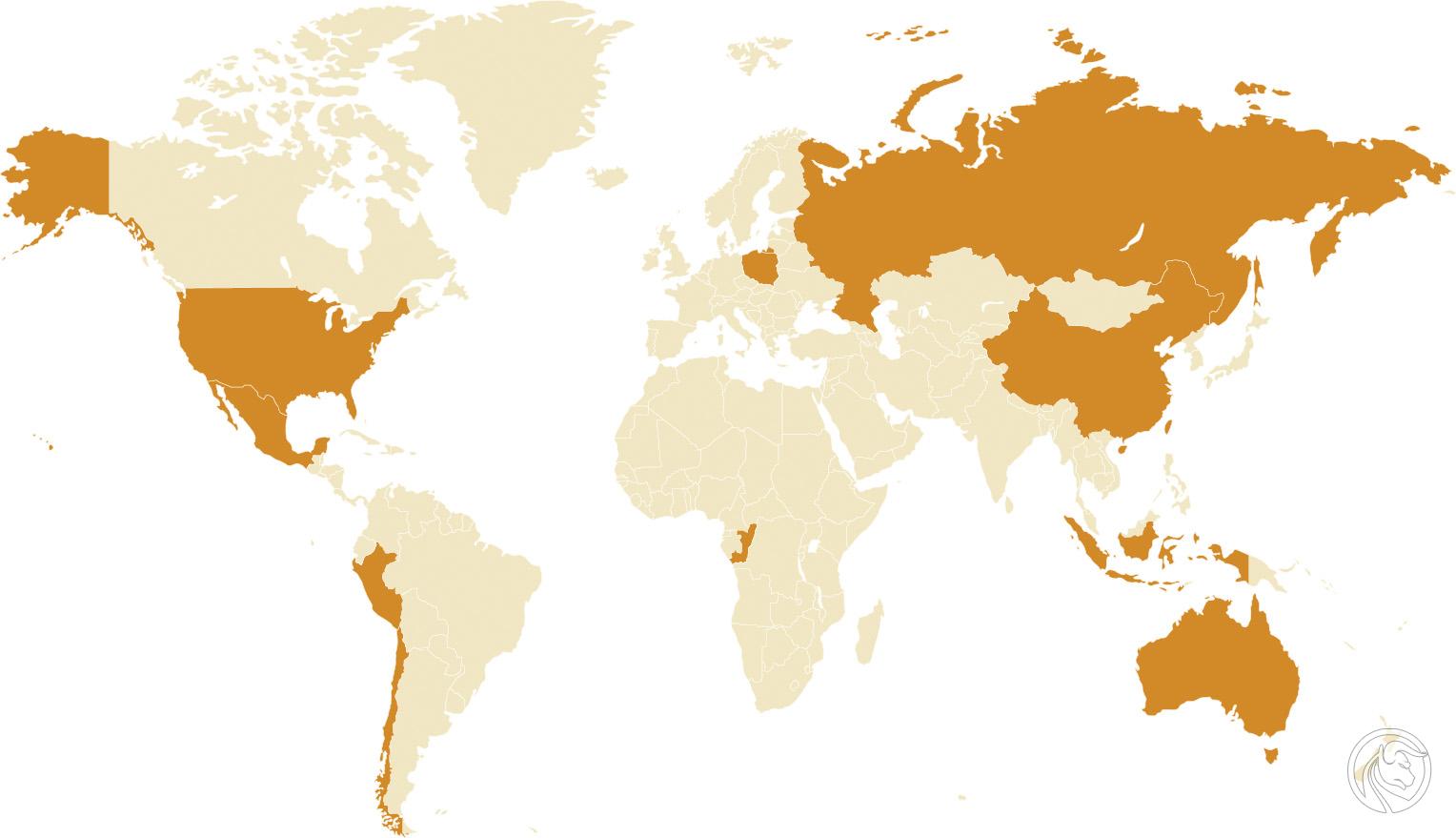

The largest copper deposits in the world are in Chile, Australia and Peru. Poland is in 5th place in terms of the size of estimated copper deposits in the world. Poland's copper deposits are located in the Sudetes. In Poland, copper is mined only in underground mines. The Rudna mine, located in Polkowice, is the largest copper mine in Europe. The graphic below shows the countries with the largest copper deposits in the world.

Source: PSI.gov.pl

The table below shows the 10 countries with the largest estimated copper deposits.

| End | Estimated deposits in millions of tons |

| Chile | 209 |

| Australia | 93 |

| Peru | 68 |

| Meksyk | 38 |

| Poland | 36 |

| USA | 35 |

| Russia | 30 |

| China | 30 |

| Indonesia | 25 |

| Congo | 20 |

Copper consumption in the world

It is estimated that 2018 million tonnes of copper were consumed worldwide in 24.5. China is the largest consumer of copper - it is responsible for 51% of the global consumption of this raw material. The remaining Asian countries account for 19% of the global demand for copper. Europe consumes 17% of global copper supply, both Americas 12%. Africa and Oceania account for 1% of world consumption.

| Region | Copper consumption in 2019 |

| China | 51% |

| Asia outside of China | 19% |

| Europe | 17% |

| North and South America | 12% |

| Africa and Oceania | 1% |

Dr. Copper - indicator of the condition of the world economy

Copper is widely used in many industries. For this reason, copper prices are considered a good leading indicator for the state of the world economy. Dr. Copper is a slang term for this phenomenon. It is believed that when copper prices are high and rising, this is evidence of a healthy economy. When copper prices are falling, it may be a sign of low demand for copper in the global economy and an indication that a crisis or economic meltdown is looming.

Research commissioned in 2014 by the Dutch bank ABN AMRO showed a strong correlation between copper prices and other indicators of the global economy. According to the statistical analysis carried out, high copper prices correlate with world trade volumes, GDP growth in China, the United States and Europe, and with oil and gold prices.

Despite the strong correlation, “dr. Copper "is not infallible. Copper prices are influenced by more than just production volume and the development of the global economy.

What influences the price of copper?

The state of the world economy

Copper is a metal with a very wide range of applications in many branches of the economy. The developing economy, numerous orders and high consumption and construction are driving the price of copper up. In turn, the breakdown in the economy is conducive to declines in the price of this commodity. At the beginning of 2020, copper on the London Metal Exchange (LME) was $ 6340 per ton. Three months later, in March 2020, the price was just $ 4731. It was related to the pandemic and the freezing of the global economy in many countries of the world. Currently, in September 2020, the price of copper is around US $ 6600, which indicates rather high demand for this raw material and the good condition of the global economy.

Copper plot, D1 interval. Source: xNUMX XTB.

Developing countries

Copper is mainly used in construction as electric cables and elements of the water supply network. Therefore, developing countries, especially China and India, are largely responsible for the demand for copper and the increase in copper prices. A stagnation and economic slowdown in developing countries, especially in Asia, would have a negative impact on copper prices.

Stagnation in supply

Two countries in South America, Chile and Peru, account for a large proportion of the world's copper supply. At the same time, these are countries prone to political turmoil, such as nationalization of industry or miners' strikes. Climatic phenomena such as earthquakes or other natural disasters can also affect the ability of mines to extract copper, and therefore increase the prices of this raw material.

Customs duties

In 2018, the United States introduced a 25% duty on steel imports and a 10% duty on aluminum imports. Currently, there is no duty on copper imports, but the imposition of such a duty by the United States or other countries could affect copper prices.

Investing in copper

Copper Futures

Copper futures are traded on the NYMEX (New York Mercantile Exchange), LME (London Metal Exchange) and CME (Chicago Mercantile Exchange). The symbol for copper contracts is HG. Contracts expire every month.

The NYMEX futures are traded at £ 25,000 copper and are quoted in US dollars. The copper futures on the LME, on the other hand, are worth 25 tonnes (£ 55,116) and are also traded in US dollars.

ETF for copper

[JJC] iPath Bloomberg Copper ETN

-

- Issuer: Barclays Capital Inc

- Annual fees: 0.45%

ETF with low fees, tracking copper contract prices. The fund buys contracts of only one month at a time and sells them shortly before the expiry date. The Fund purchases the contracts two months before their expiry dates in February, April and June and three months before their expiry dates in August and November.

[CPER] United States Copper Index Fund

-

- Issuer: US Commodity Funds

- Annual fees: 0.80%

A fund that mimics the prices of copper futures. The fund selects two or three contracts each month to minimize the effect contagion.

READ: Everything about investing in oil

CFDs on copper

Another way to invest in copper are CFDs available to many Forex brokers. CFDs are characterized by leverage - with brokers from the European Union, the maximum leverage for copper is 1:20. Below is a list of offers from selected brokers offering the best conditions for trading on copper (CFD).

Brokers offering copper CFDs

| Broker |  |

|

|

| End | Poland | Cyprus * | Denmark |

| Copper symbol | COPPER | HG / Copper | COPPER |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 500 | 0 PLN / 0 EUR / 0 USD |

| Min. Lot value | price * 30 USD | - | b / d |

| Commission | - | - | - |

| Platform | xStation | Plus500 platform | SaxoTrader Pro Saxo Trader Go |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Copper - How to invest in copper? [Guide] copper how to invest](https://forexclub.pl/wp-content/uploads/2020/09/miedz-jak-inwestowac.jpg?v=1599164401)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Copper - How to invest in copper? [Guide] Daniel Kostecki interview of the forex club](https://forexclub.pl/wp-content/uploads/2020/09/daniel-kostecki-wywiad-forex-club-102x65.jpg?v=1599145687)

![Copper - How to invest in copper? [Guide] augur rep cryptocurrency](https://forexclub.pl/wp-content/uploads/2020/09/augur-rep-kryptowaluta-102x65.jpg?v=1599332669)

Leave a Response