After our hospitable, focused webinar choosing your Forex broker, we were inspired to create this shameful ranking. Based on only situations that we personally experienced or indirectly participated in, we created a list TOP 5 in the category of the biggest mishaps we've noticed by FX brokers. These are situations that show that "the broker is also human" and he sometimes makes mistakes. Don't worry, gentlemen brokers - we will not give your names :-).

Place # 5

Frozen quotes - active trading

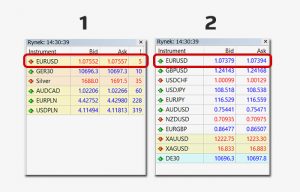

Technology can be unreliable - we have already got used to it. Breakdowns of trading platforms do not happen often, but they do happen occasionally with every broker. The most common failures are limited to breaking the connection between the broker's server and the trader's computer. This makes it impossible to view changing quotes as well as concluding / modifying transactions. There are occasional exceptions to this :-). I mean the phenomenon "Frozen quotes". It is a situation in which the prices of all or selected instruments suddenly stand still while maintaining connection with the platform. To diagnose such a situation, you need to be vigilant and at the beginning check that the clock is still active (the Market on MT4 window) and, of course, have a second one,

at the same time efficient platform. With such a turn of events, the option of trading often remains active all the time and with appropriate volatility, and at the same time divergence of rates between platforms, allows you to trade without much risk (except for not knowing when the price on our platform will "unfreeze"). All you need to do is find the right instrument where the rate is the strongest, then make a transaction and ... wait :-).

The difference between EUR / USD quotes from two brokers

Based on our experience, we are able to determine that statistically out of ten such cases, at least three turn out to be passable and such transactions are not reversed or corrected in any way. Of course, it all depends on the scale of the success of our transactions. The greater the profit, the greater the chance of catching irregularities. This is proof that even the broker himself can have a problem with monitoring everything that happens on his platform.

GOLD TIP: Stay alert and have more than one platform installed.

Place # 4

Giant debit

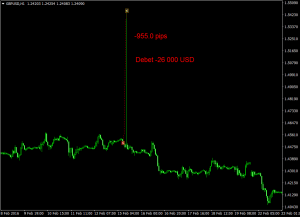

As far as you can try to suspect brokers of manipulating quotes and "price pulling", so that orders Stop Loss their clients have been "cut", it is hard to think that the 10000 pips bad tick was created intentionally and the broker believes it will go unnoticed. And as life shows, such situations do happen from time to time.

Having an open position with a relatively large volume in relation to the capital held, with such a scale of price discrepancy, regardless of the Stop Loss (price gap effect), you could see a real Armageddon… or Eldorado on your account :-). It was like that on a beautiful, speculative day ...

Real account, 3000 USD on the invoice and short position with a volume of 3.0 lots on GBP / USD. In an instant, the price jumped up by less than 1000.0 pips, then returned to its natural level after a short time.

Powerful debit triggered by an equally large bad tick.

According to the broker's regulations, the SL order was executed at the first market price. In the entire price range between the "right" price and the "Bad tick" there was a gigantic price gap visible only on the tick chart, i.e. it was invisible on MT4. Effect? A powerful overdraft facility of approximately USD 26, which is 000 times the amount of capital held. First thought: "Data? Attempt? Central bank intervention? You have to blow… ”Quick verification of the situation on additional platforms, however, reassured me that it was“ only ”a bad tick. Only and until, because the situation took place in the evening, i.e. outside the hours when the broker works at full capacity. Therefore, the correction of the account balance took several hours from the moment of filing the complaint, and the position itself disappeared irretrievably (along with the profit generated so far).

A similar situation presenting debits per billion USD caused by bad tick. Demo account.

GOLD TIP: Avoid platforms that often fail.

Place # 3

Execution of orders in a gap

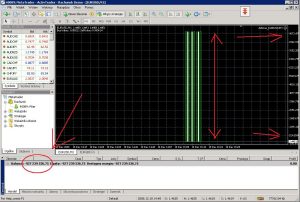

Currently, every more experienced trader knows that the occurrence of a price gap means one thing - a price slippage, i.e. execution of an order at a price different than expected. In such cases, the closing or opening of the position takes place at the first possible price that appeared on the platform. It's hard to demand that the order should be executed at a price that was not in a given range. This is called market conditions. But is it always the case that the broker offers us access to these "real conditions"? Not necessarily… 🙂

The price range in which orders were carried out.

There are exceptions, including one broker who ruthlessly executed orders in the gap for a long time, which he even advertised as one of his advantages. In such a situation, this fact could be used with pure premeditation. The implementation of SL or opening a position in the gap means that regardless of whether we dealt with the publication of NFP data or the weekend gap at the opening of quotes on Sunday, it always followed the price set in the order. Setting two opposite orders with a very close stop loss a few seconds before Friday 23:00 (programming skills in MQL came in handy) meant that the gap only had to be greater than twice the spread + a single SL to make a profit. The lot value didn't matter. The broker continued its policy of executing orders for over half a year from catching the so-called the "vulnerability" system :-).

GOLD TIP: Non-market conditions offered by the broker can be an advantage for you, as long as you can use them wisely.

Place # 2

Missing funds

Although this situation did not happen to me directly, it met a friend whom I was trying to help because of a language barrier (a foreign broker). The story is about a bank transfer of USD 10 to an FX account that ... Missing. But from the beginning.

Brokers provide bank data for payment in various ways:

- in the customer panel,

- by sending a PDF file,

- by sending data as content in the email,

- in the contract that has been signed with the client,

- on your website in the appropriate tab.

Currently, the third method is one of the less popular, but a few years ago, when brokers generally did not have "Clinet Panels", it was different. In this way, the friend received the data and on their basis made the foreign SWIFT transfer. It is known that such a transfer takes - usually in the range of 2 to 5-6 business days, where the sixth day even takes into account a really large workload in the accounting department. So much has passed, there are still no funds. At the beginning, the correspondence was resistant and focused on the slogan "please wait, they will definitely come". Whatever the case, the fact is that money does not die in kind - it only changes hands. It's just that time passed and the broker did not receive the funds. Eventually, about 2 weeks after the transfer, they returned to the friend's bank account. These were related to:

- twice the fee for a foreign transfer + share of intermediary banks (2 x approx. 250 PLN),

- double conversion of funds, because the transfer was made from the account in PLN (2 x 2,5% of the amount, i.e. approx. 500 USD),

- two weeks of the unknown, and after that time money could still not be invested.

Ultimately, the incorrect data sent by the broker's employee in which the error in the account number crept in was found guilty. The re-transfer took care of the case and refunded the costs of the first transfer. The whole operation took less than a month and cost the broker almost PLN 2000.

GOLD TIP: Use bank details that cannot be edited directly (PDF, information from the customer panel).

Place # 1

Passwords generated by brokers

Brokers' mishaps have always happened. Bigger, smaller, more and less dangerous for investors' funds. However, this situation definitely deserves first place in our ranking. Although you may not believe it, know that it really happened.

Bill list. Fuzzy "sensitive" data, part of the account number and broker name.

After setting up a demo or real account, the data for logging in to the investment platform and / or the customer panel is transferred. These data are transferred in different ways depending on the established procedure - the most popular way is e-mail, but we also meet with the transfer of data by phone, text message, and even by post, where we receive all the data together with a copy of the signed contract. While the account number is always generated automatically according to the adopted order (usually gradually by 1 number up), the passwords are different - most often they are generated automatically by the system or set by the broker, but the method of setting the password by the client himself at the time of filling in the registration form or generating it in the customer panel.

In my case, in the described situation, the login and password were provided by phone. The password was short and relatively easy (no special characters like * $ ^) so that it could be easily understood and written down by talking to the broker. Not much later, a close acquaintance, a beginner trader with an account with the same broker, asked me for help to look at his trades. For this purpose, he gave me his login and password (although it should never be done). As it turned out? The password was very similar to mine. More precisely, the password consisted of the account number followed by two letters at the end (e.g. 100181ks, 100156ks etc.), which as it turned out, were constantly.

First thought? Case! But it's worth making sure ... Did the same password rule apply to other accounts? For this purpose, we set up new accounts (so-called sub-accounts) and asked our friends if their passwords looked similar. Indeed it was so… And there is probably nothing else to add here. On the same day as my application, all passwords were changed by the broker.

GOLD TIP: Always, but absolutely always, change the password generated by the broker to your real account on your own.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response