Purple Trading

STP, ECN

EUR 100, PLN 400

CySEC (Cyprus)

Forex, indices, commodities, ETF portfolios, futures, stock CFDs

Retail client - 1: 30

Experienced customer - 1:100

Professional client - 1: 500

variable, market variable

from 0,3 pips (ECN account)

from 1,3 pips (STP account)

0.01 lot

from USD 5 to USD 8 per lot on ECN account (with Forex Club discount)

YES

to 20 000 EUR

MetaTrader 4, cTrader

MT4 Web, cTrader Web

iOS, Android (MT4, cTrader)

Purple Hub learning zone, trading tools, strategies and passive investments

- no conflict of interest

- low starting deposit

- a very large amount of custom tools

- relatively few instruments on offer

Purple Trading it's a broker ECN/STP with Czech roots, which offers instruments such as CFDs on currency pairs, indices, commodities and stocks and funds ETF and futures through the MetaTrader 4 and cTrader platforms. The broker focuses on the European market, in particular in the Czech Republic, Slovakia, Poland and Italy, where the first three countries dominate.

The company was founded back in 2016 and its main regulator is CySEC in Cyprus. Purple Trading is also licensed by the Czech National Bank (CNB) and other European countries (full list here).

The offer based on transparency, advanced tools and market execution of orders is addressed to even the most demanding traders.

COMMISSION DISCOUNT with Forex Club up to -38%

Types of accounts

Purple Trading offers its clients the following types of accounts:

- STP account – this is the default account type. With an STP account, the only fee a trader pays is the spread. There are no additional commissions or fees. This makes it an account primarily for less advanced traders or long-term traders.

- ECN account – market spreads without margin directly from the liquidity provider. With this account, a commission of between $5 and $10 is charged per lot traded. The ECN account is primarily tailored to the needs of intraday, algorithmic or scalping traders.

- PRO account – created for investors who would like to decide on their own in which model of execution and commission they want to invest.

- Demo account – free demo account on both cTrader and MT4 trading platforms.

Regardless of the type of account they have and the platform they choose, all clients can deposit, withdraw profits and manage their accounts through the client area PurpleZone.

Be sure to read: Forex broker models - ECN, STP, MM

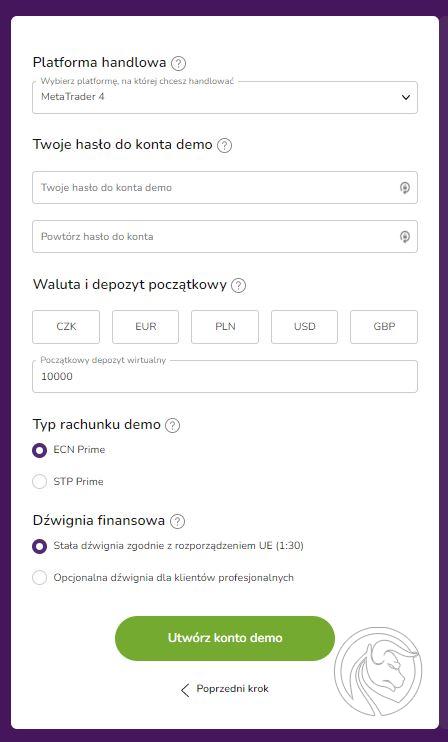

Demo account Purple Trading

Purple Trading offers a free demo account with five base currencies (PLN, EUR, USD, GBP, CZK). A demo account can be opened on both the MetaTrader 4 and cTrader platforms. It is the perfect way to try out trading, go through the features of the platforms or test your trading strategies without risking losing money. What's more, they can be used indefinitely as virtual trade credits can be topped up multiple times.

Purple Trading offers a free demo account with five base currencies (PLN, EUR, USD, GBP, CZK). A demo account can be opened on both the MetaTrader 4 and cTrader platforms. It is the perfect way to try out trading, go through the features of the platforms or test your trading strategies without risking losing money. What's more, they can be used indefinitely as virtual trade credits can be topped up multiple times.

Traders or investors can choose an initial deposit of up to $10 in virtual funds and can test trading conditions and prices in real time. To open a demo account, just fill out a simple online registration form. Clients can also choose between account types (ECN or STP) to test the features of each of the accounts offered.

Commission policy

In the case of ECN accounts, which are most often chosen by traders, in addition to the low market spread, a commission is charged on the order. This commission is charged at the time of concluding the transaction and amounts to: from $5 to $10 from 1 lot depending on account level. The amount of the commission depends on the deposit paid.

Commission discount up to -38% with Forex Club

People who decide to open an account through Forex Club by clicking on This linkwill receive a reduced commission up to -38% permanently and without limits.

Commission rates for ECN accounts

| Account type | STANDARD | PREMIUM | VIP |

| Standard deposit required | EUR 100 / PLN 400 | from EUR 20 to EUR 000 | > EUR 60 |

| Deposit required from Forex Club | EUR 100 / PLN 400 | from EUR 5 | from EUR 5 |

| Lever* | 1:30 | 1:30 | 1:30 |

| Standard commission | $10/lot | $8/lot | $5/lot |

| Commission with Forex Club | $8/lot | $5/lot | $5/lot |

| Commission discount with Forex Club in % | -20% | -38% | - |

| Activity required | NEVER | NEVER | NEVER |

| Forex Club App - Tax*** | YES | YES | YES |

- *The level of leverage depends on the classification of the client (retail 1:30 / experienced 1:100 / professional 1:500).

- **The discount is granted automatically to all persons who open an account via the ForexClub.pl website. There are no additional requirements or restrictions.

- ***App access Forex Club - Tax free for life for active accountsthat are in the Forex Club group.

How to get a reduced commission.

- go to registration form from this link.

- Fill out the application and send scans of your documents.

- You will automatically receive a reduced commission rate.

- There are no additional conditions in the form of experience, turnover or time limits.

- To be sure, after the first transaction, make sure that the appropriate commission rate has been charged.

You can assign it to the Forex Club group and get access to all the benefits offered, incl commission rebate. Write to us - CONTACT.

Financial instruments

Focusing mainly on the Forex market, Purple Trading offers a wide range of currency pairs. In addition to this, you can also find CFDs on stock indices, commodities and stocks. In total, we have over 200 instruments at our disposal:

- about 60 currency pairs,

- 10 stock indices,

- gold, silver, platinum, palladium,

- approx. 120 CFDs on stocks,

- 18 futures contracts (1:10 leverage)

- 5 types ready ETF portfolios.

A detailed specification of financial instruments is available on the broker's website here.

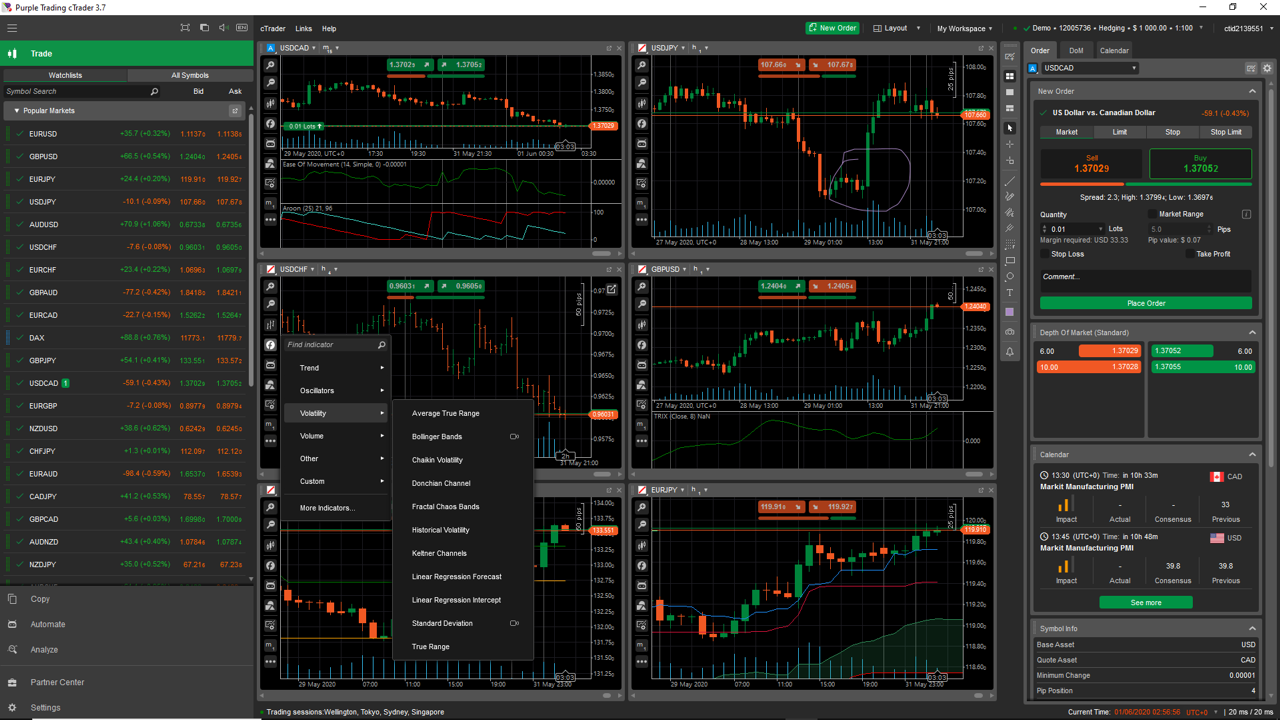

Platforms Purple Trading

Purple Trading offers two trading platforms:

- metatrader 4,

- cTrader.

Metatrader 4

The popular MT4 is the reliable standard when it comes to trading platforms. Clients who choose to trade on MT4 can use a number of additional plugins and trading tools such as indicators Purple Trading and many other custom solutions available only to broker clients.

The main advantages of the MetaTrader 4 platform:

- Access to historical data,

- Possibility to customize the charts,

- 4 types of pending orders,

- One-click execution of orders,

- Automation of trading via API,

- Over 50 built-in technical indicators,

- The most used platform in the world, multilingual interface,

- Compatibility with the vast majority of free trading tools available, EA, AlgoTrading, etc.

- Ability to use free indicators Purple Trading.

Download the software:

- Purple Trading MT4 - Windows

- Purple Trading MT4 - MAC

A set of tools for our clients:

cTrader

Purple also offers an advanced trading platform cTrader, which is gaining more and more popularity among the global community of traders. This trading platform offers an intuitive user-friendly interface, tons of trading tools and risk management options.

Main features of the cTrader platform:

- A wide range of chart types,

- intuitive design,

- Over 60 technical indicators,

- Advanced features for precise money and risk management,

- Features of the auto trading system,

- Direct access to the STP/ECN market,

- Browser-based interface,

- Complete video tutorials from Purple Trading.

Go to the application:

Deposits and withdrawals in Purple Trading

Deposits and withdrawals are made via the customer panel PurpleZone. The whole process is maximally convenient and user-friendly thanks to the intuitive interface. Traders who prefer instant payment options can use payment cards (VISA, Mastercard) or Netteler or Skrill e-wallet services. There are some transaction limitations in both instant payment options.

Purple Trading offers the following payment methods:

- Bank transfers (free for PLN, CZK and EUR),

- Card payment (VISA, Mastercard - free, processed immediately),

- Neteller (deposit and withdrawal 2% commission; processed immediately),

- Skrill (2% commission deposit, 1% commission withdrawal, min. EUR 3; processed immediately).

For details, click here.

Banks available in Purple Trading

The broker only holds its clients' funds in highly regulated EU banks:

- BNP Paribas (PLN),

- Bank PPF Czech Republic (CZK, EUR, USD, GBP),

- UniCredit Bank Slovakia (EUR, USD),

- Bank Sparkasse Malta (EUR, GBP).

B2B solutions Purple Trading

In addition to services provided to retail clients, Purple Trading also offers a modern B2B solution for Strategy Suppliers or Investors. Those who would like to start cooperation with the company Purple Trading can count on an individual approach, attention to detail and fair play.

Strategy Provider

Professional traders who would like to cooperate Purple Trading, they can do so by becoming their strategy providers. The broker guarantees attention to the legislative process and provides a framework for fully focusing on strategy development without having to worry about anything else.

Investors

Not wanting to actively participate in trading doesn't have to be a problem when it comes to being a customer Purple Trading. Those who are interested in passive investment options can opt out of professional Forex strategy or ETF portfolios.

Professional Forex Strategies

-

- Proven and profitable trading history,

- Capital drawdown depends on the adopted risk ratio,

- Possibility of investment from 100 euros.

ETF portfolios

-

- Long-term investment option,

- high diversity,

- Ability to invest from €20.

Customer service Purple Trading

Members of the customer service team are available from 8:00 am to 16:00 pm Monday to Friday (CET). Technical support (as well as financial markets) is therefore not available on weekends and holidays. To the advantages of customer service Purple Trading quick response via any form of communication and the fact that no registration is required to communicate with the chat operator and the ability to communicate in 4 languages, including Polish.

You can contact customer service as follows:

- By phone at the number provided on the broker's website,

- Through online chat on the website Purple Trading,

- Through email,

- Via Facebook.

FAQ - Purple Trading

General questions

trade in Purple Trading

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76,20% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford to take the high risk of losing your money.

Any opinions, news, research, analysis, prices or other information contained on this website are presented as general market commentary and do not constitute investment advice. LF Investment Limited will not be liable for any loss or damage including, without limitation, any loss of profit that may result directly or indirectly from the use of or reliance on such information.

The content of this website is subject to change at any time and without notice, and its sole purpose is to assist traders in making independent investment decisions. LF Investment Limited has taken reasonable measures to ensure the accuracy of the information on the website, however, it does not guarantee its accuracy and will not be liable for any loss or damage that may result directly or indirectly from the content or inability to access the website, for any delay or transmission failure or instructions received or notifications sent through this website.

At present, LF Investment Limited cannot and will not accept clients from outside the European Economic Area, Belgium, Switzerland and the USA. To become our client, you must be at least 18 years of age or over the legal age set by the laws of the country where you live.

Our payment provider is TrustPay, as authorized and regulated by the National Bank of Slovakia and Emerchantpay Ltd. regulated by the FCA. Neteller and Skrill are authorized by the UK Financial Conduct Authority (FCA) and Cardpay authorized by the Central Bank of Cyprus.

Purple Trading is a registered trade mark in Cyprus (no. 85981), in the United Kingdom (no. UK00003696619) and in the European Union (no. 018332329), owned and managed by LF Investment Limited, 11, Louki Akrita, CY-4044 Limassol, Cyprus, a licensed Cypriot investment company regulated by CySEC lic. No. 271/15. The company is legally obligated to comply with all Cypriot laws and CySEC license terms and conditions. A subsidiary of LF Inwestycja Ltd, LFA International Ltd., Aiolou & Panagioti DIOMIDOUS 9, Katholiki, 3020, Limassol, Cyprus, registration number: HE422638 is responsible for processing card payments.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)