Copy Trading at ByBit – we check how the competition does it!

ByBit cryptocurrency exchange is one of the biggest competitors Binance. People who have not had any contact with ByBit will certainly find their way around this application very quickly - it is very similar to the one belonging to the cryptocurrency market leader. It is therefore not surprising that the range of services offered is similar. Similarly to Binance, also at ByBit we have access to staking, leveraged trading on contracts, trading bots, launchpools, and… copy trading. After testing copying traders on Binance, we decided to check how the competitor's equivalent of this service works. If you want to know what it looks like and how it differs Copy Trading at ByBit, then we invite you to read.

READ NECESSARY: We summarize the first experiences with Binance Copy Trading

What is copy trading?

Copy trading is the ability to copy transactions made by other traders to our account. Everything is done automatically, which frees us from the decision-making process regarding what and when to buy or sell. Of course, it works both ways - we can also become a trader whose actions will be repeated by other investors. The remuneration of such a trader is a share in the profit achieved by the investor in agreed proportions. The trader himself does not have access to the investor's account or funds and has no influence on when the investor will start or stop copying. Thanks to this, the copying process itself is completely safe in this respect.

The idea of copy trading itself is nothing new. The first platforms such as ZuluTrade or eToro, which still base their offers today. Therefore, one may even wonder why, in such a dynamic market as the crypto market, this solution has appeared only in recent months. But it must be admitted that lessons have been learned, and the functionalities offered to users by cryptocurrency exchanges are really refined.

Copy Trading at ByBit – has it been done better?

We will refer to Binance repeatedly throughout this article for several reasons. First of all, Binance is known to virtually every crypto adept, so it is the best point of reference. Additionally, copy trading at Binance has already been tested by us and rated highly. And if we are to look for alternatives, then only better ones, so let's aim them at the best.

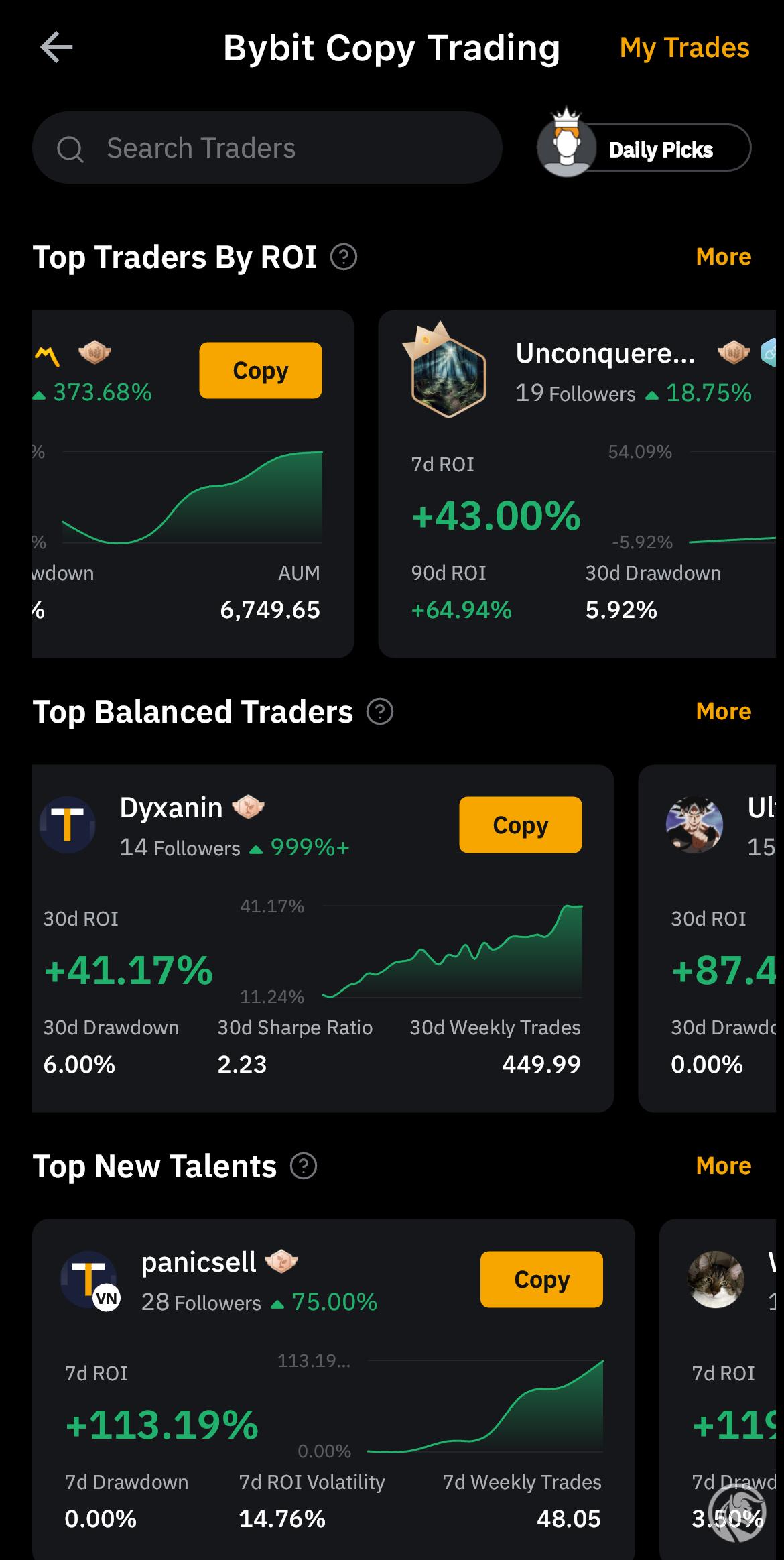

Trader's choice – division into categories

Immediately after entering the copy trading section, you can see significant differences from Binance. What is noticeable is the division of traders into several categories, which was missing in Binance. Available are:

- Top Traders by ROI – the best traders taking into account the rate of return,

- Top Balanced Traders – the best traders taking into account the low capital drawdown,

- Top New Talents – the best traders who recently joined ByBit copy trading,

- Booster Traders (+10% Bonus!) – a group belonging to a program supporting talented traders (more on this later in the article),

- Traders with the highest profit for Followers – traders who generated the greatest profit for their followers,

- Lowest Drawdown – traders with the lowest capital drawdown,

- Top Intra-day Traders – the best day traders.

Trader rankings in Copy Trading. Source: Bybit.

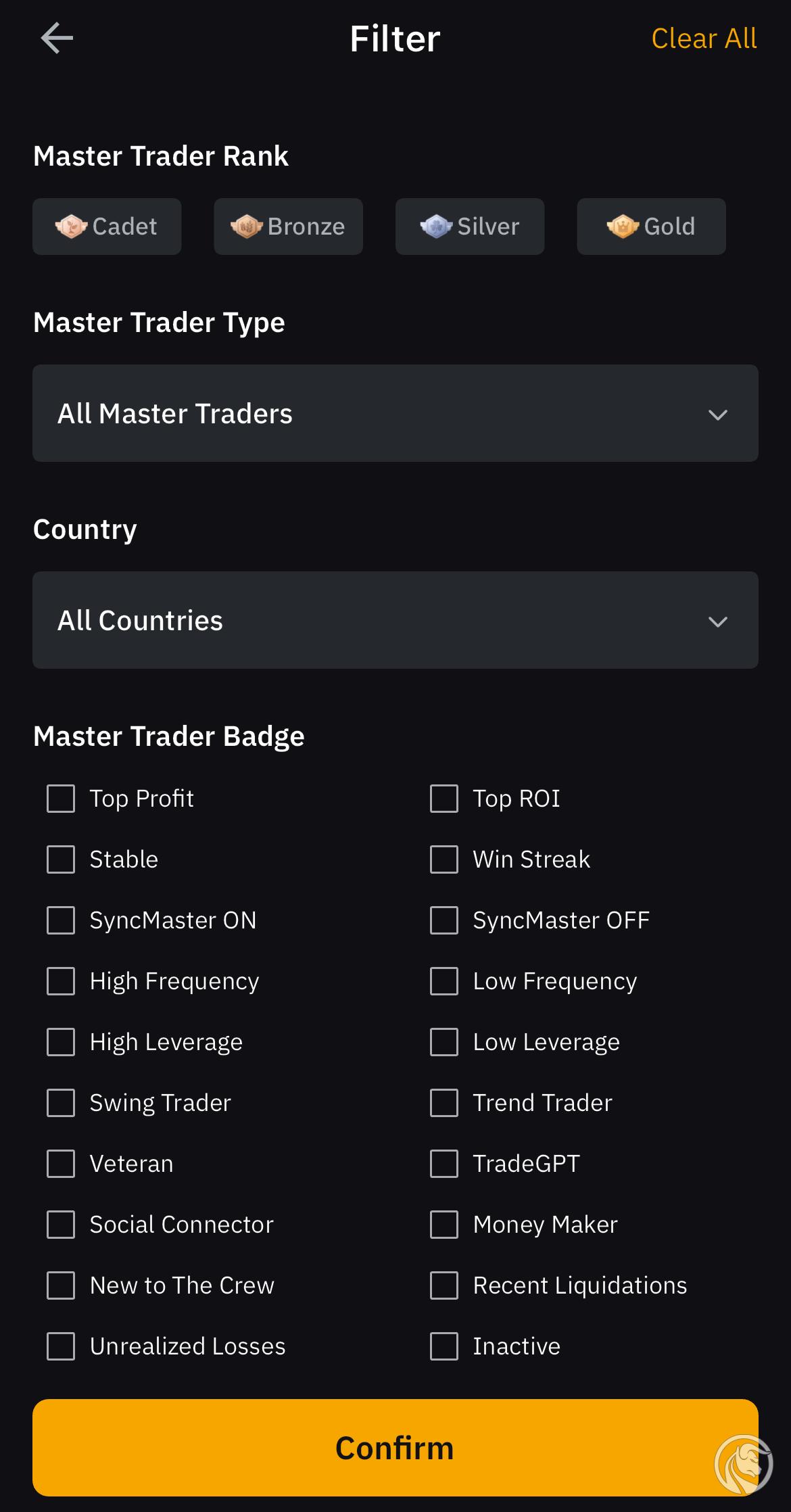

Of course, we can also classically select the list of all traders and then use independent filtering or sorting. And here again it was done better than in the competition. The filters are very transparent, we can choose the category of traders and even the countries they come from. What's more, we can filter traders who use trading bots, while on Binance we have no idea whether a given trader uses this solution or not.

Copy trading filters. Source: Bybit.

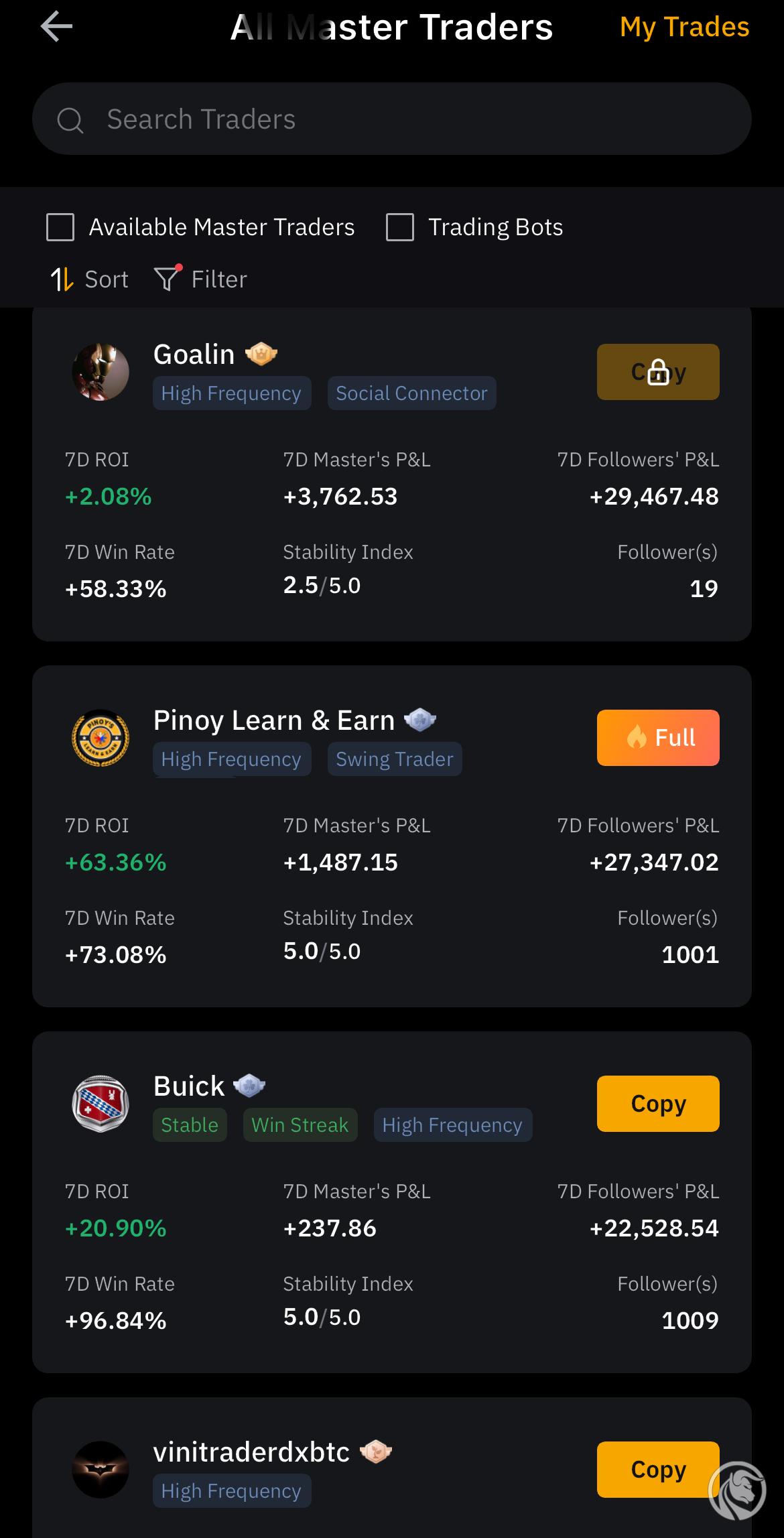

The list of traders itself also contains the most important information, although what I would consider a disadvantage is the default presentation of results over a 7-day (7D) period - this may be inadvisable, especially for beginners (spectacular short-term profit is often a poor predictor). But we can change this option to 30D or 90D in the filter settings. However, an advantage is marking with tags what characterizes a given trader (e.g. High Frequency, Trading Bot, Top Profit, Stable, Win Streak).

Trader list. Source: Bybit.

More slots, waiting list

In the case of Binance, I regularly encountered a situation where traders with the best potential had their free slots full (we could not copy them due to "no vacancies"). Unfortunately, the same phenomenon occurs here, but I have the impression that the restrictions are smaller. The record holder is the trader who, at the time of writing this text, holds over 2700 followers, which I haven't seen on Binance (limits are max. 800-1000, usually 200). Meanwhile, there are also many traders on ByBit with over 1000 followers who still have free slots. What if not? ByBit also found a solution for this by creating a waiting list (Wishlist). If a place becomes available, we will receive information in the form of an e-mail and a notification (there is a list in Binance Favorite (but you have to keep track of the number of slots yourself). But even here, there is a limit to the number of people waiting (1000 places), so we will not always be able to sign up for it. Either way, the impression is that access to traders is ultimately better on ByBit than on Binance.

How does copy trading work at ByBit?

So let's get to it "meat" and let's check what the copy trading process itself looks like. In my opinion, everything is as efficient (or maybe even a bit more efficient?) than on Binance, although there are a lot of differences, especially in the configuration of the copying itself.

Step I. Funds allocated to Copy Trading

Aby start investing on ByBit, we don't have to move our funds anywhere. They can remain in your main wallet or trading account. When configuring the settings, we select the source (Funding Account / Unified Trading Account) and that's all. But more on that in a moment.

Step II. Copy Trading tab

We go to the world of copying by clicking on the mobile application Copy Trading in the main window. This is where we have access to all traders and their statistics. Selection of options "All Master Traders" opens a list of all traders whom we can filter as follows:

- Available Master Traders – thanks to this, we will only see traders who are available for copying,

- trading bots – only traders using trading bots will be shown,

- Black – ability to sort results by 12 parameters,

- Filter – here we have as many as 20 filtering options + country selection, trader type selection and trader ranking selection (screenshot in the previous paragraph).

The multitude of filters is truly impressive and will probably meet the expectations of most people. Personally, the only thing missing is the option to choose the maximum capital drawdown yourself. But of course, you can use filters and sort them from highest to lowest until you reach the range you are interested in. Just like in Binance, there are a lot of traders in ByBit, so without the filter option it will be difficult to find the best ones. Therefore, it is worth specifying certain criteria that will improve our search.

Step III. Trader's choice

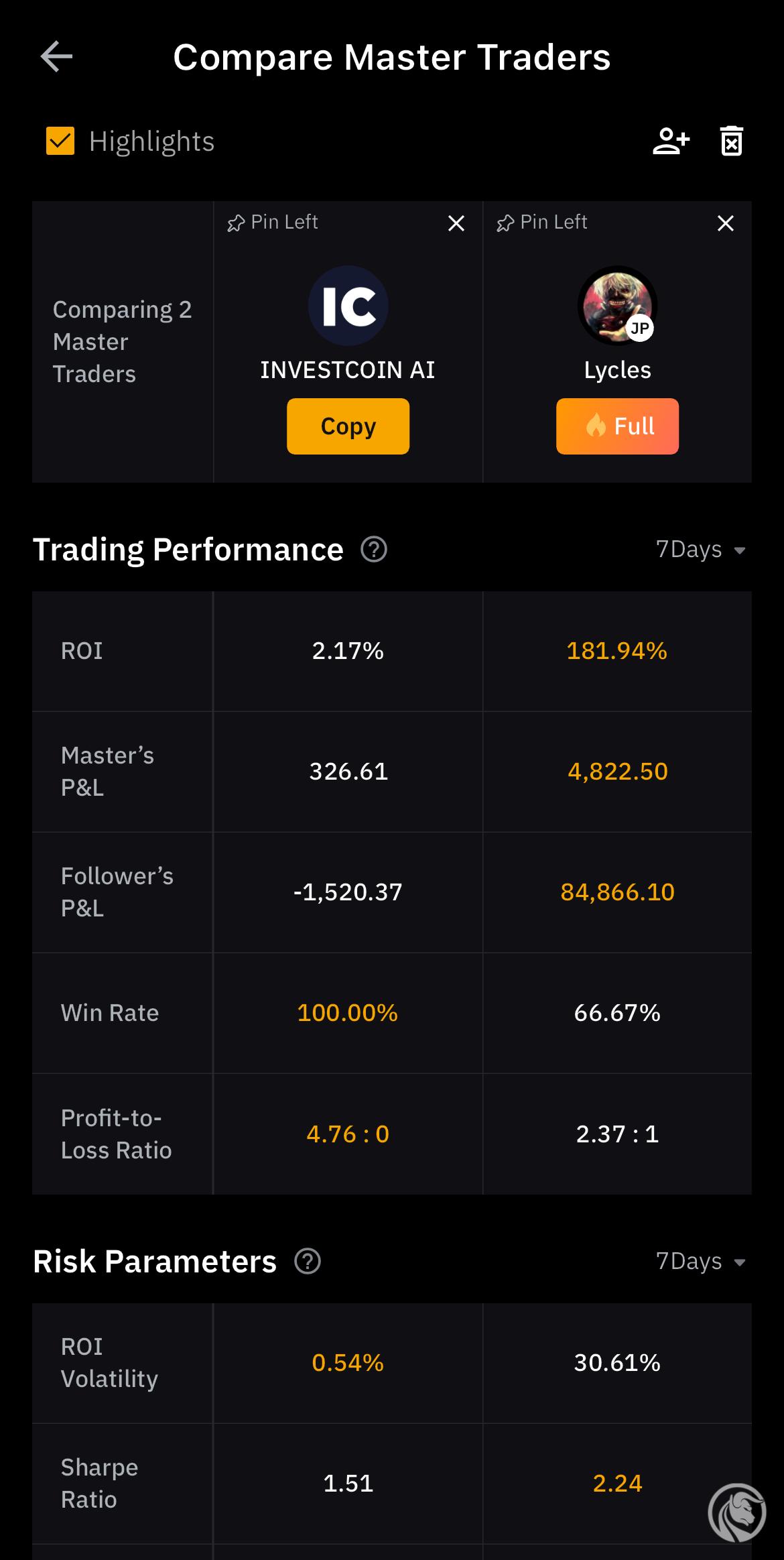

After we find the trader we are interested in, just click on him. And before we get into the details of copying, it is worth mentioning an interesting function Compare. It allows us to put several traders together and compare their results in black and white. A truly great solution to solving the dilemma of which trader to choose.

Comparing traders (Compare). Source: Bybit.

After selecting a trader, click the button Copy, and then we define the parameters. And at this point we indicate what capital we want to invest, where the investment funds should come from and whether we want them to be copied:

- USDT Perpetual Trades – transactions from perpetual contracts,

- trading bots – transactions concluded by trading bots.

Of course, we can choose one or two options at the same time.

Another interesting choice is whether the copy mode (Copy Mode) is supposed to have character Smart (trader optimizes risk adjustment and entry timing - recommended for beginners) or Advanced (we decide on the position size ourselves - recommended only for advanced users). Regardless of the selected mode, we can still configure additional advanced options. And here the choice is quite large, because we can define:

- lever settings,

- margin settings,

- max. value of the item per contract,

- max. position limit per day,

- factor Stop Loss and Take Profit per position (set as a percentage),

- max. price slippage (slippage) per position,

- choose which contracts we accept trading on and which ones we do not.

Depending on the trader you choose, we may encounter a situation where some of the parameters will be unavailable. Some traders set conditions to fully trust them regarding additional parameters. Is it wrong? Not necessarily. After all, our profit is also their statistics in the ranking and remuneration (commission), which is why they also care about our success. Therefore, some people may not want us to interfere too much with how their investment will proceed on our account (e.g. too conservative SL will result in our positions ending in premature loss). It is worth adding that in Binance we always have full control over the definition of available parameters.

Step IV. Checking the results

You can check the current copying status in the tab Copy Trading -> My Trades (upper right corner). As a test, I decided to start copying one trader for an amount of 500 USDT. I will soon let you know how this investment went and what my observations are (in a separate article or in a comment below this article). At the moment, everything seems to be working very smoothly - keep your fingers crossed! 🙂

ByBit supports talented traders

According to ByBit itself, the exchange has a base of over 200 million customers. That's a huge number of potential investors for traders who want to be copied. And in this case, ByBit once again did it better than Binance, offering traders with good results the opportunity to apply to the program "Booster Trader Program". What is that? If you have the right results in terms of competitive ROI, drawdown, volume and other indicators, you can receive distinction and better exposure on the ByBit platform. More exposure = more investors. More investors = higher commission on profits. But it is not everything. The exchange has also prepared cash bonuses (+10%, prize pool of USDT 48 per trader) for people who copy the distinguished Master Trader. In this situation, everyone wins as long as the positive results continue.

PROMOTION: ByBit covers losses up to 100 USDT

The ByBit exchange has prepared a bonus for its clients, which is intended to encourage and at the same time convince them to try their hand at copy trading. The promotion covers up to 100 USDT loss if the first Copy Trading transaction ends in a loss. The refund will be made within 14 days, and you must apply for the promotion in the application -> 100 USDT Loss Coverage – click CLAIM. You won't find anything similar in Binance. I used this option myself - we'll see if it's needed.

Summation

Bybit seems to offer its users more options and the entire copying process is more accessible. We have a lot of filtering options, a very friendly interface, and some super useful functions (trader comparison tool, copy modes). But on the other hand, what options does ByBit have to finally emerge from the giant's shadow? However, this is great news for users! Competition leads to development, and I rate the functionality of the ByBit platform really highly. The promotion with loss coverage up to $100 is a good incentive for skeptics to check whether the service itself is worth their trust. It is also worth remembering that there is no need to be discouraged by the first failures. Copy Trading is not a recipe for easy money. This type of investing also requires some skill, experience and intuition. However, in this case we are not analyzing the market itself, but also the potential and actions of traders. And in the end, the market does its job anyway - so remember to diversify!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)