We summarize the first experiences with Binance Copy Trading

Almost a month has passed since I started my adventure with... Binance Copy Trading, a relatively new functionality on the platform of the largest cryptocurrency exchange, which allows you to copy the moves of other traders. Conclusions? There are several of them. In this article, I will present both the effects of our copy trading and share my observations about the service itself.

SEE: We check how Copy Trading in Binance works in practice

In the article linked above, we describe how the copy trading service itself works, what its general capabilities are and the steps we took when starting the test. If you're not up to date, start reading here.

Binance Copy Trading – advantages and disadvantages

Saying "all that glitters is not gold" fits perfectly into what the statistics of traders on social trading platforms present us. Binance is no different. During the 4-week test (which is still ongoing), there were a few observations worth mentioning.

What matters is who you copy and... when you start doing it

It seems obvious, but not entirely. I'll explain what it's about. I decided to copy 4 traders at the same time, allocating the same amount to each of them ($100). Of course, we choose traders who are already in the black and have shown that they can do something. However, if the trader is in the black at the time we start copying him, e.g. 100%, and we are just joining, his loss, reducing the profit to +50%, may be a death sentence for us. We pass SL, but for him the game goes on, often even better than before, but without us.

And here a dilemma arises - trust the entire designated capital or use SL, which will save our deposit? There is no right answer. There is also no way to assess whether it is the right time to start copying a given trader. Therefore, the next point seems to be the key. Therefore, I would currently lean towards a different approach, i.e.:

- increasing the capital and dividing it into 8 parts,

- 4 parts of the capital allocated to 4 traders equally,

- the remaining 4 parts of the capital are waiting as security,

- trading without SL for single.

However, this would mean that we would have to start the test again with a capital of $800, but I think it would increase the chance of success in the long term.

Diversification is essential

Copying 2-3 or even 4 traders at the same time seems to make the most sense, especially when we decide to trade without an SL assigned to each of them. Even if the statistics look optimistic and the trader himself has just made a series of good trades, I have noticed that as the volatility on the crypto market increases, the results thin out significantly. Those who were in the positive end up in the negative, and vice versa. Sometimes they have a dozen or so items open. It's hard to adapt and manage (assuming the bot doesn't do it, and if so, it also counts as a delayed response). Either way, it is not the volatility itself, but the change in volatility that is dangerous. Therefore, you need to diversify, preferably based on traders with a diverse approach to trading.

Copy restrictions and capital requirements

And here we come, in my opinion, to the key problem. As a reminder: on Binance Copy Trading, a trader who allows himself to be copied determines the maximum number of people who can do it and the minimum amount he can spend on it. And this is a big minus in my opinion.

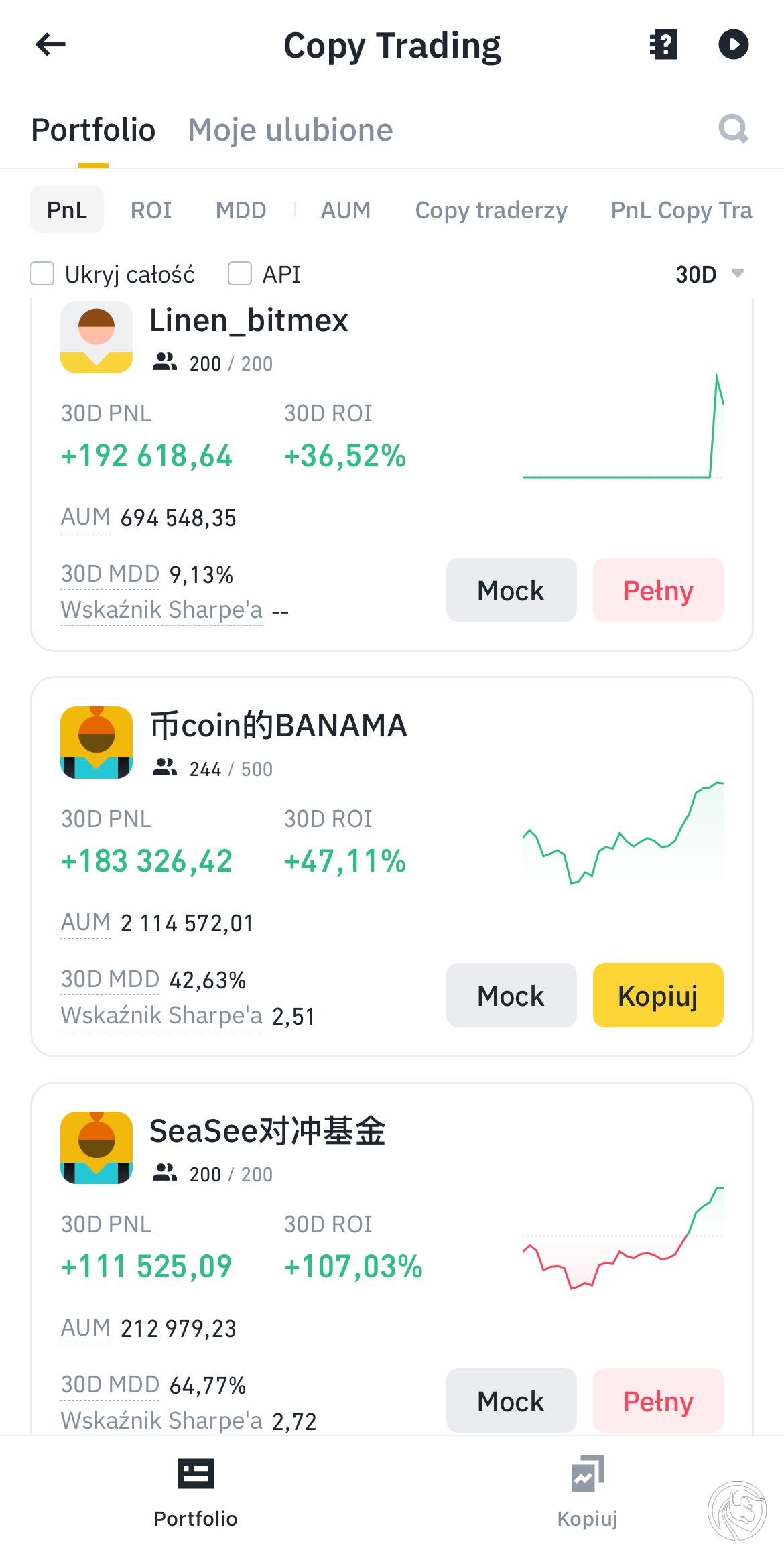

Limitations on the number of people copying a given trader (often max. 100-200, but sometimes 500 or more) is something that prevents effective diversification on the Binance platform. In addition, the requirements include at least: $500 or even $2000 as the minimum amount from which we can start copying them can be prohibitive, because even if we have more at our disposal, it would be rational to test someone first instead of rushing in with a large capital. Of course, we will find many traders who have a set limit of $100 and free slots, but very often the best ones are quickly spotted by the community and we have to wait until they become available to us or lower the entry threshold.

On the one hand, it's understandable. A trader who begins to be recognized and achieves good results wants to have "better customers"who invest large amounts. On the other hand, sometimes trading takes place in illiquid instruments, so large sums can be problematic. Hence, some restriction may be advisable. But from the perspective of someone who wants to build a profitable portfolio based on copy "elite", the task seems to be very difficult.

Two out of three high-gain traders have no free copy space. Source: Binance App

Copy Trading and achieved results

In short: nothing to brag about. Finally, after 4 weeks, I am at a loss. First trader he said goodbye to us just a few days after the start, having reached the SL level. Interestingly, he didn't do too badly after that, but my timing of starting to copy him wasn't the best, and that tipped the scales. Second trader he fought bravely and then lost miserably to the market and it ended with SL again. But in this case it is final - he is not on the list of traders on Binance. Third trader he practically stopped trading a few days after the start, so we had no choice but to give up and release capital (loss of about 5% of $100). The fourth trader it is still copied and achieves not the worst results - but will it manage to make up for the losses generated by "colleagues"? We'll see. Currently I am approximately -$90 at a loss.

Finally, I added one more trader, and although it seems not enough, because I would prefer to have at least 3 of them in my portfolio, unfortunately the deposit requirements for the candidates I have selected are too high (sometimes $2000), so it will remain as it is for now. If I have additional thoughts in the future, I will share them with you in a future article.

Binance Copy Trading Summary

The copy trading service in Binance itself works very well. It has useful configuration options, informs us by e-mail about what is happening on our account (e.g. passing SL), is transparent, has the necessary statistics to assess the situation - overall the impressions are very positive. The biggest disadvantage I see is the restrictions and requirements for copying some traders. We don't have any freedom here as in eToro, but there is almost always a ceiling that limits our choices. Therefore, patience and... much more capital are required for this game if we want to have access to top traders.

By registering using the link above, you receive a 10% COMMISSION DISCOUNT

It's time for Bybit!

You can always do the same thing only better. But is this the case with Bybit, which also launched its copy trading? We have no choice but to check it. Therefore, we will soon come back to you with an article describing Binance's competitor and we will test their social trading part of the offer on real funds. Stay tuned!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)