Masayoshi Son – a man who lost $70 billion and did not stop investing

Masayoshi Son is an example that investing can make you a fortune or get you into financial trouble. His story shows that even when you lose most of your wealth, you should not give up. During his investing career, he could be right and achieve spectacular profits, but also very wrong. Investments in... can be considered a success Alibaba, while the investment and rescue attempts were a failure WeWork. He is one of the most famous Japanese investors of all time. He became famous primarily for establishing and managing SoftBank, an investment holding that invests in technology companies. It is worth taking a look at the history of this unique Asian investor.

Early years: education, McDonald's and the first millions

Masayoshi Son was born on August 11, 1957 in the Japanese city of Tosu, which is located on the island of Kyushu. Our hero's grandfather was a Korean who moved to Japan, where he worked as a miner. The life of Koreans was not the easiest then, as there was discrimination based on origin. One of the reasons for the family's difficult situation was the lack of knowledge of the language, limited financial resources and a rather xenophobic society. Due to the more difficult financial situation, Sona's family had to work hard. Masayoshi's father raised pigs and chickens and developed the illegal sale of sake. Thanks to his entrepreneurship, the hero's father bought the first car in the town. The improvement in the family's financial situation allowed Masayoshi to go to a better school, which certainly stimulated him to develop faster.

READ: Japan – between tradition and modernity

He took his cue from Dan Fajita, who built the McDonald's business in Japan. Masayoshi wanted to meet his idol so much that he called the office every day and asked to talk to Fajita for a moment. Thanks to his persistence, he achieved his first major success. He met with him for a 15-minute conversation. Son was encouraged by him to learn how to use a computer, which he believed had great potential.

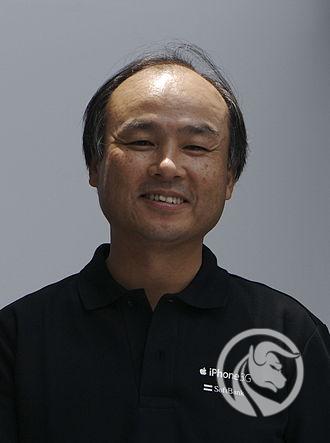

Masayoshi Son (2008). Source: wikipedia.org

His move with his family to the United States was a huge step in the development of his future career. Masayoshi was 16 years old at the time. It was a difficult situation for the young man, but it certainly helped shape his character. Moving to the US also helped improve his English and introduce him to the fledgling world of computers. Son then went to the University of California, where he studied economics and the application of computer science to economics. He believed that the world was on the threshold of another technological revolution, which was not yet certain at that time. Every day he spent a few minutes a day coming up with new ideas, which he then tried to turn into income. After a year, he had a notebook full of 250 potential innovations. Some of them have been monetized.

Even as a student, Son had a knack for running a business. His interest in technology led him to invent his own ET (Electronic Translator), which he sold for $1,7 million to Sharp Corporation. He made millions more by importing used video game machines from Japan. The machines were installed in restaurants and pubs. After graduating, he sold his video game company for $2 million. Thanks to this, he became a millionaire as a young man. He could slow down and live on the money he earned, investing in stable companies. However, his ambition would not allow him to do so. He decided to return to Japan. Money made it easier for him to fight stereotypes.

Return to Japan: the path from millionaire to billionaire

Masayoshi returned to Japan because he promised his mother. Thanks to the funds he had collected and education in another country, he was not afraid to make decisions and was not ashamed of his origins. After years in the United States, he believed that technology would change lives. Returning to Japan was a good idea because the country was experiencing rapid economic growth. In the 80s, there was a huge boom on the local market. Stocks and real estate were skyrocketing. Back then, Japan was admired like China is now. According to some, it was supposed to overtake the United States in terms of GDP within a few decades. Even Lech Wałęsa mentioned that he would turn Poland into a "second Japan". Certainly, developing a business in the 80s in the Land of the Rising Sun was a good idea.

Masayoshi is inextricably linked with the history of Softbank, this company became the "child" of a Japanese investor.

Creation of Softbank

Sofrbank's Tokyo headquarters. Source: wikipedia.org

In 1981, Masayoshi Son founded Softbank, which initially dealt with software distribution. Back then, such companies were one of the key elements of the IT market. This was due to the fact that software producers did not have such easy access to customers as they do now. Therefore, an efficient stationary distribution network was crucial in those times. After just a year, the company diversified its activities and started publishing Oh! magazines. PC and Oh! MZ, which were the largest technology magazines in Japan.

However, this is not the end of the business diversification policy. In 1984, Japan Telecom was founded and operated on the telecommunications services market. Thanks to the development of this segment, Softbank had two businesses that provided stable profits from distribution, publishing magazines and selling telecommunications services. The cash generated was used to further increase market shares and invest in further ventures.

The bursting of the stock and real estate bubble at the turn of the 80s and 90s did not prevent plans to debut on the stock exchange. IPO took place in 1994 with a capitalization of $3 billion. The cash obtained from the debut was used for further acquisitions.

In 1995, Softbank focused on investment activities, where it looked for entities with great prospects. In the 90s, he invested $3 billion in about 800 startups. Most of them were not successful, but he knew that individual investments would more than cover the losses from previous trades. An example of a not very successful investment is Ziff Davis, for which Softbank paid $2,1 billion. The transaction was intended to diversify the publishing activities geographically. The portfolio of websites also seemed attractive. Back then, some people believed that some of them could achieve huge values in the future. Unfortunately, the investment in Ziff Davis did not turn out to be a goldmine. Ultimately, Softbank managed to sell the shares for a decent profit (about $273 million).

In 1996, Softbank began cooperation with an American Internet company Yahoo!. As part of the cooperation, Yahoo! was created. Japan, which became the most popular website in Japan. Such cooperation was based on expectations regarding future revenues resulting from user monetization (advertising, paid access to extensive content, another place to acquire customers for telecommunications services). Within a few years, he invested $374 million in the company. In 2004, Wired reported that Yahoo!'s net worth Japan increased 50 times.

Softbank has also had many failed investments. These include the purchase of 80% of shares in Kingston Technology. Softbank paid $1,5 billion in cash and shares for the shares. The reason was that the memory market was developing dynamically. Masayoshi expected Kingston's revenues and profits to skyrocket, so the current price is a promotion. Unfortunately, after only 3 years it turned out that the demand for Kingston products was much weaker than forecast. As a result, Softbank decided to exit the investment in 1999. The buyer was… the previous owners (John Tu and David Sun). They bought back 80% of the shares for approximately $450 million. Masayoshi's investment turned out to be unsuccessful.

Kingston logo. Source: wikipedia.org

The bursting of the dotcom bubble – or how to lose $70 billion

The boom in technology companies in the 90s was a fascinating time on the stock market. Companies from this sector were growing like weeds. There were many millionaires who became billionaires by investing in individual companies. There was a belief that the technological revolution would change the entire world. Old branches of the economy were to be quickly digitized, while trade was to quickly move online. As it turned out later, the expectations were too high. Digitization and digitalization did indeed occur in the economy, but it did not take a few years, but a decade. As a result, companies' forecasts for rapid growth were revised downwards over time. This has resulted in valuations “dotcoms”. Among the companies on which investors lost huge amounts of money were such stars as Pets.com and Webvan. Large companies such as Cisco also lost several dozen percent in value.

Right before burst of dotcom banks Mayasoshi's wallet grew at a rate of $10 billion per week. Of course, it was not a cash flow, but an increase in the value of shares in companies. In a 2017 interview with David Rubinstein on Bloomberg, Masayoshi mentioned that at the top of the bubble he was the richest man in the world. As he himself said, before he mentioned it to his friends, his shares began to drop dramatically. In 2000, Softbank's shares were valued at 198 yen, but two years later the price dropped to 000 yen. As a result of the crash, his fortune decreased by $70 billion (or 90%). As a result, he came close to bankruptcy. However, the market situation calmed down, and Masayoshi quickly extinguished the fires that broke out in his organization during the crisis. He then decided to invest in safer companies. An example would be the acquisition of Vodafone Japan by taking out a significant loan. Vodafone started selling smartphones Apple Lossless Audio CODEC (ALAC), exclusively, which over time provided huge income. However, Son had to wait a few more years for his life investment.

Investment of a lifetime – Alibaba Group

Jack Ma, founder of Alibaba. Source: wikipedia.org

It happens that one transaction more than pays for many unsuccessful ones. One of them was made by SoftBank in 2000. The company invested in a Chinese entity operating in the digital market. In hindsight, it seems like buying a tech company at the height of the dotcom bubble shouldn't have been a good idea. But this time it was different. Masayoshi Son decided to invest in a Chinese start-up that was founded by a former English teacher. Jack Ma had no business plan or significant revenue. Masayoshi was charmed by Jack Ma because he thought he had charisma and shining eyes. Son trusted his instincts and decided to invest in the fledgling Alibaba.

The amount was large because it amounted to $20 million. Considering Son's entire fortune, the investment didn't seem like much. However, it is worth looking at it from this perspective that Softbank invested such an amount in a small Chinese company that did not have a dominant position on the market or a large customer base. Alibaba was just building an e-commerce platform for small and medium-sized enterprises in China. It is worth remembering that at that time the Middle Kingdom was not very developed in terms of Internet access. So it was one of many risky bets the Japanese company made. Most startup investments fail, but this one paid off with a vengeance. According to estimates by The Wall Street Journal, by 2023 Softbank has earned approximately $72 billion from the entire investment. Stunning money. This high rate of return resulted from several factors, including:

- dynamic development of the Chinese e-commerce market,

- entering retail trade (Taobao, Tmall),

- creation of a fintech business (Alipay).

The company grew rapidly and gained a dominant position in the e-commerce market in China. Alipay has also become a solution that has made a real revolution in the cashless payments market. From that moment on, all you had to do was download the application to your phone, top up your account with funds and you could pay for services by scanning the QR code. In 2014, Alibaba conducted an IPO in the United States. The success of the Alibaba investment made Masayoshi's star shine again. This made his next big project easier: Vision Fund.

Vision Fund, or how to get $45 billion in 45 minutes

Vision Fund is another investment idea of Masayoshi Son. The fund was established in 2017 and very quickly collected $100 billion of investment capital. Masayoshi boasted in an interview with Rubinstein that during a conversation in Saudi Arabia he convinced him to invest $45 billion in 45 minutes. The largest investors in the project were the Public Investment Fund ($45 billion), Softbank ($28 billion) and Mubadala Investment Company ($15 billion). The rest of the funds were provided by smaller investors, including Apple.

The fund itself was to invest in technology companies at various stages of development. It was to acquire shares in companies that had an idea for disrupting developed sectors of the economy (e.g. transport, finance, real estate) as well as those that focused on new trends (e.g. artificial intelligence). Unfortunately, it was visible in the initial years of operation FOMO effect. Vision Fund invested in various ventures that turned out to be investment mistakes. Among them can be mentioned WeWork, which later had to be rescued (with poor results) by Softbank. The fund invested in well-known companies (e.g. Uber), as well as early-stage startups like Crisis (development of autonomous cars). However, in 2020, dark clouds gathered over Softbank and the fund. Activists from Elliott Management purchased shares in Softbank for $2,5 billion and demanded greater transparency in the Vision Fund and the company itself. In May 2020, VF reported that it had lost $18 billion on unsuccessful investments. Layoffs and company reorganization began. Son's position was undermined, which resulted in the second Vision Fund collecting only half of the planned $108 billion. However, the liquidity injection introduced by central banks caused the Vision Fund's assets to grow very quickly. Large profits from investments in Korean Coupang (the native version of Amazon) helped.

Despite the increase in assets, the fund still made spectacular mistakes, including: in investing in Katerra, Wirecard or Zymergen. In August 2022, VF reported a $23 billion loss in Q2022 XNUMX. As a result, he decided to reduce employment. Accusations began to appear that Masayoshi's strategy was playing the bigger fool. This means that he bought shares in popular companies at a high price, believing that subsequent rounds of financing would increase their valuations. Interestingly, Vision Fund invests in competitive projects. At the same time, he held shares in, among others, In Didi, Grave and Uber.

Summation

Masayoshi Son is undoubtedly one of the most expressive figures in the world of investing. Some love him for his long-term vision, others accuse him of often being too careless with risk. Intuition, his strength, is also his greatest weakness. Thanks to it, he made huge money on Alibaba, but also lost billions of dollars on his investment in WeWork. The more uncompromising people say that this one “Japanese Bill Gates” likes to play the bigger fool. The spectacular losses in 2000, 2020 and 2022 suggest that there are indeed some problems in risk management. On the other hand, it may be a well-thought-out strategy. The masses know that investing in technology companies provides equally spectacular returns, accompanied by volatility. His wealth proves that Masa knows what he is doing. After all, accumulating $31 billion in net worth (data for 2024) cannot be a coincidence. Masa is certainly not afraid of risk and can use it successfully financial leverageto multiply profits. One more conclusion can be drawn from Son's story: sometimes one or two good investments can set any investor up. All you need is a little courage, luck and patience to let your profits grow.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response