Plus 500 is a brand that has achieved spectacular success in a very short time. If you haven't heard of it yet, it means that you are just starting your adventure with investing or you have all ads blocked in your browser :-). Plus 500 is quite visible on the web but not everyone knows that this is a company that is listed on the London Stock Exchange and the company's capitalization exceeds 500 million GBP (!). Meanwhile, the offer looks quite average compared to its competitors. So how did such an inconspicuous broker achieve great success in such a short time? The offer based on an intuitive trading platform combined with a demo account and effective online campaigns turned out to be a hit. But let's get to what we will be interested in in this article - the trading platform.

Licenses held:

- Plus500UK Ltd is authorized and regulated by the Financial Supervision Authority (FCA) (#509909).

- Plus500CY LTD is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) (#250/ 14).

- Plus500SG Pte Ltd is licensed by MAS (# CMS100648-1) and IE Singapore (# PLUS / CBL / 2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed for:

Admission word

The main phrases displayed on the broker's website, demo account registration, as well as the transaction platform - all this leaves no illusions. For a more experienced trader, these simplifications sting the eyes. Even the platform itself is stripped of its proper name so as not to absorb the fresh mind too much with unnecessary nomenclature. Therefore, we can choose mobile versions for Android and iOS, as well as a stationary version. Due to the fact that the browser version is almost identical to the desktop version, I decided to review the latter. Ready?

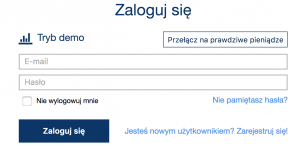

Installation and login

The Web Trader Plus 500 platform is based on a web browser, so it does not require any additional software installation. Thanks to this, we can start trading on the demo in just a few seconds. And that was probably also the idea. Logging in, both to the demo account and to the real account, takes place using an e-mail address and a password defined by us, so it is simplified to the maximum possible - you do not need to save passwords consisting of rarely used characters or logins in the form of a sequence of long numbers. Logging in is very smooth and it should be so. There is also a minus - you cannot be logged in twice to the same account at the same time - even if we use the same computer, browser or other platform. When you try to log in to the same data, the platform automatically disconnects us (and here comes the security issue).

Notorious disconnection. In addition, I do not know if this situation occurs only with me, but despite the stable internet connection, the platform regularly logged me out after a few minutes from the moment I switched to another browser window (Plus 500 was running in the background). Perhaps this is another form of security, where the broker is to ensure that no one accidentally leaves the platform on. It's just that you don't need to enter a password to reconnect - just one mouse click.

Plus 500 appearance and interface

Appearance - well ... Like in a hospital. White and sad. A little blue and gray. But it makes it very transparent. The menu is on the left and the account parameters are at the top, so they are always at hand. The screen is divided into two parts in landscape orientation - the upper one is used to process orders, and the lower one is a chart. And that's roughly it. There is no need to look for secret tabs with additional great options, because they are not there.

Personalization. Customization of appearance? Forget it. We can "choose" one color, which we cannot modify in any, even the smallest way. Change the menu arrangement? Or maybe the location of the windows? Okay, maybe their size? No, no and no more. We cannot modify any of these things. All we can do is resize the entire browser window. This means that the scaling of the platform itself also changes very quickly (and at least a small plus). What stands out on the demo account is the advertisement, and more precisely the encouragement to verify the phone and switch to the real account.

The right mouse button is completely inactive, and the keyboard will be useful only for entering the course and the volume when placing orders. But this is quite typical for most platforms based on a web browser.

The menu on the left consists of two parts:

- drop-down tab "Menu", where we can find "settings" for the account.

- 4 buttons for position management, transaction history and cash.

In the first point, the "settings" are in parentheses not by chance. Virtually nothing can be set. The first three options are for deposits and withdrawals only, and one more item at the bottom encourages you to deposit real funds. Therefore, we can configure / edit: password change, notifications and price alerts.

The tabs from the second point are something like a Terminal from MT4, but of course much more limited in functions. Additionally, activating the "orders" and "closed positions" tabs cause the chart to collapse, which is completely unnecessary.

Functions and possibilities

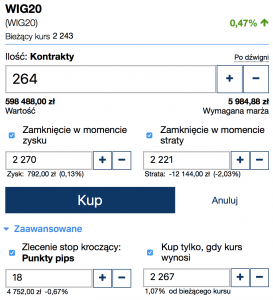

Transactions. There is a very interesting thing here. On the entire platform, we will not find such terms as Short, Long, Stop Loss, Take Profit, Trailing Stop, Limit, and even Polish terms such as "pending order". All terms were immediately translated into utter cliche. For example, Stop Loss is "Close on loss". The entire transaction process is based on the drop-down window on the right side of the platform. The window is activated when you click on Buy / Sell. There is no option to close a position with one click - confirmation is always required. But we have a "trailing stop", or Trailing Stop with the note "pips points", which for a beginner probably means nothing, but an experienced one is wrong.

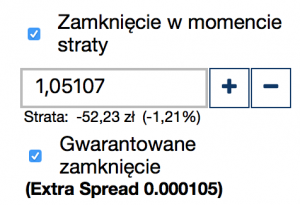

Under the defined SL / TP you can see the percentage profit in the currency - useful. For selected instruments, an additional parameter is available when defining SL - "Guaranteed closure". This is an option that for an additional fee in the spread ensures that we close the position at a defined price. Several well-known Market Makers have a similar service on offer so we can not treat it as an innovation.

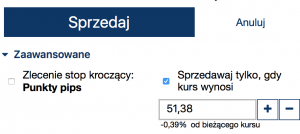

Pending orders. I have sought to find this option. The naming of a typical FX trader is to blame. To set a pending order, expand the window containing orders, select Buy / Sell, then enter the tab "Advanced" and tick "Buy only when the rate is:". To set a pending order for sales, you have to go back to the beginning and repeat the action for "Sell". Super-extra-hyper uncomfortable and unintuitive.

Of course, don't expect to be able to modify anything from the chart. The level of a pending order is visible when it is set, then it disappears. Only visible in the chart "Current selling rate"that shows us the price at which we would close the position we opened.

Library of instruments. The Broker Plus 500 offers a whole bunch of different instruments. These are CFDs based on assets such as currencies, indices, commodities (even niche such as Palladium), ETFs, options, shares of listed companies from around the world (even a lot from Poland) and even cryptocurrency, including Bitcoin. The choice is really big. The list of instruments is available on the left side of the platform, where all of them are already grouped. In addition, we can sort them by the most popular or by the largest percentage changes in the session scale. There is also a list of favorites that we can create ourselves, and at the top of the platform we have access to the search engine all the time. Maybe all this does not look very professional, but I have to admit with pain - this solution is convenient (much more convenient than on MT4) and works in practice.

Chart support. We have a choice of 10 types of charts. Pretty good. Standard time intervals + tick and H2 are available, so there are 10 in total. While playing with the platform, I knew at the very beginning that there is no point in dreaming about e.g. detachable graph windows. But despite everything, I counted on the possibility of changing colors. Unfortunately. There is a crosshair, but hovering over the candle displays a relatively large OHLC information window, which cannot be turned off. The only additional options is the possibility of manipulating the zoom in / out and, interestingly, we can change them in two ways - using the bar at the bottom of the chart or the magnifying glass from the upper left.

Chart on the Plus 500 platform. Illustrative prices

And here is also a curiosity. The range of data visible on the chart is not limited by historical source, and the platform itself does not scale this data to other intervals. For example, the Bitcoin chart on D1 covers the beginning of 2016 history but on the weekly week it goes back to 2013. Unfortunately, we can only have one chart open at a time.

Indicators and tools. There are 90+ indicators of technical analysis in a few cases several additional variances (moving averages calculated as one). We cannot add external indicators (let nobody even think about scripts or machines).

Additional tools in Plus 500

Keyboard shortcuts. On the Plus 500 platform, we do not accept any keyboard shortcuts. The keyboard can only be used to enter the volume or define the SL / TP level.

Notifications. The platform offers us the so-called price alarms that we can set for all instruments. But there is also a cool thing - bill notifications in the form of e-mail and SMS. You can see how they work in the video presentation below.

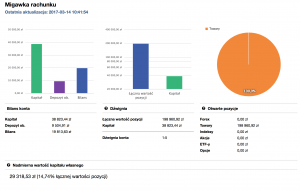

Account snapshot. In total, it is difficult to call it a tool but always something. This is a very transparent presentation of the account balance, specifying the capital frozen on individual instruments and taking into account leverage. If somebody trades on many different markets at the same time, then maybe something will help him. Otherwise it's just a mini-bajer.

Plus 500 speed

In this respect, the platform is amazing. It works very quickly, efficiently and does not freeze for a quarter of a second. Well ... Only this is primarily the effect of not much burdening her. Simple design and a very limited number of available functions make the requirements of this application comparable to MahJong (or smaller) mini-games. The process of entering orders is relatively slow, but there is also no tragedy (you have to wait up to half a second for it to disappear from the platform).

Summation

The goal has been achieved. A very simple platform has been created that does not absorb the mind of a trader with "redundant" tools and functions, new concepts and enigmatic macro news. A person who does not require too much (or requires absolutely nothing) can be satisfied. The application itself is transparent and works very quickly. It's just that it doesn't offer anything a trader would expect from the platform. All settings are practically imposed by the broker, and it is practically impossible to perform any analysis. The Plus 500 application only creates the illusion that we are dealing with any stock exchange and nothing else.

| Pros | Cons |

|

|

CFDs are complex instruments and involve a high risk of a quick loss of cash due to leverage. 80% of retail investors' accounts record losses as a result of trading CFDs at this supplier. Think about whether you understand how CFDs work and whether you can afford a high risk of losing money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

I started my adventure with trading at plus500. and I know that when someone is gripped, it is rather a platform not for him but how do we start? I don't see anything wrong with it. very easy to use, the profits pay off (happiness of a beginner ... 😀)