Sugar - How to invest in sugar? [Guide]

Sugar, a product very eagerly welcomed in our kitchen. It turns out that it has accompanied mankind since the dawn of time. Evidence shows that sugarcane was grown in Africa as early as 8000 BC. Despite the popularity of this raw material, half of the world's production comes from just two countries. As a result, sugar is prone to large price fluctuations, and thus many investors can find investment opportunities in this value. How to invest in sugar and make money on changing market prices? About it below.

The use of sugar

Bakery products

Sugar is used in bakery products due to its properties. It softens and increases the moisture content of baked goods, and also increases their use-by date. Sugar supplies the baker's yeast with food, accelerating the rising time of the baked goods.

Jams and preserves

The addition of sugar improves the color and taste of processed fruit. Sugar itself has preserving and gelling properties, which makes it perfect for preparing jams and jellies.

Sweets

Sugar is the main ingredient in most packaged sweets.

Other

In addition to food and bakery applications, sugar can be used for the production of biofuels, added to mortars, in the textile industry for fabric processing and in the pharmaceutical industry. The alcohol fermentation process also requires the addition of sugar.

Sugar requirements and cultivation

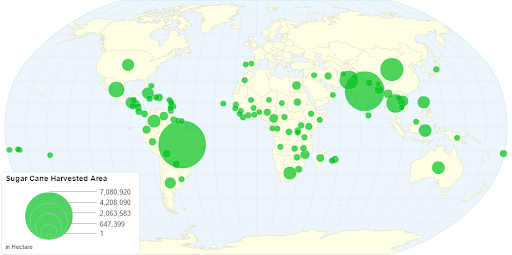

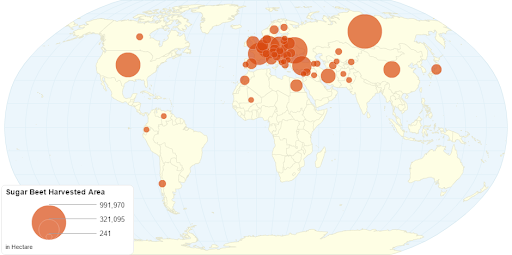

Sugar is obtained from sugar cane (70% of world production) and sugar beet (30% of world production). Sugar cane is grown in South America, the United States, India, China, Africa and Australia. The cultivation of sugar beet is popular in Europe, Russia, the Middle East and Canada.

The map below shows the regions of the world where sugar cane is grown. The size of the circle represents the size of the harvest in a given region.

The map below shows the places in the world where sugar beets are grown. Similarly to the example above, the size of the red circle corresponds to the size of the harvest from a given region.

Sugar producing countries

Annually, over 120 million tons of sugar are produced worldwide. Sugar is grown in over 120 countries around the world, but only two countries account for 50% of the annual production of this raw material. They are Brazil and India.

The largest sugar producers

| End | Annual sugar production in 1000 tons |

| Brazylia | 39 150 |

| Indie | 22 200 |

| The European Union | 22 200 |

| Tajlandia | 10 033 |

| China | 9 300 |

| United States | 8 135 |

| Pakistan | 6 140 |

| Meksyk | 6 314 |

| Russia | 6 200 |

| Australia | 5 100 |

Most of the sugar produced (over 70%) is consumed in the country of origin. The largest consumers of sugar are India, European Union countries, China, the United States and Brazil.

Factors influencing sugar prices

Sugar supply

Due to the high concentration of global sugar production in two countries, Brazil and India, sugar prices are susceptible to the size of the harvest produced in these specific regions of the world.

Demand for sugar

Along with the increasing wealth of the society, the demand for luxury goods, including sweets and bakery products, is growing. Along with the development of developing countries in Asia and South America, we can expect a growing demand for sugar, and thus an increase in the prices of this raw material.

Brazilian Real

Due to the huge share of Brazilian sugar in the world production of this raw material, the weakness or strength of the Brazilian currency - Real - may affect the behavior of sugar farmers and ultimately its prices on the world market. When Real is strong, Brazilian sugar producers are more willing to sell sugar on the domestic market. When Real weakens, on the contrary, they will look to sell sugar abroad in stronger economies, which will increase supply and possibly lower sugar prices in the end.

Subsidies for agriculture and customs

Agriculture is an industry heavily subsidized and subsidized by governments. Many countries simultaneously apply subsidies to sugar farmers and import duties on this raw material to protect the domestic market for this commodity.

Weather conditions

For proper growth, sugarcane requires no frost and a moderate amount of rainfall. If significant weather anomalies occur in one of the world's leading sugar producers (India, Brazil or, for example, Thailand), we can expect low yields and an increase in sugar prices.

Health issues

The awareness of the public about the harmfulness of consuming large amounts of sugar is growing more and more. Increasingly, there is talk of the link between sugar consumption and diabetes, obesity and heart disease. Considering the fact that the popularity of tobacco smoking has decreased in recent decades due to the growing awareness of the public about its harmfulness and government programs aimed at reducing consumption, it is possible that the same will be true with sugar. If governments of leading sugar consumers engage in effective information campaigns and levy significant taxes on confectionery products, it is possible that demand for sugar will decline.

How to invest in sugar

Futures contracts

On the NYMEX (New York Mercantile Exchange) we can find cane sugar contracts called Sugar No. 11 or Sugar # 11.

Sugar # 11 pricing includes shipping cost to port.

One contract is for £ 112 of raw cane sugar. Contract valuation is the benchmark for setting prices of this raw material around the world. The symbol for sugar contracts is SB. Sugar contracts expire in March (symbol H), May (symbol K), July (symbol N), and November (symbol V).

CFD

Another option is to buy contracts for difference in price (CFDs, contract for differences) or Forex brokers. These are leveraged contracts, usually with a leverage of 1:10 for individual investors.

How to invest in sugar - CFD Brokers

Below is a list of offers from selected brokers offering favorable conditions for trading on sugar (CFD contract).

| Broker |  |

|

|

| End | Poland | Cyprus * | Denmark |

| Sugar symbol | SUGAR | SB / Sugar | SUGAR |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 500 | 0 PLN / 0 EUR / 0 USD |

| Min. Lot value | price * 1120 USD | - | b / d |

| Commission | - | - | - |

| Platform | xStation | Plus500 platform | SaxoTrader Pro Saxo Trader Go |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETF

There are two on the market ETFs giving us exposure to the sugar market.

[SGG] iPath Series B Bloomberg Sugar Subindex Total Return ETN

-

- Issuer: Barclays Capital Inc.

- Annual fees: 0.45%

A fund that buys sugar futures two to five months before their expiry date. The fund manages $ 18 million, the annual fees are 0.45%, which is quite a low figure for a commodity ETF. The average daily spread is 0.68%.

[CANE] Teucrium Sugar Fund

-

- Issuer: Teucrium

- Annual fees: 3.72%

The fund has $ 11 million in assets under management. Annual fees are as high as 3.72% and daily spreads are 0.28%. The fund holds three sugar futures simultaneously to minimize the contango effect (you can read more about contango in TYM article).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Sugar - How to invest in sugar? [Guide] how to invest in sugar](https://forexclub.pl/wp-content/uploads/2020/10/jak-inwestowac-w-cukier.jpg?v=1601823913)

![Sugar - How to invest in sugar? [Guide] crypto retirement 2020](https://forexclub.pl/wp-content/uploads/2020/10/kryptoemerytura-2020-102x65.jpg?v=1601650733)

![Sugar - How to invest in sugar? [Guide] stocks and etf xtb commission](https://forexclub.pl/wp-content/uploads/2020/10/akcje-i-etf-prowizja-xtb-102x65.jpg?v=1601884324)