Cotton - How to invest in cotton? [Guide]

It is estimated that cotton has been known to mankind for at least 9 years, and some sources say that it is even 14 years old. A real revolution in the cultivation of this plant was brought about by the invention of machines for weaving yarn and cotton harvesting, and then by the invention of genetically modified cotton, resistant to the most popular pests. How to invest in cotton and make money from exchange rate fluctuations? We check.

The use of cotton

Textile industry

Cotton is mainly used in the textile and clothing industry. Cotton fibers are used to create fabrics such as velvet, satin, denim, calico or corduroy. In addition to the production of clothing, cotton fibers are also used in the production of fishing nets, coffee filters, book binding and luxury paper.

Animal feed

Cotton is inedible to humans due to the presence of a chemical called gossypol. Nevertheless, it is sometimes used as high-quality feed for ruminants (e.g. cows). To other mammals, cotton is also poisonous due to the presence of this chemical.

Cosmetics ingredient

Cotton seeds can be pressed into oil, which is a valuable ingredient in cosmetics and soaps.

Banknotes

Some banknotes contain cotton fibers, such as dollars.

Cotton requirements and cultivation

It is believed that the ideal conditions for the rapid growth of cotton are in Egypt - high air temperature and high soil moisture. However, despite favorable climatic conditions, currently Egypt does not have a significant share of the global cotton cultivation.

Cotton needs a lot of sunlight, moderate rainfall and no frost for most of the year to grow properly. Currently, most of the cotton crops are outside the ideal climate zones and are irrigated artificially (especially in India).

It is a plant very susceptible to pests, especially cotton flower is harmful to the harvest. For this reason, cotton cultivation has largely relied on, and still relies on, chemical fertilizers and insecticides.

Cotton Bt

Introduction of Bt cotton in the 90s, a genetically modified variety of cotton enriched with the bacterial gene Bacillus thuringiensis, reduced the need for pesticides. Thanks to this modification, Bt Cotton is resistant to certain pests, as its tissues have become toxic to them.

It is estimated that the introduction of Bt cotton to cultivation in China and India increased the yields and profits of small-scale cotton farmers. Initially, the use of pesticides also decreased significantly. Currently, the majority (over 95%) of cotton cultivations in India, China and the USA are genetically modified, i.e. the Bt cotton variety.

Cotton producing countries

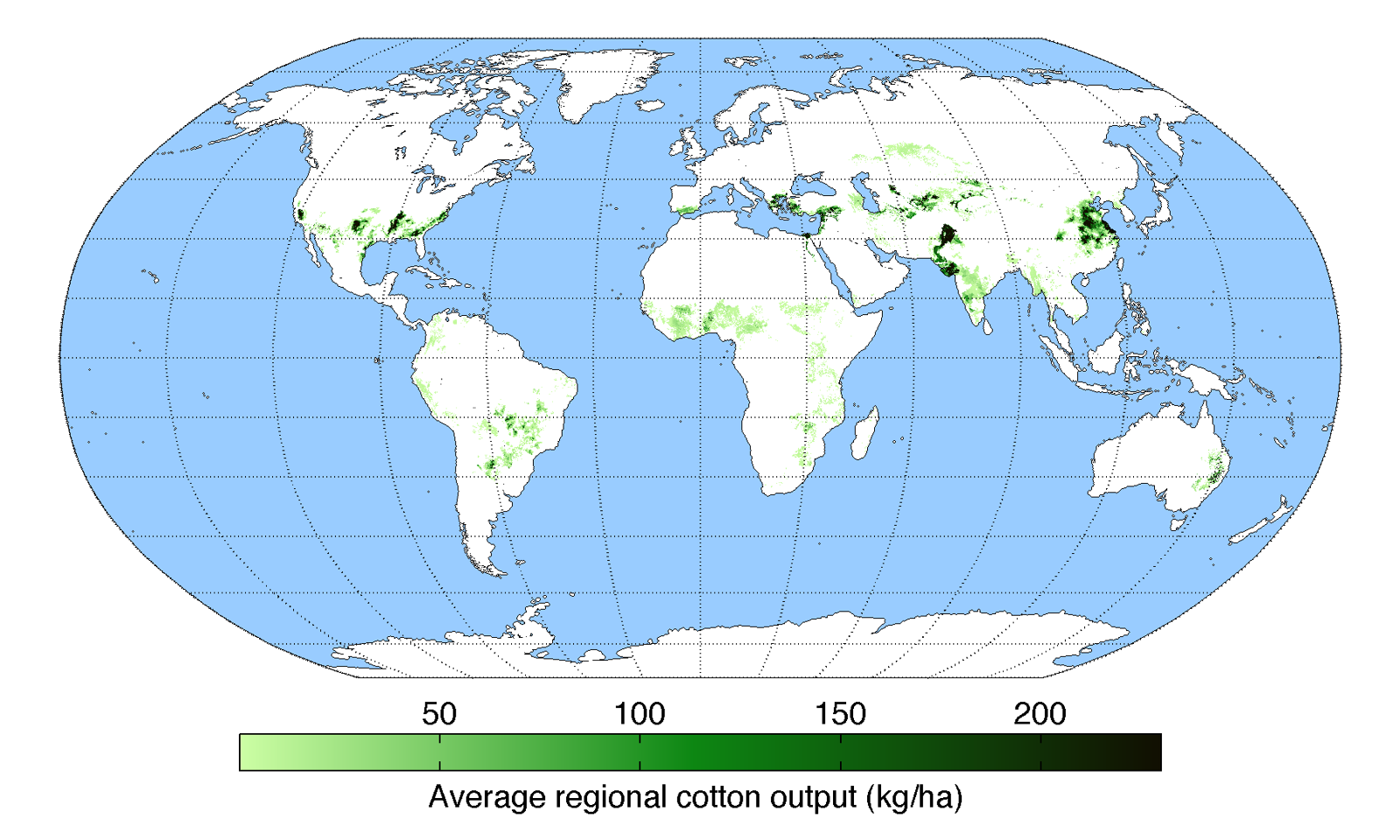

Currently, the largest cotton producers are India, the USA and China. The map below shows the regions of the world where cotton is grown. The darker the color, the more cotton is harvested per hectare.

The largest producers of cotton

| End | Cotton production in thousands of tons in 2019 |

| Indie | 5770 |

| United States | 3999 |

| China | 3500 |

| Brazylia | 2787 |

| Pakistan | 1655 |

| Turkey | 806 |

| Uzbekistan | 713 |

| Australia | 479 |

| Turkmenistan | 198 |

| Burkina Faso | 185 |

Factors influencing cotton prices

Reserves

In recent years, China has led a large-scale build-up of cotton reserves. As a result of these actions, cotton prices in China were significantly higher than in other countries. Such actions by China or other countries may result in a shortage of cotton supplies and prices will increase. On the other hand, selling off material reserves may lower the prices of this raw material due to the increased supply.

Demand

With the general development of society and the increase in wealth, the demand for cotton grows. China is the largest importer of cotton, so it is especially worth observing the state of the Chinese economy and cotton orders to predict the future movement of this raw material's prices.

Replacement price

Cotton competes on the market with artificial counterparts such as polyester. It is worth observing the regulations regarding plastics, such as PTA, from which polyester is made. Regulation of the use and marketing of these materials can significantly affect the demand for and prices of cotton.

Climate

Climate change and climate disasters have a large impact on the prices of agricultural raw materials, including cotton. Cotton requires a lot of sun and adequate rainfall for proper growth. The lack of frosts is also key, so in the event of an unexpected inflow of cold air to the regions of India or China, we could expect significant increases in cotton prices and a reduction in the supply of this raw material.

Politics

Agricultural raw materials are often subsidized by governments. Cotton is a commodity heavily subsidized by the US government, which keeps cotton prices low.

Oil prices

Prices oil they are important for all raw materials as they affect transport costs. However, with cotton, the price of oil plays a much bigger role. Cotton is an expensive raw material to produce, and the cultivation and harvesting process is almost completely mechanized. The cotton is sown and harvested by specialized machines, and the further processing of the fibers is also done by machines. For this reason, fuel prices are of particular importance for the final production costs of cotton, and thus for its prices.

How to invest in cotton

Futures contracts

Cotton futures can be found on the US NYMEX (New York Mercantile Exchange) under the symbol TT. Contracts expire each year in March, May, July, October and December.

One contract is for £ 50 of cotton.

Cotton contracts are also traded on the NYBOT (New York Board of Trade) under the symbol CT. They also expire in March, May, July, October, and December.

CFD

Another option is to buy contracts for difference in price (CFDs, contract for differences) or Forex brokers. These are leveraged contracts, usually with a leverage of 1:10 for individual investors.

How to invest in cotton - CFD Brokers

Below is a list of offers from selected brokers offering favorable conditions for trading on cotton (CFD).

| Broker |  |

|

|

| End | Poland | Cyprus * | Denmark |

| Cotton symbol | COTTON | CT / Cotton | COTTON |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 500 | 0 PLN / 0 EUR / 0 USD |

| Min. Lot value | price * 500 USD | - | b / d |

| Commission | - | - | - |

| Platform | xStation | Plus500 platform | SaxoTrader Pro Saxo Trader Go |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETF

The commodity market is not rich in ETFs. As for the cotton market, we can only choose BAL iPath Series B Bloomberg Cotton Subindex Total Return ETN.

[BAL] iPath Series B Bloomberg Cotton Subindex Total Return ETN

-

- Issuer: iPath

- Annual fees: 0.45%

The fund manages 10 million US dollar assets. The average spread is 0.59%, annual fees are 0.45%. The fund buys cotton contracts one month to five months before expiry.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Cotton - How to invest in cotton? [Guide] cotton - how to invest in cotton](https://forexclub.pl/wp-content/uploads/2020/09/bawelna-jak-inwestowac-w-bawelne.jpg?v=1601393208)

![Cotton - How to invest in cotton? [Guide] namecoin nmc](https://forexclub.pl/wp-content/uploads/2020/09/namecoin-nmc-102x65.jpg?v=1601391774)

![Cotton - How to invest in cotton? [Guide] presidential debate trump - biden](https://forexclub.pl/wp-content/uploads/2020/09/debata-prezydencka-trump-biden-102x65.jpg?v=1601452421)