Free Cash Flow yield - What does the FCF indicator tell us about?

Many investors at the beginning of their adventure with fundamental analysis look for the perfect indicator that will be a perfect filter for the company's attractiveness. Initially, the most popular measure is indicators based on net profit. The most popular of these is the famous price to profit (C / Z or P / E). However, the disadvantage of such an indicator is that it is based on accounting concepts. As a result, the net profit is not the same as the actual cash inflow to the company's account. Sometimes it happens that despite the fact that the company reported a significant net profit, operating activities generated a cash outflow. The reason could be the increase in the demand for working capital or the profit from the revaluation of the company's assets. For this reason, some analysts are advocating filtering the company based on the level of FCF generated. One popular filter is the FCF yield indicator.

In today's article you will find answers to the following questions:

- what is FCF,

- what are the advantages and disadvantages of FCF,

- what is FCF yield,

- what advantages and disadvantages does FCF yield have.

What is Free Cash Flow?

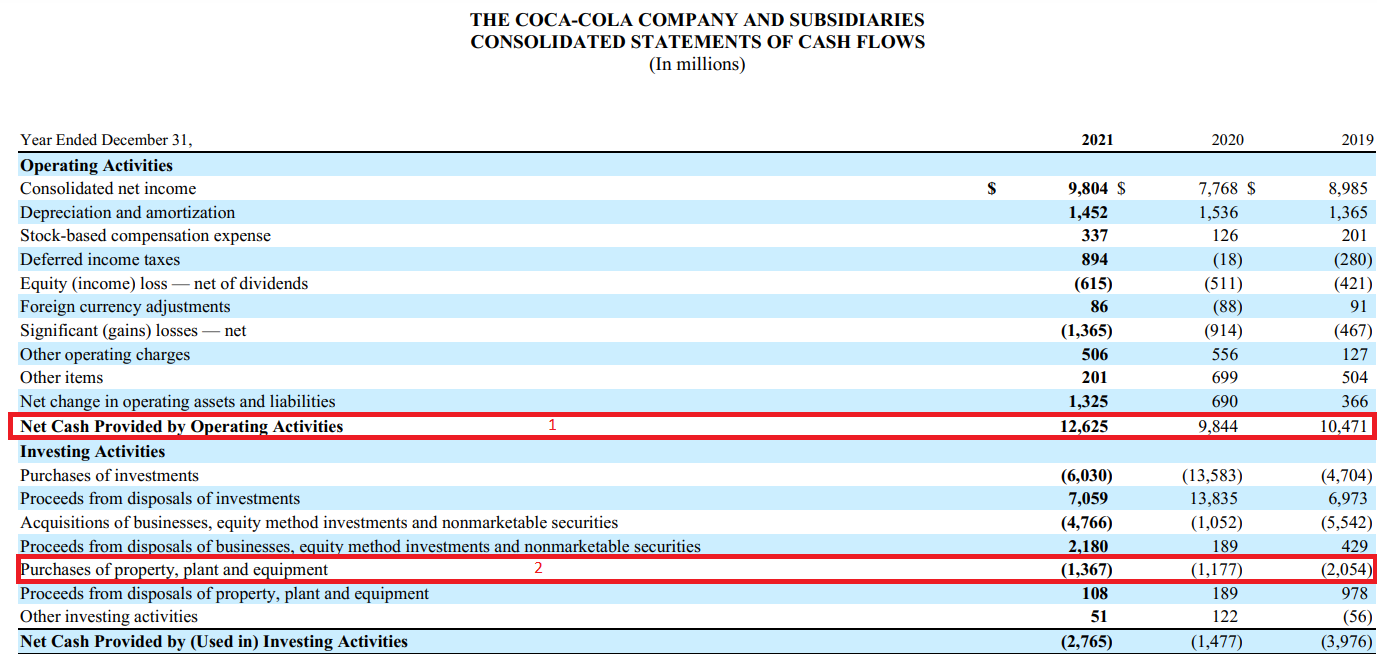

FCF stands for Free Cash Flowwhich can be translated into Polish as free cash flow. The formula for calculating the FCF is relatively simple if you have a cash flow statement at hand. Free Cash Flow is the result of operating cash flows less capital expenditure (CAPEX). The chart below shows an excerpt from Coca-Cola's annual report. The number 1 indicates cash flows from operating activities and the number 2 indicates capital expenditure (CAPEX).

Source: Coca-Cola financial statements

Briefly: FCF represents the level of cash generated by operating activities minus capital expenditure (replacement and investment). The advantage of this indicator is that it takes into account changes in working capital that are important for companies involved in, for example, wholesale trade. Additionally, FCF excludes all non-cash income and expenses of the enterprise. These include, among others depreciation or stock based compensation (SBC). There are two types of free cash flow in finance. These are:

- FCFF,

- FCFE.

FCFF otherwise Free Cash Flow to Business, this is the "classic" measure of FCF. It means how much cash the company has generated for all capital owners (shareholders and creditors). Generally speaking, these are cash flows from operating activities less capital expenditure (CAPEX).

FCFE it's different Free Cash Flow to Equity. Therefore, it means how much the company has generated cash for its shareholders. This is FCFF plus changes in debt and less interest paid. FCFF and FCFE are equal, if the company does not finance itself with debt, for example by issuing shares.

Interpretation of the FCF

Positive FCF

An overall positive FCF level (when operating flows are higher than CAPEX) is a good signal. It means that the company is able to finance itself, and in addition it can use the surplus cash for further development (organic, acquisitions) or return the generated cash to shareholders (dividend, share buyback). Of course, you should be careful if the high level of FCF is not due to the reduction of capital expenditure, which may adversely affect the company's profitability in the long term.

Negative FCF

On the other hand, when FCF is negative, it is usually negative information. This is because the company with a negative FCF reports that it is not yet able to generate enough cash from operating activities to finance capital expenditures. The reason for the occurrence of a negative FCF may be due to negative cash flows from operating activities or too high capital expenditure. Of course, negative free cash flow is often understandable when a company wants to quickly increase the scale of operations and invests in new machines, industrial plants or a car fleet. However, such a situation occurs only when the company operates in the asset heavy industry, which requires large capital expenditures. An example of such a company is Wayfair, which invested heavily in the development of logistics needed for fast and safe delivery of furniture to American consumers. Below is a collective table that compares cash flows from operating activities and CAPEX.

| Wayfair ($ million) | 2016 | 2017 | 2018 | 2019 |

| OCF | 62,8 | 33,6 | 84,9 | -197,0 |

| CAPEX | -96,7 | -100,5 | -159,2 | -272,0 |

| FCF | -33,9 | -66,9 | -74,3 | -469,0 |

Wayfair stock chart, interval W1. Source: xNUMX XTB.

A negative FCF may (but need not) signal for:

- poor management of working capital

- a signal of liquidity problems

- potentially higher interest costs

Advantages and disadvantages of FCF

Like any indicator, FCF also has its advantages and disadvantages. In this part of the article, we will introduce the basic advantages and disadvantages of this indicator.

Disadvantages

Sometimes, due to accounting tricks, it is necessary to "clean" FCF from the company's accounting policy. An example would be the use of paying in shares to your employees instead of paying the "traditional" wage. In such a situation, the company may report a much greater FCF than it would have been under the normal payroll policy. It is true that the company does not pay cash to its employees, but shareholders pay for such a strategy due to the dilution of the number of shares.

The indicator is sensitive to manipulations at the level of capital expenditures. Capex reduction may significantly increase the level of free cash flow but it is an unsustainable policy in the long term. This is due to the fact that while part of the capital expenditure can be postponed (e.g. construction of a new production hall), it should be remembered that part of the capital expenditure is a replacement of the company's production capacity (major overhauls of machines, etc.). A skilled analyst should look at capital expenditure levels and compare them with competitors' expenditure (taking into account the age of the fixed assets).

Advantages

The great advantage of FCF is paying attention to changes in working capital. You can imagine a situation in which the company regularly generates a net profit of PLN 100 million. Looking at the accounting measure of profit alone, the company seems stable and has solid foundations for further growth. However, the analyst noticed that the company is not in such a good condition as it would result from the profit and loss account itself. For two years, the company has been struggling with an increasing level of inventories, growing receivables and faster repayment of suppliers. These factors may be due to:

- worse sales and poor warehouse policy (growing inventories)

- weaker financial condition of recipients (increase in receivables)

- pressure from suppliers to pay off their liabilities faster (decline in the trade liabilities turnover cycle)

These factors extend the cash conversion cycle, which is reflected in the declining FCF, despite the fact that the net profit remained unchanged. Simply company more and more cash is freezing in unsold inventory and uncollected receivables.

FCF is also a better measure to define how much funds can the company spend on further development or the payment of a surplus to its shareholders. This is because the dividend or share buyback is done by having cash in hand and not "accounting profit".

READ: Dividend aristocrats - buy, keep and earn [Guide]

The advantage of FCF is also its sensitivity to the level of capital expenditure. As a result, it "favors" companies to operate asset light rather than asset heavy. Asset light companies include enterprises operating on the basis of the SaaS model (software as a service). Such companies do not have to spend large funds on capital expenditures, thanks to which they can spend more money on customer acquisition or payment of excess cash to shareholders.

Free Cash Flow Yield

This is an indicator of the attractiveness of the company's valuation for an investor. The calculation of this ratio is based on the level of free cash flow (FCF) generated by the company and the company's capitalization or the enterprise value level.

The most common method of calculating the Free Cash Flow Yield is dividing the FCF level by company capitalization. It is a very simple indicator to calculate, and an additional advantage is that many websites and portals publish its value for free.

However, its supporters also find the opinion that it is better to replace market capitalization with enterprise value (EV) in the denominator. EV increases capitalization with net debt as well as minority and preferred shares.

Theoretically the higher the FCF yield level, the more attractive the company is to the investor. However, sometimes a high FCF yield is a warning to the investor. Sometimes it may result from the fact that the company is cyclical and in the period of short-term prosperity it generates a very high FCF and then "overtakes it" at a time when the market environment for the company is unfavorable.

An example of using FCF yield

Coca-Cola is one of the most important food companies in the world. There is also a company listed on the US stock exchange. The company is obliged to publish quarterly and annual reports. For this reason, there is no problem with the FCF yield calculation for this company.

In 2021, the company generated:

- positive cash flow from operating activities of $ 12 million,

- capital expenditures of $ 1 million.

As a result, Coca-Cola's Free Cash Flow (FCF) was $ 2021 million in 11, with the current capitalization (as of September 258, 2) of $ 2021 billion. This means that the FCF yield is 264,5%.

Coca-Cola stock chart, interval W1. Source: xNUMX XTB.

Advantages of FCF yield

FCF yield has a number of advantages, the most important of which are:

- simplicity of construction and interpretation,

- based on generated cash,

- easy to compare companies operating in the same industry.

Simplicity results from the fact that to calculate it you need 3 data (in the basic version). These are: cash flows from operating activities, capital expenditure and market capitalization. At the same time, the basic interpretation of the ratio is very simple: the higher the FC yield, the potentially “cheaper” the company is.

Due to the fact that the indicator in the numerator is based on the amount of cash generated by the company, and not the level of accounting profit, FCF yield calculates the impact of changing working capital and capital expenditure on the company's operations. Thanks to this, it allows you to avoid many accounting tricks that are used to improve the financial result.

FCF yield can be used as a tool to compare companies operating in the same industry with each other. This is due to the fact that companies operating in the same industry must operate in a very similar micro and macroeconomic environment.

Disadvantages of FCF yield

There is no indicator without weaknesses. The same also applies to the FCF yield.

The most important disadvantages include:

- sensitivity to the company's investment policy,

- the indicator is influenced by the company's sales policy,

- payment of remuneration in shares is increased by FCF,

- the indicator is based on the past.

The more the management board of the company saves on capital expenditure, the higher the level of free cash flow. This in turn improves the FCF yield level. However, such an investment policy is very short-sighted. For manufacturing companies, outdated machinery will worsen the company's profitability in the long term.

The company's sales policy also affects the size of FCF. If a company sells its product and collects an upfront payment (e.g. payment in advance for 5-year software rights), an increase in sales causes an increase in the cash level. The faster a business grows, the more deferred income appears on the balance sheet. As a result, the FCF may in such a situation be higher than it would appear from the profitability of the product alone.

FCF is also sensitive to the level of SBC (Stock Based Compensation) i.e. payment of remuneration in shares. Due to the fact that this type of cost does not generate a cash outflow, it causes the operating flows to be higher than in the case of a company paying remuneration in a "traditional" manner.

It is an indicator that is based on the past. This is especially important for companies operating in industries with deep cycles. Such companies may have an attractive FCF yield at peak times. However, even in the next year, the level of free cash flow may be much lower.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response