Digitization of the Gig Economy: Upwork and Fiverr [Guide]

With the development of digitization of the economy, new income opportunities appeared. The trend accelerated with the popularization of access to the Internet and smartphones. As a result, platforms appeared that began to act as intermediaries between companies and potential contractors. At the same time, digitization has increased the popularity of "non-standard" forms of remuneration, such as zero-hour contracts. This type of contract comes from the UK and means that the employer does not have to provide minimum working hours, while the employee has the right not to accept the contract. Flexible employment and lower tax burdens mean that flexible forms of employment are gaining more and more popularity. As a result, it appeared a phenomenon called Gig Economy.

What is Gig Economy?

Gig Economy is an economy in which an employee does not provide his services in a full-time model, but by carrying out specific orders (projects). Although the current form is new, it has already appeared in the old economic history. The current gig economy is deceptively similar "Homework", which was popular before the creation of manufactories.

Currently, access to the Internet has made it possible to work remotely, which has allowed to reduce the "geographical problem" that still affects the global labor market. The geographical problem arises from the fact that candidates for stationary work live in an area that economically justifies a change of job. For this reason, a poor Indian citizen is unlikely to run for the job of financial analyst in New York. However, if an American company makes orders to build a financial model available via the Internet, all English-speaking companies "Freelancers" may compete for the execution of the contract. This increases competition for the order, which reduces its price. While such a solution is beneficial for both corporations and "Global labor market"this puts pressure on wages on "Local", the American job market.

Although the term Gig Economy is most often associated with employees Uber, Glovo or Lyft are employees who are part of this sector of the economy:

- artists,

- consultants,

- part-time employees,

- freelancers,

- independent professionals,

- "Temps" (temporary contract workers) - the so-called temporary workers.

New opportunities for cooperation have contributed to the emergence of a new phenomenon, which is crowdsourcing. It is the acquisition of ideas, services or content from a wide range of internet users.

It is clearly visible that the concept of Gig Economy is very broad, which means that many "classic" works can be included in this concept. Nowadays, most of the gig economy work is still concluded in a traditional way. The traditional methods of employment include carrying out classic recruitment or using an employment agency. For this reason, many companies have appeared that are trying to digitize the gig economy. Digitization is aimed at accelerating the recruitment of an employee to perform a specific project or task. In today's article, the companies will be briefly described Upwork and Fiverrthat want to digitize the market.

Upwork

It is an American platform that aims to connect companies and freelancers, consultants or looking for a remote job. The current company was established in 2013 as a result of a merger Elance z oDesk. Elance was founded in 1999 by an MIT graduate - Beerud Shath and investor Srini Anmol. ODesk was founded in 2003 by two friends Odysseas Tsatalos i Karamanlakis Stratis. The oDesk platform was a marketplace that connected job seekers and employers. After the merger of the companies, the company Elance-oDesk was established. After two years, the company name was changed to Upwork. As early as 2017, Upwork had 14 million users from 180 countries. In 2018, the company made its debut on the New York Stock Exchange.

In 2019, there was a slight change in the business model. Rather than focusing on the "majority" of the Gig Economy market, Upwork has decided to focus more on the largest companies (those on the Fortune 500 list). This resulted in a partial "cleaning" of the platform from freelancers who had little skills and had a low rating on the platform. As a result, 2020 million freelancers were removed from Upwork in 1,8. Upwork movements aimed to reduce the skills gap resulting from the gap between companies' expectations of the skills of the hiring person and the skills of freelancers.

At the end of 2020, contracts worth $ 2 billion were signed on the Upwork platform. The platform allows you to find an employee in over 90 categories such as: sales, marketing, data science, design or software development. Upwork categorizes over 10 skills on its platform. The company also provides DTT (Direct-to-talent) services, which reduces the dependence of companies on employment agencies such as employment agencies.

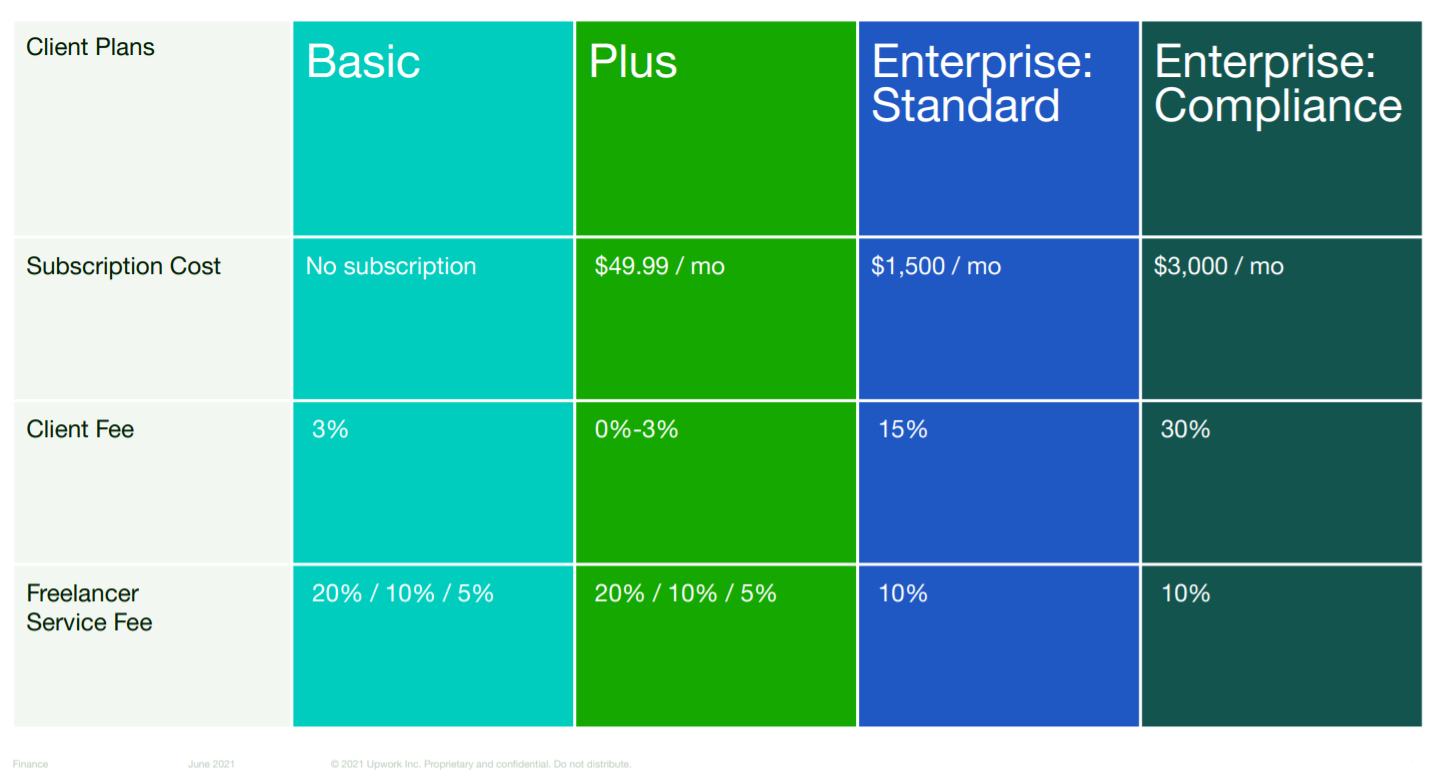

Upwork operates in a subscription model where it charges both companies, freelancers and specialists. The company creates various types of plans, where the scope of services and the price list change.

- Upwork Basic is the basic plan on the platform. It enables enterprises to access employees with verified work history on the platform with customer reviews.

- UpworkPlus this is a feature that makes it possible to find an employee and hire him very quickly. As part of this plan, the company also receives access to support (general and job-specific).

- Upset Enterprise it is a solution for large clients. In addition to the Upwork Plus service included in the package, the company gets a dedicated team of consultants, consolidated invoicing services and reporting services in accordance with the company's standards. In addition, the company (client) gets premium access to the best freelancers and more flexible payment terms.

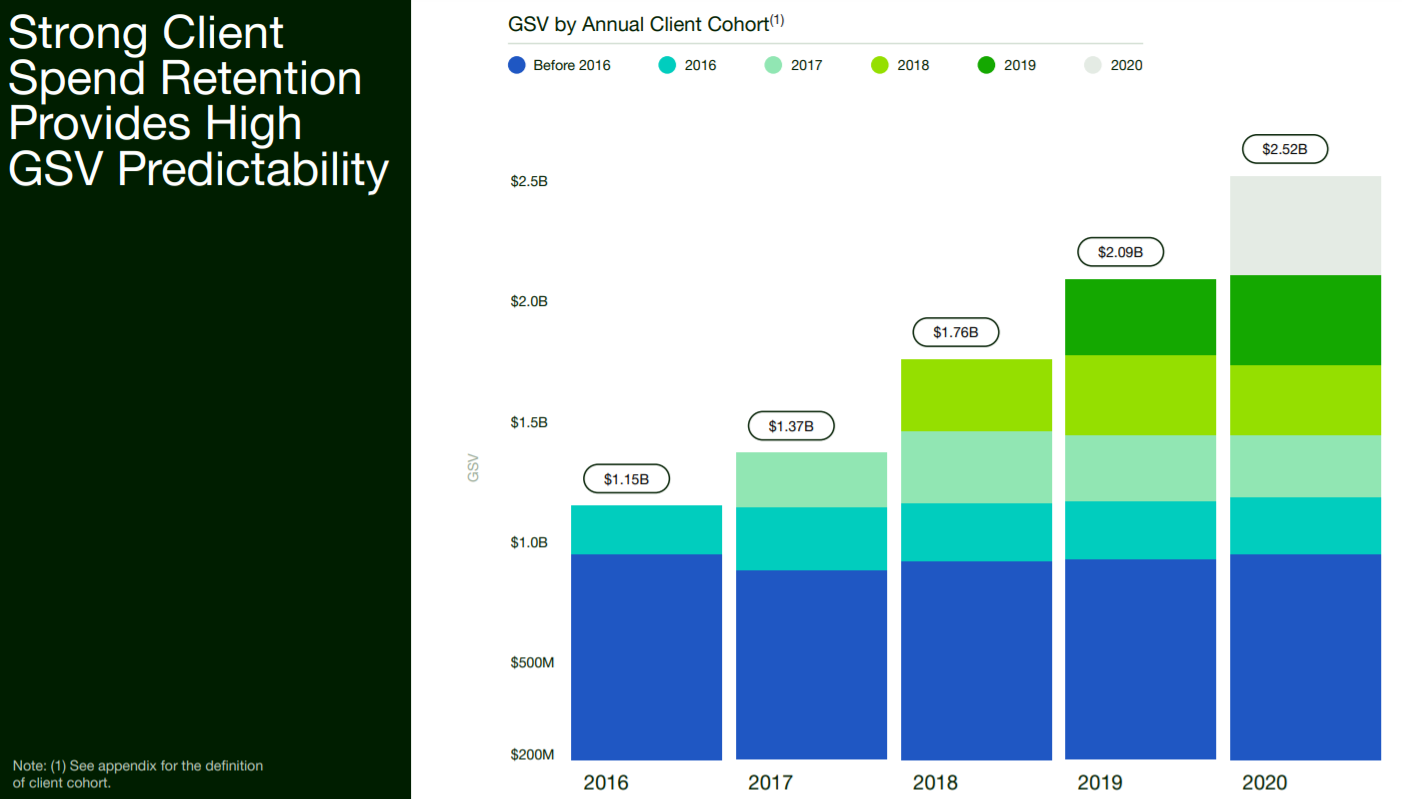

The most important thing for the company is to create a platform effect. The more companies available on the platform, the easier it will be for specialists joining the platform to find a job. The more specialists there are, the more companies will want to be active on the platform. It is important for Upwork that customer retention is as high as possible and that the frequency of transactions is increased. As a result, each cohort of acquired clients in the positive scenario will grow, which will result in effect "Snowball". For now, Upwork has problems with the growth of new cohorts in the following years. As a result, the increase in revenues is mainly based on the acquisition of new clients, and not on increasing the monetization of previous clients.

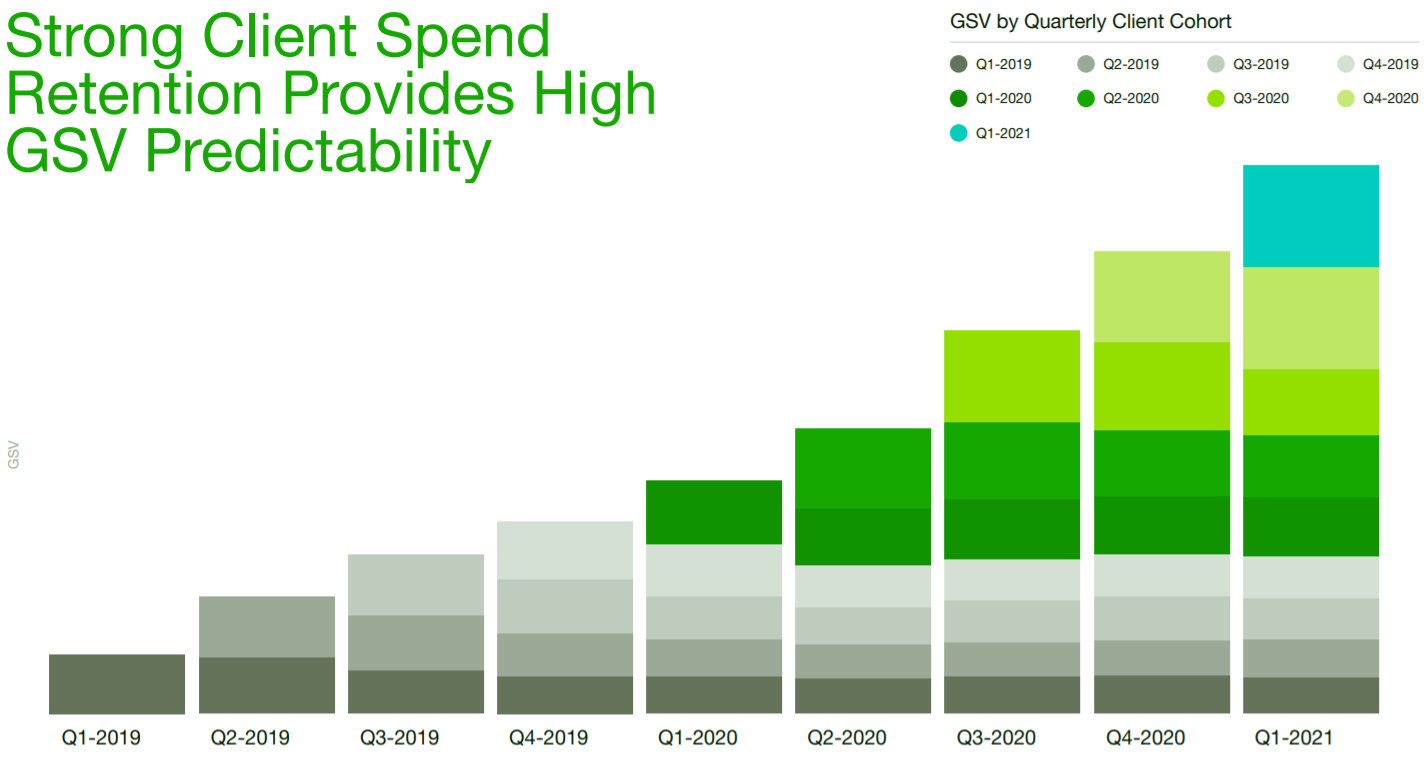

It is clear that so far customers are slowly "returning" to the platform. This can be seen in the quarterly cohorts. Quarterly data show that in the perspective of a few quarters from the "acquisition of customers" there is a slow "erosion" of revenues obtained from a given cohort.

The company is trying to build a platform that will be the industry standard of quality. Freelancers will be sure that they will receive the promised salaries for their work, while employers will be sure that the employed person will guarantee the assumed level of quality.

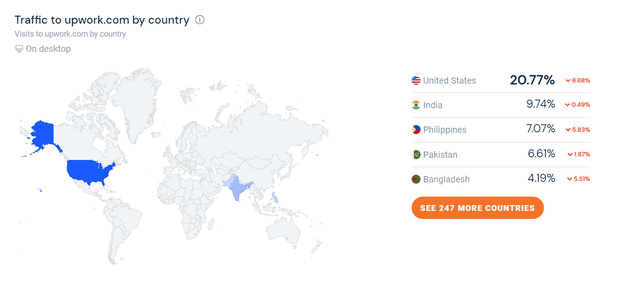

It's also worth taking a look at the popularity of upwork.com worldwide. As you can see, it is highly diversified. 20% of traffic comes from the United States, while another 4 places are occupied by countries with low wages. However, it is worth remembering that in 2020 more than 2/3 of GSV on the platform was generated from American customers. This means that American companies cede some of their responsibilities to workers from poorer countries. As a result, geographic rent is slowly "disappearing" in some American workers.

Source: similarweb.com

CEO of Upwork

Hayden Brown has served as CEO since January 2020. However, she has been associated with the company since 2011 (she started her career at Elance-oDesk). During these less than 10 years, she has moved from the director of the marketplace to the position of head of marketing (CMO). So it is a person "from within" who understands Upwork's culture. However, it should be remembered that this is her first career CEO position. Before working for Upwork, she was employed, among others, by at McKinsey & Company (as a Business Analyst) and at Microsoft (Manager in the Acquisitions and Mergers team).

Financial and operational results

The company's revenues in the analyzed period increased by approximately 20% annually. However, there is no improvement in the operating margin. This is most likely due to the fact that the company wants to grow to become one of the leading platforms of this type in the world. As a result, they sacrifice present results to a larger scale in the future. Sales and marketing expenses increased from $ 53 million in 2017 to $ 133 million in 2020, an increase of 150% in a few years. In the same period, revenues increased by less than 85%.

| Upwork | 2017 | 2018 | 2019 | 2020 |

| revenues | $ 202,55 million | $ 253,35 million | $ 300,56 million | $ 373,63 million |

| Operational profit | -$ 3,12 million | -11,71ml $ | -$ 18,73 million | -$ 22,41 million |

| Operational margin | -1,54% | -4,62% | -6,23% | -6,00% |

| Net profit | -$ 4,12 million | -$ 19,91 million | -$ 16,66 million | -$ 22,87 million |

| take rate | 13,2% | 13,0% | 13,1% | 13,6% |

| Key customers | 86 400 | 105 500 | 124 400 | 145 400 |

| Client Spent Retention | 99% | 108% | 102% | 102% |

If we look at retention (customer spend retention) has remained at 102% in the last two years. It may not be a very high value, but it guarantees a slight "organic growth". However, the company still needs new acquisitions to increase the scale of its operations. So far, it can be seen that the company is managing to increase the number of "key customers", which are companies that have spent at least $ 5000 on the platform and have been active in the last 12 months.

The company manages to increase its take rate, which was 13,6% in 2020. This is a large commission that companies and clients cost for the provision of brokerage services. In the coming years, Upwork will certainly be under pressure to cut commission. However, the development of additional services may neutralize market pressure.

The company is valued at approximately $ 6,1 billion, a price / revenue multiplier of 16,4. This is a high valuation that largely discounts the future success of the company. However, if the pace of growth accelerates, you can expect an increase in the company's value on the stock exchange.

UpWork stock chart, interval W1. Source: xNUMX XTB.

Fiverr

It is an Israeli company that is listed in the US market. Just like Upwork, it is a platform that connects job seekers with employers. Its main focus is on the work freelancers can do. Fiverr was founded in February 2010 by a serial entrepreneur, Mich Kaufman i Shai Wininger (one of the founders of Lemonade). In the beginning, Fiverr focused mainly on small services worth $ 5 (hence the name of the company). Initially, the platform was dominated by writing, translation, video editing or graphic works. Each small order was named on the platform gig. Between 2010 and 2012, about 1,3 million "gigs" were processed on the platform. In 2013, fiverr.com was one of the 100 most popular sites in the United States and 200 in the world.

In 2013 and 2014, Fiverr developed applications for the Apple App Store and Google Play. In order to develop, the company had to use the capital of investors. In the first 5 years, the company raised over $ 125 million. Square Peg Capital, Bessemer Venture and Accel were among those offering capital. Of course, development was not without obstacles. In October 2015 Amazon started legal action against 1114 Fiverr users on the grounds that they offered fake review writing services on the Amazon platform. Fiverr has started removing services from its site. 2015 was also a breakthrough year, as the company decided to expand its offer to include higher-value orders. In 2019, the company made its debut on the New York Stock Exchange.

Fiverr is a platform that currently has over 500 service categories. Each Gig on the site has a clearly defined description, duration, price and buyers' opinion. It allows "Service buyers" (e.g. companies) to easily find someone willing to provide a specific service. There are both $ 5 and $ 2020 job offers on the Fiverr platform. This allows Fiverr to build up economies of scale faster because buyers have a wide selection of potential collaborators. The Fiverr platform introduced "e-commerce experiences" in its offer. In 700, the platform generated 3,4 million GMV from XNUMX million buyers. The platform focuses primarily on buyers, they are supposed to easily and quickly find a contractor.

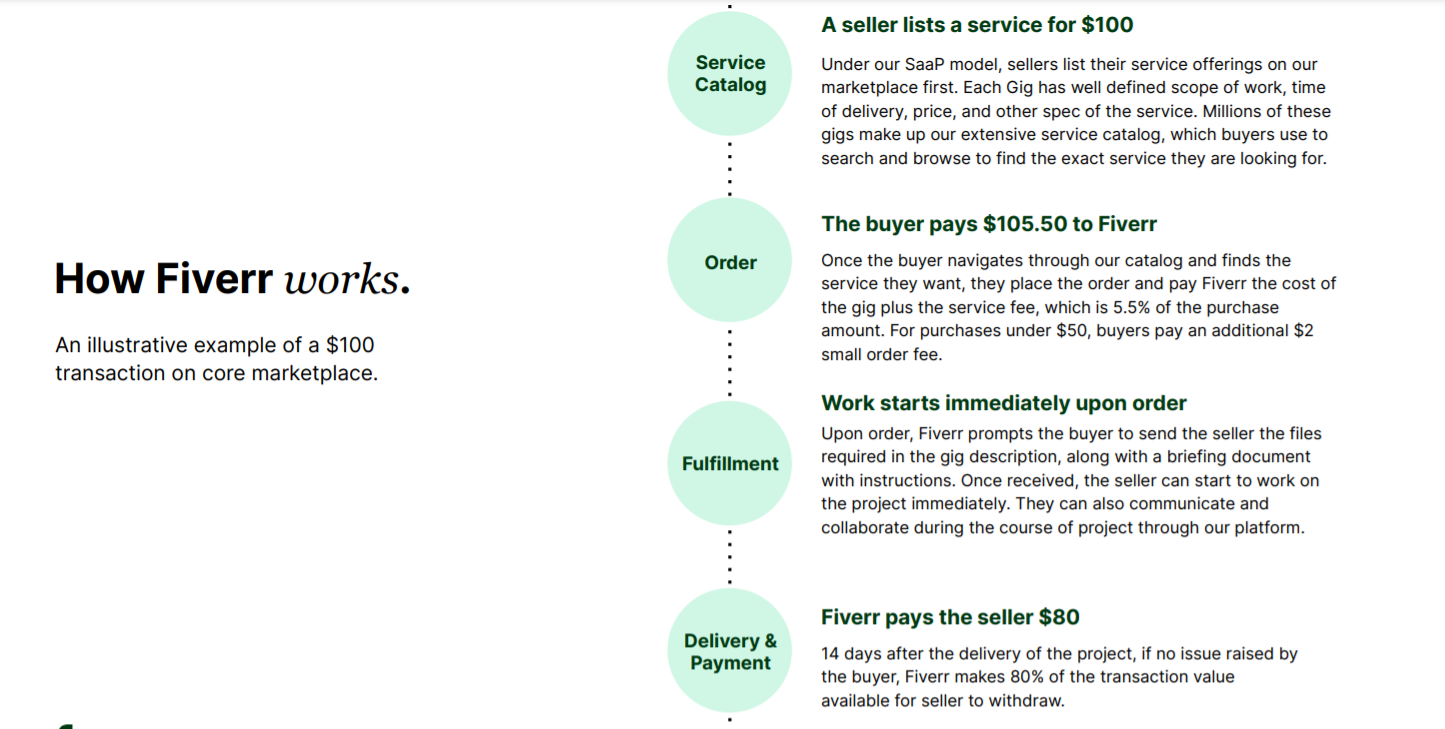

As you can see below, Fiverr charges the contract holder much more than the principal. As a rule, around 20% of the commission is charged to Fiverr for its brokerage. In turn, an additional 5,5% has to be paid by the "buyer". Fiverr is therefore a very expensive solution, so it can be expected that there will be pressure to cut wages in the following years.

For the company, the primary variables that drive revenue are the number of active buyers, average buyer spending, and cohort retention. If you look at the number of active buyers, the period of 2020, as a result of a greater shift of companies to remote work, was a catalyst for growth. In 2020, the number of active buyers increased by 1 million.

At the same time, the company managed to encourage buyers to become bigger "Purchases on the platform", the measure of effectiveness is the ratio of value per buyer. Expenses per buyer (GMV divided by number of customers) are constantly growing and amounted to $ 2020 in 205. In 2019, that figure was $ 170.

Like Upwork, Fiverr is trying to create a platform effect. Fiverr will try to attract as many "buyers" as possible in the hope that the abundance of orders will attract specialists. So far, despite the increase in the number of buyers and the increase in the value of transactions, the cohorts have problems with "organic" growth. This can be seen in the chart below, which presents revenues broken down by individual cohorts. So far, it is not visible that the older users of the platform significantly increase the frequency of transactions. "Regular customers" are not able to "fill" the hole generated by churn of customers.

CEO of Fiverr

Mikha Kaufman comes from Israel. His career began with patent law and intellectual property. After 6 years of work, he decided to change his "career path". In 2003, he was the founder of Keynesis, which sold encryption software. In 2005, she was also one of the founders of Spotbacj, which was a site that provided personalized information (based on user preferences). After withdrawing from these projects, he began to develop the Fiverr company. Micha is thus a "serial entrepreneur", the founder and still a leading figure in the company.

Financial and operational results

2020 was a great year for the company. Revenues increased by 80% and at the same time the operating leverage was working, which led to the improvement of the company's operating margin. This was partly due to the fact that marketing and sales expenses grew slower than revenues. As a result, S&M costs in 2020 amounted to 49,8% of revenues. A year earlier, sales and marketing expenses amounted to 58,6% of revenues. Expenditure on R&D and administration grew even slower. Reasonable budget management allowed us to bring operating loss at reasonable levels. At the same time, rule 40 was fulfilled, which defines how "healthy" the business of fast-growing companies is.

| Upwork | 2017 | 2018 | 2019 | 2020 |

| revenues | $ 52,1 million | $ 75,5 million | $ 107,1 million | $ 189,5 million |

| Operational profit | -$ 19,5 million | -36,5ml $ | -$ 34,6 million | -$ 11,4 million |

| Operational margin | -37,42% | -48,34% | -32,30% | -6,01% |

| Net profit | -$ 19,3 million | -$ 36,1 million | -$ 34,2 million | -$ 14,8 million |

| GMV | N/A | $ 292,8 million | $ 401,0 million | $ 699,3 million |

| take rate | N/A | 25,78% | 26,70% | 27,09% |

| Active buyers | 86 400 | 2,0 mln | 2,4 mln | 3,4 mln |

Including same time, the average GMV per customer improved to more than $ 200. The increase was due to GMV growing faster than the number of active buyers. The company still manages to improve its take rate, which is quite rare. Especially when you consider that take rate is already over a quarter of the GMV generated on the platform. It can be expected that in the coming years there will be a stronger downward pressure take rate.

The company is valued at approximately $ 6,1 billion, which gives a price / income multiplier of 16,4. This is a high valuation that largely discounts the future success of the company. However, if the pace of growth accelerates, you can expect an increase in goodwill on the stock exchange.

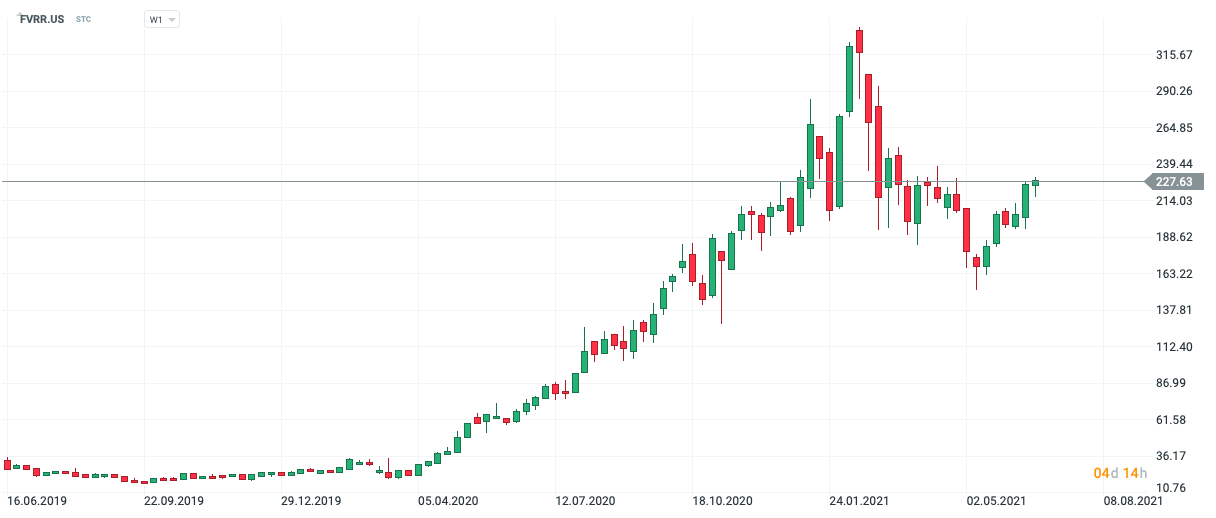

Fiverr stock chart, interval W1. Source: xNUMX XTB.

Where to invest in stocks

Below is a list of offers from selected brokers offering both shares and CFD per share and ETFs from around the world.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Gig Economy: Summary

Gig Economy is a trend that will develop over the next dozen or so years. As a result, the "wind in the sails" will blow in the case of companies operating in this industry. It is worth looking in particular at the digitization segment of this market, which is still in its infancy, as most contracts are still signed in the "traditional way". Examples include companies such as Upwork and Fiverr. Of course, these are not the only companies operating on this market, the competition will be very fierce in the coming years.

Gig Economy is a broad concept, therefore the companies operating in this market include Uber, Lyft, Airbnb, Yandex or Just Eat TakeAway.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Digitization of the Gig Economy: Upwork and Fiverr [Guide] Gig economy upwork fiverr](https://forexclub.pl/wp-content/uploads/2021/06/Gig-Economy-upwork-fiverr.jpg?v=1624349050)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-300x200.jpg?v=1711729561)

![Digitization of the Gig Economy: Upwork and Fiverr [Guide] paul tudor jones trader](https://forexclub.pl/wp-content/uploads/2021/06/paul-tudor-jones-trader-102x65.jpg?v=1624345870)

![Digitization of the Gig Economy: Upwork and Fiverr [Guide] bitcoin farms china](https://forexclub.pl/wp-content/uploads/2021/06/farmy-bitcoina-chiny-102x65.jpg?v=1624438825)