The Russian crisis of 1998 - Prelude to the failure of the Russian economy (Part I)

Some financial crises have no major impact on world history. Most of them are remembered mainly by historians, financiers and economists. This is because most of them have consequences for several quarters or years. However, there are crises that change the history of the country and the entire region. This is one of them Russian crisis of 1998. It was he who paved Putin's political career. The trauma of 1998 meant that Vladimir Putin was treated with admiration by a large part of society. It was then that the myth of liberal economic transformation in Russian society was shattered. The 90s undermined faith in democracy. Many Russians wanted the order he was supposed to provide “enlightened dictator”. Ultimately, Putinism led to Russia's aggression against Ukraine. In this article, we will present the history of the Russian crisis. However, due to the extensiveness of the material, we will divide it into parts. In this article we will cover the years after the collapse of the USSR. These years are part of the explanation for why the crisis broke out and why people no longer wanted neoliberalism.

Perestroika – catastroika: the landscape of the 90s in Russia

Mikhail Gorbachev, it was under his term that the USSR collapsed. Source: wikipedia.org

Collapse of the Union of Soviet Socialist Republics was a shock for political elites on both sides of the Iron Curtain. As a result of the dissolution of the USSR, a number of new countries appeared on the map. Collapse of military and political power "Eastern Bloc" caused many of the former socialist countries to begin to integrate with other countries “West”. Europeanization, modernization and integration were one of the engines of progress in countries such as Poland, the Czech Republic, Slovakia, Hungary and the Baltic countries.. However, some countries have not decided on such a development path. They imported neoliberal solutions, but did not think about joining the European Union. This is what Russia, Ukraine and Belarus decided. The largest country resulting from the dissolution of the Union was the Russian Federation. She recognized herself as the one "heir to the power of the USSR". To this day, Russia has a huge nuclear arsenal left over from the Soviet Union.

Huge hopes

The beginning of the 90s saw the rejection of the socialist view of economic management. The so-called Washington Consensus began to take the lead. Privatization, liberalization and marketization of the economy were to take place. Restrictions on capital flows were to be liberalized. Many Russian citizens did not realize how inefficient the USSR's economy was. At the beginning, everyone believed that the transformation would be quick and convergence to Western countries would be very quick. They believed that after the introduction of the free market there would be a rapid increase in prosperity. However, the citizens' hopes turned out to be in vain.

The West also had great hopes for Russia. The country has become a source of great hopes for economic transformation and business opportunities. A population of over 140 million people with large consumer needs was supposed to be a paradise for companies from Western Europe and the United States. The oligarchs benefited most from the economic transformation in Russia. These were people who, very often at the very beginning, made money by expropriating the country's property. Sometimes wealth was built on tax fraud or simple theft. But more on that in a moment.

McDonald's in 1991 in Moscow. One of the symbols of Westernization. Source: wikipedia.org

Therapyzokowa - a shock for society

Boris Yeltsin – was one of the faces of the reforms. Source: wikipedia.org

Due to the difficult economic situation, there was no time for serious analyses. Economists argued about the path to take. It was decided shock therapy. Her supporters were party of President Boris Yeltsin. Importantly, liberalization was not introduced comprehensively, but in waves. This was partly due to political instability and the increasing influence of oligarchs on political decisions. The oligarchs fought to maintain their strong market position. Shock therapy was pushed by the United States and International Monetary Fund. The Washington Consensus was not only implemented in Russia. One of the countries that also opted for shock therapy was Poland.

Prices were freed, which resulted in a change in Russia hyperinflation. Artificially low prices have simply been made more realistic. For many Russians it was the first shock. The increase in inflation was also a problem for many industrial plants. Many of them were ineffective and operated only thanks to the command-and-distribution system.

A big problem was limiting military spending. This caused entire industries to experience a decline in orders. From steel to engine manufacturers. Smaller orders mean higher unemployment. Higher unemployment, in turn, means lower demand for services.

The period of pauperization of the population began. Many educated people were left unemployed. The reason was the closure of inefficient industrial plants.

A big surprise for many companies was that after opening the economy to trade, many Russian products turned out to be uncompetitive. This applied to both heavy and light industry products (e.g. clothes, fabrics). The sad reality was that Russia did not have many products that were desirable on world markets. In practice, the main export goods were Petroleum and non-ferrous metals.

Inflation and currency instability are a huge problem for the economy

In 1992, there was a significant increase in the monetary base. This, combined with the liberalization of prices, resulted in large hyperinflation. Inflation this year was over 2500%. In 1993-1994 the annual inflation rate exceeded 200%. In the following years, prices normalized. Already in 1996, the CPI dropped to 16,5%.

Macroeconomic instability was visible in the ruble exchange rate. As a result of market reforms, it was possible to exchange the ruble for dollars. Between June 1992 and October 1995, the exchange rate of the Russian currency decreased from 144 rubles per dollar to 5000 rubles per dollar. Sometimes the drop in RUB value was really big. For example, on Black Tuesday in 1994, the value of the ruble fell by 27%.

The massive depreciation of the ruble was a problem for the Russian government. It is true that the weakening currency helped exports, but it significantly weakened the purchasing power of Russian citizens. In June 1995, the Central Bank of Russia announced that it intended to defend its currency. He also set the range within which the ruble exchange rate could move. The dollar exchange rate was supposed to move between 4300 and 4900 rubles. Initially, the defense was supposed to last until October 1995. However, the protection period was then extended until June 1996. Thanks to this, the value of the ruble was stabilized. In the following months, the range of fluctuations. At the end of 1996, the permissible fluctuation range for the ruble was set at 5 - 500 rubles per dollar. In 6, the ruble exchange rate was stabilized. More restrictive fiscal and monetary policies helped. Thanks to stabilization, the ruble was completely convertible into other currencies. Also for Russian citizens. However, normalization did not last long, because after just two years Russia ran into financial problems.

Robbery privatization

With the dissolution of the USSR, there was a shift away from a centrally planned economy. According to the Washington Consensus, state-owned enterprises should be privatized.

Tested citizen shareholding. Citizens of the Russian Federation were to receive shares in state-owned companies. The plan could work in a society with strong economic knowledge. However, ordinary Russian citizens did not have one. At the same time, poor citizens treated the mentioned shares as free money. As pauperization continued, savings were used to buy consumer goods. Moreover, how could citizens raised in socialism be able to value the enterprises of which they became shareholders?

Boris Berezovsky one of the most powerful oligarchs of that time. Source: wikipedia.org

Shares were bought by oligarchs or enterprising people. The so-called nomenklatura. It was quite a specific party-mafia-entrepreneurial environment. This group, thanks to their network of contacts, was able to make money very quickly. Nay, the first money they earned allowed them to corrupt officials, policemen and other state bodies. In addition, they employed talented people who allowed them to create structures that allowed them to avoid taxation and transfer money abroad. The nomenklatura was able to quickly acquire shares "privatized" industrial plants. Over time, the nomenklatura transformed into an oligarchy. It was a tragedy for Russia. These wealthy people acquired wealth and made sure that no one would prevent them from increasing it further. Laws were written to meet the expectations of oligarchs, while state property was often sold for a fraction of its true value.

The more promising industrial plants were the subject of fights between mafia bosses, oligarchs and politically powerful people. Corruption was commonplace. The quickly obtained money was transferred to foreign accounts in tax havens. The period of Boris Yeltsin's presidency was a paradise for these people. Economic transformation was often called by citizens as “catastrophe” – it was a combination of words referring to disaster i perestroika (one of Gorbachev's slogans).

Russian crisis of 1998 – how did it start?

The period before the crisis of 1998 was as interesting as the crisis itself. Certainly, the things that were common back then are material for really interesting films. The Wolf of Wall Street's fraud pales in comparison to what was going on in Russia in the 90s. So let's take a closer look at the climate of these times from the perspective of the economy and society.

The years 1991-1992 – credit eldorado

The initial enthusiasm was not only about people, but also banking sector. Risk management was then in its rudimentary form. There was no skeptical assessment of loan applications. Moreover, the first influences of nomenclature began to be visible. A friend of the bank president, who had an unprofitable company, could very easily obtain a large loan. Sometimes the borrower knew at the time of signing the contract that he intended to embezzle the money. Loans also started to appear “on the pole”.

At the beginning of the transformation, there was credit expansion. Domestic credit increased 9-fold between 1991 and 1992. The borrowed funds went to companies (often state-owned). At the same time, price controls were abolished in early 1992. Many companies experienced a drastic drop in demand after the prices were released. Instead of reducing production capacity and adapting operations to current demand, enterprises maintained the current level of production. As a result, people still had jobs, but inventory levels on farms increased significantly. This resulted in significant capital being frozen in stocks that no one wanted to buy. How did companies finance the increase in inventories? Through loans (often from other companies). In mid-1992, the value of debts that had been significantly delayed in repayment amounted to 3,2 trillion rubles (approximately $20 billion).

The budget of the Russian Federation also had a problem. This was due to the fact that budget expenditure significantly exceeded budget revenues. This was partly due to financing “key” branches of the economy and the costly maintenance of the huge army that was inherited from the USSR. The budget was literally falling apart. Instead of the expected deficit of 5% of GDP, the deficit exploded to 20% of GDP. Due to the fact that there were not many people willing to finance the deficit of the Russian Federation, the government decided to increase the issuance of rubles. This, combined with price liberalization, led to an increase in the inflation rate above 2000% (1992). It is certainly no surprise to the reader that such high inflation has resulted in the rapid impoverishment of Russian society. This undermined enthusiasm for liberal reforms. Therefore, Yegor Gaidar's government collapsed. The cabinet of Wiktor Czemodyn, who had previously managed his predecessor, was formed Gazprom. The new government was not favorable to Russia's subsequent liberal reforms.

1993 - attempts at stabilization

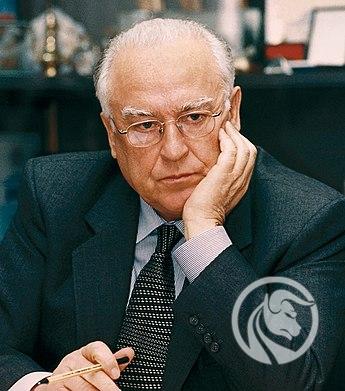

Boris Fedorov was the one who tried to save Russia's finances in the early 90s. Source: wikipedia.org

A more conservative wing came to power (among liberals, of course) and did not want to introduce all liberal reforms. At the very beginning, attempts were made to solve the dire fiscal situation. He took care of sorting out the financial situation Boris Fedorov. He wanted to continue reforming Russia, but first he focused on stabilizing the macroeconomic environment. The priority was to reduce inflation. He used a small shock therapy, which consisted in tightening fiscal and monetary policy at the same time. Budget expenditure and subsidies to many industries were reduced. State-owned companies were also forced to find a way to self-finance. Attempts were also made to control salary increases in state-owned companies and salaries of state employees. However, this resulted in a slow brain drain. More enterprising people tried their luck on the private market. They founded companies or took jobs with the emerging oligarchy. Thanks to their network of contacts, they were a valuable asset in the hands of entrepreneurs. There was also a slow erosion of the quality of public services. Low pay encouraged officials to take bribes. Corruption degraded the state and increased social inequality. Also people started to realize that “they are equal and more equal”.

Efforts were also made to increase the effectiveness of social programs (e.g. for the unemployed). However, it was done in a specific way. Optimization did not result in more funds being allocated to those most in need. The savings went to the common budget, and there they often disappeared "Magic" way. Oddly enough many people in government have become significantly wealthy by serving in high public office. Of course, no one grabbed anyone's hand because no one tried to find corruption in government circles.

Reducing the pace of price growth and fighting the deficit convinced the International Monetary Fund to pay a tranche of aid in the amount of $1,5 billion. However, it is worth remembering that inflation has been reduced to "only" 1000%. So it was still astronomically high. With such high inflation, it is very difficult to make long-term investments and make business decisions. The export industry was gaining, because it sold its products for foreign currencies and inflation "diluted" employee costs.

1994 - further attempts at reforms and the great crash

Viktor Chemodryn – the “unsinkable” Prime Minister of Russia. Source: wikipedia.org

Czemodryn's government had to try to calm down Western lenders and the very conservative wing of parliament, which was against reforms. Therefore, further political transformation and maintaining economic stability were necessary to reassure the more skeptical part of parliament. Czemodryn, thanks to his political sense, was able to balance between supporters of reforms and politicians who longed for “the good old days”.

The Central Bank of Russia tried to stimulate the economy by offering low-interest loans to businesses. This was due to the strong lobby of the industrial and agricultural sectors. However, cheap loans were most often wasted and allowed companies to survive rather than restructure them. So it was giving the proverbial fish instead of a fishing rod. Companies should modernize to become competitive on the domestic and foreign markets. However, a thorough restructuring was necessary. However, the problem was the management boards of many companies that could not cope with the free market reality. They were afraid to make unpopular decisions and look for markets for their products. The entire stabilization was based on flimsy foundations. The reforms have still not been fully implemented, and a large part of society has experienced enormous poverty. So there was no strong domestic demand.

A real blow to the perception of Russia was the so-called Black Tuesdaythat took place October 11, 1994. On the interbank market, the value of the ruble fell by 27%. This meant that companies with liabilities in foreign currencies experienced huge problems with debt servicing. Exporters benefited as they suddenly became more price competitive.

However, such a sharp decline in the ruble exchange rate was a signal that the policy of the Central Bank of Russia was inappropriate. President Boris Yeltsin decided to dismiss Viktor Gershchenko, who was the president of the central bank. He appointed Tatiana Paramonova in his place. The new president of the bank decided to introduce strict monetary control and stopped financing enterprises at a low interest rate. At the same time, the parliament passed a new law that significantly limited the financing of the deficit through monetary policy (the so-called monetizing debt). From now on, the Ministry of Finance had to use the debt market to finance the deficit.

XNUMXst Chechen War. Source: wikipedia.org

The Russian Federation has become an economic dwarf. Even after taking into account purchasing power parity. Russia's GDP was then $678 billion. At the time, it accounted for about 10% of the United States' Gross Domestic Product. Converting GDP (in parity) per capita in Russia, the indicator amounted to $4. So it was about 573% of the US level. This confirmed the thesis about the unipolarity of the world. Only the United States mattered. The other countries were too weak to be an equal partner for the US. For many Russians it was a cold shower and “national disgrace”. Many of them longed for a strong leader who “will sort it out” Russia and make it a power.

It is also worth remembering that in December 1994, the Second Chechen War broke out and lasted for over a year and a half. It showed that Russia's power is more paper than real.

1995 - further attempts at reforms

In 1995, the government also tried to control the deficit. It was going quite well (a budget plan was being made). However, this was due to the delay in raises for employees of state-owned companies and officials. This caused the brain drain to continue. This worsened the quality of public services, which were already much lower than at the beginning of the reforms. The lack of trained staff was also a problem for state-owned plants, which operated below their potential. An interesting phenomenon was emerging. Inefficient state-owned plants became profitable after privatization. The new owner was simply not afraid of thorough restructuring, which, of course, was often carried out brutally. Colloquially speaking, there were people “thrown to the street”.

At the end of 1995, the party reluctant to reforms became more and more vocal. She was a great example the resignation of Anatoly Chubais, who was a supporter of continuing the liberalization of Russia. His place was taken by Vladimir Kadannikov. He was from the environment of opponents of reforms. Previously, he worked as a manager in a car factory. This was a clear signal that reforms would not be continued. There was also a political dispute regarding the appointment of the President of the Central Bank of Russia. Boris Yeltsin's circle saw Sergei Dubinin - Chemodryn's protégé - in this position.

Mikhail Fridman – oligarch in the Yeltsin and Putin era. Source: wikipedia.org

In 1995, support for Yeltsin was very weak. Russians saw firsthand that the country was being stolen and that the oligarchs had more and more power in the country. The communists, led by Zyuganov, began to become popular. When the situation of the Russian president became hopeless, the oligarchs came to the rescue. This was not out of concern for Russia, but for their own fortunes. Yeltsin guaranteed that the old order would continue. The so-called siemibankirszczyna, which included the 7 most influential oligarchs. These include: Boris Berezovsky, Mikhail Khodorkovsky, Vladimir Vinogradov, Mikhail Fridman, Vladimir Gusinsky, Vladimir Potanin and Alexander Smolensky. The originator of this "support committee" was Boris Berezovsky, who was the most powerful of them all. Billionaires controlled the media. Vladimir Gusinsky owned the NTW station and owned two newspapers and a weekly. He was also a sponsor of Echo Moskwa. In turn, Berezovsky controlled the ORT television channel.

In addition, the oligarchs began to grant the state loans, which were to be secured by shares of state-owned companies.

1996 - a step back in reforms

After several years of reforms, opinions about them were mixed. The country was slowly transforming economically. However, this was done at the expense of society. This, in turn, aroused resistance to further reforms and nostalgia for the old days.

Post-Soviet Russia experienced a drastic decline in GDP and the standard of living of its citizens. Throughout the years 1992-1996, Russia was in a social, economic and political crisis. According to official statistics, at the end of 1995, the GDP of the Russian Federation was only 50% of the 1990 level. The level of decline in the economy was higher than that of the United States during the Great Depression. Sectors related to the Soviet military-industrial complex shrank particularly sharply. Reducing the size of the armed forces and slowing down the modernization of troops resulted in less demand for goods produced by the metallurgical and chemical sectors. The products of these companies were not in demand on the free market.

On the other hand The following sectors began to undergo successful transformation: agriculture, energy resources and light industry. The private sector played a particularly important role. At the turn of 1995 and 1996, the private sector accounted for 60% of employment in the entire economy. It is worth remembering that trade was developing dynamically at that time. A large number of people were engaged “home trade”. Such people went to foreign markets to purchase goods, which they then sold in local markets. Such ventures lacked scale. On the other hand, it allowed many households to tighten their budget.

The Russian private sector experienced heavy competition from Western products. This was particularly visible in the fast moving consumer goods (FMCG) segment. Companies like Coca-Cola, Pepsi, P&G quickly gained customer recognition. Domestic production focused on less wealthy customers. This meant that such companies generated low profits and were unable to raise the necessary capital to improve the quality of their products and allocate large funds for advertising. Many of them operated in the gray zone. This resulted in such companies not paying taxes and often avoiding paying employee contributions. This resulted in the central budget collecting insufficient amounts from taxes. As a result, the quality of public services decreased, which further encouraged dishonest employers to avoid paying their liabilities to the tax office.

There was a two-pronged transformation of the country. The province fell into great poverty and was underinvested. In turn, large cities experienced rapid economic growth. Moscow was the center of change. This is where wealth was most visible “newcomers”. Moscow also became the financial center of the country. She began to play a special role Moscow stock exchange. At the same time, the weakness of state structures was visible in the cities. In practice, the activities of mafia groups were open to the public. Most successful businesses had to pay tribute for security. It was called “they cry” (i.e. roof in Russian). If someone did not want to pay, they had to take into account the consequences (arson, extortion, mutilation, and even death). Many people paid for peace of mind.

There were fewer and fewer supporters of continuing the reforms. However, the number of supporters of the old order increased, especially among middle-aged and older people. In 1996, there were also presidential elections. The candidates outdid each other in promises of state support for citizens. Boris Yeltsin bid really high. According to Chubais' calculations, during the election campaign Yeltsin promised extensive social assistance. Social assistance plans amounted to $250 per citizen per year. This would result in a doubling of the deficit. However, after re-election the promises were not fulfilled and very quickly society forgot about them.

Years 1997 – 1998: a breath of optimism

In 1997 it happened “little stabilization”. Inflation came under control, which allowed the value of the ruble to stabilize. This, in turn, encouraged foreign companies to invest in Russia. At the same time, the privatization of companies made it possible to obtain funds that supplemented the budget. Another positive impact from the privatization of plants was the increase in the productivity level of such companies.

In 1998, there were problems with continuing reforms in the country. It turned out that, unlike Poland, the Czech Republic or the Baltic countries, the economic transformation was not going well. There was a lack of consistency and efficient state structures that could oppose the oligarchs. The oligarchs were able to significantly influence the shape of economic and fiscal policy.

The country fell into a severe financial and currency crisis. The reason was, among others, bad economic situation on the oil market. The drop in prices caused the export of this product (in terms of value) to collapse. This put the budget in a very difficult situation.

Summation

Just before the crisis broke out, Russia was a country that had problems with its economy. The reforms did not allow for creating lasting foundations for economic development. The oligarchy was growing in power and was reluctant to modernize Russia and introduce the rule of law. They felt much better when they could control politicians with their wallets. But the worst was to come. The Russian crisis of 1998 was fast approaching. You can read about him in next part soon.

Read: The Russian crisis of 1998 - the sad end of Yeltsin and the beginning of the Putin era (Part II)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)