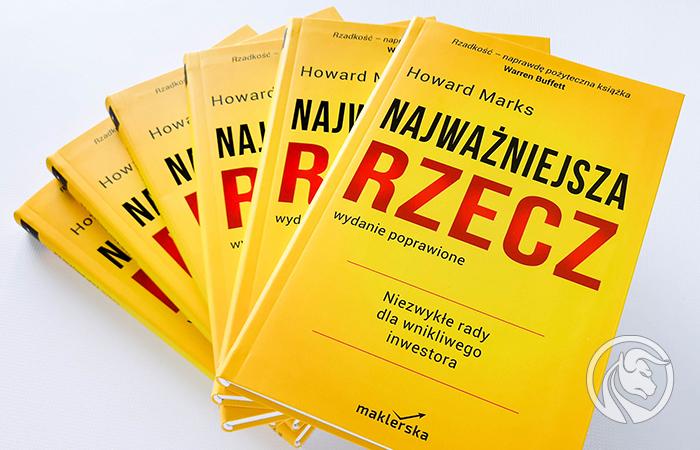

"The most important thing" - A must for every investor

Howard Marks is famous for brilliant letters addressed to his clients. Using them in the book, he presents his investment approach, which is based on the cyclical nature of markets, the relation of price to internal value and the identification and conscious acceptance of individual risks. He lists the most important things in investing in 20 and discusses, among others, such elements as: the concept of second-level thinking, the counter-counterinary approach or defensive investment.

20 the most important things to invest in ...?

The most important thing is a great proposition for those interested in the equity and debt markets in the medium- and long-term time horizon. In addition to the Intelligent Investor, it is the basic source of knowledge for people focused on responsible and safe investing in value.

Michał Masłowski, Association of Individual Investors:

“There are many books on the financial market that comprehensively present the idea of effective investing. Most of them focus on the method, presenting the reader with a lot of complicated charts from which to come out when to trade and how to properly set a stop loss. This book, however, is about human emotions, the psychology of investing, about the fundamental principles of a stock market investor, i.e. - as the title of the book suggests - about the most important things.

This book is excellent, but it will be appreciated by experienced investors, especially those who have gone bankrupt on the market once and know that the method is not the most important. And what is? Everything that has been written down in Marx's Most Important.

"This is a rarity - a really useful book"Warren Buffett wrote. And that should be enough for the best recommendation. "

Forex Club is pleased to take patronage over the Polish edition of the book.

About the author

Howard Marks - American investor and author of several books on investing. In 2017, 374 took the "Forbes" ranking in the year. place among the richest Americans. His wealth was estimated at $ 1 billion by 1,91. Marx completed his BA degree in Finance at the Wharton School in Philadelphia and defended his Masters in Accounting and Marketing at the University of Chicago. At the beginning of his career, he took a managerial position at Citibank, and then joined the TCW Group. In 1995 he became a co-founder of Oaktree Capital Management, an asset management company worth 122 billion dollars. In the investment environment, Howard Marks is known for publishing the so-called Oaktree memos, i.e. letters in which it describes in detail investment strategies and explains the complexities of the functioning of the economy.

A fragment of the book and table of contents - Download

The book is available only at the book brokerage.pl at 84 PLN

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Dariusz Bartłomiejczak - How to find stocks in the early phase of a trend? [VIDEO] xtb trading club](https://forexclub.pl/wp-content/uploads/2019/01/xtb-trading-club-1-300x200.png)

![Piotr Jaromin - How to start investing in the stock market? [VIDEO] Piotr Jaromin](https://forexclub.pl/wp-content/uploads/2018/09/Zrzut-ekranu-2018-09-28-o-11.27.23-300x200.png)