Stocks of luxury goods producers do not react to the state of the Chinese economy

Thematic basket focusing around luxury goods it has gained 32% in value over the past year as investors have strongly invested in this segment of the stock market to make the most of the reopening of the Chinese economy. While commodity prices have not responded in the way most investors expected, consumer spending in China has increased and the market seems to have captured this shift in the Chinese economy correctly by betting on luxury goods. It is also worth looking at the long-term risks to this market segment and issues related to the green transition, as this thematic basket underperformed last year due to higher interest rates and high electricity prices.

Is China changing in a way that is more conducive to consumption compared to commodities?

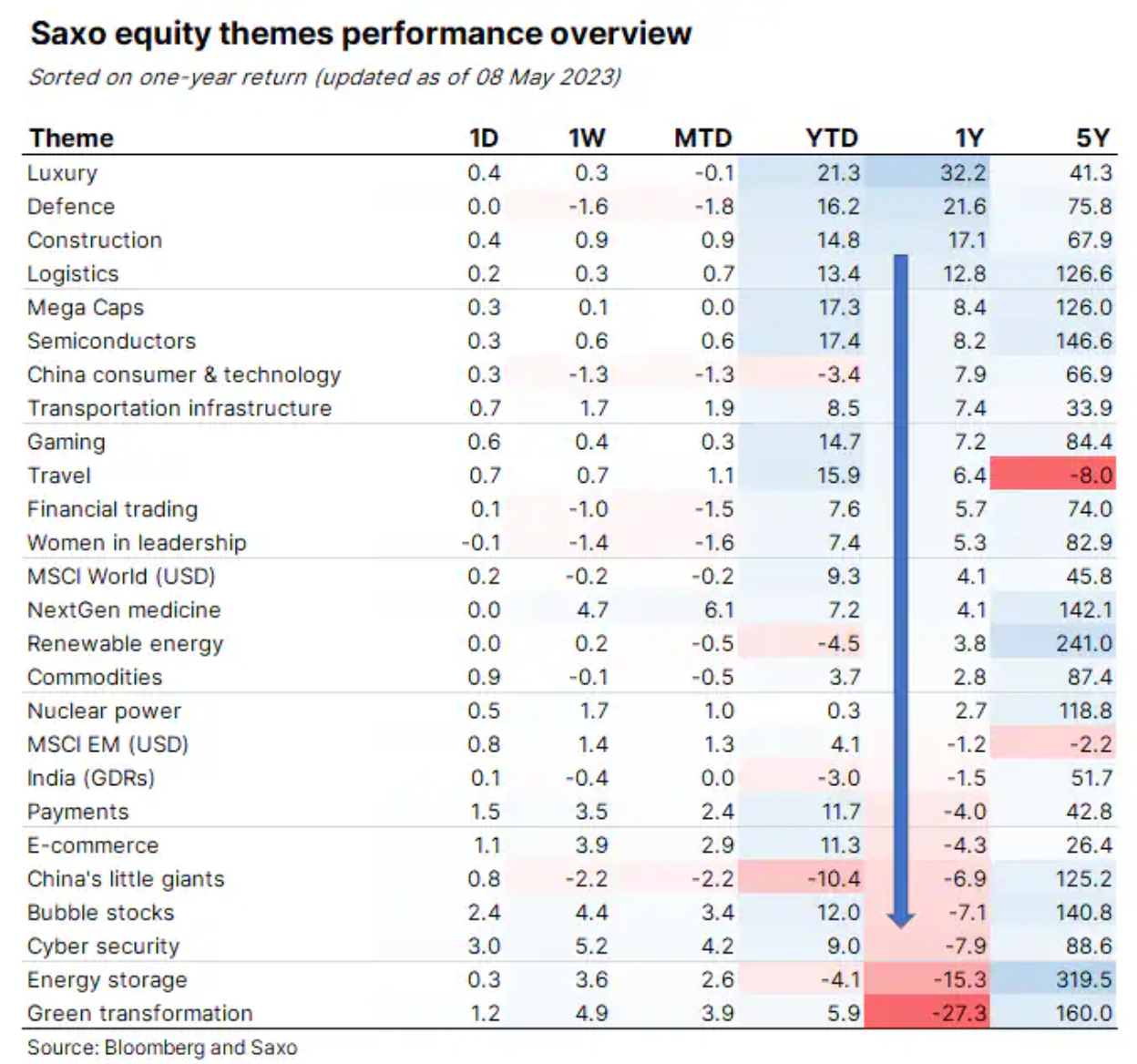

Let's take a look at the annual results of our thematic baskets. It can be seen that an extra class of thematic baskets has emerged, including luxury goods, defense and the construction sector. The last two topics are related to global fragmentation, resulting in a significant expansion of the armed forces in Europe and significant investments in infrastructure around the world. The third of the mentioned topics, which is the hottest trend on the stock market this year, is luxury goods, which in 2023 gained 21% in value, and last year as much as 32%. The Swiss manufacturer of luxury goods - Richemont - on Friday has present your results and are expected to be positive given the performance of other luxury goods companies such as LVMH or Hermes.

Why is the luxury goods industry in such a good shape when we receive more information explaining the weakness of the recovery in China? This question deserves a longer answer; today we will present it only in outline. China's economic model based on large investments is losing momentum, and in the context of the game of fragmentation, the Middle Kingdom needs to transform its economy into a more consumer-oriented one. This process is already underway, and you can see it in China's consumer spending data and in the results of consumer-focused companies. The high beta of this trend, but also a function of reopening the economy, is the luxury goods segment, so the market correctly predicted this shift by betting on these stocks instead of the more classic move of gaining exposure to commodity-oriented companies.

The key long-term risk for the luxury goods segment is geopolitical fragmentation

While luxury goods stocks are currently taking the capital markets by storm and will continue to generate solid performance in the coming years, there are some risks that investors should not underestimate. The fragmentation game we wrote about in our forecast for the second quarter, concerns two systems of values: liberal democracies and authoritarian states, which have broken with their increasing dependence in the recent period of globalization. This fragmentation will lead to the strengthening of nationalist politics in many regions, including China, and the risk for the luxury goods segment is that China will emphasize domestic producers of consumer goods, including luxury goods, and potentially strengthen its own culture at the expense of " Western culture” related to the luxury goods industry.

The green transition has suffered the most over the past year

While the topic of the green transition was the strongest topic in 2020, it underperformed last year as higher interest rates crushed valuations and slowed activity. Keep in mind that the green transition is capital-intensive, so higher interest rates will make the transition not only more expensive but also slower. The key to the green transformation is the electrification of transport and heating, but one of the key threats in this context is our electricity grid, which may prove to be a critical bottleneck in the coming years.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response