Internet bubble [Dotcom] - unfulfilled dreams of fast digitization of the world

The years 1995 - 2003 are one of the most interesting periods in the history of the American stock exchange. It was then that the market initially choked with new technologies, and then fell into deep skepticism towards new technologies. Bursting dotcom bubble took place at the turn of the 90th and XNUMXst centuries. This was a result of the normalization of valuations after the XNUMXs madness, when investors believed that the internet, e-commerce and digitization of companies would change the world. They were right, the adaptation of the Internet allowed the creation of such giants as Amazon, Booking or Alibaba. However, the process did not take 5-10 years, but decades (and still going on). It is not unusual to overestimate the effect of technological change. Bill Gates already mentioned that:

"Most people overestimate what they can do in one year and underestimate what they can do in ten years."

So it was this time. Both individual and institutional investors have fallen into this trap. As a result, they overestimated company valuations paying a lot for promises that were not fulfilled. During this remarkable period, it was believed that technology companies would very quickly revolutionize the "old economy". This applied to both companies specializing in online sales (Pets.com, Webvan, Boo.com, Amazon, eBay), as well as companies digitizing the method of booking hotel rooms (Priceline) or companies from the telecommunications industry (Worldcom).

The beginning of the Dotcom bubble

It is not unusual to recall that 30 years ago it took place in the United States and Western Europe "Internet revolution". In the early 90's, thanks to the advent of internet search engines, computers gained easier access to the World Wide Web. As a result, a new market niche emerged that many start-up companies wanted to develop. At the same time, in the minds of consumers, the computer began to change its image. From a "luxury product" it began to become a necessary tool. Between 1990 and 1997, the share of American households owning a computer increased from 15% to 35%. These two mutually supportive phenomena have led to greater investor interest in companies operating "on the Internet" and increased investment by telecommunications companies in infrastructure (masts, optical fibers, etc.). There was also a belief that the digitization of companies would proceed very quickly and the world was entering a new time - the age of information.

After the first successes of technology companies, many institutional investors fell into FOMO (Fear of missing out). For this reason, many VC funds have started investing "in bulk" in companies operating in the technology sector. Companies with the suffix ".com" were especially popular. For this reason, the subsequent bubble burst was named "Dotcom bubble".

In 1999, 39% of all VC funds were directed to the "new economy" sector. It is worth remembering that the share of this sector in the entire economy was much smaller. Due to the fact that the supply of good-quality companies was limited and was much smaller than the demand for them (investors' capital). As a result, capital financed companies with much weaker business models and "pumped" the valuations of prospective companies. The 90s and the beginning of 2000 are an Eldorado for technology companies. In 1999, it made its debut in the United States 457 companies "from the new economy". There were such companies in Q2020 XNUMX 91. Easily available capital allowed many companies to create large mergers. The most famous was the January 2000 connection between American Online and Time Warner. It was the largest in the history of the American capital market.

Many companies operating in this market have sold investors stories with incredible prospects. The current losses are irrelevant as they are the acquisition of customers who are to create a "network effect" which was to provide an advantage over the competition. The companies focused primarily on growing, no matter what the cost. Many companies offered their products for free or with very large discounts. The motto that guided such companies was "Get big fast" and "Get large or get lost". A very advantageous offer was to attract more customers and increase brand recognition. There have been allegations that this practice is short-term because eventually the company has to start earning money. Defenders of growth companies objected, saying that in the new economy, profit is not the most important thing, but market shares that must be obtained regardless of costs. Investors were of a similar opinion, therefore they willingly invested in growing companies.

Between 1995 and 2000, the Nasdaq Composite index, which became the litmus test of technology companies, rose from 1400 points to 7300 points. At its peak, the indicator Prices to profit (P / E) exceeded the level of 200. It is worth mentioning that when the bubble burst w Japan in 1991, the P / E for the local stock exchange was 80. The year 1999 was crazy for many companies. Qualcomm increased by 2%, while another 619 technology companies increased capitalization by over 12%. However, 1000 was already a period of "double speed", as many of the "stars" of the previous years were far less well behaved. The Nasdaq during this period was mostly "hauled" by large, popular technology companies.

Bursting the web bubble

The loss of investor confidence in the rapid development of technology companies caused an outflow of capital from growth companies towards companies operating in the old economy. At the same time, the increase interest rates in 2000 it raised the "cost of money". Growing technology companies that have focused mainly on increasing revenues and market share at the expense of profitability. Difficulties in raising capital and rising interest rates put such companies in a very difficult financial situation. Many of them were taken over for a fraction of their value, while some of them had to go into liquidation. The decline in the valuation of technology companies put in a difficult position Softbankwho invested very aggressively in these kinds of companies.

After the bubble burst, the "fashion" returned to value companies. Another effect of the bubble bursting was the plunging of the US economy into recession. It prompted FED to cut interest rates. The low interest rate environment was one of the reasons for the bursting of the real estate bubble that began to burst in 2007.

Dotscom bubble heroes

To better understand what the dot.com bubble was and how far market valuations were detached from reality, it is worth following the stories of popular companies at that time.

pets.com

It was a company that was established in 1998 and dealt with the sale of products for animals. Pets.com was registered in 1994, but the company was established 4 years later after being excluded from the WebMagic structures. In 1999, Amazon acquired 54% of the company's shares. Julie Wainwright (CEO Pets.com) described the name of Amazon's investment "A marriage made in heaven". In the same year, Hummer Winblad Venture Partners also invested in the company. Pets.com spent the funds raised on the creation of large warehouses and the development of delivery infrastructure (including cars). At the same time, the company developed through the acquisition, taking over in June 2000 the rival Petstore.com for $ 10,6 million. Ambitious plans meant that the company also looked for capital on the stock exchange. In February 2000, the company raised $ 82,5 million from its Nasdaq debut. The company's capitalization was $ 300 million.

The company also believed that aggressive marketing campaigns should be used to gain recognition among potential customers. Pets.com spent $ 2000 million in advertising during the Super Bowl in 1,2. It would not be surprising if it were not for the fact that in the previous fiscal year the company generated only $ 0,6 million in revenues. It is worth mentioning that in 1999 the company spent almost $ 12 million on advertising (about 20 times more than revenues). The company's advertisements were catchy and the slogan: "because pets can't drive" became the company's showpiece (along with the mascot). In 2000, the company generated $ 25,7 million and spent more than $ 60 million on advertising. The net loss this year was approximately $ 85 million.

The company also believed that aggressive marketing campaigns should be used to gain recognition among potential customers. Pets.com spent $ 2000 million in advertising during the Super Bowl in 1,2. It would not be surprising if it were not for the fact that in the previous fiscal year the company generated only $ 0,6 million in revenues. It is worth mentioning that in 1999 the company spent almost $ 12 million on advertising (about 20 times more than revenues). The company's advertisements were catchy and the slogan: "because pets can't drive" became the company's showpiece (along with the mascot). In 2000, the company generated $ 25,7 million and spent more than $ 60 million on advertising. The net loss this year was approximately $ 85 million.

The company also tried to attract customers by offering price reductions or free delivery. However, this resulted in the company constantly delivering products at a loss (even before marketing expenses). The catalog of products sold on the website was very wide (e.g. food, toys or clothes for animals). However, most of the products offered on the site were readily available in local stores. The website lacked a unique offer that would allow for the creation of a "moat" in relation to stationary stores. Customers had the choice of either waiting for delivery (often several days) or buying "the old way" through stationary stores. The company did not manage to quickly change its purchasing habits. The lack of a fresh capital injection forced the company to file for bankruptcy. It took 9 months from the IPO to bankruptcy. In October 2000, Amazon owned a 30% stake in the company. Currently, the largest company in the United States that offers pet products online is Chewy, valued at $ 37,8 billion.

Pets.com advertisement

Webvan

It was a company operating in the e-grocery segment, i.e. home deliveries. Business was ahead of its time because this market is only gaining popularity now. The company intended to offer the delivery of food products within 30 minutes from the moment of completing the order. Currently, such plans seem ambitious, but in the 90s they were even more difficult to implement.

Webvan was founded by Louis Borders (co-founder of book, record and music cassette seller - Borders Group). The company was founded in 1996 and raised capital ($ 3,5 million) from Sequoia Capital i Borders. Another financial round ($ 50 million) was funded by Sequoia. He was another investor Softbank ($ 160 million), Goldman Sachs ($ 50 million), E-commerce i Yahoo! ($ 10 million). The company also obtained capital from the stock exchange ($ 375 million), which gave its capitalization exceeding $ 4,5 billion.

The funds obtained were used to expand the scale of operations. The company needed warehouse space, a delivery fleet, employees and working capital (inventory). Webvan chose the path of building an "asset heavy" model. For this reason, in the initial wave of growth, the larger the scale of operations, the greater was the capital need for logistics to “keep up” with demand. The benefit of such a strategy was "Control" over the entire "customer experience" (from ordering to delivery to your door). Disadvantage - huge costs during business growth.

The funds obtained were used to expand the scale of operations. The company needed warehouse space, a delivery fleet, employees and working capital (inventory). Webvan chose the path of building an "asset heavy" model. For this reason, in the initial wave of growth, the larger the scale of operations, the greater was the capital need for logistics to “keep up” with demand. The benefit of such a strategy was "Control" over the entire "customer experience" (from ordering to delivery to your door). Disadvantage - huge costs during business growth.

It is worth mentioning that the company's management did not have experience in the food sector (e.g. in supermarkets). As a result, they did not have full knowledge about the nuances of this industry. The company also generously rewarded the CEO (George Shaheen), which she downloaded from Andersen Consulting. In November 1999, Webva agreed to pay $ 375 a year for the rest of his life if he remained as CEO by the end of June 000.

The company's problem was also a badly selected target group. The company targeted the mass market where customers are very price sensitive and unable to pay more "for convenience." For this reason, Webvan had to compete on price in a very low-margin market. Falling off the margin made the sale unprofitable. At the same time, the company wanted to offer the highest standards of service. In the long run, this was not a bad strategy, but it required two factors that were not enough: time and additional capital. Time was needed to "habituate" customers to online grocery shopping. In turn, capital was needed to finance promotions, logistics development and high-quality customer service.

The company believed that it must grow fast (the so-called Get Big Fast), which is why its activity "exploded" into new markets. Webvan has offered its services in Washington, San Francisco, Dallas, San Diego, Los Angeles, Chicago, Seattle, Portland, Atlanta, Sacramento and Orange County.

In 2000, the company boasted $ 178 million in revenues. However, costs at the same time amounted to $ 525 million. The company had over 750 active customers. Even though revenues continued to grow, Webvan ran into liquidity problems. Difficulties with obtaining additional capital meant that in 000 the company was forced to apply for protection against creditors. The company had to lay off over 2001 employees. It is worth mentioning that in 2000, Amazon launched its e-grocery service (Amazon Fresh). Jeff Bezos also hired former Webvan managers to "learn from mistakes" made several years earlier.

Enron

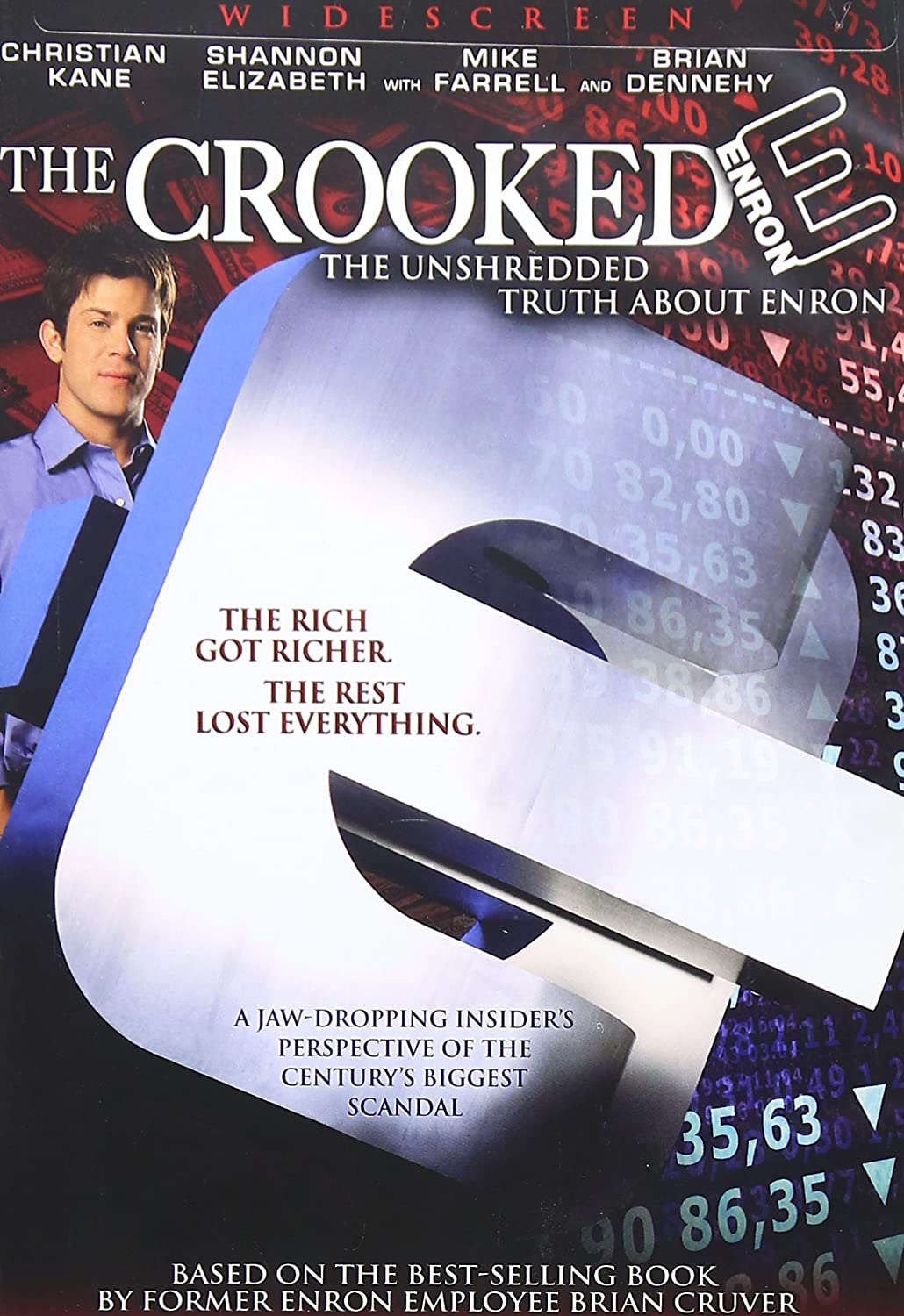

The Crooked E: The Unshredded Truth About Enron (2003)

This is another company that went bankrupt after the dotcom bubble burst. The scandal caused by the bankruptcy of Enron resulted in the collapse of one of the largest audit firms - Arthur Andersen. The scandal made Enron the protagonist of the film: The Crooked E: The Unshredded Truth About Enron (2003). Two years later, a document appeared: Enron: The Smartest Guys in the Room.

Before bankruptcy in 2001, the company employed 22 people. In 000, the company's revenues were $ 2000 billion and it operated in the energy, paper, communications, mining and commercial industries. It was the latter activity that developed dynamically, making Enron one of the largest gas buyers in the United States. The company was the darling of the financial industry and the media. Fortune magazine in 100-1996 awarded the company the title of "America's Most Innovative Company". The company boasted about profits, but in Q2001 2001 the company reported a net loss of $ 618 million. At the request of the SEC (the American equivalent of the Polish Financial Supervision Authority), an analysis was made and the subsequent adjustment of the financial statements for the years 1997-2000 reduced the net profit of $ 2,68 billion to $ 2,09 billion. This resulted in a loss of trust of financial partners, which resulted in a loss of financial liquidity. The scandal resulted in charges being brought against the president of Enron. J. Skilling was sentenced to 24 years in prison. Arthur Andersen, in turn, replied for helping to falsify financial statements. As a result, Arthur Andersen ceased to be part of the auditors' big five.

A wonderful three

Not all dotcom bubble stars have gone bankrupt. Among the companies that have achieved market success, one can mention Amazon, eBay and Priceline (currently Booking). Of course, the bursting of the bubble caused these stocks to sell off sharply. For example, Amazon lost over 90% of its value after the bubble burst. In 1999, one Amazon share was worth $ 113, however after two years, the company's share price fell below $ 6. However, in the long term, the companies' offers have defended themselves. After 10 years, Amazon's course returned to the 1999 levels. Currently, one share is worth over $ 3200.

Read: How to invest in Amazon? [Guide]

The aforementioned companies managed to survive the difficult conditions of 2001-2003, which resulted in the loss of many less well-capitalized companies. They had a healthier business model, good management, and had no problem financing growth. eBay and Priceline had the Asset-light model, while Amazon had a great management board that successfully introduced the asset-heavy model.

Summation

The bursting of the dotcom bubble showed that not every growth company has a bright future ahead of it. Sometimes even an interesting business model may fail if it was created too early. Examples include Pets.com or Webvan. Although the companies could become dysfunctional in the long term, they were not able to obtain financing for further development. Another conclusion that can be drawn is that even a 90% decrease in the value of shares does not mean that the company is bankrupt. Consider Amazon and Priceline, which, despite the "pogrom", constantly increased their competitive advantage during the bear market. However, it is worth remembering that there is no such thing as buying a company regardless of the price. In 1999, Amazon stock buyers had to wait 10 years to break "nominal" to zero (excluding inflation).

Amazon chart, monthly interval. Source: XTB xStation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Internet bubble [Dotcom] - unfulfilled dreams of fast digitization of the world dotcom internet bubble](https://forexclub.pl/wp-content/uploads/2021/08/banka-internetowa-dotcom.jpg?v=1628757698)

![Internet bubble [Dotcom] - unfulfilled dreams of fast digitization of the world safemoon crypto](https://forexclub.pl/wp-content/uploads/2021/08/safemoon-crypto-102x65.jpg?v=1628692072)

![Internet bubble [Dotcom] - unfulfilled dreams of fast digitization of the world Axie Infinity token cryptocurrency](https://forexclub.pl/wp-content/uploads/2021/08/Axie-Infinity-token-kryptowaluta-102x65.jpg?v=1628759223)

Leave a Response