Brexit: Britain's Brexit risk premium will go up

What is Brexit? It's a situation where you want to kill a fly and you blow up the house. We anticipate Brexit to be a top topic in the coming weeks, replacing Covid as a major concern for UK companies as tension between the UK and the European Union increases. The market pricing of a no-deal Brexit risk has gone up, but it is clear that there is room for volatility and further decline in British assets as Prime Minister Boris Johnson approaches the 'soft' deadline for reaching an agreement on October 15th.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

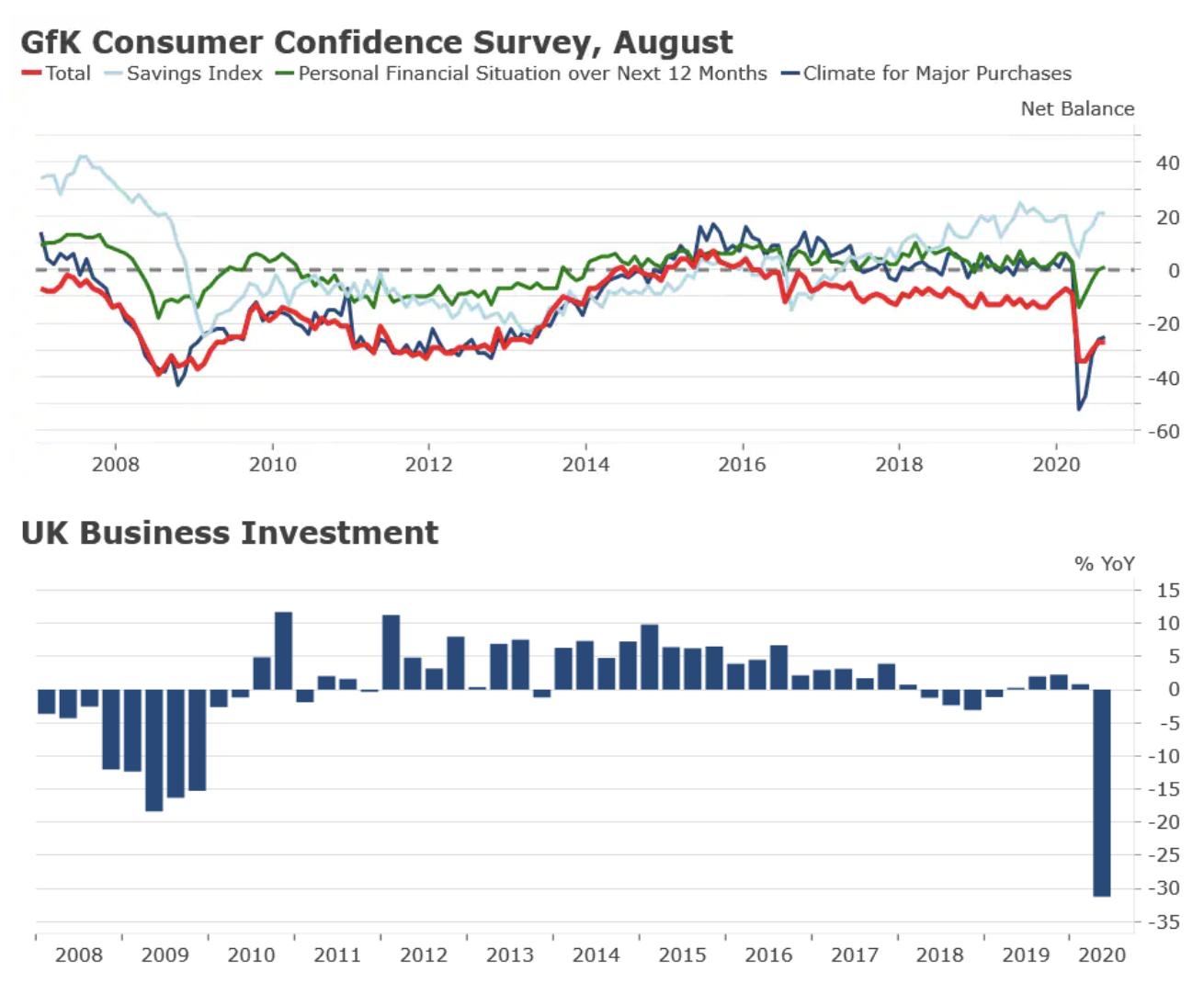

Given the increase in uncertainty about the negotiations and the post-Brexit situation in the UK (in particular with regard to taxation and the country's position in international markets), we would not be surprised by a QXNUMX reversal due to another decline in business investment and sluggish aggregate demand (fig. 1).

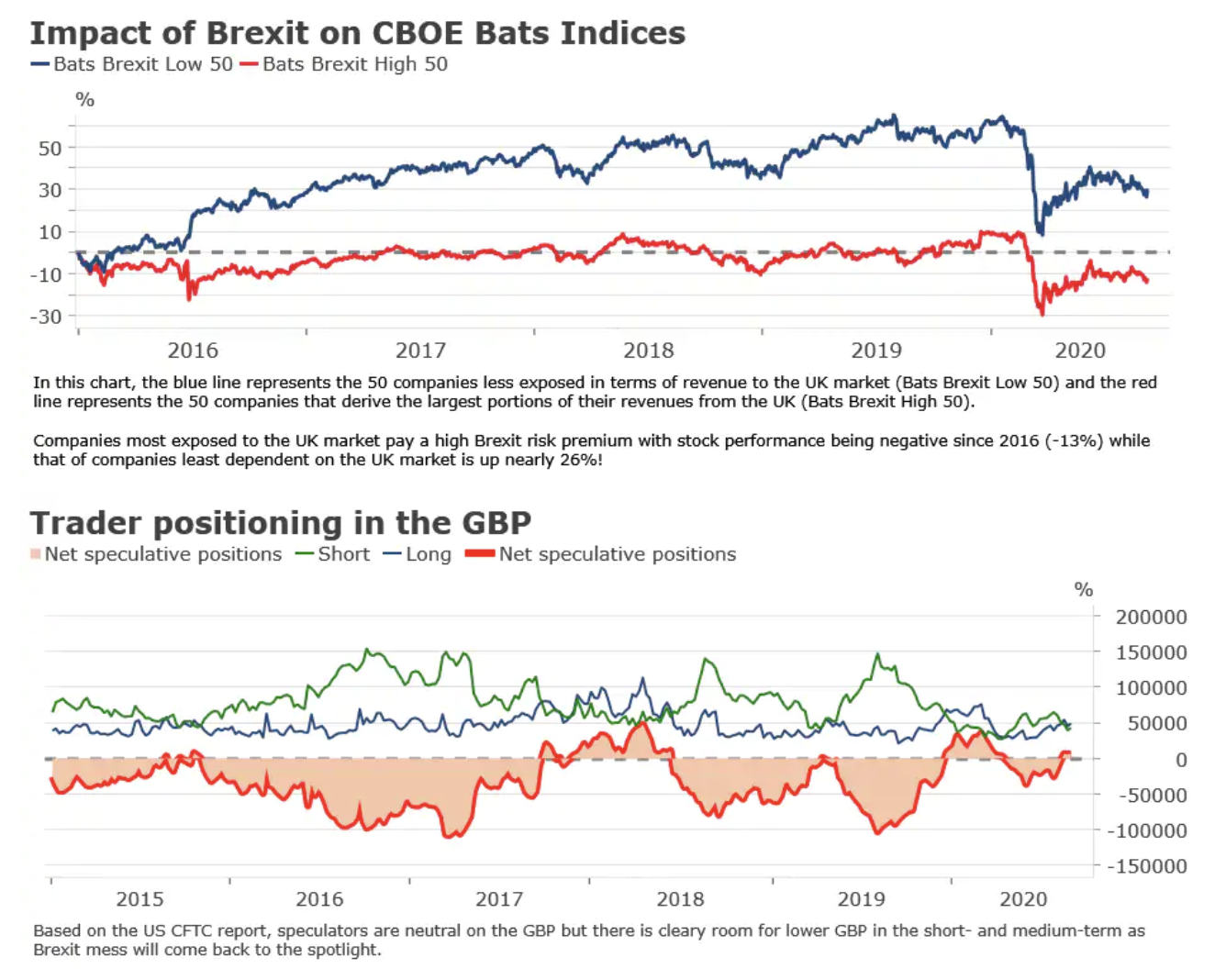

The short to medium term outlook for British assets is getting worse every day. The Brexit equity risk premium for the most committed companies in the UK market has recently risen again. While this is an ideal time to buy discounted stocks according to some investors, we believe there are too many risk factors and in such uncertain conditions it would be wiser to reduce your exposure to UK assets. The pound has lost ground against the main currencies in recent days and further negative news in the short term will surely lead to further declines. Given that this week the EUR / GBP pair broke resistance at 0,9135, we predict that the upward trend will continue, followed by the testing of resistance levels 0,9285 and 0,9387 (fig. 2).

We believe that there are basically three options for the development of British-European relations:

- weak agreement, i.e. the most optimistic scenario,

- No agreement,

- disagreement in an atmosphere of extreme hostility.

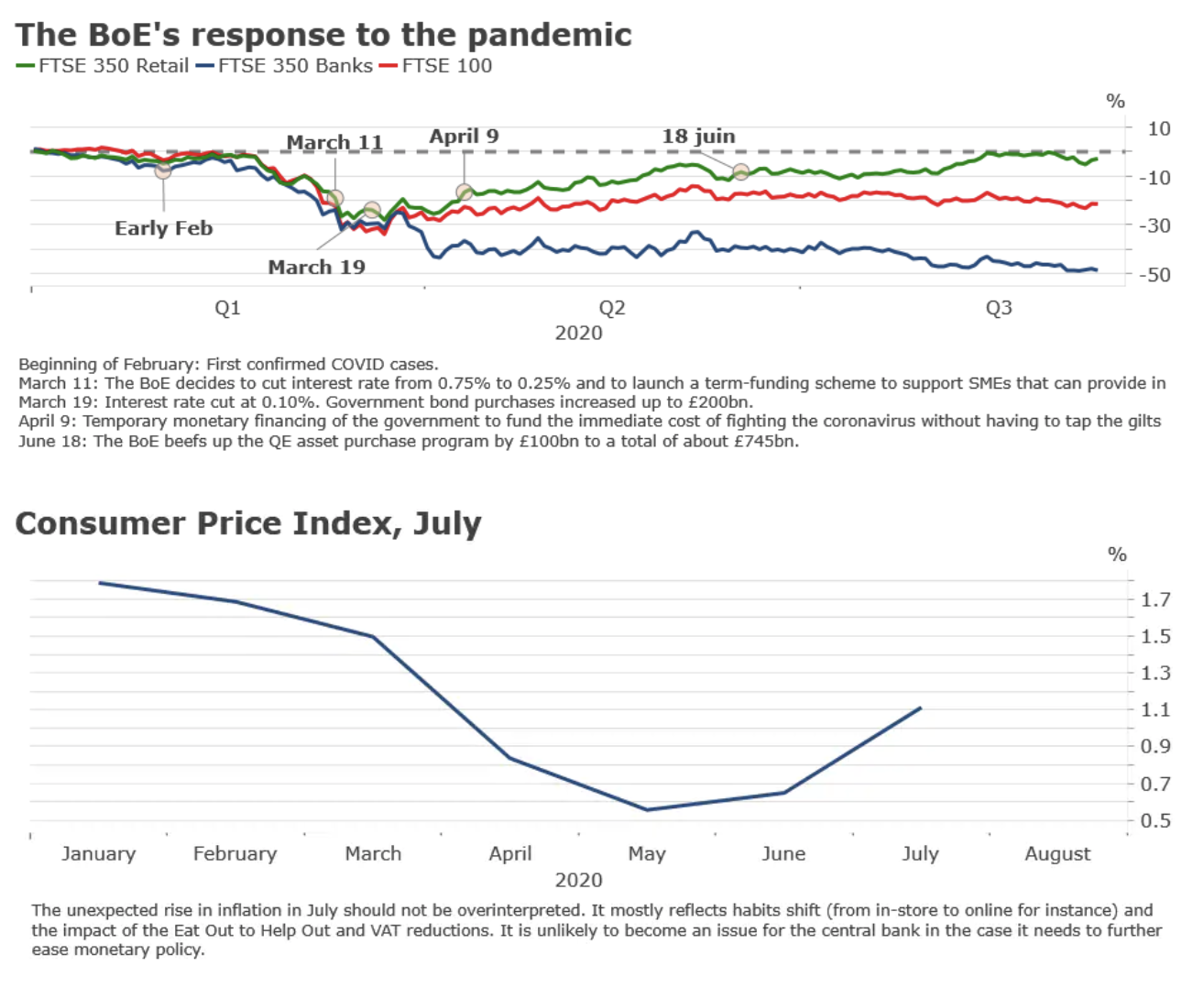

So far the UK government seems to prefer option three, but this could change quickly. It's a real rollercoaster. In the event of a disagreement, the Bank of England will extend support to the economy by first resorting to quantitative easing and temporary government funding via the mechanism "Ways and Means". Such debt monetization through the back door should limit the negative financial and economic consequences of a no-deal Brexit, and in the event of a weak agreement, it can be used to finance the new interventionist policy preferred by London (fig. 3). The next key date for British-European relations is September 25 and the extraordinary Brexit summit of the European Council.

Makro

Rumors of no-deal Brexit in the context of a pandemic recession threaten a slow economic recovery initiated by the end of isolation. The increase in uncertainty about the future will most likely strengthen the current saving trends and lead to another decline in business investment, which may cause a reversal in the fourth quarter of this year.

Markets

As Brexit uncertainty increases, the Brexit risk premium will go up in the coming weeks, which will worsen the performance of the most involved companies in the UK market. The FX market has been relatively calm so far, however we believe there is room for further declines in the GBP in the short to medium term.

Monetary policy

The recent spike in inflation is unlikely to stop Bank of England against further monetary easing in the event of a no-deal Brexit.

We are leaning towards two scenarios:

- increasing quantitative easing,

- increasing quantitative easing and even more negative interest rates.

The last variant, however, may provoke a stormy debate in the Monetary Policy Council due to the documented impact of negative rates on banks' profitability and the approach to risk.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response