Building a risk management plan - How to do it? [Guide]

By trading on Forex market we do many things automatically. We have our favorite type of charts, a favorite template, our own strategy and a favorite position size. As a beginner trader, the lot size is often determined "blindfold"because we don't want to write too much, but also not too little. After all, the game is not worth the candle if the contract size is too small. Then what should its appropriate size be? I want to discuss this topic in the context of building a simple risk management strategy before we even place an order on the market. One of the simpler and more interesting methods on money management is the one I will describe below, because even before opening any position, it allows you to immediately build an exit scenario, set the appropriate stop loss and take profit level and effectively manage the open order.

Signal generator

Let's start with the simplest thing, i.e. signal generator. It can be the price level (based on support / resistance), the intersection of the averages or the overbought / oversold level on the RSI indicator. The generator doesn't really matter much at this point, as it only provides the trade entry price. Of course, a well-chosen place supports risk management (e.g. by limiting the size of the stop loss), but it is not the most important element from the level of money management. By showing you how to build a simple maximum loss risk management system, I will be building on wicked demand / supply zones at key price movement locations.

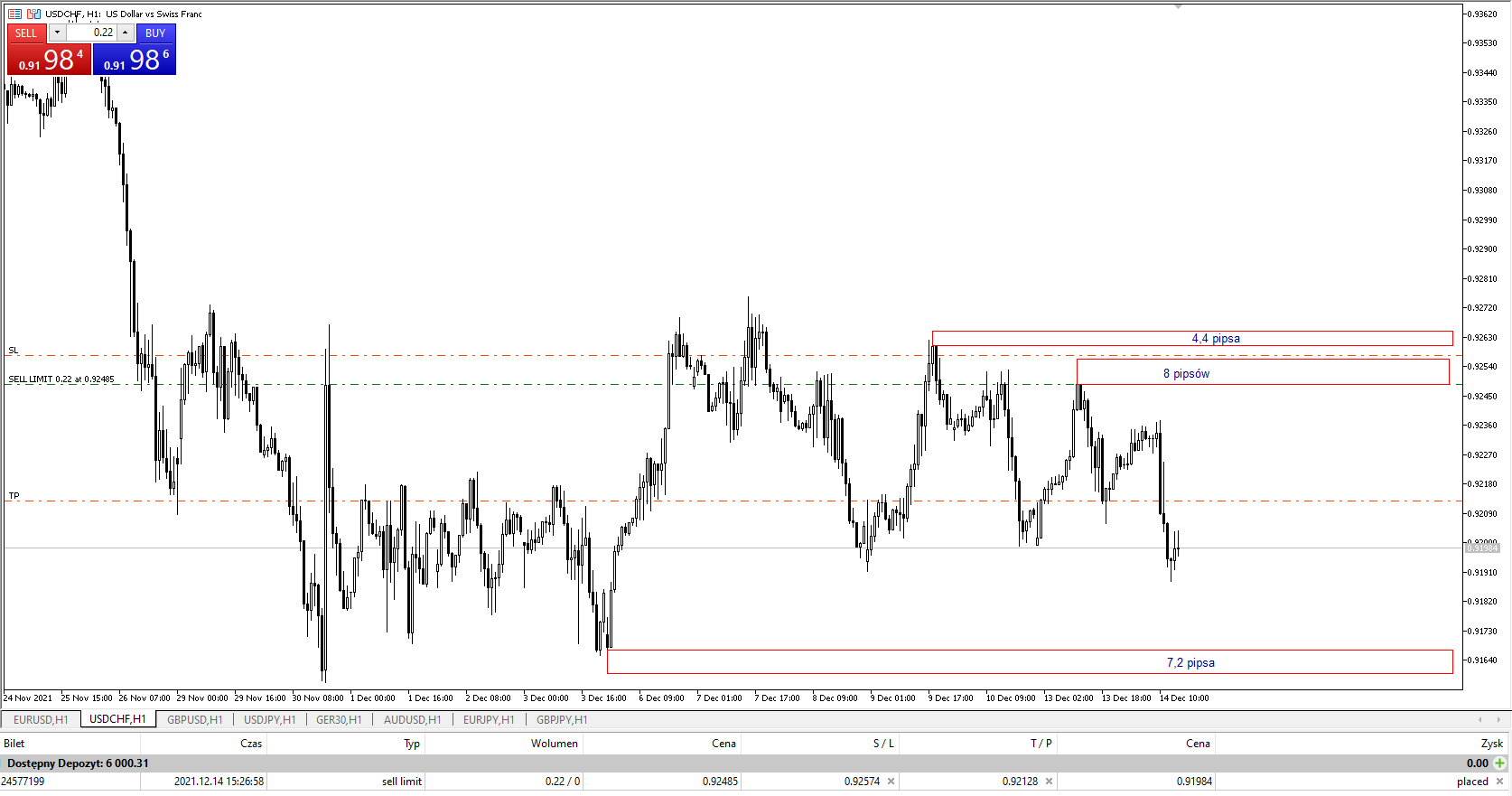

To briefly explain our generator, it will be (as mentioned above) demand / supply zones. I mark them on an hourly interval, usually at highs / lows that have not yet been price tested. The width of these zones (red rectangles) is the width of the wicks. Why? Because the wicks indicate an accumulation of sell / buy orders. In addition, I use here only those places that were followed by a price impulse (strong up or down movement), because it is information for me that buyers / sellers whose pending orders have been accumulated in the price (zone) of the marked wick, were strong that they pulled the price in a specific direction. So when I mark myself such a zone, I count on "First reaction" market and I never use a reacted zone (i.e. one where the price has touched and bounced off it). Thanks to this, I always trade at fresh levels.

How much of my capital do I want to risk?

Knowing our signal generator, let's move on to another important issue, i.e. how much do I want to risk for one position. If you want to be a professional trader who manages risk in a consistent and even business manner, you need to be aware of how much risk you are risking to earn X. Would you go into a business where you risk 100% of your capital and expect a 2% return? Of course not. Therefore, it is not worth doing this with your account.

So when building my plan, where we know the trigger (signal generator), the next parameter that I define is the maximum exposure to 1 trade. It is easiest to define it as a percentage. It tells about how much capital I want to risk (with a given stop loss, which I will talk about later in the text) in only one order. Personally, I don't use parameters larger than the interval 0,25%-0,50%. I prefer calm trading that will not wake me up in the middle of the night with concerns about my account balance. Of course, the parameters can be set freely. Personally, I make sure that drawdown did not exceed 4% -5% of my account, hence the maximum exposure that I allow myself is just 0,25% -0,50%.

Minimum computation, maximum control

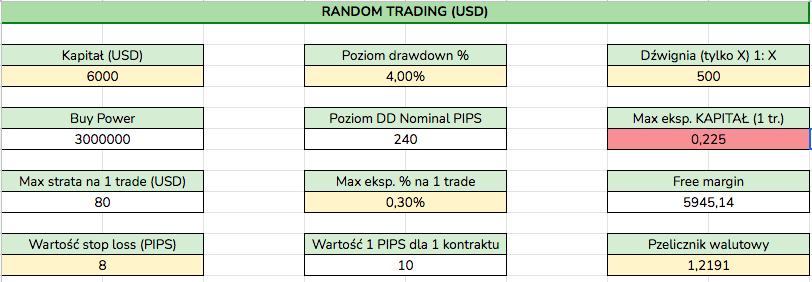

Since I know the above two elements, it's time to transfer them to the chart and set the optimal order size. As you can see in the chart above, we will be using a $ 6 account. We will use the maximum exposure per one order in the form of 000% of the total account. Given these two parameters, let's measure the size of our stop loss. My size is the width of the zone.

Personally, in order not to count these parameters each time, I created an excel file - a simple calculator to enter only the stop loss size. Such a calculator can be based on the formula that I am about to write. How the calculator works, how to create it and how to trade with it can be found in the video below.

Pattern:

(capital x max exposure on 1 trade) / (stop loss x 1 pip value *)

* 1 pip value for 1 lot

To simplify the calculations as much as possible, let's assume 1 pip for 1 USD / CHF lot is $ 10. Thus, substituting all the data for the above formula, we get:

($ 6000 x 0,3%) / (8 x 10) = 18 / 80 = 0,225

we round down (!) =>0,22

Interpreting the above, it means that if you want to risk 0,30% of your account to conclude one trade, the risk of which is 8 pips (we also set a stop loss there), we can place a trade of 0,22 lot. Of course, we should set take profit larger (at least x 1,5). This pattern can be used to create a simple excel like the one we share below.

How do I set items?

Taking the strategy I described above as a benchmark again, I never trade between these zones. I place orders very close to them and usually they are pending orders that already have a stop loss and take profit set. Just click on the level with the right mouse button on the chart, set the position size calculated by us in the panel for placing orders (in the upper left corner) and select the type of order, which machine (taking into account the current price) we will substitute.

You can then double-click on the pending order that appears and set the stop loss and take profit according to the appropriate profit / risk ratio. Usually it is worth adding 2-3 pips more to the stop loss (in the case of this strategy), in case the market breaks a little above the zone and is dragged back to it.

Summation

Building a risk management plan does not have to be full of complicated patterns with Greek letters. We can really easily calculate the position size and adjust it to the account and market conditions, starting from the maximum single loss on equity. Risk management is an essential part of a good investment strategy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Building a risk management plan - How to do it? [Guide] risk management](https://forexclub.pl/wp-content/uploads/2021/12/zarzadzanie-ryzykiem.jpg?v=1639495023)

![Automatic Stop Loss on MetaTrader 5 - how to do it? [Video] auto-stop-loss-mt](https://forexclub.pl/wp-content/uploads/2021/11/auto-stop-loss-mt-300x200.jpg?v=1637831541)

![The role of psychology in a trader's decision-making process [Webinar] investment psychology Rafał Glinicki webinar](https://forexclub.pl/wp-content/uploads/2021/11/psychologia-inwestowania-webinar-rafal-glinicki-300x200.jpg?v=1637569532)

![Building a risk management plan - How to do it? [Guide] germany capital market dax etf](https://forexclub.pl/wp-content/uploads/2020/11/niemcy-rynek-kapitalowy-102x65.jpg?v=1606680128)

![Building a risk management plan - How to do it? [Guide] cryptocurrency flow nft](https://forexclub.pl/wp-content/uploads/2021/12/kryptowaluta-flow-nft-102x65.jpg?v=1639580459)

Hello, I would be obliged to send you the calculator. I am learning the issue. It will be easier for me to understand by analyzing the "structure" of the calculator items.

Pozdrawiam

And154

email: AndKos154@gmail.com