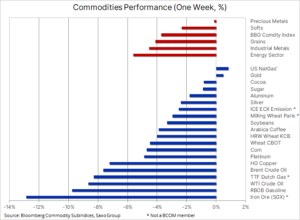

Commodity prices are slowing on the dollar, the virus and concerns about growth in China

The commodities sector has suffered significant losses recently, most notably China's key commodities, amid concerns about economic growth in the country's largest consumer. Moreover, in the short term, the continued spread of the Delta variant of the coronavirus is more worrying, leading to temporary lockdowns and reduced mobility in selected major world economies. Another problem was the prospect of an earlier than expected return to the tightening of monetary policy by the US Federal Reserve, which contributed to the strengthening pressure on the dollar, thus reducing the risk appetite in the markets.

In Asia, South Korean and Chinese stock markets sound the alarm - KOSPI 200 index dropped to its lowest level since January and the CSI 300 went down 9% on a yearly basis. The introduction of strict technology regulations and a shift in priorities in China, including a new data privacy law, are reversing global money flows from Asia to other regions, in particular the United States, which explains near-record levels despite the clouds looming on the economic horizon.

Declining risk appetite amid fears that the Delta variant and US asset purchase constraints may dampen the global recovery saw the Bloomberg spot index post its biggest weekly rise in two months and its highest level since November.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

All these developments have raised doubts about the short-term direction in commodities markets, and the scoreboard shows that recently, only a few commodities escaped losses. The stronger dollar was slightly offset by stable or lower yields on US government bonds in response to lower commodity prices reducing inflationary pressure, as well as the fundamental question whether the global economy, including the US economy, has already reached its "peak", thus limiting the trajectory of future interest rate increases.

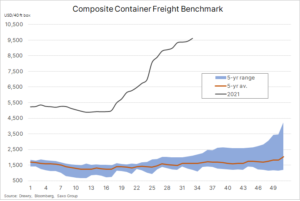

Container Rates: The cost of worldwide containerized freight freight, including numerous raw materials, continues to rise. The price of a 9-foot container on the Drewry Composite Container Freight Index reached $ 600 this week. This index is based on the cost of transporting a container on major routes from Asia to Europe and the United States, as well as on transatlantic routes. This index now exceeds six times the five-year average, highlighting the continuing challenges facing the global supply chain.

The biggest increase last week was seen in the US West Coast as the steady influx of container ships created a bottleneck at this largest trade gateway to Asia, delaying returns and limited container availability elsewhere. Moreover, the third largest container port in the world, China's Ningbo-Zhoushan, has been partially closed for a long time due to the Covid-19 outbreaks.

Precious metals

While silver struggled with the general weakening of industrial metals, gold managed to take advantage of the strong technical signal from the previous week, when the crash caused by the rise in yields rebounded sharply. Relative support for gold, despite a stronger dollar, ensured a relative demand for safe investments, which also managed to keep bond yields low, even in the face of increased risk of limiting asset purchases, signaled in the minutes of the last FOMC meeting.

The market may also conclude that the virus-related swivel in consumer sentiment since this meeting could lead the FOMC to think twice before starting to cut asset purchases. An example of this was New Zealand, where new outbreaks of the Covid-19 virus led to renewed lockdowns and the cancellation of an expected rate hike by the New Zealand central bank.

The short-term outlook remains in question due to the risk of rising yields and the dollar ahead of the Jackson Hole central bank meeting on August 27, the annual symposium that has been used in the past to send signals to the market about changes in central bank policy or priorities. Speculative investors have reacted to these potential handicaps by deeply reducing their net long positions in CME futures. In the week ending August 10, net long position fell 52% to 5,1 million ounces. This reduction was a result of a 2,6 million ounce decline in gross long position, while the "naked" short position increased by 2,9 million ounces, reaching the highest level in 26 months. To carry out squeeze of these recently created short positions and for gold to shine brightly again, it must definitely break above the $ 1 / oz level.

Copper

The price of copper dropped to a four-month low and a fall below the trendline support around $ 4,2 attracted new sellers of tactical shorts. The price dropped below USD 4 / lb, and managed to rebound slightly before the weekend. The metal, along with iron ore, the raw material of greatest importance to China, has suffered losses as a result of the recent deterioration of Chinese economic data, the Covid-19 pandemic and the strengthening of the dollar. Despite the worsening of the short-term technical forecast and the possibility of a decline to as much as USD 3,77 / lb, the long-term outlook for copper remains favorable. This is related, in particular, to the global pressure on green transition, which should lead to an ever greater reduction in market supply over time. Despite the aforementioned difficulties, the potential threat to supplies in the form of strikes in Chile, the world's largest copper producer, should not be forgotten.

Clothing

The price of Brent crude oil has fallen to the lower end of the $ 65-75 range, which may remain until the end of this year. We see a lower risk of a drop below this range due to our predictions that OPEC and the company may intervene and announce market support measures, potentially postponing the agreed increase in production until the outlook for demand becomes clearer. Crude oil is on the defensive this month since the number of Covid-19 cases in China and the United States began to rise, adversely affecting the outlook for demand in the world's largest importers and consumers of crude oil.

In addition to the concerns about demand and general risk aversion driving the dollar to strengthen, weekly EIA data showed that US drilling companies, in response to the previous sharp rise in prices, have been producing the largest volumes of oil in a year. Add to that the expected seasonal slowdown in demand, perhaps exacerbated by the rise in Covid-19 infections, and supply in the market seems to be less constrained at the same time than it was predicted a few weeks ago.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response