Is the excitement of tourism stocks excessive?

Today, Saxo Bank is launching its seventh thematic basket of equities focusing on equities in the travel industry. This segment of the stock market is poorly monitored due to the poor structure of the stock indices and ETF. Saxo's tourist basket will be much broader, encompassing a wide variety of tourism-related industries, as well as geographically more diversified. It will enable customers and our team to monitor the market discounting of the re-opening of the sector and the resumption of tourism activities.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on TV, incl CNBC and Bloomberg TV.

A broader travel perspective

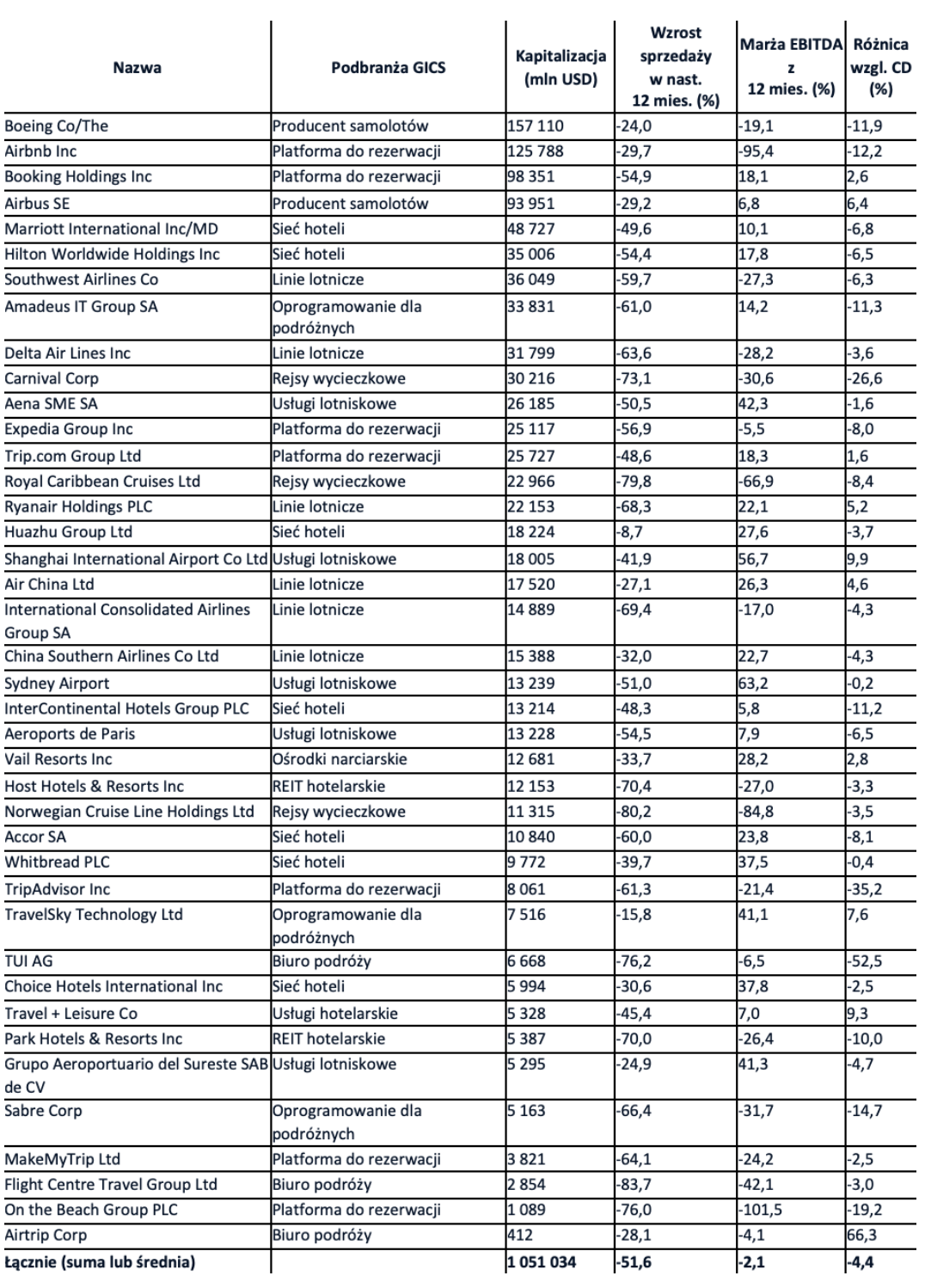

If we look at the current travel stock indices and the available ETFs, we can see that this segment was not particularly popular. The main index is the STOXX 600 Travel & Leisure, however it is quite narrow and also includes shares of companies from the gaming industry. Our basket includes stocks of 40 companies (see below) across the value chain, from passenger aircraft manufacturers to booking platforms, hotel chains, travel software, airlines, cruise liners, publicly traded airports and tourist resorts from around the world. The tourist basket is designed to take advantage of the growth of the travel business in both the purely tourist and business segments.

The basket has a market value of $ 1,05 trillion, most of which is generated by Boeing, Airbnb, Booking, Airbus and Marriott International. As can be seen in the table, companies in this industry recorded a dramatic decrease in revenues (52%), and for many of them EBITDA margins are negative. In the next 1-2 years, revenues will significantly increase as the world travels again. It is also interesting that most of the stocks in this industry are currently trading above analysts' target prices (CDs).

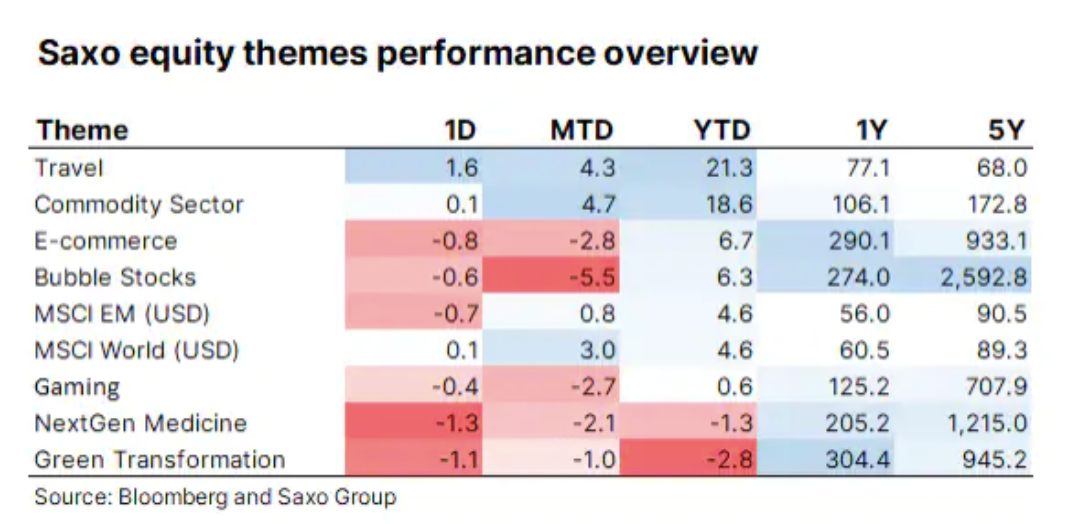

The segment with the best results on a year-to-day basis

This year, tourism stocks are performing very well, and the thematic basket of these stocks gained 21,3%, even surpassing our commodity basket, which is rising due to the reflation. Naturally, tourism stocks gain on the assumption that certain segments will be held in the coming year stock market will record good results on vaccination and the associated opening up of economies and the growth of tourism.

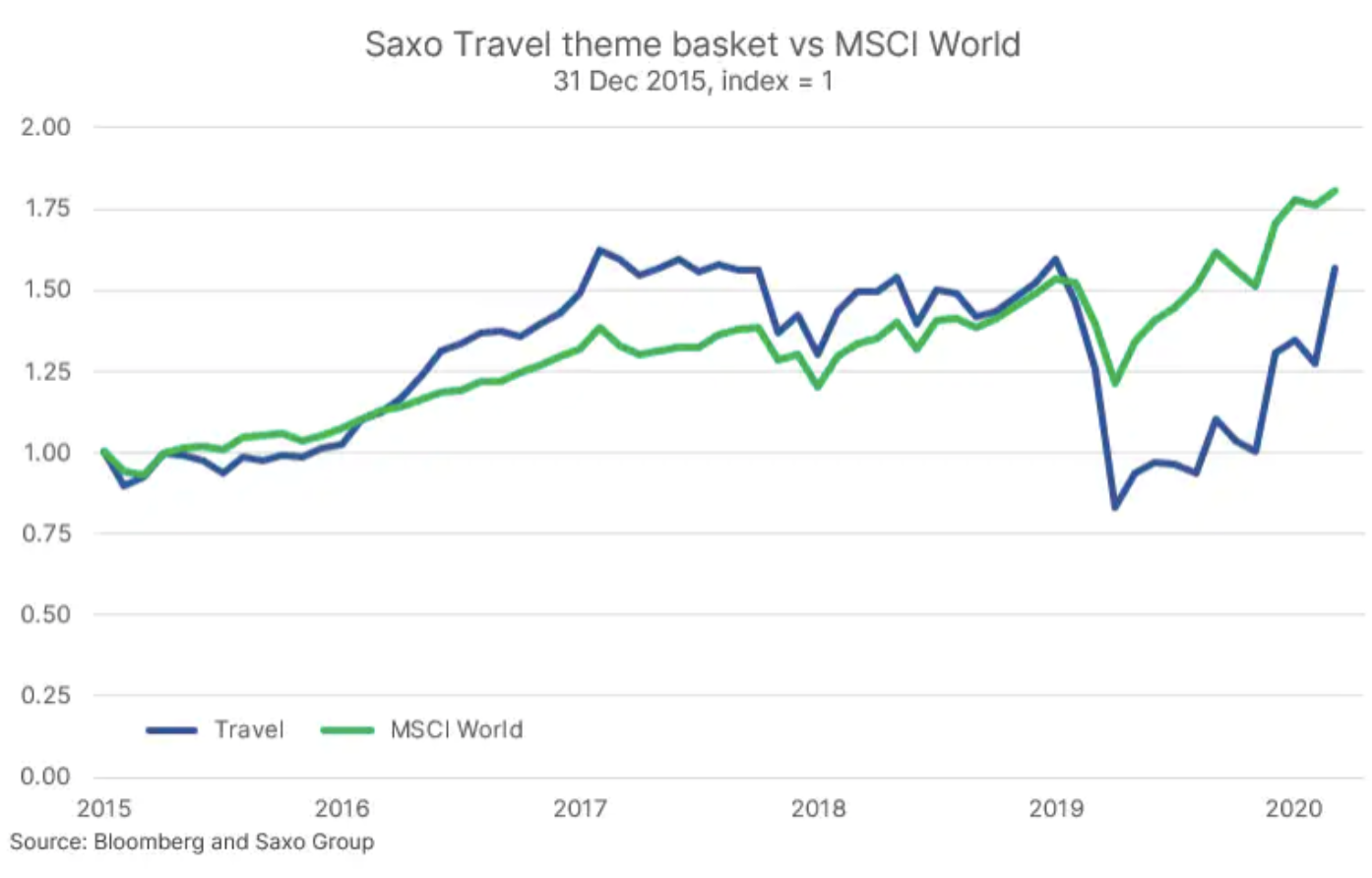

As can be seen in the long-term price chart, this industry stock basket is rapidly approaching its highest levels since the end of 2015, indicating high profitability expectations. In the initial phase, short- and medium-haul travel is likely to increase, and travel further afield will increase at a slower pace, and we do not yet fully know to what extent consumer and business travel behavior has changed. Many of the companies in our basket are trading at high multipliers for the next two years, and they have increased their balance sheet debt to keep their assets and operations unchanged. A further rise in prices from current levels would suggest that investors assume tourism companies will be able to charge higher prices during the normalization period due to excess demand and supply constraints due to bankruptcies etc.

As with all of our thematic baskets, it should be noted that the basket does not reflect investment recommendations, and the selection of companies is not based on our predictions of optimal results, but on the characteristics that ensure the best exposure profile within a given subject area. Moreover, the overall return on a basket of travel stocks historically is not an indicator of future performance.

Risk

The greatest risk to this basket comes from further vaccination delays, including more bad news about AstraZeneca, as it could delay or even endanger the start of the holiday season. In addition, valuations of many travel companies are historically high, which could negatively affect future ROI if profitability exceeds pre-pandemic levels. In the coming years, the most important question will be to what extent consumer behavior with regard to business travel will permanently change. Many companies have recognized how much can be saved by reducing business travel, so the question is will business travel return, and if so, how soon?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response