What are Badetic and where do they come from?

The chart and the quotes of the financial instruments that make it up are the foundations on which all traders use in their investments technical analysis. It is an indispensable source of knowledge for them. Based on what is happening on the chart, they decide when to buy, sell or hold off a trade. Complicating things a bit is the fact that the foreign exchange market is a decentralized market with no single correct price all over the world. Hence, quotes often differ slightly from other brokers, even though they relate to the same instrument at the same time. But sometimes Bad Tick does happen and this difference is completely out of touch with reality, destroying the entire analysis ...

Bad Tick and what's next?

On internet forums you can often come across an entry with the question "what was the minimum for instrument X at Y?". The question may seem strange, but it is not pointless. It results from concerns that:

- the broker could have tinkered with quotes (eg to cut out the client's order),

- or there may have been an error on the broker's platform.

The first case is very, very rare and mainly with Market Maker brokers with dubious reputation. Other companies are unlikely to play such games anymore due to the fact that customers are vigilant. This type of play would come to light, and most of them would give him a red card immediately. Usually, small differences take place anyway, because it results from different spreads offered by the broker, different quote providers (datafeed providers) and connected liquidity providers (liquidity providers), and even the difference in the speed and load of broker servers. Therefore, small discrepancies of several pips are natural and must be accepted.

Bad Tick: $ 1 billion in the back

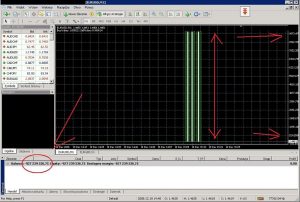

It happens, however, that there are larger deviations from what actually happened on the market. As far as the difference is on EUR / USD at the level of 0.5-2.0 pips is acceptable, 30.0-50.0 pips may be a concern. There are also extreme cases where there is a shot of quotes, e.g. at 400.0 pips, compared to other brokers. These are so-called bad ticks.

Where are the bad tits coming from?

Broker it is generally a broker that provides its clients with a trading platform, its servers, access to quotes and market liquidity. The quotes are taken from the quote providers (datafeed providers). Then, via the bridge, they go to the server, where they are processed, and then to the platform. The servers are equipped with a filtering mechanism with different sensitivity depending on the settings, which limits the number of ticks (most often on demo servers, so as not to overload them too much) or does not allow unreliable prices, e.g. single ticks, which differ significantly from the previous ones and were not confirmed.

However, when a given error loops (which is confirmed), the price will be released on the platform and that's what we have a bad tick. Erroneous quoting most often comes from the datafeed provider, but there are also errors on the broker's server side.

How to deal with them?

Well ... You can't protect yourself from them too much because we have no influence on what is happening on the other side of the platform. So what to do when we find them? It depends on the situation.

READ NECESSARY: Dirty plays by brokers - TOP 5

If we had an open position on an instrument with a non-market price, this will have a significant impact on our account balance. It will most likely result in a clear profit or a considerable loss, or even an overdraft. There is no point in deluding ourselves that in the first case, we will easily earn a large amount in a short time. The broker will certainly ask for it. However, we also do not have to worry that we will suddenly end up with a negative balance on the account. In a situation where quotations are at fault, no matter for what reason (broker, platform, quotation provider error), we have the right to make a complaint. In this case, information such as the transaction number (Ticket, Position ID) and a description of the situation should be sent by e-mail to the broker, preferably supported by a screenshot from the platform. There are three outputs:

- the broker will restore the position and balance of the account to the point before the error,

- will restore the quotes and the account balance before the error, however the position will be simply canceled

- quotes and account balances will revert to pre-error status, the position will be canceled, however account balances will be cleared until the bad tick occurs.

Each company approaches this differently, although the solution 1 seems the most fair. Unfortunately, sometimes the broker can not offer it for technical reasons.

There is also another situation when we do not have an open position, and the bad tick itself only adversely affects our analysis. It then distorts the chart and thus the appearance of indicators and patterns. In this case, it is enough to notify the broker of the error by e-mail, specifying the account type (demo/ live), a financial instrument, an exact time, and preferably include a screenshot from the platform. All this will make it easier to identify the error and speed up its correction.

A good broker does not have bad ticks

Unfortunately, not entirely. Even the best brokers can hit them. Unfortunately, a technique like a technique - can be unreliable. The more complicated it is, the more things can break despite the best security, and the broker has a limited influence on quotes. Therefore, let's not blame the broker for going wrong once in a while. Let's evaluate his approach to the client, i.e. how quickly and how he reacts to the problems and complaints reported by us. Does he / she make every effort to avoid these errors? Even if errors are corrected in an express manner, if their frequency is very high, it can be discouraged.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response