David Tepper - a story about making billions of dollars in banks

We are starting a new series of articles that will bring you closer to the famous transactions that allowed investors to earn huge amounts of money. We present large transactions of both the most famous investors Warren Buffett, Bill Ackman, Czy Carl Icahnand less known to a wider audience. Today's article will show you the history of several transactions that allowed you to earn billions of dollars. The founder of these positions had nerves of steel, he thought unconventionally and against the headlines of the newspapers that reported financial Armageddon. In today's article, we will present the deals made by David Tepper in 2009.

David Tepper was the manager of the Appaloosa fund during the burst of the US real estate bubble. Tepper founded the fund in 1993 after leaving Goldman Sachs. David was known for his out-of-the-box deals that resulted in high returns. For example, in 2001, it generated 61% profit on investment in high-risk bonds, the so-called distress bond. However, the year 2009 brought real fame to this investor.

The years leading up to the Great Depression were the golden age of banks. The rushing economy and huge profits from modern derivatives lull the vigilance of regulators, bank managers and investors. It seemed that the increases would last forever. Only a handful of investors have invested against this market. The heroes of the game were filmed in the famous movie Big Short. However, big money was also made a few quarters later. One of the people who made a lot of money was David Tepper, who took advantage of a huge discount from well-known companies.

Situation before the transaction

Fall Lehman Brothers, one of the oldest investment banks in the world, caused many investors to treat banks like lepers. Nobody knew who was going to be pedaled. This was due to the risk of the network. Investors did not know who owned the toxic assets. The entire American financial sector was in trouble. An example is AIG, which, due to its difficult financial situation, had to use the help of the American government. Supplying the financial sector with money sparked a dispute among some politicians and commentators. As a result, there were more and more voices about the need to nationalize key financial institutions because "the market has failed". Another problem was the strong recession, which increased the insolvency of companies and deteriorated loan portfolios. Private consumption has also been weakened due to problems with rising unemployment.

Citigroup

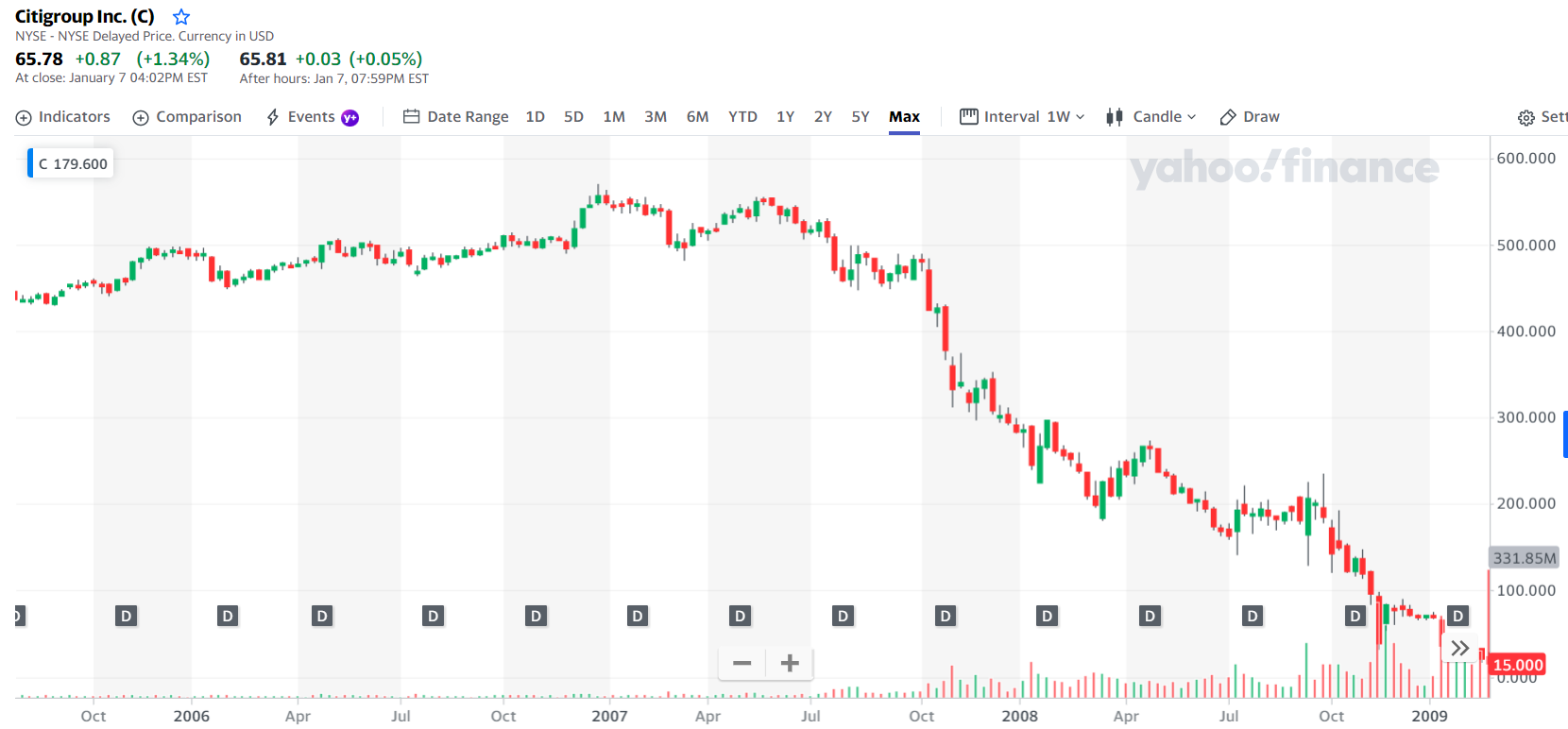

As you can see in the chart below, Citigroup was a blue chip company before the bubble burst. Stable operations and regular dividends have made Citigroup shares in the assets of many mutual funds, pension funds and individual investors. It seemed to be one of those "boring and unsinkable" companies worth keeping in the safe part of your wallet.

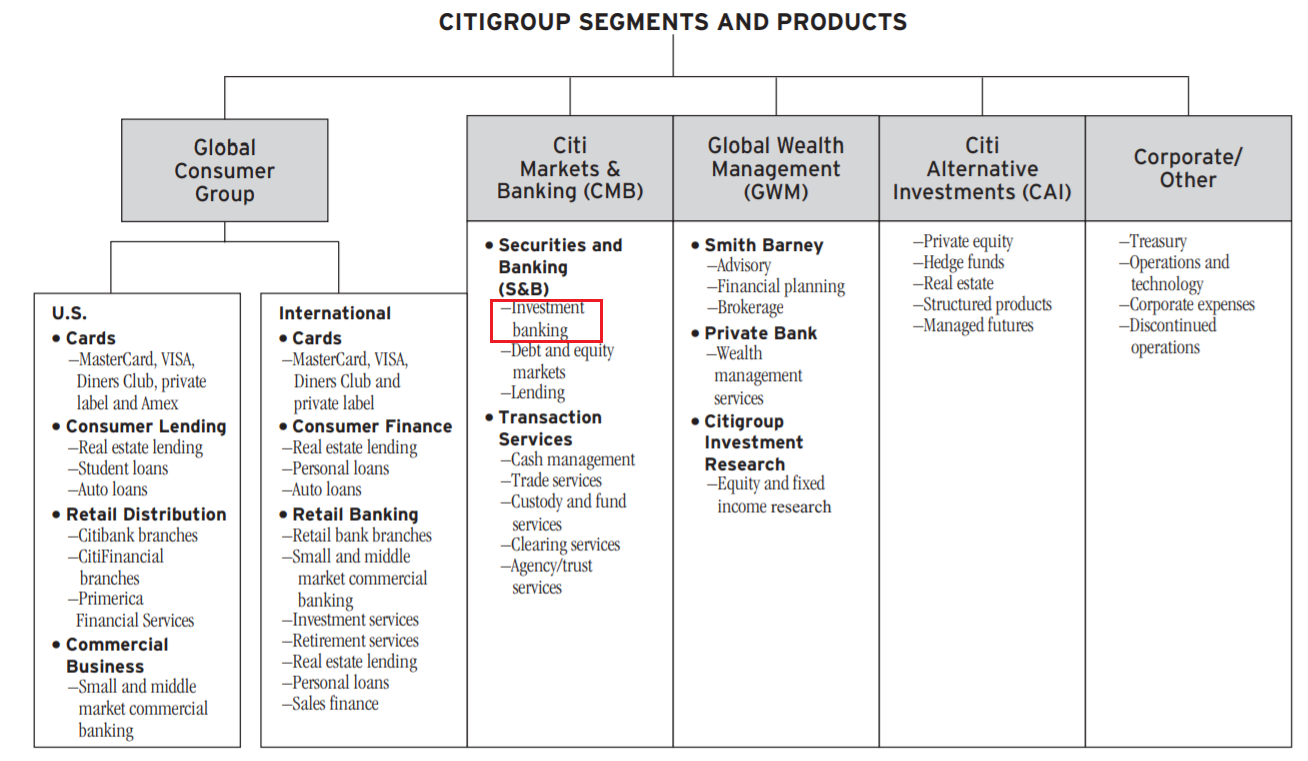

Before the crisis, Citigroup was one of the most important financial institutions in the world. According to the 2007 annual report, Citigroup had over 200 million consumers in over 100 countries. At the end of December 2007, the company employed over 147 employees. Citigroup was a universal bank with both retail and investment banking services. A wide range of services was to ensure greater diversification, which was to increase the profitability of the business and greater predictability of profits.

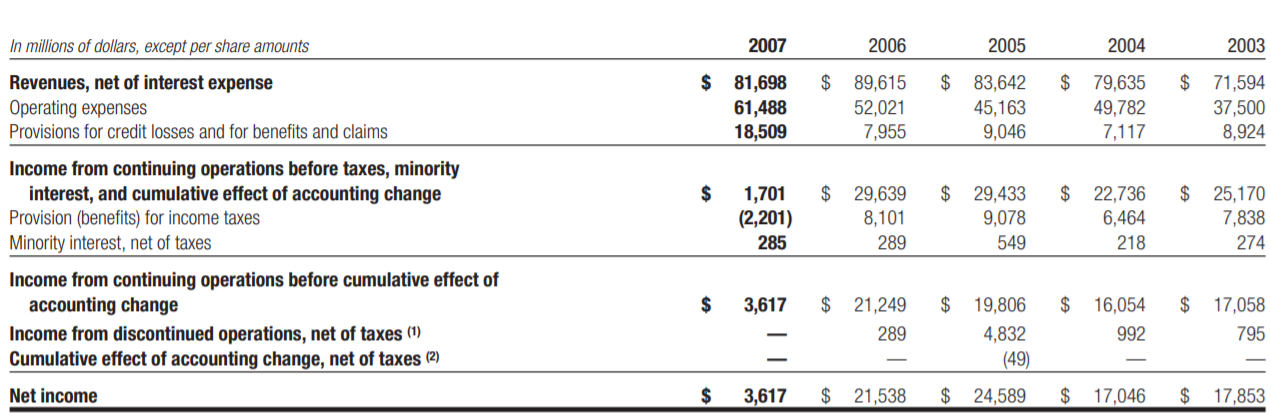

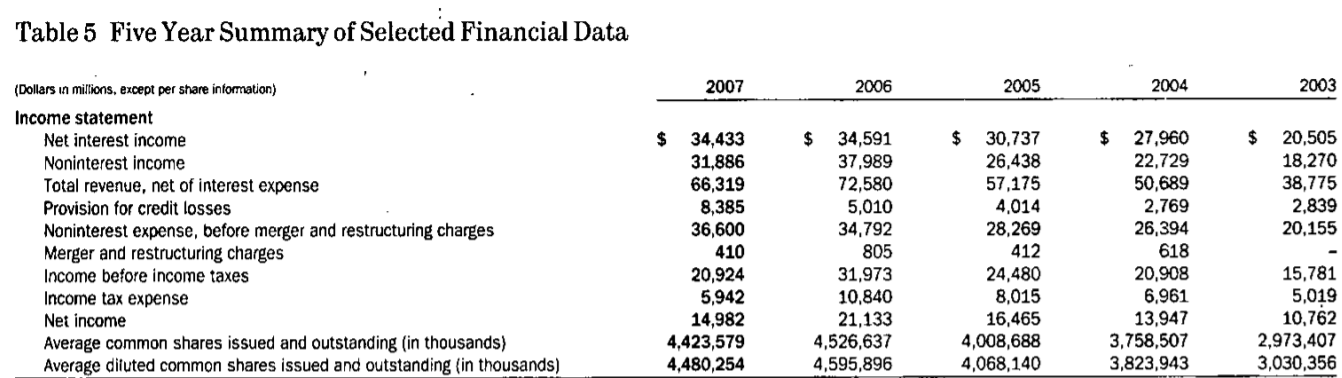

The years 2003-2006 were very good for the bank. A net profit of several billion dollars was not unusual. In addition to nominal net gains, Citigroup boasted a high return on equity. Ctigroup's ROE in the years 2003-2006 ranged from 17% to 22%. In addition to high profitability, the bank also had a fairly high Tier 1 capital adequacy ratio between 8,5% - 8,9%.

The problems did not start until 2007 with the deterioration of the real estate market in the United States and Western Europe. The decrease in profit resulted, among others, from from large write-offs in the CMB segment (Citi Markets & Banking). The write-offs concerned, inter alia, CDO or leveraged loans. In 2007, the earnings per share of the company decreased by approximately 83%. Poor results from 2007 meant that in the annual report, among the goals for 2008, the bank announced that it intends to quickly change "Risk management culture in the company" and "Better allocate capital".

With the publication of the weak quarterly results in 2007, the share price plunged to the lowest levels since 2002. The sharp drop in the exchange rate was a result of investors' disappointment with the bank's risk management method. The myth that the bank could quickly cut losses on toxic products was beginning to collapse.

As it turned out later, 2007 was not "Accident at work". The next two quarters also brought disappointing results. Further write-offs and deterioration of liquidity in the interbank market were the next ones "Red flags". As a result, the course steadily headed south.

After the collapse of Lehman Brothers, more and more investors began to shed company shares. As a result, the share price began to decline rapidly. In 2008, the peak of panic came in mid-November. However, after the moods calmed down for a while, there was a return to declines. The reason was concerns about the bank's solvency. Nobody knew how much exposure the bank had to toxic assets. The US government came to the rescue with a bailout. It amounted to $ 25 billion. The government bought preference shares that paid 8% of dividends. One of the requirements set by the government was to limit dividends paid to shareholders. Another condition that Citigroup had to accept was the need to obtain government approval for a dividend increase over the next three years. On the news of the aid, at the end of November 3 in a single day, Citigroup shares surged more than 50%. The risk of the bank going bankrupt was gone away. However, in early 2009, investors feared that the bank would be nationalized by the government.

Bank of America

It was one of the largest banks in the world. At the end of December 2007, he had over $ 1 billion in assets. He operated in 600 states in the USA and 32 foreign markets. It employed over 30 full-time employees. In 210, the bank divided its activities into three main segments:

- Global Consumer and Small Business Banking

- Global Corporate and Investment Baking

- Global Wealth and Investment Management

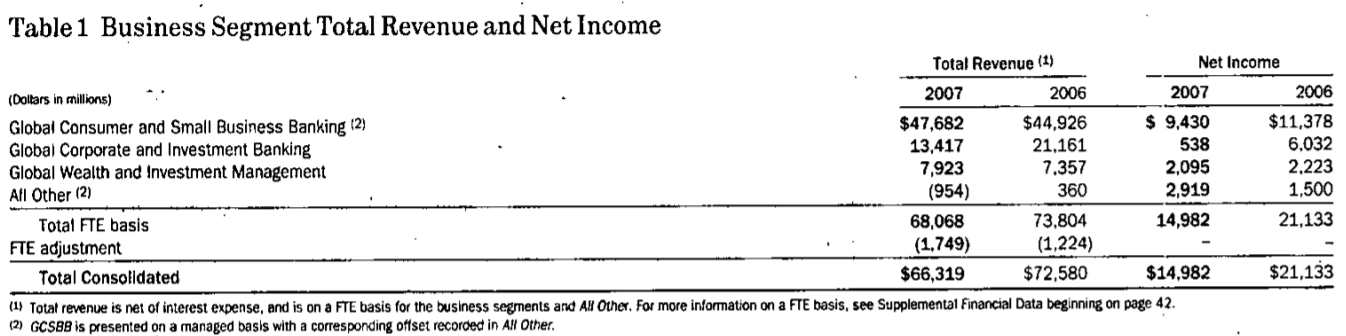

So it was a universal bank that dealt with both traditional and investment activities. The activity related to investment banking was particularly profitable, which in the "zloty" years 2005 - 2006 it generated $ 6 billion in net profit and approximately $ 20 billion in revenues. This segment was responsible for both servicing companies with revenues in excess of $ 2,5 million and investing in complex derivative instruments. Just the losses on the so-called Collateralized Debt Obligation (CDO) and other derivatives led to a 91% drop in profit from $ 6 billion (2006) to approximately $ 0,5 billion (2007). At the same time, the bank had to write off $ 350 million on loans granted to corporate clients.

The main activity of the bank was servicing retail clients and small businesses. On this account, the bank generated about $ 45 billion in "normal" 2006. Net profit this year exceeded $ 11,3 billion. In 2007, revenues increased by $ 2,8 billion, while net profit decreased by $ 1,9 billion. It is worth noting, however, that in 2007, non-interest profit increased by 13% (+ $ 2,1 billion y / y) to $ 18,9 billion. Mainly because of good sales of mortgage loans and bank charges.

Asset management activity flourished in 2007. Assets under management (AUM) grew by over $ 100 billion, ending the year at over $ 640 billion.

The years 2003 - 2007 were a very good time for the bank. Assets at that time increased from $ 750 billion to $ 1 billion. Growing assets did not prevent the achievement of a decent ROA ratio, which in the years 600-2003 oscillated between 2006% - 1,33%. It was not until the "crisis" year 1,44 that the profitability of assets fell below 2007%. ROE, ie the return on equity in the years 1 - 2004 was over 2006%. Moreover, Bank of America improved its Tier 16 ratio from 2003% to 2006% between 1 and 8,02. In 8,64, the ratio deteriorated rapidly to 2007%.

The company was a large company that paid dividends on a regular basis. For many investors, Bank of America was a bet for the stability of the American banking sector. Regular profits and the payment of a generous dividend have placed Bank of America in the portfolio of many investment and pension funds. BoA also increased the scale through acquisitions. For example, in 2005, he announced a plan to acquire MBNA for $ 35 billion. The company seemed TBTF (too big to fail).

However, 2007 undermined faith in the company. The falling real estate market in conjunction with disappointing BoA results resulted in the Bank of America share price fell by almost 2007% between October 2008 and May 40. It is worth mentioning that at the turn of 2007 and 2008, Bank of America controlled approximately 20% of the US mortgage market.

In 2008, the BoA took part in the rescue operation of the US financial system. In June 2008, he completed the acquisition of an entity operating on the real estate market Countrywide Financial, which at the end of 2007 managed a portfolio of approximately 9 million mortgages. On September 14, 2008, Bank of America announced a merger with Merrill Lynch. The transaction was valued at $ 50 billion. This step saved Merrill Lynch from bankruptcy. The bank also planned to take over Lehman Brothers, but the lack of sufficient government guarantees and the difficult liquidity position of the bank caused BoA to abandon the idea of taking over Lehman. As a result, the investment bank declared bankruptcy on September 15, 2008.

On January 16, Bank of America received $ 20 billion in government aid and $ 118 billion in guarantees under the TARP program (Troubled Asset Relief Program). It is worth mentioning that the bank previously received $ 25 billion under TARP. In total, government aid amounted to $ 45 billion.

Despite the enormous financial aid, investors feared that nationalization would be the only option for the bank to survive. Rumors, coupled with a truly “deathly” investor sentiment, made BoA stock seem bottomless.

David Tepper comes into play

On February 25, 2009, the US Department of the Treasury published Capital Assistance Program. It states that the preference shares will be converted into Citigroup common shares at a price 37% higher than the market price. Bank of America shares were to be converted at a price 21% higher than the market.

David Tepper drew two conclusions from this information:

- The government does not intend to nationalize these banks.

- US bank stocks are highly undervalued.

The turn of February and March 2009 was the peak of the market panic. Stocks were sold in companies with poor balance sheets and a poor future, as well as in stable and very profitable businesses. The market did not seem to notice the foundations. The market bears, which were predicting the financial end of the world, won applause.

Tepper has started buying shares of Citigroup and Bank of America with the Appaloosa fund. He then paid "pennies". Bank of America Shares he was buying around $ 3 a sharewhile Citigroup was paying just over $ 1 for the stock. He sold his shares when Citigroup shares tripled in value and BoA shares fivefold. Additionally, he invested in securities of such institutions as AIG, Commerzbank or Lloyds. Tepper has invested over $ 2,5 billion in the banking sector through its fund and other vehicles. The investments have more than returned. The Appaloosa fund ended 2009 with a profit of approximately 120%. The fund's nominal profit exceeded $ 7 billion. It is worth mentioning that on December 2, 2009, Bank of America announced a plan to repay all TARP support ($ 45 billion).

Summation

The bank purchase transactions were one of the best in the history of the Appaloosa fund operation. It is not about the result on the transaction itself, but also the conditions under which the transaction was initiated. This was a time when central banks were not yet so eager to carry out quantitative easing. The drying up of liquidity, network risk and the 'doom of the world' atmosphere did not encourage a bold decision. However going upstream, strong nerves and appropriate timing were one of the main factors that allowed Tepper to close this deal with multi-billion dollar profits.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-300x200.jpg?v=1713870578)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

Leave a Response