Trading with the help of vending machines

The world is moving forward, and with it technological progress. This means that in many areas of the economy everything is moving towards automation or semi-automation. It is no different in the case of financial markets, and especially in the Forex market. It is not surprising, therefore, trading with the use of vending machines Forex marketwhere from year to year, automatic strategies are gaining more and more popularity. This can be seen in the growing base of various robots and technical solutions in the network, as well as in the interest in contests strictly for vending machines organized by currency brokers.

Often, beginner investors bored with continuous tracking of quotes come up with the idea that an easier way to earn money and increase the amount of free time will be entrusting the most important activity, i.e. making transactions, robots and scripts. Unfortunately, this is a rather naive course of reasoning.

Trading with the help of vending machines

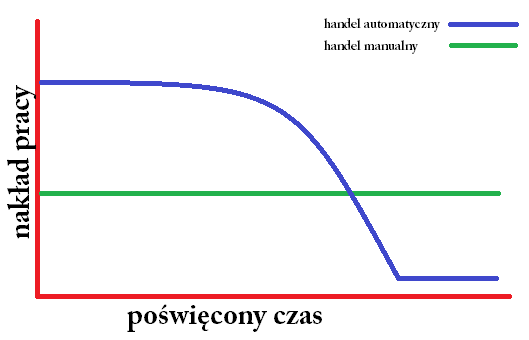

Very often, creating or finding an efficient machine requires much more work and skills than learning to invest effectively. In the long run, after a huge effort, it may turn out that we will actually relieve ourselves of the duties related to trading and we will not have to spend so much time analyzing the charts and clicking the mouse.

How does it look in practice?

There are two variants:

- We create a machine according to our own idea.

- We find a ready solution on the Internet.

Referring to the first point. Here, too, we have two more options. Either we learn to program in a given language, or we entrust the creation of the machine to someone else. Each programming language has its own characteristics. One is more complex, the other less, making it easier to learn. Practice shows that it is difficult for less exact minds to educate themselves in programming quite efficiently and to a reasonable degree. If we do not have the will, time or simply predisposition to do so, we can use the services of people who have these things - unfortunately it will cost money. The advantage of this solution is that if we pay, we require and the person should program exactly what we want and any corrections should also be included in the price, up to the desired effect. Unfortunately, if our idea turns out to be wrong, each subsequent change will also require the intervention of the developer.

READ NECESSARY: Automatic trading on Bitcoin. Does it make sense?

If we decide to look for a ready-made automaton on the Internet, then we must arm ourselves with angelic patience. There is a whole bunch of them, and not all are well described.

The problem will certainly be that some robots can be made available without the source code, which means that any interference in its operation (except for general parameters) will be impossible. In the event that we have access to the code, it will not be easy to make any changes here either. If we can program, everything is OK. It's only a matter of time before we figure out the code, although sometimes it may take more than rewriting it. On the other hand, software companies rarely want to modify third-party solutions because one change may affect the rest and when something does not work, the client will blame the company - usually there is much more work than benefits.

This is just the beginning

Creating or finding a robot that will implement our original assumptions is just the beginning. The next step is testing on historical data. Appropriate selection of such elements as: broker, financial instrument, time interval, as well as the combination of machine parameters will decide whether the strategy will prove to be effective or deficit. A very large number of combinations means that the initial tests can take quite a long time, and they still can't guarantee anything.

If we can configure the machine well, it remains us to test it on the real market, preferably on a small deposit and transaction volume. It will also take time and will require us to closely monitor the operation of the robot. It is necessary to check whether it has errors, gaps and whether it implements our assumptions. If everything goes well, and the machine brings income, it will be the right time to start earning money on the right scale. Still, you can not leave it alone.

The characteristics of the markets are still changing. Today we can have high volatility on a given currency pair, and in six months it will be 3 times bigger. This means that even if the robot is effective today, it may stop working or it will simply require re-calibration of the parameters. Although we have given up most of the work involved in the trade of automatic strategy, this does not mean that our role has ended. It has only been limited.

READ ALSO: Backtesting is definitely not enough. Check your machine

Hard work pays off

The article up to this point could have had a little positive tone and could discourage it from taking this path. There is nothing to hide that it is not easy, and this is often the impression of the novice traders. The game using machines requires a lot of effort, which can be very fruitful. The workload put in at the beginning is usually greater than when learning manual trading, but over time these proportions can be reversed and supervision of the operating machine will require minimal effort.

The advantages of automatic strategies

Robots have many elements that prevail over the manual game, which is why, despite the hard work to be done, it is worth thinking about them. The main advantages are:

- monitoring the 24h market daily,

- no emotions related to entering into transactions (fear, uncertainty, greed, etc.),

- faster response to market changes,

- the ability to play multiple instruments at the same time,

- instrument analysis on many levels using complex calculations in less than a second.

Learning programming

- The official MQL course from Meta Quotes

- The official MQL documentation

- MQL Practically. Basics and Market Puls [Programming Course]

- MQL Practically. Panic Button, part I [Programming Course]

- MQL Practically. Panic Button, part II [Programming Course]

- MQL Practically. Ace of Intelligence, ie notifications on the phone [Programming Course]

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response