Historic increases on Wall Street fulfill the American dream?

The next session on Wall Street ended in significant increases, and the indexes are close to historical peaks. The bull market lasts almost a decade, and the recent increases are the effect of improving moods after signing the initial trade agreement US-China. The run of good data is constantly being extended, but the market does not react to this information with greater movement. Automotive giants - such as - Harley Davidson are breaking out of their utopian dream of power.

The record streak overseas that began to propel stock markets after the announcements of the US-China trade agreement is in full swing. Retail news and the Fed index from Philadelphia added to the good news. Macro readings from the US confirm the excellent condition of the US economy. They show that consumers are still a strong foundation for economic growth and that American companies are stronger than those from other parts of the world.

The three main indices once again climbed to all-time highs with companies in the technology and financial sectors (Dow Jones Industrial Average and S & P500 close to historical records). Banks and chip manufacturers also gained strong after the publication of solid results by Taiwan Semiconductor Manufacturing Co. and Morgan Stanley. Everything looks pink, especially since there are no disturbing signals coming from the foundations that may disturb market optimism. Are you sure that the American dream of capitalist power will come true?

American dream

We check. Retail sales indicated a still strong attitude of consumers as the foundation for economic growth, while data on business activity indicate a definitely stronger position of US enterprises than in other parts of the world. This primarily gives a fresh breeze in the sails for Wall Street index increases, but also indirectly strengthens the USD. It is always difficult to balance the impact of good US data on the currency: either it is positive because it dismisses the vision of loosening Fed policy; or negative because it strengthens the appetite for risky assets at the expense of the dollar. Currently, the pendulum tilts more strongly towards the first.

The dollar is definitely strong. It is stronger after data, but rather not through data - evaluates Konrad Białas, chief economist at TMS Brokers.

A dream of power

According to the expert, data on the possibility of improving sentiment in industry are more important. And it is he who underpins the American dream, which was de facto built on the foundation of automotive power. Her symbol became, among others the legendary Harley-Davidson, who is in a very difficult position.

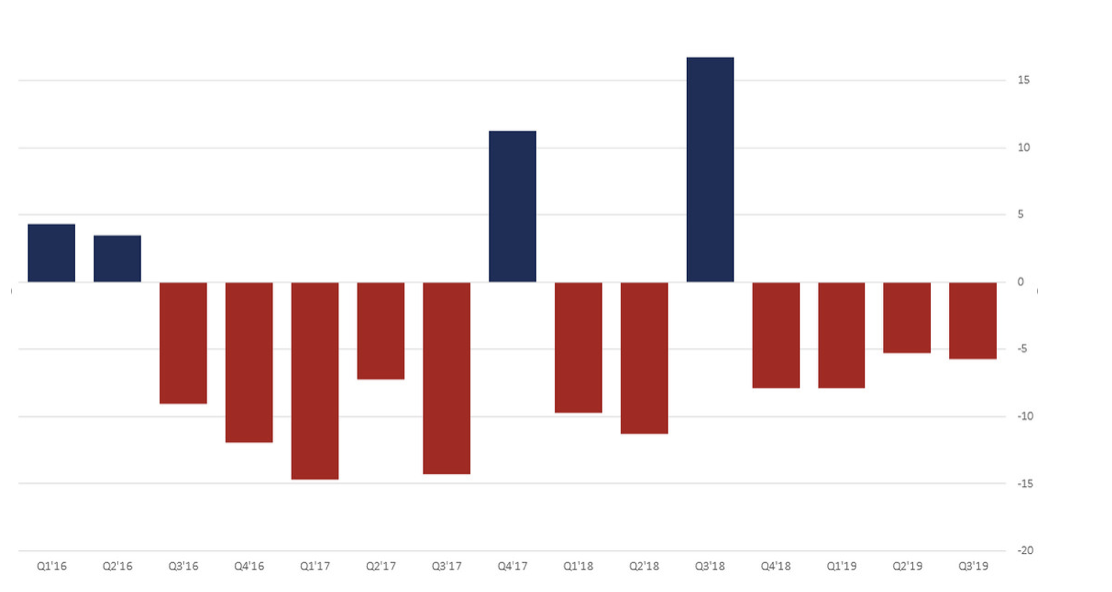

The demand for motorcycles in recent years has been falling at a rate of over 5 percent. In year-to-year terms, quarterly order dynamics are virtually continuously negative. The demand for the company's products has been at levels below the global financial crisis and recession of 2008-2009 for over two years, despite fantastic consumer sentiment, hot labor market and fast economic growth.

Production is more than half lower than five years ago. The company is not able to reverse the negative trend in demand for its flagship vehicles with high engine capacity. Customarily, American dealers build inventory in the first quarter, before the start of the season. In the last five years they have always reported lower demand than in the previous year, and yet inventories remain high, which negatively affects margins.

Despite the boom in the US, the demand for large motorcycles is constantly weakening. Annual dynamics of quarterly orders for new motorbikes. Source: Bloomberg, Harley Davidson

The company's management aims to acquire two million new customers by 2027. Recently, these projections have been halved. The solution may be a stronger geographical diversification of sales or an attempt to attract younger drivers. While the Harley-Davidson motorcycles sales outside the US in the last reported quarter were the highest in history for the company, the anemic dynamics of export markets shows that they are unable to compensate for problems in the domestic yard.

Threats to make your dreams come true

Trade wars and the slowdown of the world economy are still a threat.

“Reaching an agreement has been supporting the mood on world stock exchanges for weeks, its signing has not aroused enthusiasm anymore. You should not expect an immediate impact on the condition of the global economy " - explains Białas.

In addition, in countries with the highest growth potential, Harley-Davidson wheelers do not meet the demand due to the excessive engine capacity and price. Attempting to offer lower-capacity motorcycles or even electric vehicles is a dangerous turnaround in marketing strategy, as it requires significant investment, brand image change and threatens the loss of traditional clientele.

The scale of the challenges is reflected in the course of the listing on the New York Stock Exchange. In 2019, the S & P500 index increased by approximately 30 percent. and serially broke all time records. Although the Harley-Davidson exchange rate has risen by several percent, it remains in a long-term downward trend. Its quotations in the middle of last year fell to the ten-year lows and reached almost 60%. below the peaks of the last decade. According to TMS Brokers analysts, the relative weakness will be maintained and the price of the instrument will continue to follow a downward trend.

source: DM TMS Brokers press material

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response