Inflation in Poland. Are there any chances to slow it down in the second half of 2020?

We have been struggling with high inflation for some time. Monetary Policy Council (which additionally decided yesterday about another interest rate cut) for a long time ignored the upward dynamics on this indicator. We entered the "coronavirus crisis" (like many countries) with high the increase in prices, which de facto led to stronger side effects with the slowdown in the economy. The restrictions, particularly in the sphere of the services sector, have affected not only the PMI (from this industry), but above all economic growth. At least in theory there should be some positive correlation. Therefore, inflation in Poland should also slow down in the near future.

Too many at once

It's hard to talk about a complete slowdown in inflation this year. It is true that the inflation trend will be much smaller, but this does not entail normalizing price increases in the perspective of even a few dozen coming months. It is worth noting that the Polish economy has experienced short-term "shocks" in recent months. At the beginning, mainly the service sector was practically, completely cut off from the demand for its goods. Supply based on restrictions, disrupted the implementation and collection of orders in most businesses in the country. Now we have the opposite situation, "shock" frostbite. The demand we are observing now is extremely impulsive. Of course, it begins to flatten. The uncertainty that still inhibits business investment and more substantial consumer spending in the economy, especially on luxury goods.

Inflation in Poland and costs

Launching almost all businesses that had to stop business operations for the time of the largest restrictions are behind us. The costs incurred by entrepreneurs in connection with the introduction of restrictions were not fully compensated (sometimes even negligibly). Of course, despite the recurring demand, additional bans still limit it. Masks, disinfectants and other special precautions and fewer customers generate additional costs that companies have not faced before. Will they want to transfer them to consumers?

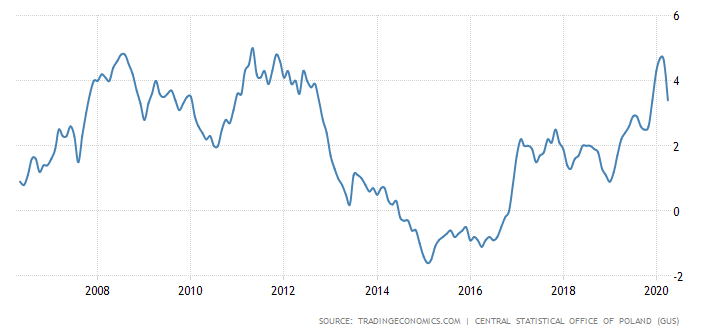

Inflation in Poland in 2006-2020. Source: Trading Economics

We are in fact at a similar moment in the value of inflation as in 2008-2009 and at the turn of 2011-2013. On the one hand, due to lower economic growth (or reduced growth dynamics) the inflation rate should also slow down significantly. On the other hand, there are increased costs that can be passed on to the consumer through subsequent price increases.

Perspective for the second half of 2020

Lack of clear inflation outlook may cause slight consternation. It is worth looking at other macroeconomic indicators, which are good parameters for determining inflation trends. Let's pay attention to the consumer price index. Of course, the data used for calculations are averaged. They concern the prices of goods and services purchased by households.

Consumer price index in Poland in 2006 - 2020. Source: Trading Economics

The consumer price index, which we indicated above, looks almost analogous to inflation. This is due to the simple fact that the higher the consumption, the de facto the higher the inflation. Increased demand for services and goods inflates their prices. The presented data date back to 2006-2020. The high growth dynamics we observe between the end of 2019 and 2020 is significant. One could argue that we still have a "place" to increase inflation, as consumption behavior has not changed significantly. On the other hand, many analysts say the highest inflation is behind us, suggesting a "peak" on food prices. In fact, we can expect to drop from levels close to 8%.

In the environment of limited demand that we are currently dealing with, the vision of further price increases is less likely. High inflation has already affected the zloty, whose decline in purchasing power resulted in a weakening against the major currencies (the most visible are depreciation to EUR and USD). There is therefore a good chance that we will be able to stabilize inflation in Poland for a while, but the prospects of keeping it under control for a long time are already strongly blurred. If we assume that a deep recession is yet to come, we are likely to see inflation rising further.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response