How to invest in GTA 6? Is it worth buying Take-Two shares? [Guide]

Take-Two shares have attracted investor interest due to the release of the trailer GTA VI. Due to the enormous interest, it entered the Guinness Book of Records - the video was viewed by over 90 million people within the first XNUMX hours of its publication on YouTube. Thanks to the good reception by players of the new installment of the cult Grand Theft Auto series, in which we play the role of (originally assumed) a car thief, the company confirmed that it is one of the most important companies in gaming industry. The fact that computer games are a profitable industry can be proven by the following: Microsoft wants to invest very heavily in this market. A great example of this is submitting a share takeover offer Activision Blizzard (owner of, among others, the Call of Duty series). Some investors are already divided on the bear market and expect large profits from the future release of GTA. Will it be so?

Take-Two Interactive Software Inc. chart, W1 interval. Source: xNUMX XTB.

Take-Two business model

It is worth noting that the gaming market is already very mature. According to forecasts published by Newzoo, in 2023 this sector is expected to be worth approximately $212 billion. In the following years, the market will grow at a rate of 2-3%. So if TWO intends to grow faster, there are two possibilities:

- take over smaller competitors,

- increase market share in a traditional way (more games or increase in revenues from available gaming projects).

Take-Two uses both organic development and growth through acquisitions. The company's development results in an increase in the number of employed programmers who are responsible for translating the creators' vision into lines of code. It was still a full-time job in 2014 1 developers, to increase to. after 6 years 4 300. In 2023, more than were employed 8 programmers. Part of the reason for this rapid employee growth is due to company acquisitions Zynga.

Many commentators focus on the new GTA, but Take-Two is much more than that. For many years, the American gaming company has been widely diversifying its products. Thanks to this, the future of the company does not depend on the success of one person “flagship”. The mentioned step was a very interesting step acquisition of Zynga for $12,7 billion. Thanks to this, Take-Two is the owner of many very popular mobile games. It is worth adding that this is exactly what it is the mobile gaming market is the largest part of the gaming sector.

In addition, the company's portfolio includes products from the AAA gaming category. A perfect example is a series set in the Wild West universe - Red Dead Redemption – which won the hearts of many players by offering them a huge, open world, an interesting plot, good graphics and truly amazing realism and attention to detail. Other popular games are NBA2K24 or Max Payne. As you can see, Take-Two has a very wide portfolio of games, which allowed it to create lasting foundations for the further development of the company.

The most famous game titles in the Take-Two portfolio. Source: Take-Two

Therefore, the company's business model is divided into four segments, the most important of which are the following three:

- RockstarGames,

- 2K,

- Zynga.

Take-Two's crown jewel is its Rockstar subsidiary, which is renowned for delivering high-quality games. The studio does not release games in batches. Instead, it focuses on the released products being much better than the competition. Thanks to this, the company can distinguish itself from other companies in the industry. The result of this policy is that the company has a crowd of fans who impatiently wait for new products from "stable" Rockstar Games. In this case, psychology facilitates sales because fans want to buy a new version of a game for which they sometimes have to wait over a decade. In such a sales model, there is also a risk of not meeting investors' expectations. This can undermine trust in the brand. Shareholders found out how dangerous this is a few years ago CD Projekt. Disappointment Cyberpunk caused the share price of the Polish gaming company dropped by several dozen percent.

In the case of 2K, the crown jewel is the basketball simulation - NBA 2K - which is released every year and has gained great popularity. The debuts of subsequent installments ensure a constant inflow of cash to Take-Two, which allows the company to have more time to refine games like GTA.

Subsidiaries of Take-Two. Source: Take-Two

As can be seen from the chart, Zynga stands out as a company that focuses exclusively on the mobile segment. Take-Two acquired Zynga in 2022 for $12,7 billion. Why did the owner of GTA decide to take such a step?

Acquisition of Zynga and the mobile segment

Zynga's business model is completely different than other Take-Two subsidiaries. The mobile games market is characterized by completely different time spent by the average player on activities and the revenues they generate. It's worth remembering that most games run in F2P model (Free to Play). Therefore, installing games is free. So how do mobile games make money?

There are two primary sources of revenue:

- microtransactions,

- in-game advertising.

Microtransactions are in-app purchases. They are usually made by a small number of players who want to complete individual levels faster or buy a unique item. However, for this to be possible, the game must interest the audience. That is why it is so important to properly target the target group and focus on playability and providing players with joy. Typically, the value of a single item is small and sometimes amounts to just a few dollars. This causes some players to decide to make microtransactions to speed up or make the entertainment more attractive. It is worth remembering that income from such transactions is subject to a commission for, e.g. App Store or Google Play. The amount of such a fee is often: 30% of the transaction value.

Another source of revenue is in-game advertising. Advertisers are most often… competitors. This may seem strange, but it is due to the nature of the industry. There are few mobile games that have managed to stay on the market for a long time. This is the result of huge competition, because the costs of publishing mobile games are low. It is also a problem high user churn rate (The so-called. churn). There are few mobile games that can attract users for a long time. For this reason, you need to monetize the game as much as possible before it is lost. Of course, advertising cannot be too intrusive, as it will reduce the joy of the game and accelerate its agony.

The advertising sector on the mobile market is very extensive. Interestingly, there are specialized companies that deal with advertiser aggregation (DSP) or aggregation of advertising space exhibitors (SSP). The central point of closing the transaction is ad network and/ or ad-exchange. And here's another interesting fact - Zynga owns a DSP and SSP called chartboost.

In short, Zynga is a company that aims to acquire the largest possible group of players through marketing campaigns. The next step is to try to get people interested in the game and not let them quickly abandon the game. While playing, the title is monetized via micropayments and advertising.

Why did Take-Two decide to acquire Zynga?

Zynga is a company that aims to acquire the largest possible group of players through marketing campaigns. The next step is to try to get users interested in the product and prevent them from abandoning it quickly. While playing, monetization occurs via micropayments and advertising.

The company lists a number of synergies related to entering the mobile games market. First, it is possible to create cross-promotion via various platforms on which TTWO operates. There is also a chance to create mobile games based on intellectual rights owned by the company. Another plus is that Zynga is one of the leading players in this market. Thanks to the acquisition, Take-Two gained another source of predictable revenues in the largest segment of the gaming market.

It is also worth looking at cost synergies, which are estimated at $100 million per year. This is due to, among others, from reducing similar job positions, reducing the number of contractors and optimizing the number of rented properties.

How to monetize a 10-year-old game?

For now, players from all over the world are discussing possible new features and playability of GTA VI on the Internet. However, we will only find out what the game itself will look like in a dozen or so months. So right now it's just speculation. It took less than 10 hours for the GTA VI trailer to reach 50 million views on YouTube. After three days, views amounted to over 124 million. The game itself will be available on Sony PlayStation 5 and Microsoft Xbox Series X and S. The manufacturers of these products will certainly also benefit from this debut, as fans of the series who own older consoles will certainly decide to buy new ones.

Watch Trailer 1 - GTA 6

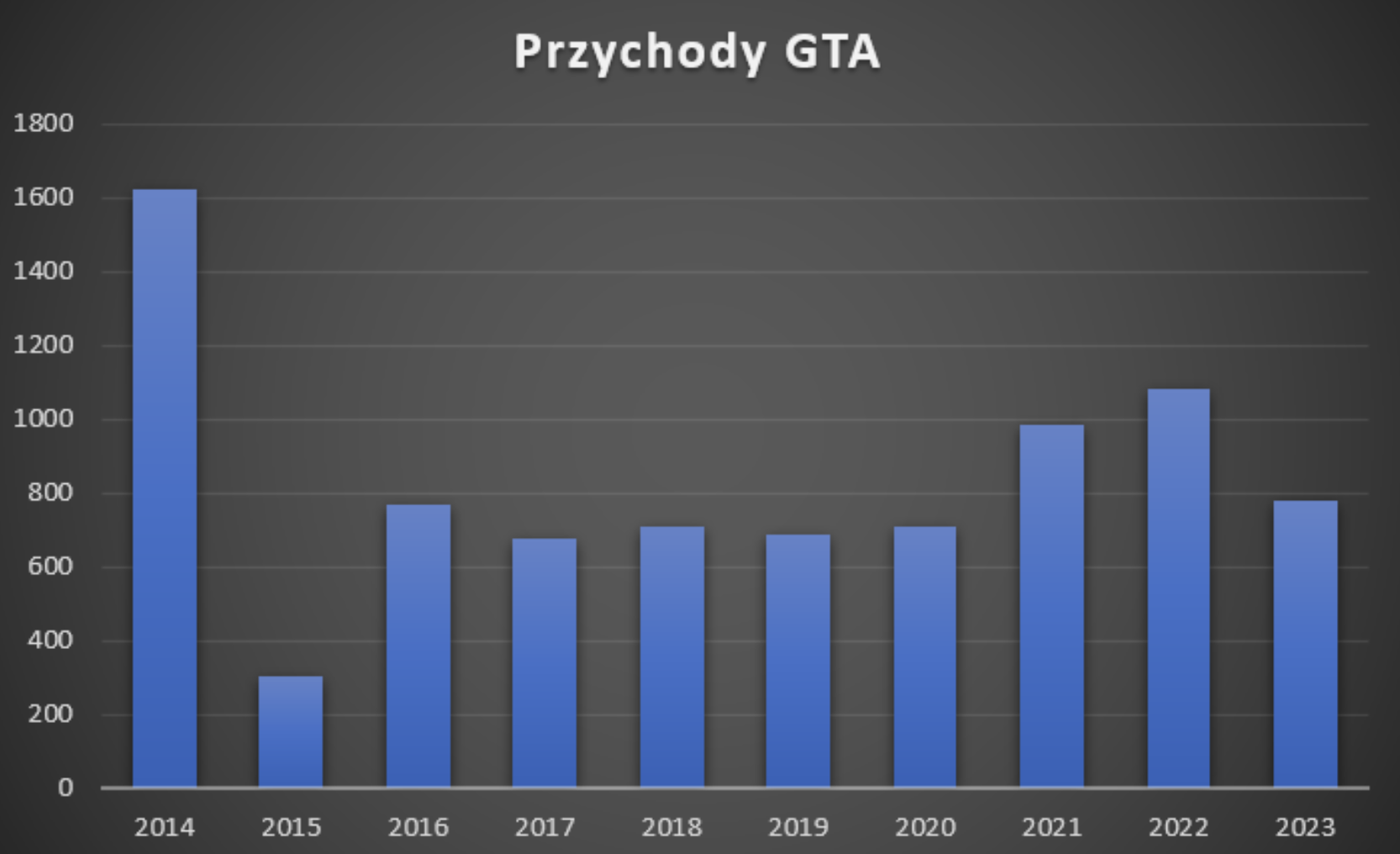

Take-Two has been able to monetize games for a long time. Editing is a great translation GTA V. The mentioned game debuted in... 2013. And it is still very popular. This means that the American company has been generating revenues from this title for over 10 years. Over the course of a decade, GTA 5 brought the company revenues of over $8,3 billion. What sustains the profits is an active community that willingly buys new add-ons or makes large numbers of microtransactions. Take-Two is constantly working to improve functionality and adds new elements. The efforts are reflected in recurring revenues, which help Rockstar stay in business until the next titles are released.

The budget for the production of GTA V alone was $265 million, so the rate of return on this investment is very good. In the case of the next version of the game, the bar is set much higher. It is estimated that the new GTA VI may cost around $2 billion. In an optimistic scenario, it can be assumed that the new installment of the cult series will earn more than GTA V. "Five" it sold 185 million copies, which means that even people who have never been fans of games know it (the girlfriends and wives of players also know what GTA is :)). Therefore, after 10 years, the sales potential of the "six" is even greater. It's important to remember that the number of copies sold is only part of the revenue stream. Next are subscriptions and in-game shopping. The two sources of income mentioned above were responsible for almost 2023% of Take-Two's reported revenues in 80.

Take-Two's GTA revenues. Source: Own study

As you can see in the chart above, the GTA series has a long time to generate revenue. Sales peak always occurs in the first year. In the following years, revenues from subscriptions and in-game purchases dominate. Investors must therefore remember that the company's work after the product is released is also important. It is necessary to take care of the community and listen to its requests. This makes players more likely to return to the game, and a small percentage of users make in-app purchases.

We will have to wait a little longer to see the profits from GTA VI

The company itself mentions that the game's debut is planned for 2025, without specifying a specific half-year or quarter. This is when you can expect two things. A rapid increase in sales of games and services related to GTA VI and a decline in revenues from the GTA V series. Such cannibalization is nothing new. Whenever a new game in the series debuts, interest in the older version decreases. This is especially the case “old” titles like GTA. Since the product has been monetized for 10 years, it will be difficult to convince key customers (those making in-game purchases or using subscriptions for many years) to play both the newer and the older version.

It can be safely assumed that the sales of GTA VI will be better than those of "GTA XNUMX". A necessary condition for implementing such a scenario is to provide a great product and create an appropriate atmosphere of "waiting" for the game's debut. On the other hand, you can blindly assume that its price will also be significantly higher.

It is worth noting that on August 11, 2023, Rockstar Games (a subsidiary of TTWO) acquired cfx. The acquired company is dedicated to improving the player experience through platforms such as fiveM or redM. The mentioned platforms enable the creation of mods for multiplayer gameplay in games such as Grand Theft Auto V or Red Dead Redemption 2. This transaction was most likely carried out so that GTA VI would also have similar functionality. After all, you don't change proven solutions.

Results for the second quarter of fiscal year 2023

At the very beginning, it is worth recalling that the company has a postponed financial year, which ends on March 31. This means that the second quarter ends on September 30.

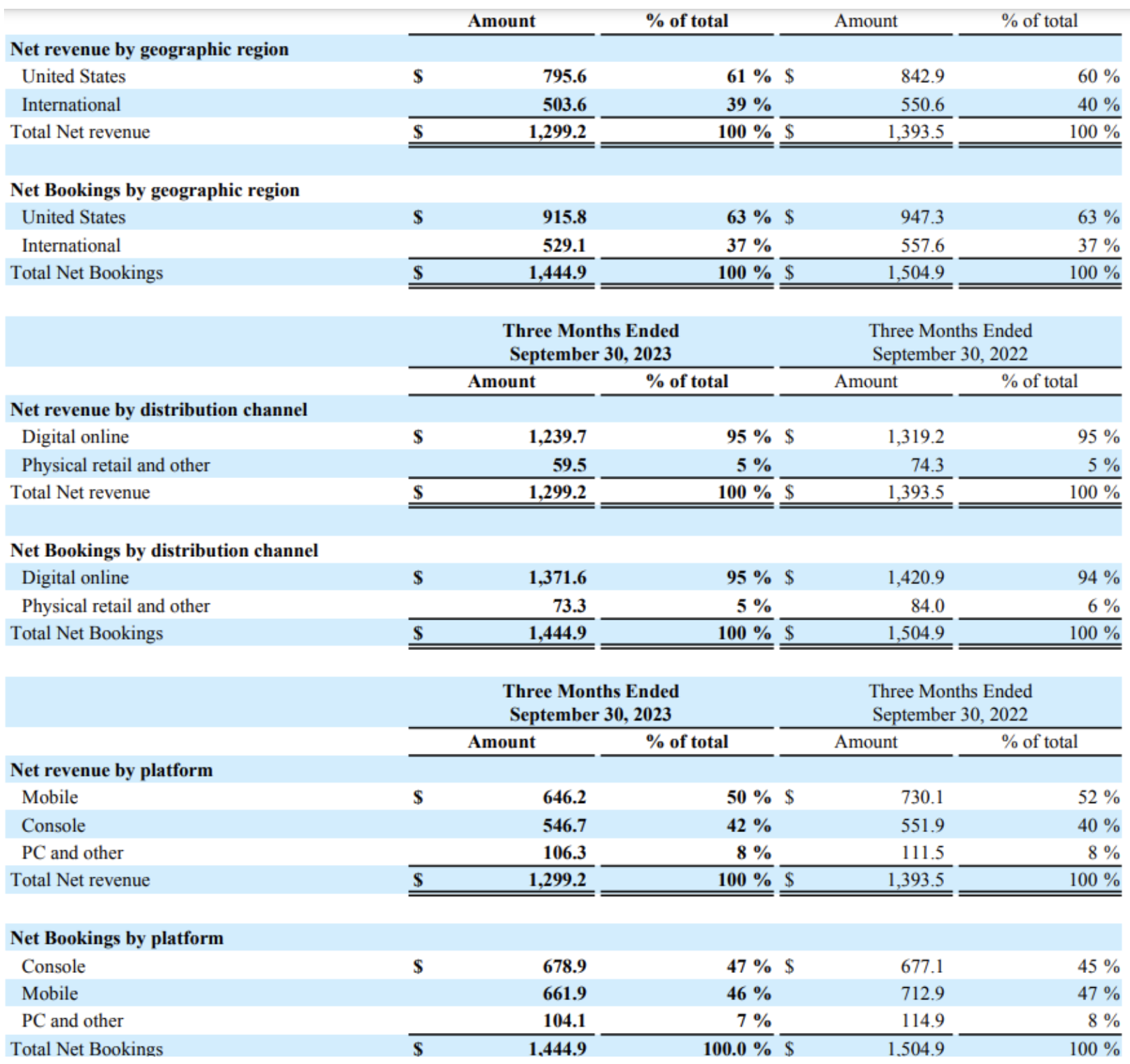

Net Bookings reached the value of $2023 billion in Q1,44 4, which meant a y/y decline of XNUMX%. If we just focus on “repeatable” booking, it dropped by 7% y/y. It was this component that had the greatest impact on the above-mentioned indicator. This is because future recurring payments accounted for approximately 2023% in Q78 XNUMX. You have to remember that booking this is not revenue. Typically, recognized revenues differ slightly from estimated sales. The following games sold best:

- gta online,

- GTA V,

- NBA 2K24,

- NBA 2K23.

In addition, the portfolio of hyper-casual and mobile games performed well “casino games”.

If we look at revenues, they fell by 7% y/y to $1,30 billion. Sales of "repeatable" services, such as subscriptions, shrank much more. Recognized sales in this respect decreased by 9% y/y. It is worth noting that “repeatable payments” had a 77% share in the company's revenues.

Let's take a look at the revenue structure, because it shows how dependent the company is on the condition of the American consumer. According to the information included in the quarterly report, in Q23 61 approximately 50% of revenues were generated in the United States. Another interesting fact is that XNUMX% of sales were generated by the mobile games segment. As you can see, the acquisition of Zynga allowed Take-Two to significantly increase its revenues.

Take-Two reported a net loss of $3,2 per share last quarter. In nominal terms, the loss amounted to PLN 543,6 million. Approximately $380 million consists of write-offs on current assets and goodwill.

Finally, let's check the flows. Due to its light business model, the company does not have a large need for working capital. Therefore, operating cash flows should be positive - and indeed they are. In the first half of the year, cash flow from operating activities amounted to +$70 million. For comparison, in the period under review the net loss amounted to approximately $750 million. It is worth noting, however, that the so-called positive operating cash flows had a very large impact on positive operating cash flows SBC (stock-based compensation). These are remuneration paid in shares, which are an accounting expense, but the settlement is not in cash (dilution of shareholders occurs). Below is an abbreviated version of cash flows from operating activities.

| million USD | 6M 2022 FY | 6M 2023 FY |

| Netto result | -361,0 | -749,6 |

| SBC | 151,8 | 169,1 |

| OCF * | 155,4 | 69,8 |

*OCF: operating cash flow. Source: own study

To increase TTWO's revenues, it does not have to create a stationary sales network, because most of it comes from the online channel. For this reason, CAPEX is small.

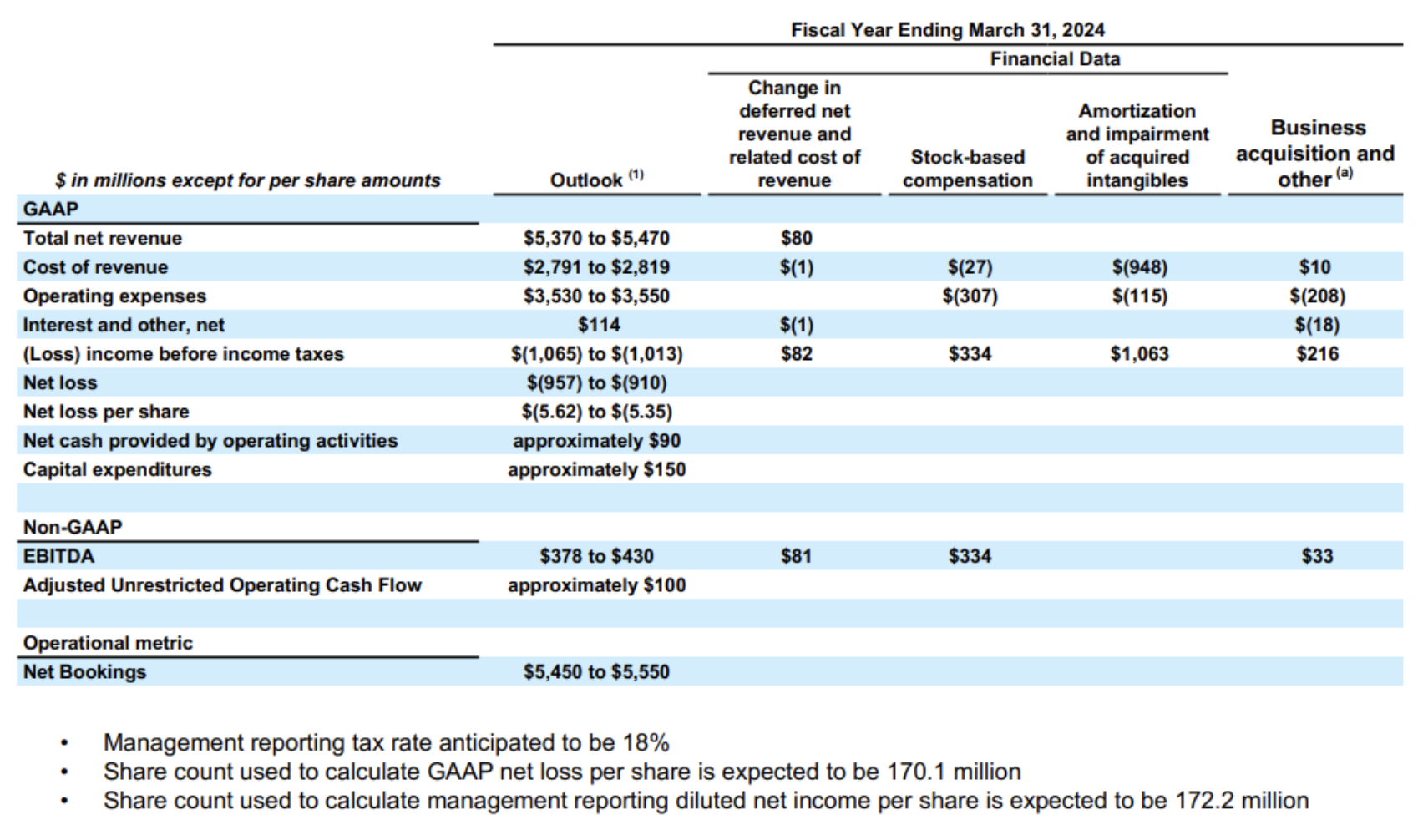

The management board mentioned that the company's results will improve in the future because games with good sales potential will soon be released on the market. The latest report included new forecasts regarding the company's revenues and profits. The new forecast for the fiscal year ending March 31, 2024 assumes higher revenues than the previous estimate by $80 million. As a result, net revenues will reach the level of $5,37-5,47 billion. In turn, the forecast EBITDA she corrected increased by $81 million and amounted to -$1065 million to -$1013 million

Forex brokers offering ETFs and stocks

How can you invest in GTA6? Apart from purchasing the game itself, we can invest in an ETF for the gaming sector - you can read more about it In this article. However, we can also focus on Take-Two Interactive Software Inc. itself. (ticker symbol: TTWO), listed on the American stock exchange. It is available from most Forex brokers offering access to this market, both in the form of normal shares and leveraged CFD instruments.

An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| Country | Poland | Denmark | Cyprus |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 21 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

3 - shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

323 - ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | 0% commission* |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 | 100 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

EToro platform |

*Zero commission means no brokerage/transaction fee was charged during the activity. However, they may still incur general fees, such as currency conversion fees for deposits and effects in non-USD currencies, fees for fees, and (if applicable) inactivity fees. Market spread also applies, although this is not a "fee" charged by eToro.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Summation

Take-Two is one of the largest players on the gaming market. The jewel in the crown is the Rockstar Games subsidiary that creates these blockbusters such as GTA. It was the trailer of this game that caused great interest among both players and investors. Fans of this series can't wait for new functionalities and an engaging storyline. In turn, investors are slowly estimating the revenues and profits that the company will generate from this game. For now, it's just writing in the water, because the grace of the players is on a wild horse. CD Projekt shareholders found this out and lost several dozen percent of their invested capital after Cyberpunk's debut.

GTA's debut is planned for 2025. There are also rumors about the budget for GTA VI. Some forecasts say as much as $2 billion. So we can say that it is a serious investment for the company because Take-Two's annual revenues do not exceed $6 billion for now. Will the expenses incurred be recouped? Probably yes, because GTA V generated over $8 billion in revenue over the course of a decade.

It is also worth noting that TTWO is diversifying its revenues. Zenga has strengthened the company on the mobile gaming market, while Cfx gives the opportunity to improve players' experience by adding their own mods to a game such as GTA. How will this translate into an increase in the company's share prices? This will be decided by the market, economic situation and... the efforts of the game developers.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in GTA 6? Is it worth buying Take-Two shares? [Guide] how to invest in gta 6](https://forexclub.pl/wp-content/uploads/2023/12/jak-zainwestowac-w-gta-6.jpg?v=1701871856)

![Gaming on the Polish Stock Exchange – Rafał Janik and Paweł Sugalski [Webinar] gaming on the Polish stock exchange](https://forexclub.pl/wp-content/uploads/2023/04/gaming-na-polskiej-gieldzie-300x200.jpg?v=1681291966)

![How to invest in GTA 6? Is it worth buying Take-Two shares? [Guide] Valentine's Day-Promotion at Armada-Markets](https://forexclub.pl/wp-content/uploads/2016/04/Promocja-Walentynkowa-w-Armada-Markets-102x65.jpg)

![How to invest in GTA 6? Is it worth buying Take-Two shares? [Guide] forex scam gdansk](https://forexclub.pl/wp-content/uploads/2020/10/oszustwo-forex-gdansk-102x65.jpg?v=1602598455)