Will the cannabis industry turn growth into profit?

Cannabis: This industry offers significant growth opportunities over the next five years, but they pose huge risks.

The sector suffers from slow cash flow, increasing the risk of refinancing growth and operations. Recreational use is considered to be the main factor for future growth, but it means an additional regulatory risk because marijuana was originally intended for medical use. In addition, 2019 was a difficult year for this industry due to the weakening of market foundations causing a fall in share prices and the possibility of bankruptcy of enterprises.

In 2020, everything will depend on whether the sector enters a profitable growth path.

Be sure to read: A perfect storm on the gold market - a weekly overview

Smoke without fire?

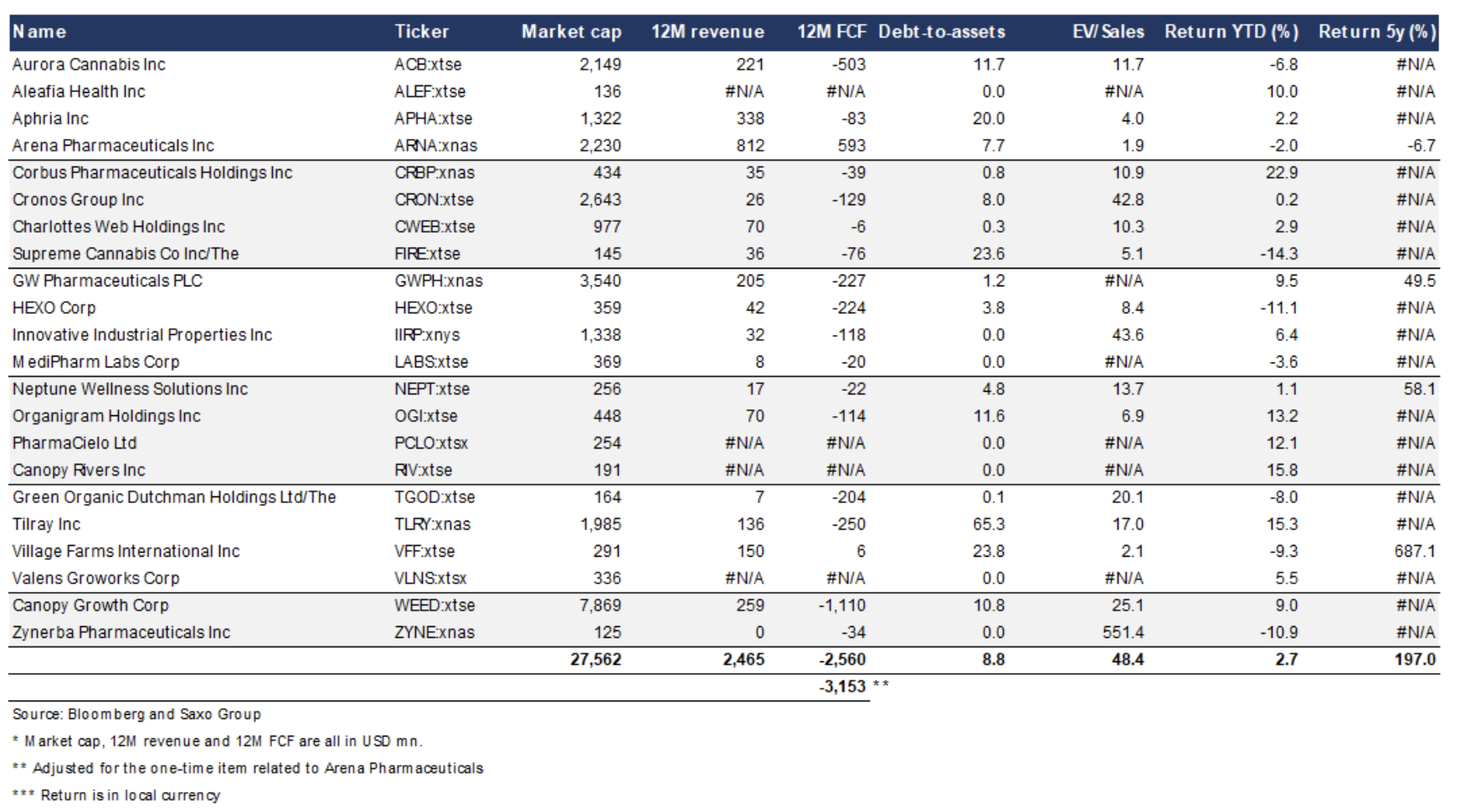

In January 2020, the total market value of listed companies in the cannabis industry, measured by the International Cannabis Index (S & P / MX), amounted to $ 27,6 billion, and the largest companies were Canopy Growth, GW Pharmaceuticals, Cronos Group, Arena Pharmaceuticals and Aurora Cannabis. The index includes 22 companies with combined revenues of $ 12 billion in the past 2,5 months, but they were largely concentrated in just a few companies.

The biggest problem in this industry is the lack of profitability despite the high growth - twelve-month free cash flow in the companies covered by the index shows a total loss of USD 3,2 billion. According to widespread expectations, the decline in form value will intensify in Q50, as earlier acquisition values will no longer offset the weak market foundations recorded in Canada in the second half of the year. For some companies, the ratio of goodwill to assets exceeds 20%, and in several others it is about XNUMX%, which affects the sensitivity of this industry from a balance sheet perspective.

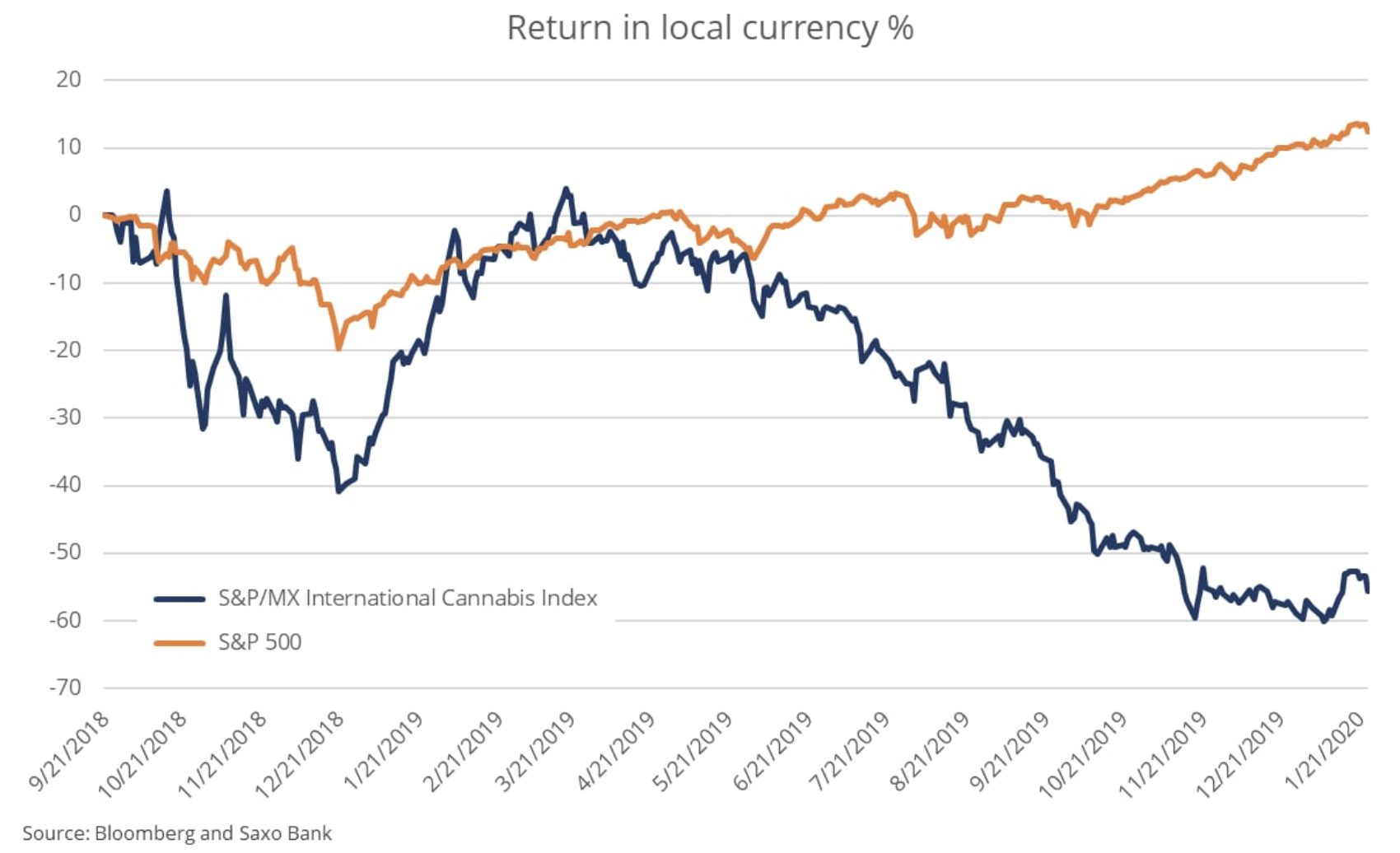

Concerns about the possible bankruptcy of some companies, combined with a large negative free cash flow mean that the sector is facing a huge recurring refinancing problem. Given that since September 2018, stocks of companies in this industry have fallen by 55%, funding opportunities from traditional banks are running out, shifting the burden of increasing capital financing to shareholders. The decline in stock prices also illustrates the high risk associated with this industry despite its rapidly growing revenues.

Recreational use will heat up the atmosphere

Historically, the growth rate of the cannabis industry has been high and this trend is expected to continue in 2020. Canada's legal cannabis market is expected to grow 50% to around $ 1,7 billion (according to Kenneth Shea, senior food and beverage analyst in Bloomberg Intelligence) due to the increase in the number of stores offering products using cannabis, including groceries, beverages and electronic cigarettes. Recreational rather than medical use is likely to be the main driver of growth in the coming years, but this is associated with an increased risk of consumer regulation.

At Saxo, however, we expect growth to be high in the coming years, based on Bloomberg Intelligence projections and restructuring to accelerate the process of eliminating the weakest entities in this industry. The sector will face significant problems until consolidation leads to the creation of larger entities with so-called operational moats operational moats), which will improve operational margins. So far, regulations have been beneficial to the cannabis industry, but this may change over the years as recreational marijuana use becomes more widespread. In our opinion, the situation in this industry will change for years.

Growth accumulated in volatility and risk

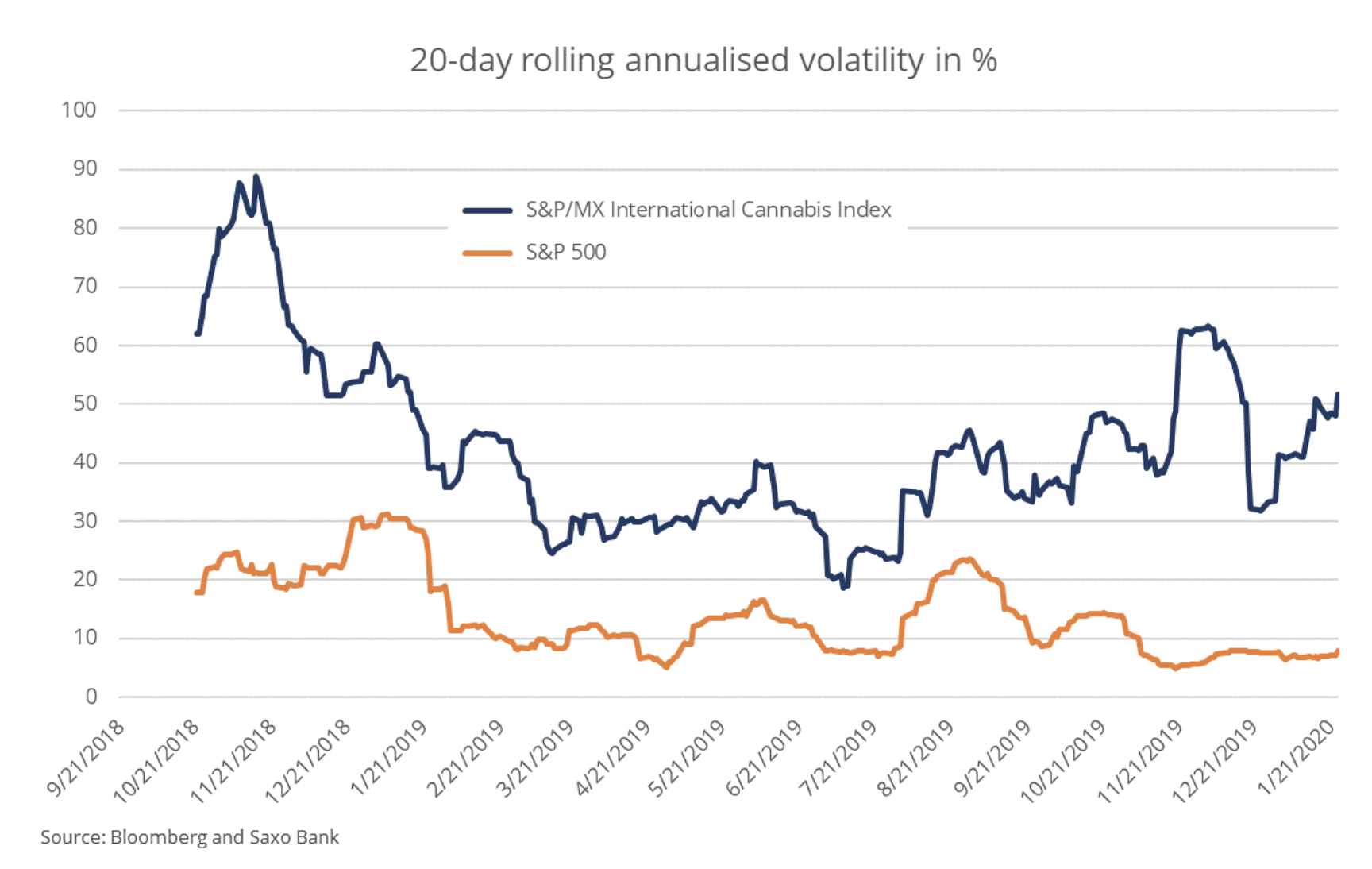

Since the cannabis index launched in September 2018, its annualized volatility is 45,6%, three times the volatility of the S&P 500 (15,1%). The correlation with the S&P 500 index is only 0,11, which proves that the shape of this industry is not influenced by general macroeconomic factors, but rather by many idiosyncratic risk factors. This also underlines the attractiveness of Saxo's products new futures contracts on the cannabis indexas the S&P 500 index or any other stock index may constitute an inadequate hedging instrument.

The idiosyncratic risk factors in this industry include high indebtedness of some companies and new regulations related to the increase in recreational use. The decrease in goodwill and very high valuations of shares also cause strong drops in share prices during the period of profit publication, which explains the high level of volatility hindering long-term investment.

Source: Peter Garnry, director of stock market strategy at Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response