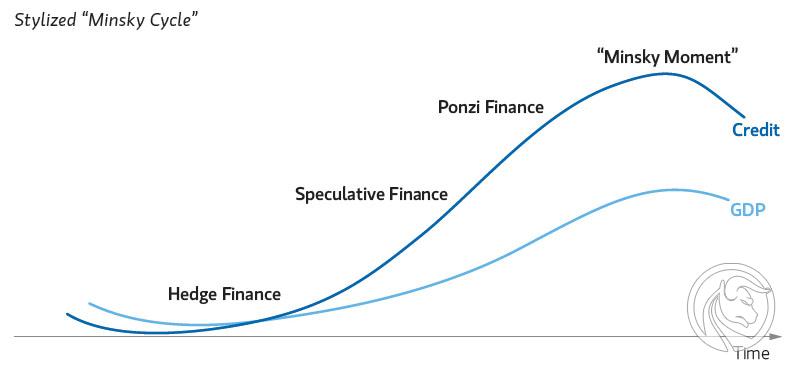

Minsky crisis. Are we dealing with it now?

In the literature on financial crises, one can find a considerable amount of information and models presenting broad ranges of concepts. Some focus on the cyclical nature of markets and the crisis phenomena that are associated with them. Others, however, are characterized by more traditional assumptions including (generally understood) a rapid increase in assets, which ends with a significant correction in their valuation.

The model we want to present today was developed on the basis of observing the variability of credit supply in leading global economies. It is not difficult to guess that one of the subjects of the study and at the same time the economic situation subjected to the study by Hyman P. Minsky were the United States or Great Britain. In fact, in this model we find many similarities to the idea expressed by Alfred Marshall, Knut Wicksell and Irving Fisher.

Borrowers in the spotlight

Minsky attached great importance to the debt structure and financing of investments such as real estate, securities or commodity market products. Such borrowers and their expenses (which were financed from the debts incurred and allocated to the above-mentioned assets) are focused on achieving short-term profits from investments in them. Of course, the main reason for entering into such transactions is potential profitability. The positive difference between the rate of return on investment and the interest rate on the loan is the borrower's profit. Well, but what impact do people / institutions making commitments to finance speculative market play have? The economic stability of systems and its maintenance is one of the main objectives of central banks. Hyman P. Minsky saw this relationship. Relationships between economic stability and excessive lending.

When does the crisis hang on the economy?

Minsky has really pointed out a whole series of dependencies determined by changes in credit supply. The first step that determines a potential crisis is for the economy to experience a "shock". To understand the essence of this concept well I will illustrate it on the example of the 20s in the United States. At that time, the shock was the extremely dynamic development of the industry, car production, and increasingly widespread access to telephones. Can we see a similar phenomenon in the current global economy? It could be assumed that it is the development of technology. At this stage, euphoria is developing that drives the purchase of equity securities (or other financial assets) from the "thriving" industry. We could already say at this stage that we know the further development of the situation, where intense demand would lead to an increase in prices to unprecedented levels, and this in turn to a speculative bubble.

The economic shock reaches a certain limit in the whole process. It is e.g. production capacity, which causes a further increase in demand for specific goods or services. They attract new entrepreneurs and investors willing to place money in a promising (in their opinion) industry and enterprise. Exactly at this moment there is a significantly reduced aversion to taking purely speculative activities.

Follow the leader

We are dealing with it at the stage of euphoria. Investors and people not necessarily connected with markets are increasingly convinced that there is currently no simpler way to earn money than on the stock market. De facto, the needs for financing such projects are increasing here. No interested person has the amount to obtain satisfactory profits. On the other hand, probably everyone incurring commitments for this purpose accounted for profitability. What is the effect (because we should call this phenomenon) follow the leader? It involves joining the speculative behavior of subsequent stakeholders (who in the vast majority do not have knowledge and experience about investment). This works by observing the actions of speculators. These observers want to join the opportunity and earn money on a specific move. Phase euphoria, which has its origin in this imitation, pushes prices to high levels. This is where the potential return on investment is usually overestimated. A well-functioning market will encourage investors to invest in it. Banks wanting to keep their share of this piece of cake. These institutions are preparing special offers enabling them to make cheap commitments to finance their "investment adventures". We are talking here about institutional and individual investors (however, they incur debt of lower value).

Minsky's boom

Subsequent tranches of cheap loans are drawn by enterprises. The vision of high profits does not allow rational behavior of investors. The boom according to Minsky's model is of course fueled by excessive credit expansion of banks. These institutions behave extremely extremely during this period. At the stage of a significant increase in interest in the market they get a large dose of optimism suggesting cheaper financing and looser credit conditions. We can call this phenomenon simply an underestimation of risk. It is only when the moment of "enlightenment" comes that the banks drastically increase the requirements that must be met to obtain additional funding.

Source: Economic Sociology

System instability

Minsky focused in his forecasts and reflections on the crisis on the relationship between private and public sector debt. The economist's theory is extremely complex and describing it on several pages will not be enough. However, knowing the basics of the assumptions on which modern crises are explained (also the one from 2008), we are able to assess the probability of their occurrence. Minsky himself considered them increasingly difficult to achieve due to the economic stability that the financial institutions appointed to do so care.

The current economy is in the moment of cheap credit. Although the economist's model of crisis (and, as he says) is difficult to fulfill, the market and emotions prevailing on it can cause extreme feelings about this thesis. Trying to answer the question of whether we are currently fulfilling the Minsky scenario we would have to examine extremely carefully the (public and private) debt ratio of many economies and take into account pandemic factors. It seems to me that it is too early for companies to completely flood the market and even "stuff themselves" with debts in order to speculate on relatively profitable assets. To a large extent, the activities of institutions responsible for fiscal and monetary policy maintain a good level of economic stability. I think that nobody can estimate how long they will be able to do it.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

His theories were ignored for a long time. And then came the year 2008. However, people are appreciated after years.

Exactly, usually after the fact