McDonald's is chasing cost-cost inflation - how is the company doing on the stock market?

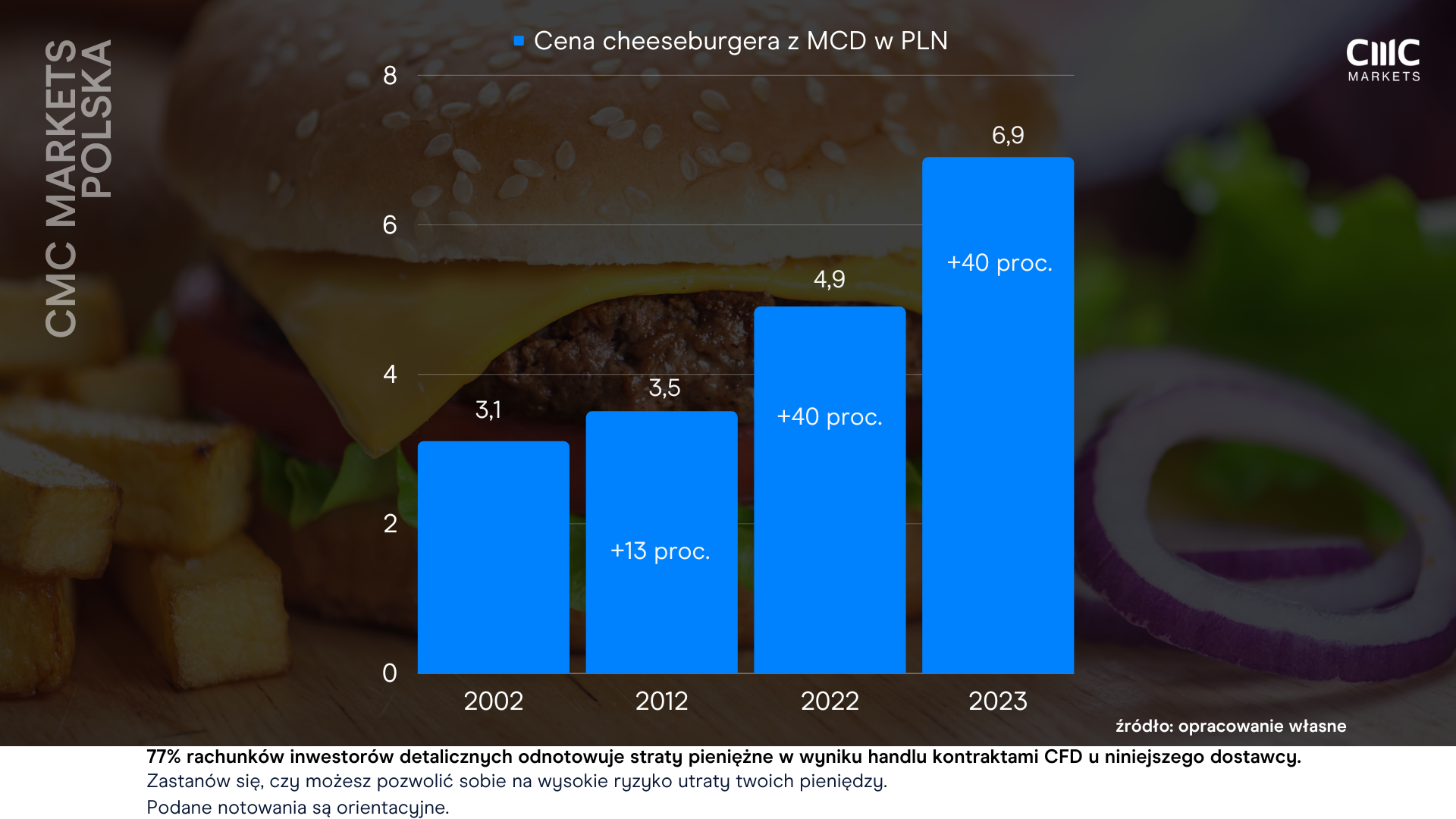

The price of a cheeseburger in a popular fast food chain has increased to PLN 6,90. Looking at the history of the price of a well-known sandwich, we see that 21 years ago, in 2002, the price of a burger with cheese was PLN 3,1 in the regular offer. The next price in 2012, i.e. after 10 years, increased to PLN 3,5, so we can say that the sandwich inflation was quite moderate and amounted to 13 percent. in a decade.

In 2022, a cheeseburger cost PLN 4,90, which means a 40% increase in price. over the next decade. At this point, you can see inflation accelerating, but that's just the beginning. Between 2022 and the current 2023, inflation increased by another 40%. (however, not in a decade, but only in one year!). Thus, comparing the total price today, PLN 6,90, to the one 20 years ago, in 2002, PLN 3,1, we notice inflation at the level of 122%.

Is that a lot? This gives an average inflation rate of 5,3 percent, which is not an alarming result, and is mainly due to the fact that MCD has not changed the prices of its sandwiches for many years.

McDonald's share price change over the years

Comparing the increase in the price of the popular sandwich in two decades to what happened to the price of the company's shares on the American stock market, we will see a gulf. Over the past 20 years, MCD's share price has increased by a staggering 3276 percent. and today it is close to its record level. Looking to measure CAGR (from Compound Annual Growth Rate - this is the average annual growth rate in the period under review, assuming that annual increases are added to the base value of the next period), it amounts to 19,22%.

Key indicators for McDonald's:

- P/E at 32,2x,

- forward P/E is 25,4x.

- earnings per share (EPS GAAP) for full 2022 was $8,33

- the market consensus predicts an increase in this measure to USD 10,58 in 2023 and to USD 11,72 in 2024.

- the company's revenue in 2022 amounted to USD 23,18 billion

- estimates for 2023 and 2024 indicate a possible further increase to USD 24,40 and USD 25,95 billion

- the dividend yield in February 2023 was 2,26 percent.

The company also runs a share buyback program. In 2002, almost 1 million shares were traded. Currently, it is 290 million. This helps to maintain a relatively high earnings per share ratio.

CHECK: How to invest in Fast Food? [Guide]

McDonald's shares

At the close of the session on February 22, the company's share was worth USD 268,64. The all-time high in closing prices was set on November 8, 2022 at $276,86. MCD's stock price, on the other hand, peaked at $281,67 last year, down only 4,9 percent from the previous year. above the February 22 price.

Price chart CFD per share McDonalds. Source: CMC Markets platform Next Generation

The capitalization of the company is USD 196,76 billion, which places MCD on the 48th place of the most expensive companies in the world.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response