Limited pressure on the gas market in Europe

The risk of a serious energy crisis in Europe became the subject of discussion among key politicians, but also ordinary members of society who were afraid of interruptions in electricity or heat supplies. Over the past months, European governments have introduced a number of preventive measures to protect against the worst-case scenario. The development of the situation in the critical period, which is the last quarter of the year, gives grounds for cautious optimism.

The weather situation is favorable for Europe

In December, the weather situation became Europe's great ally. Temperatures above the long-term average provided a breather for gas, which is a key market for assessing the prospects of energy policy in Europe. The relatively warm Christmas and New Year period should not be a cause for concern. The unexpected weather conditions are reflected in the high dynamics of gas prices on the Dutch TTF market.

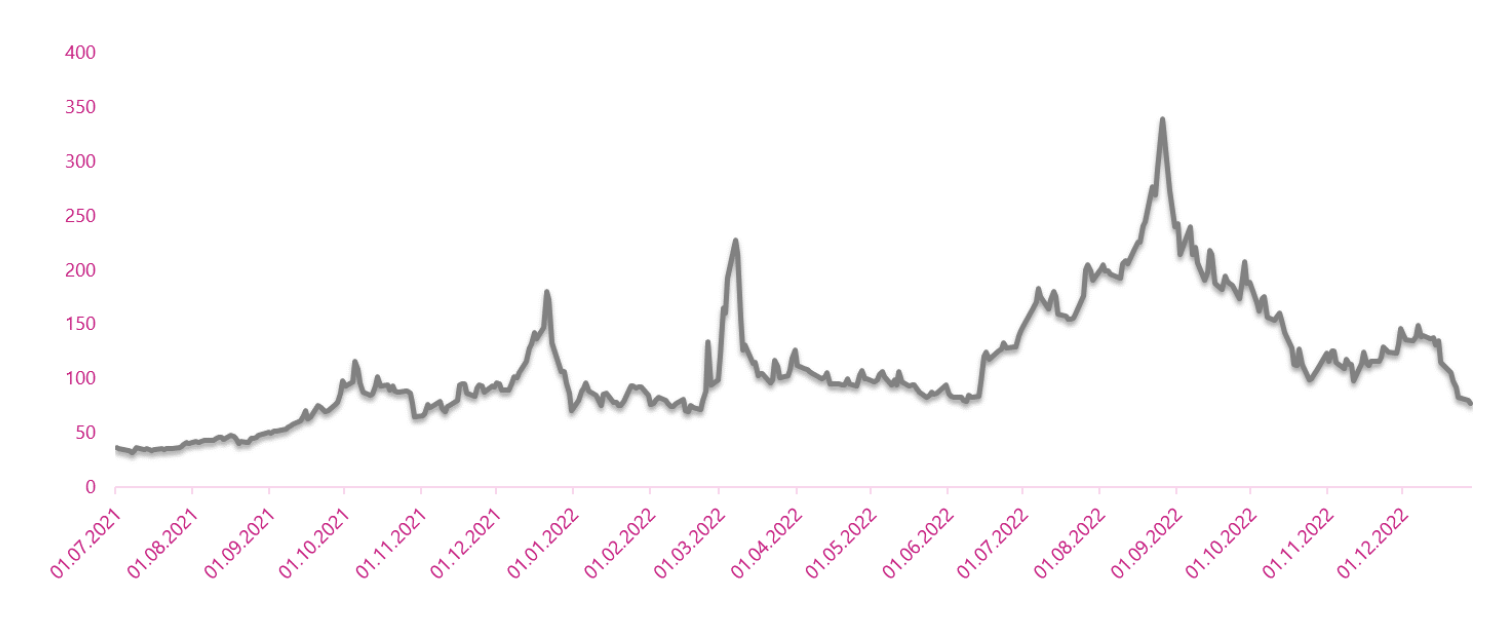

Gas price evolution (continuing monthly contract) on the TTF exchange. Source: Own study based on Investing.com data

Currently, gas price on the stock exchange dropped to the level last seen before the start of Russia's invasion of Ukraine. The January 2023 gas delivery contract is quoted at EUR 82.00/MWh (December 29.12.2022, 1). The scale of the observed traffic is best evidenced by the fact that at the beginning of December the price of 150 MWh was around EUR 350, while at the end of August the contract reached a record value of nearly EUR XNUMX/MWh. This year's trend is not in line with the standard seasonal cycle, when gas prices were usually in an upward trend in the winter. The further development of events will depend on many factors, but ensuring a kind of safety buffer at the beginning of the winter period is invaluable.

High stock levels in warehouses

Undoubtedly, the currently observed situation would not have been possible without the EU countries rolling up their sleeves and introducing the target of filling gas storage facilities. This commitment set a minimum limit of 80%, and the cut-off date was November 1 this year. This goal was more than achieved, and the maximum level of gas in the storage facilities was reached in mid-November and amounted to approx. 95%. Favorable weather conditions and stable gas supplies mean that gas stocks are currently significantly higher than last year.

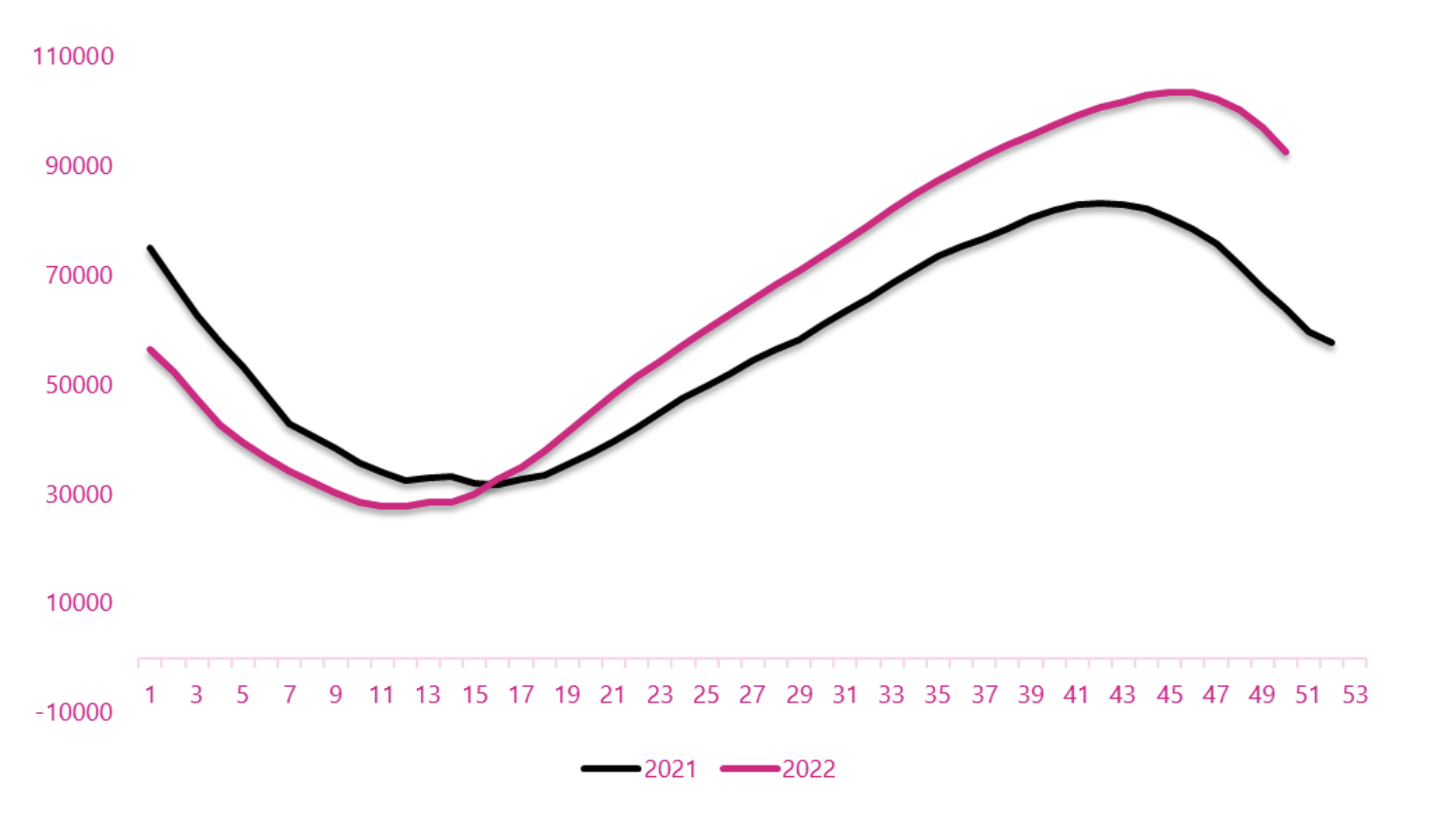

The level of gas in the storage facilities of EU countries in 2021-2022. Source: Own elaboration based on data Bruegel.org (European natural gas imports – Dataset)

The filling of gas storage facilities at the end of December, exceeding the level of 80%, allows us to look to the future with optimism. Continuation of the current trend will most likely translate into a much higher level of gas at the end of the withdrawal period (March/April). In previous years, this figure was at the level of less than 30%, and next year, under favorable circumstances, it has a chance to be around 50%. Undoubtedly, the realization of such a scenario would reduce the pressure on the gas market, could ease price tensions and allow prices to move towards the long-term average, which would be a huge relief in Europe.

LNG supplies replaced Russian gas

At this point, the key issue to be clarified is how Europe has managed to compensate for the supply constraints from the Russian direction. Almost all of us learned about the interruption of supplies via the Yamal pipeline, the failure of the turbines used in the Nord Stream gas pipeline, and later about the explosions and gas leaks that brought the Northern pipeline to a standstill for good. All these events intensified market tension, and at the same time significantly reduced gas supplies from Russia to Europe. Market circumstances in the form of reduced demand for LNG in Asia allowed for a significant redirection of supplies to Europe. In 2022, record-breaking LNG deliveries were recorded, and the main direction that allowed for an increase in the use of this gas source turned out to be the USA.

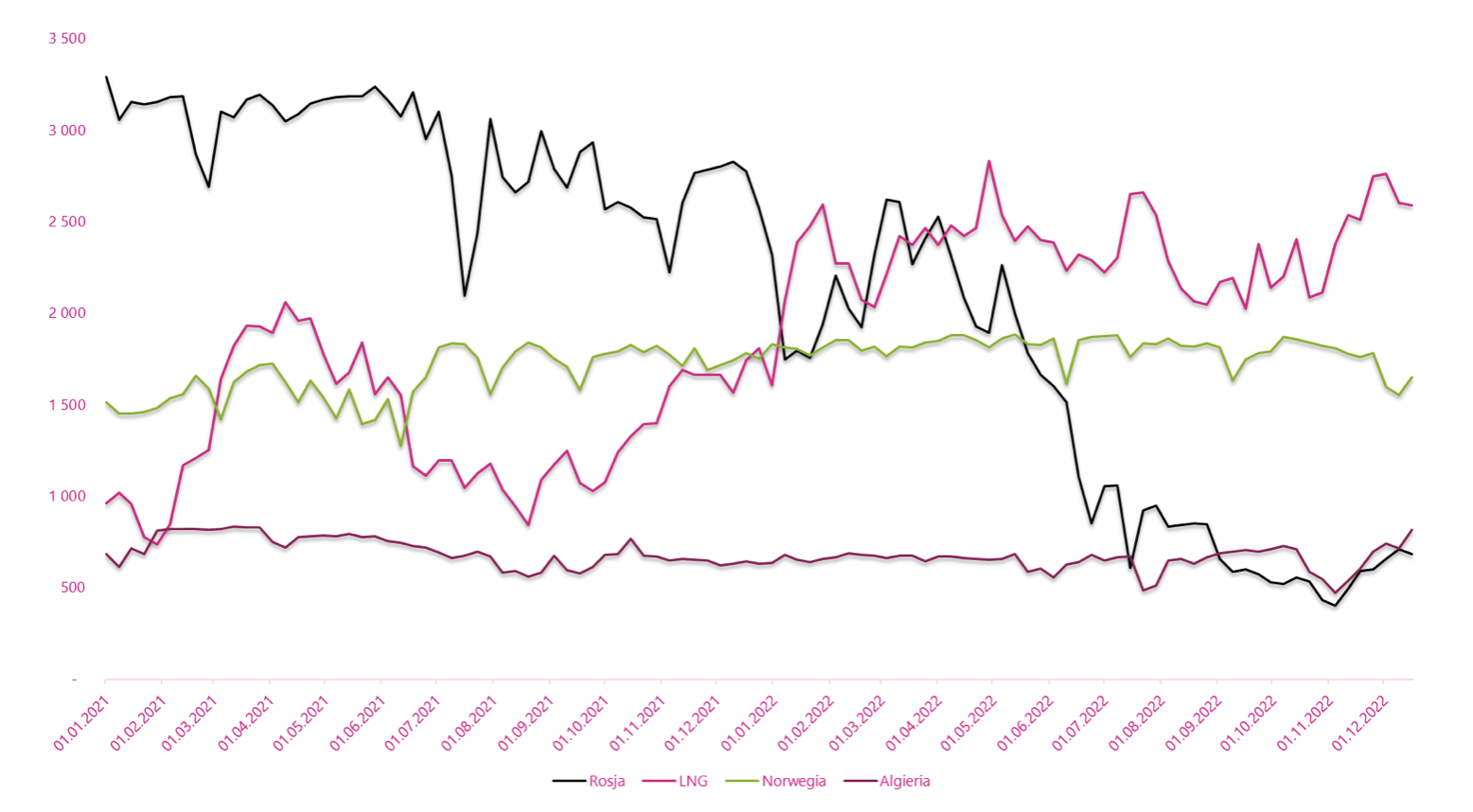

Main sources of gas imports to Europe in 2021-2022 (million cubic metres)3). Source: Own study based on Bruegel.org data (European natural gas imports - Dataset)

LNG deliveries almost entirely made it possible to compensate for the shortages resulting from the reduction of supplies from Russia. However, this segment is associated with a number of uncertainties. It is possible that in the face of China's exit from the "zero-Covid" policy, the demand for LNG in Asian countries in 2023 will increase, which may generate greater competitiveness and make it difficult to guarantee the same level of supplies as in 2022.

The second factor that should not be forgotten in the context of the demand/supply balance is the reduction of demand for gas. The lower demand for gas was mainly determined by its price, which in extreme moments was several times higher than the average in recent years. According to data collected for the first 11 months of 2022, demand in EU countries fell by as much as 11% compared to the previous year. In some countries, the downward dynamics may be shocking. In the case of Finland, it is -53%, and for the main EU economies, such as Germany (-15%) or France (-9%), the declines are also above average. In Poland, it is estimated that demand decreased by 13% over the same period.

Impulse for industries affected by the gas crisis

The situation on the gas market has a significant impact on the functioning of enterprises. In many industries, the purchase of gas is a key cost of the company's operations, which has a negative impact on profitability, and in extreme cases translates into limiting or suspending production. At this point, companies from the chemical industry, but also many industrial enterprises should be mentioned. The year 2022 was full of market information indicating a decision to limit the production of fertilizers, aluminum, steel and many other products, putting many European companies at a disadvantage compared to global competitors. The stabilization of the situation on the gas market offers an opportunity to reduce the resulting imbalances and provides space for a "new life" for many companies.

Summation

In recent quarters, the gas market has become a source of many current problems and concerns about the future of European countries. Adapting to unfavorable market circumstances by Europe and ensuring alternative directions of gas supplies to the Old Continent allows for gradual mitigation of the negative consequences of the current situation. The high level of gas in storage facilities and favorable weather conditions have been the catalysts for the fall in gas prices on European exchanges in recent weeks. Continuation of the favorable trend may allow Europe to catch a balance and avoid a "hard landing", which may accelerate the return of the economy to the path of growth.

Author of the article: Piotr Langner, Investment Advisor, WealthSeed

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response