Omikron gives way - what companies are gaining?

Although the US stock market has recently experienced a period of declines - S & P500 since the beginning of the year it has decreased by 8,2 percent. and increased volatility - VIX volatility index increased by 60 percent. in the same period, it was the companies involved in the economic recovery after the pandemic that made profits at the time.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Industries re-opens with a chance

Since the beginning of the pandemic, the stock market has distinguished between two groups of companies, the current results of which are related to it (to a greater or lesser extent). The first are "work-from-home" companies, ie those that benefited from the fact that most of the employees stayed at home. These are companies from various industries, such as computer games, e-commerce, home finishing and decoration, and remote work. Its opposite are "Re-openers", i.e. companies associated with the opening of the economy after the pandemic. They include, among others companies related to the tourism industry: airlines, shipping, car rentals, hotels and casinos.

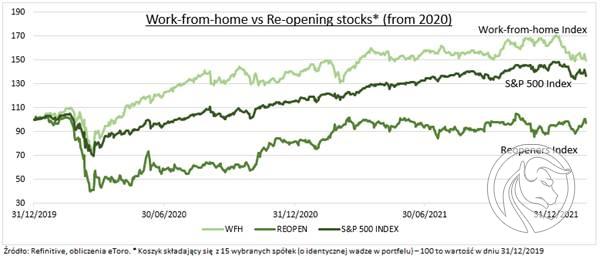

In order to compare these two groups, we created indices (see chart) with 15 companies from each group. Since the beginning of the year, while the S & P500 has dropped, re-openers have seen a positive rate of return. These companies proved to be immune to the effects of the spread of the variant Omikron coronavirus as well as market volatility. And ahead of them is a time of increased profits related to the economic opening up after the pandemic, which is clearly subsiding. In many countries, such as the United Kingdom and Denmark, most pandemic restrictions have already been lifted. Also in Poland, the Ministry of Health announced a possible loosening of the restrictions in early March. Re-openers' share prices have remained 40% since the start of the pandemic. below the S & P500 index, these companies' profits are half of their pre-pandemic levels, and their valuations, when profits return to their former levels, will be well below market average. This means they have a lot of room for growth as economies recover. This is especially true of the tourism industry, which is constantly operating in slowdown in the world. When the pandemic restrictions in most countries are gone, the recovery of the industry is likely to be quick, although one should also bear in mind the constantly rising oil prices.

Source: Refinitive, eToro calculations. * Basket consisting of 15 selected companies (with the same weight in the portfolio) - 100 is the value on 31/12/2019

When it comes to stay-at-home businesses, our index of stay-at-home companies has fallen by 12% since the beginning of the year, which is more than the S & P500. The share prices of these companies are currently around 50%. higher than at the end of 2019 (before the start of the pandemic). Company valuations exceed pre-epidemic levels, but are justified by 50%. higher earnings forecasts than before it exploded. This does not apply to all companies, some of them, such as Netflix and Peloton, performed below market expectations, which resulted in a serious sell-off for them.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response