Options: Gamma - coefficient estimating the change in the option price

It was described in the previous section Greek coefficient - delta. It allows you to determine how much the option price changes in the event of a change in the price of the underlying instrument. However, the delta itself also varies depending on the strike price, volatility, and the time until the option expires. Greek coefficient which allows you to test the sensitivity of a change in the delta caused by a change in the price of the underlying instrument is gamma. It is also one of the so-called "Second derivatives". Gamma allows you to significantly improve the management of the "delta-neutral" strategy and more accurately estimate the change in the price of the option along with the change in the value of the underlying instrument.

READ NECESSARY: WHAT ARE THE OPTIONS? INTRODUCTION

What is gamma

In the simplest definition, gamma determines how quickly the option delta changes due to a change in price stock, index or currency on which "Based" there is an option. This makes it easier to estimate the change in the option price. Of course, the gamma size is not constant. What it comes from? The answer is very simple. The delta of the call option can be in the range 0 to 1, while the put option can be from 0 to -1. Since the range is finite and the price of a stock or index can theoretically grow indefinitely, the gamma must change. There are several factors that influence the size of the gamma. These are:

- Option settlement price,

- Time until option expires,

- Variability.

Option settlement price

This parameter affects the size of the gamma. As a rule, options can be divided into three types:

- ITM options,

- ATM type options,

- OTM options.

ITM options are otherwise called "in money". ITM stands for the type of options that have an intrinsic value. In the case of a call option, this means that the option strike price is lower than the current market price of the underlying asset. In the case of a put option, the exercise price of the option is higher than the market price of the underlying instrument.

ATM options is a type of option whose strike price is equal to the current market price of the underlying instrument. It has no intrinsic value. The total price of the option consists of the so-called time value.

OTM options are the "cheapest" in nominal terms. These are options whose strike price is either higher than the market price of the underlying instrument (for call options) or lower (for put options).

As mentioned before, delta is limited to 0 to 1 for the call option and 0 to -1 for the put option. Why can't the delta of the call option be higher than 1? The answer is simple. If the price of the call option had increased by 1,5 while the price of the underlying would have increased by 1, the possibility of arbitrage would arise. It would consist in the investor writing a call option and buying the appropriate amount of shares at the same time.

For example:

The $ 50 strike option is currently $ 0,5 and the current stock price is $ 50. For example, a share price would go up by $ 1 and options would go up by $ 1,5. This would mean that the option delta is 1,5 (an increase in the instrument by $ 1 increases the delta by 1,5). The current option price is $ 2 with an exercise price of $ 50. The current market price is $ 51. The investor issues an option with an exercise price of $ 50 to $ 200 ($ 2 * multiplier). The investor writes an option when he receives $ 200 and invests $ 5100 by purchasing shares ($ 51 * 100). After some time, the option price drops below $ 1 (the market finds itself ineffective). The investor buys back the option and sells the stock for $ 51. Profit from the transaction exceeds $ 100.

The more the ITM call option is, the larger the delta it has. However, the delta shift slowly diminishes as you get closer to 1. This means that the option gamma (delta shift) decreases with increasing delta. If the delta value reaches 1, the gamma value for growth will be 0, and if the price drops, the gamma value will be close to 0.

The more the OTM call option is, the smaller the delta it has. The limit of the delta value is 0. This means that as the delta decreases, its change is smaller and smaller. This means that the gamma of the options (delta change) goes down as the delta gets smaller.

As you can easily guess, the gamma value is the highest around ATM, i.e. when the option strike price is closest to the current market price. It is worth noting that the gamma value is always positive. Regardless of whether the option is of the call or put type.

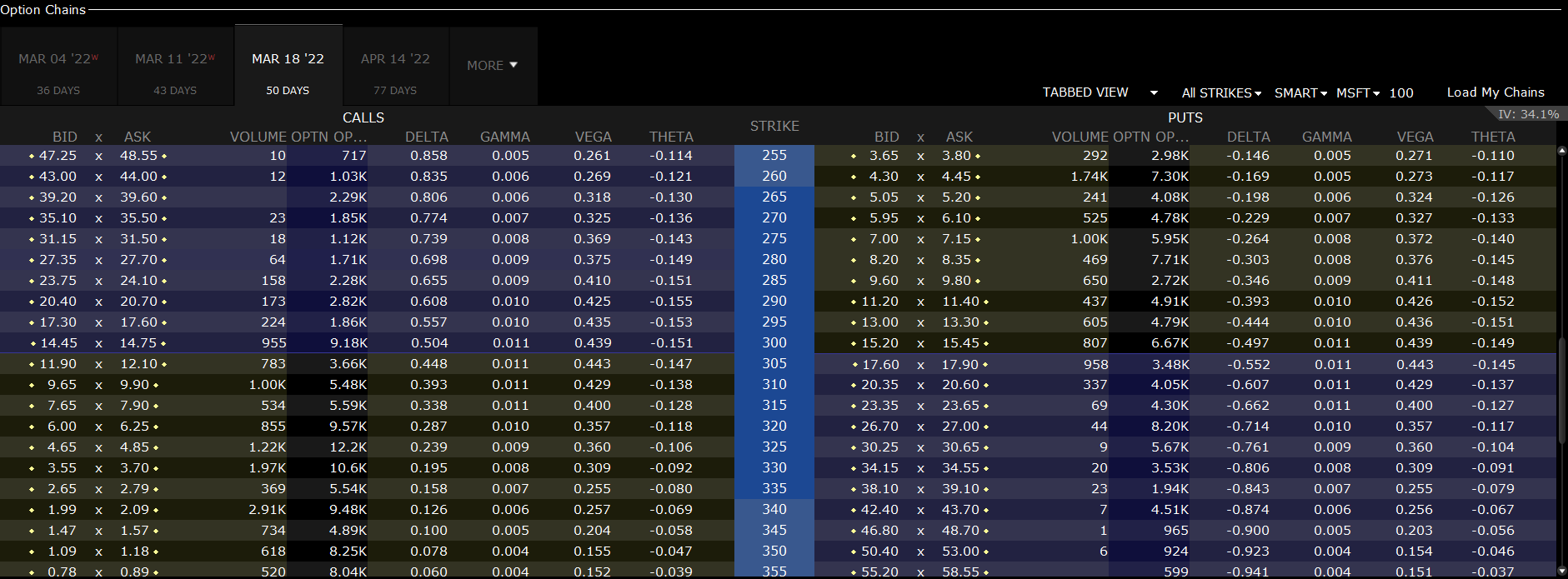

It is worth following an example. Listed below are call and put options for Microsoft shares expiring on March 18, 2022. The graphic below was made on January 27, 2022.

Source: GRP platform

The picture clearly shows that in the case of the call gamma option it is the highest for options located in ATM and they are falling as they move away from the market price of Microsoft stocks. The gamma for a call option with a strike of 300% is 0,011. This means that a $ 1 change in price causes a delta change of 0,011. As you can see, the delta of the call option with the strike price of $ 300 is 0,504. In turn, the delta for a call option with a strike price of 295 is 0,557. Estimating the change in delta based on gamma, we get the value 0,559. Of course, a list delta using gamma's an approximation, not an exact value. Hence, there is a slight difference in the calculation of the "theoretical" and "real" delta.

Gamma and time to exercise options

Gamma is related to delta, which in turn also depends on the time it takes to exercise an option. We know from the text about delta that the closer it is to the option execution, the following are:

- The value of the delta of ITM options (in money) is increasing,

- The delta value of the OTM option is falling (except for money),

- The delta for the ATM option has a similar value.

Below are examples of option deltas for call options on Microsoft shares. Data from January 27, 2022:

|

Call options on Microsoft |

March 4, 2022 |

March 18, 2022 |

April 14 2022 |

|

Strike price: $ 260 |

0,867 |

0,843 |

0,810 |

|

Strike price: $ 280 |

0,733 |

0,712 |

0,690 |

|

Strike price: $ 300 |

0,516 |

0,522 |

0,528 |

|

Strike price: $ 320 |

0,267 |

0,304 |

0,347 |

|

Strike price: $ 340 |

0,096 |

0,134 |

0,190 |

Interesting relationships happen with the gamma itself. For the option that is ATM, the gamma value increases. This is because the shorter the time to expiry of the option, the more sensitive the ATM price is to changes in the value of the underlying instrument.

The reverse is the case with deep ITM and OTM options. In the case of a deep OTM (DOTM) option with a week to expiration, the chance that the option will become ITM is practically zero. For this reason, the delta is insensitive to changes in the price of the underlying instrument. The same is true for the Deep ITM (DITM) option. If the delta is above 0,95 the gamma is very small. It is worth using a gamma comparison on the basis of stock options of the German technology company SAP SE. The price per share was € 4 on February 2022, 110.

Below is a summary:

|

Call options on SAP |

11 February 2022 |

March 18, 2022 |

June 17 2022 |

16 December 2022 |

|

Execution price: 90€ |

0,003 |

0,008 |

0,011 |

0,011 |

|

Exercise price: € 100 |

0,017 |

0,024 |

0,019 |

0,015 |

|

Exercise price: € 110 |

0,116 |

0,043 |

0,026 |

0,017 |

|

Exercise price: € 120 |

0,007 |

0,024 |

0,022 |

0,015 |

|

Exercise price: € 130 |

0,001 |

0,006 |

0,013 |

0,012 |

As you can see for the option with the longest execution time, the option gamma becomes flatter. This is because the deltas for the DITM options are much smaller than for the faster-to-execute options. On the other hand, DOTM deltas for options with a longer time to exercise are higher than those for options with the same strike price but with a shorter time to expiry.

For a comparison of the delta SAP stock options as of February 4, 2022:

|

Call options on SAP |

11 February 2022 |

March 18, 2022 |

June 17 2022 |

16 December 2022 |

|

Execution price: 90€ |

0,991 |

0,934 |

0,876 |

0,814 |

|

Exercise price: € 100 |

0,949 |

0,818 |

0,735 |

0,673 |

|

Exercise price: € 110 |

0,418 |

0,481 |

0,503 |

0,507 |

|

Exercise price: € 120 |

0,013 |

0,127 |

0,261 |

0,351 |

|

Exercise price: € 130 |

0,001 |

0,023 |

0,109 |

0,227 |

Gamma and volatility

This section describes the relationship between volatility and gamma. For low volatility stock options, the ITM reacts sharply to the price movement. This is because option traders do not expect a lot of volatility in stocks and therefore do not pay much for the time premium. In turn, for deep ITM and OTM options, low option volatility causes the gamma to drop drastically. For DOTM (deep in money) it is because of a very low delta, for DITM (deep in money) it is because of a very high delta.

The situation is completely different in the case of options on instruments with very high volatility. In such a situation, sudden changes in the price of the underlying instrument are not unusual. As a result, investors are willing to pay more for these types of options, even if they are deep beyond the money. This causes the time value of the option to increase. At the same time, high expectations of high variability make gamma relatively "flat".

Delta strategy - gamma neutral

Delta can also be used to create portfolio hedging strategies. This strategy is to build a portfolio with a delta of zero (delta neutral). In such a situation, the loss on the equity portfolio is compensated with the gain on options. It should be noted, however, that the wallet is only in the delta neutral position for a short time. The reason is the constant change of the option delta, which requires the portfolio adjustment (so-called rebalancing). The periodic change of the portfolio means that a so-called dynamic delta hedging is used.

As you can see, using the neutral delta strategy alone is not very useful in case of large market fluctuations. The reason is "gamma" which alters the delta coefficients of the option which causes the position deltas to "mismatch". The solution is to build the portfolio in such a way that the delta and gamma coefficients are neutral.

For example:

An investor buys 10 call options on SAP shares with an exercise price of € 110 expiring on March 18, 2022. The delta of this option is 0,481. This means a delta of 481 (0,481 * 10 * multiplier). The price of one option is € 344 (€ 3,44 * multiplier). To neutralize the delta effect, the investor has to sell 481 SAP shares for € 110. In effect, the delta is 0. However, one call option has 0,044 gamma. Multiplied by 1000 shares equals 44. To reduce the gamma, the investor decided to write 40 put options with an exercise price of € 126. The gamma of one option is 0,011. Multiplied by 4000 actions, the gamma is -44. In effect, the gamma is 0. However, the written option has a delta of 0,954 (the written put has a positive delta). As a result, the position delta is 3816. It is worth adding that one option has a value of € 1715 (€ 17,15 * multiplier). As a result of this calculation, the investor should shortly sell 3816 SAP shares at a price of € 110. As a result, the wallet has both a neutral gamma and a delta.

Summation

The gamma of options is a very important Greek factor. It allows you to estimate how the gamma value will change when the price of the underlying instrument changes. Thanks to this, the investor is able to "predict" how the delta may change, which allows to more accurately estimate the potential profit from an option transaction. Another use of gamma is to build a wallet that is delta-gamma neutral.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![VSTOXX - the European equivalent of the American VIX [Guide] Vstoxx index](https://forexclub.pl/wp-content/uploads/2022/10/Index-vstoxx-300x200.jpg?v=1666609979)

![VIX Index [Fear Index] - in search of market volatility [Video] vix fear index](https://forexclub.pl/wp-content/uploads/2021/12/vix-index-strachu-300x200.jpg?v=1638525622)

Leave a Response