Tax on investment in XTB - how to handle it? [Dividends and foreign shares]

There is the last week left to settle accounts with the tax office Forex tax, CFDs and other equity investments. Practice shows that it is at the last minute that most traders focus on it "Sad duty". Contrary to what you can read on the web - this process is not difficult at all and does not require specialist knowledge. In the case of foreign Forex brokers, our application comes to the rescue Forex Club - Tax 8 and our knowledge base.

But there are also many myths and confusion about this year's tax settlements on transactions concluded with Polish brokers, such as XTB. In this article we explain, just on the example of this broker, what should be done to make it fast and trouble-free settle all transactions.

PIT-8c and foreign shares and dividends

In accordance with applicable regulations, the XTB brokerage house provides its clients with PIT-8C, which includes income from: contracts for exchange rate differences (CFDs on shares, currencies, commodities, ETFs, cryptocurrencies, etc.) and from the sale of shares and ETFs listed on the WSE . Because in their annual tax return, investors should also take into account the income from the sale of shares / ETFs listed on foreign stock exchanges, XTB also provides data on such transactions for the purposes of completing the PIT-38 form. Additionally, XTB is the first brokerage house in Poland provides data on taxes on foreign dividends for the purposes of their correct disclosure in the annual tax return, and collects all investment data, necessary for the correct completion of the PIT-38 annual declaration and presents them in one collective document - Tax report.

Remember that CFDs on stocks are a different category of instruments than "physical" stocks (!).

XTB tax report

The PIT-38 tax form has separate fields where it is enough to enter the appropriate values provided by XTB in Tax report. For the investor's convenience, XTB indicates in the document which value should be entered in a given item of the form:

Examples of data included in the tax report:

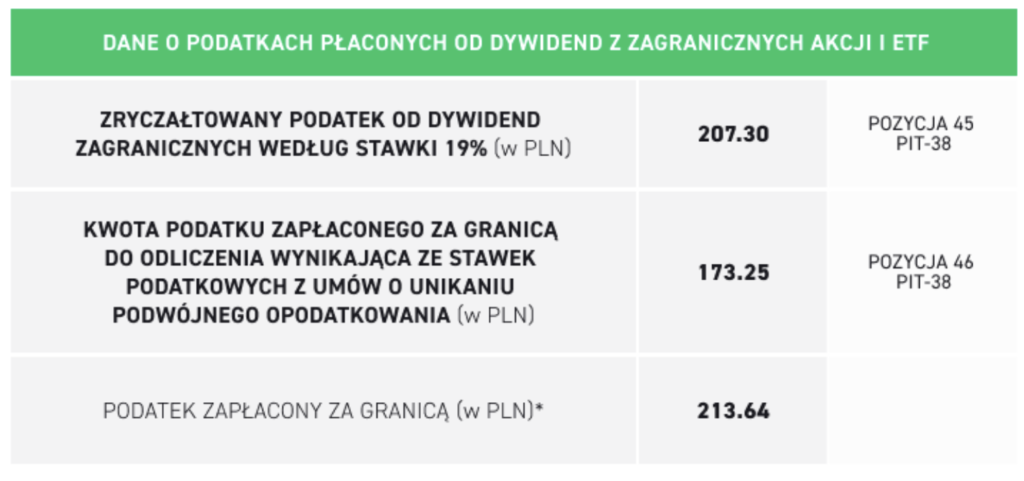

Investors who in the tax year 2021 achieved income from dividends on foreign shares or ETFs in XTB, as a rule, should also include these income in the annual settlement, rewriting the appropriate values in the fields of the PIT-38 tax form indicated in the list.

Examples of data included in the tax report:

The XTB brokerage house also provides a full list of revenues and costs from foreign exchanges. You can find there, among others the number of each transaction concluded, its volume, symbol and ISIN of the instrument, as well as the opening and closing prices of the position.

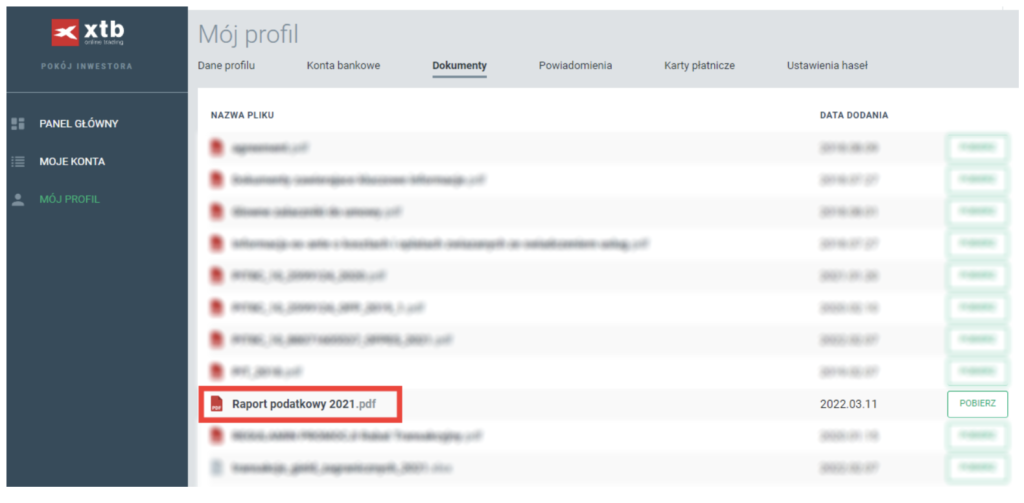

Where to find the Tax Report?

The tax report, like PIT-8C, is made available to XTB's clients in Investor's room in the bookmark My Profile -> Documents.

To make it even easier for customers to make their annual billing, XTB has published Handbook on accounting for tax on income from cash capital, in which you can find a number of tips to help you settle your capital gains tax.

The brokerage house also prepared responses to frequently asked questions about tax settlements. It may seem complicated at first glance, but it definitely is IS NOT. With the help of all the above materials, it will take you literally a few to several minutes.

Do you use the services of a foreign broker?

Everything you need to know:

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Tax on investment in XTB - how to handle it? [Dividends and foreign shares] xtb tax report](https://forexclub.pl/wp-content/uploads/2022/04/raport-podatkowy-xtb.jpg?v=1650629603)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Tax on investment in XTB - how to handle it? [Dividends and foreign shares] macron marie lepen](https://forexclub.pl/wp-content/uploads/2022/04/macron-marie-le-pen-102x65.jpg?v=1650622372)

![Tax on investment in XTB - how to handle it? [Dividends and foreign shares] forex club tax 8 video](https://forexclub.pl/wp-content/uploads/2022/04/forex-club-podatek-8-video-102x65.jpg?v=1649947587)

Leave a Response