Potential cryptocurrency regulations (again) in focus

Last week, a number of countries raised the issue of cryptocurrencies, which fueled the debate over potential regulations. Despite this, more than $ 2 billion was poured into cryptocurrency companies and projects in August. After amassing over $ 300 million in June, one noteworthy project - Solana - Last week, it experienced an outage that lasted about 18 hours.

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

Regulation once again in the spotlight

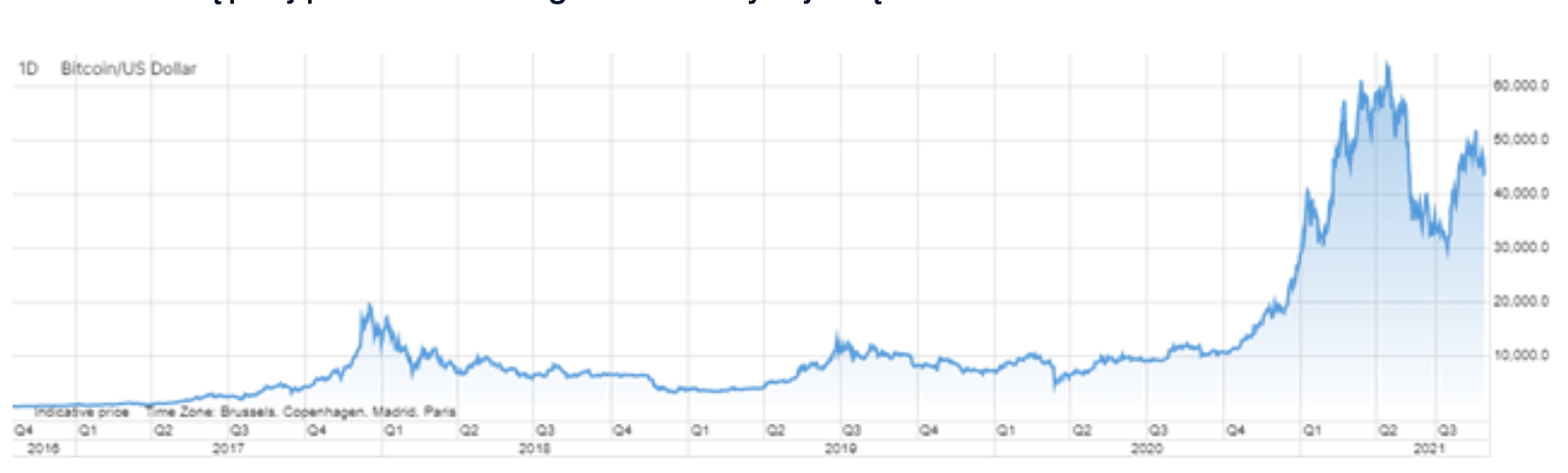

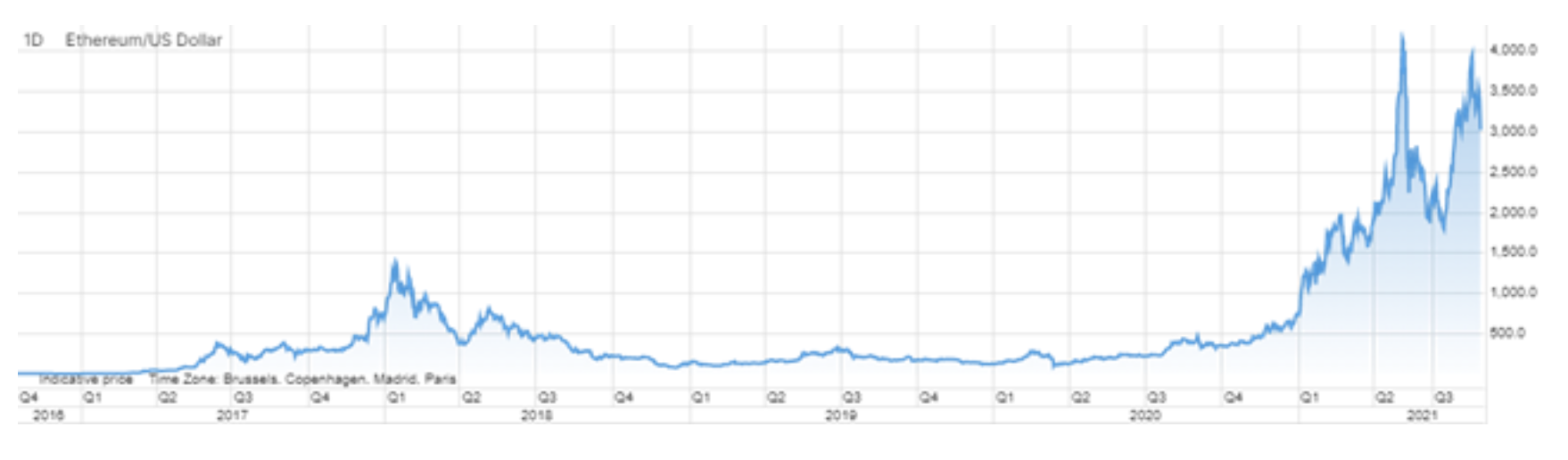

The global cryptocurrency market is to some extent unregulated or, at best, vaguely regulated by local and often outdated laws that did not address cryptocurrencies at the time of development. With the growing market capitalization of the crypto area and the increasing activity of chains over the past year, regulators are turning more and more attention to cryptocurrencies. Market participants should be aware of how regulation can affect the market - both positively and negatively.

Recently, regulators have been attracting the attention of "stabilized currencies" (ang. stablecoinswhich are pegged and linked to other assets) because on a year-to-date basis supply increased from $ 29 billion to $ 123 billion. Last week, many opinion-forming American newspapers reported, that this is currently the most pressing topic in Washington's financial circles as regulators are examining how to properly regulate the stablecoin issue. According to the portal Bloomberg officials are even considering a formal review by the Financial Stability Supervisory Board (Financial Stability Oversight Council) to determine if they pose a threat to the economy. The impact of stablecoin regulation on the cryptocurrency market should not be underestimated, as they act as a benchmark in the crypto market due to the fact that they are the most liquid currency pairs and are the basis of most decentralized financial protocols. On the other hand, the regulations governing stablecoins could possibly prove beneficial as an appropriate regulatory framework and clarity on regulated entities can provide more stability in this area.

Russian central bank reportedly issued guidelines directed to banks so that they stop the transfers of fiat money to cryptocurrency exchanges. As the central bank maintains, the goal is to avoid "emotional" purchases of cryptocurrencies by Russian investors and thus protect investors from losses if the market "collapses to zero." Over the years, the possibility of a total introduction has been mentioned many times ban on cryptocurrencies in Russia, however, it did not enter into force.

On the other hand, Uzbekistan banned cryptocurrency payments as early as late 2019, and the country will likely never ease the ban, judging from last week's statements by the deputy governor of the Central Bank of Uzbekistan, who argued that cryptocurrencies have no real value.

Last week, Turkish President Recep Tayyip Erdoğan attended a question-and-answer session. One participant asked Erdoğan for his opinion on cryptocurrencies; the answer was:

"We have absolutely no intention of accepting cryptocurrencies."

Erdoğan added that Turkey is competing with cryptocurrencies as it is in the process of launching the Central Bank's Digital Currency (CBDC). Central Bank Digital Currency), the first tests of which are scheduled for the end of this year.

Venture capital gains access to cryptocurrency companies

The last month was definitely unique in terms of venture capital investments in companies and projects related to cryptocurrencies and blockchain technology. According theblock, nearly $ 2,1 billion was invested in companies in this industry through 124 financing rounds. In the second quarter of 2021, it was successful in total gather $ 4,38 billion, compared with $ 2,89 billion in the first quarter. Considering that Avalanche cryptocurrency has obtained last week $ 230 million, The third quarter is likely to exceed the total amount of investments from the second quarter. Basically, increased investment activity in companies and projects related to cryptocurrencies and blockchain technology indicates a growing faith in enterprises and ventures serving the cryptocurrency and blockchain technology industry.

The Solana network recorded an outage lasting 18 hours

In the context of fundraising, Solana - currently the seventh largest cryptocurrency measured by market capitalization, which in June this year raised USD 314 million - she was around eighteen last week failure. During this time, users were unable to send transactions and interact with the entire network, which in practice meant that the funds in blockchain technology, including stablecins, were unavailable. Since Solana is officially in beta, the crash was caused by the network being tossed with an unmanageable number of transactions, rendering the entire network down. After this event was implemented hotfixto prevent this problem from reoccurring; additional corrections will also be introduced to ensure the tightness of this solution. The crash showed the vulnerability of the current cryptocurrencies, especially the newest ones that have not yet been tested under all conditions. All in all, the crash is unlikely to lead to a favorable stablecoin regulation, as having billions in such a currency offline for approximately 18 hours does not seem advisable.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response