The Federal Reserve and the Bank of England: same problems, different paths

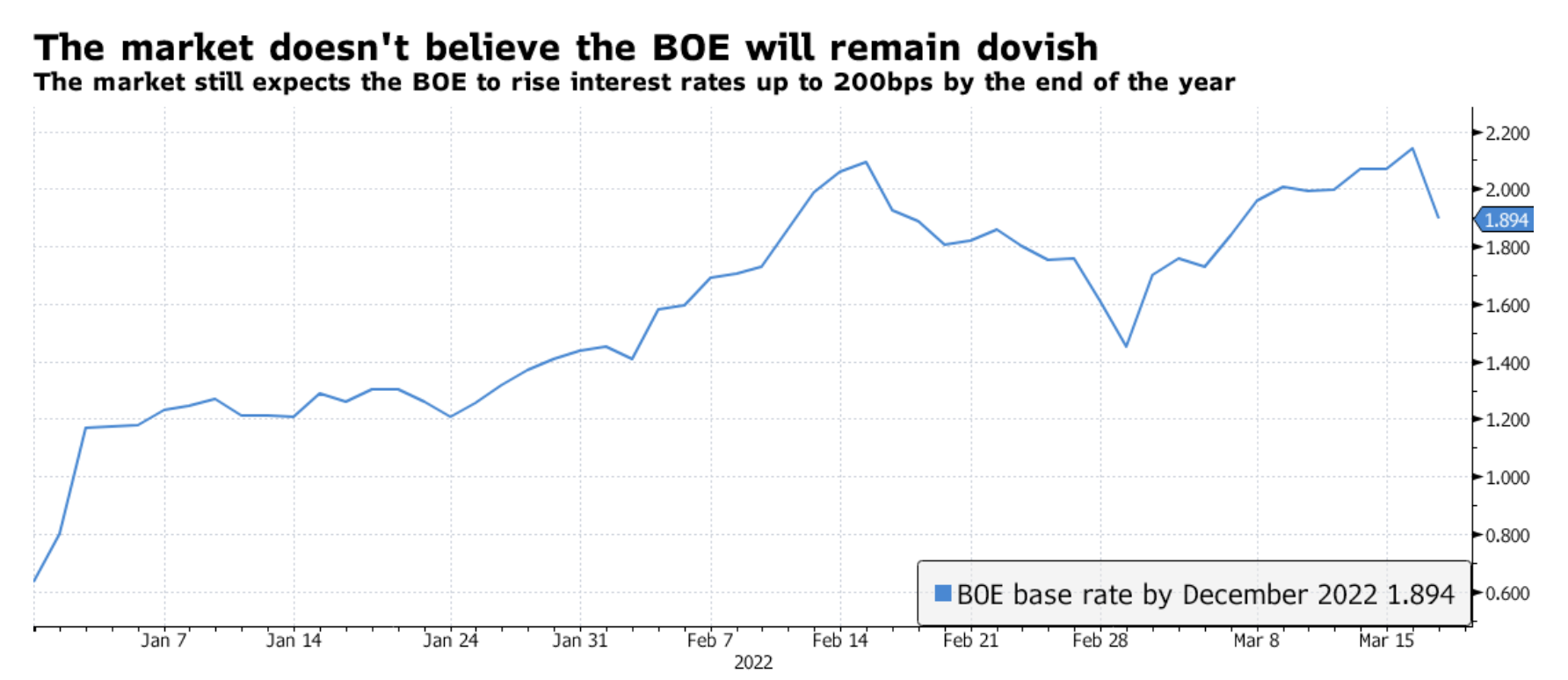

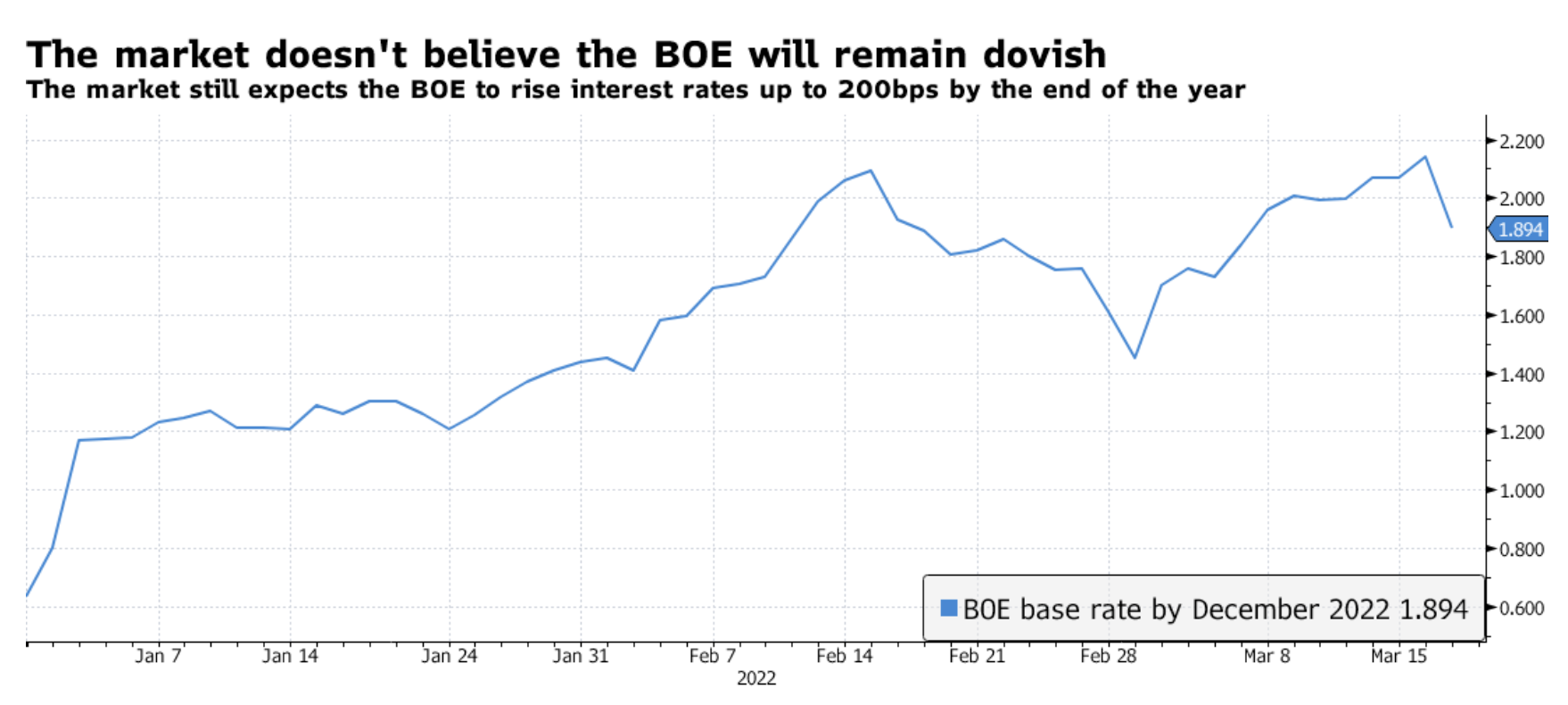

The market is not buying the narrative either Federal ReserveNor Bank of England. While the Federal Reserve believes it can aggressively tighten the US economy without triggering a recession, the bond market maintains that a slowdown may be inevitable. Despite a dovish meeting on monetary policy in the UK, investors still believe that the Bank of England will not be able to maintain its soft approach and that it will be forced to raise rates to 2% by the end of the year.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Feet up but slowly

After aggressive rhetoric European Central Bank last week and the Federal Reserve the day before yesterday, the market expected that the Bank of England would also make a “hawkish” decision on monetary policy. However, he did not join the chorus of central banks about the need to fight inflation, and instead of focusing on price pressures, he focused on economic growth. This is a significant change compared to the February meeting of the Bank of England, at which four out of nine members voted for a rate hike of 50 bp instead of 25 bp. As can be inferred from the conclusions of the monetary policy meeting, An interest rate hike of 50 bp is currently not taken into account.

"In the opinion of the Commission may be appropriate further moderate tightening of monetary policy in the coming months ”. In February, this passage assumed that the tightening of the policy "most likely it will be appropriate".

The central bank sends a message that it prefers to tighten the economy at a slow pace as the risk of stagflation increases with the continued increase in inflationary pressure and slowing growth.

BoE too gentle?

There is, however, a problem with the reasoning of the Bank of England. Until the end of last year, it was predicted to be one of the most aggressive central banks in developed countries. At present, it seems to be the most mild, which negatively affects the pound against the US dollar and thus supports the rise in inflation.

Therefore, the market is not buying a statement from the British central bank. Before the announcement of the monetary policy decisions, investors had estimated that by 2022 the base interest rate of the Bank of England would increase to 2,25%. After yesterday's meeting, they predict only five rate hikes, as a result of which the base rate will rise to 2%. If investors thought the Bank of England could afford a less aggressive policy, they would boldly lower their interest rate expectations for this year.

On the other side of the Atlantic, the Federal Reserve's announcement was clearer: the central bank will not rest until inflation is under control. The hawkish statement from the Fed was supplemented forecast (the so-called dotplot)which almost fully matched the market expectations for interest rate hikes. Interestingly, the forecast shows that interest rates will rise above the Fed end rate by 40 bp in 2023 and 2024., which suggests that the central bank assumes that high inflation will last longer than expected.

The biggest problem with the Fed's decision is that there is a stark contrast between the central bank's monetary tightening program and its economic outlook. While economic growth has revised down from 4% to 2,8% this year, the Fed expects it to remain above 2% over the next three years. Even more surprising is the forecast for the unemployment rate, which suggests that unemployment will remain stable over the next few years, rising from 3,5% to 3,6% in 2024. The assumption that economic growth and unemployment will remain stable during when the central bank tightens the economy, it is a manifestation of wishful thinking. Limiting consumption demand means weak growth or higher unemployment, and neither of these phenomena has been taken into account in the forecasts.

Summation

In the UK, the central bank is realistic about the impact it may have on the economy high price pressure and the war in Ukrainehowever, does not see the danger of inflation remaining at a high level. In the United States, the Federal Reserve continues to ignore the economic impact of high inflation and an aggressive monetary tightening program, while also demonstrating its readiness to contain price pressures.

Nevertheless, the bond market rightly signals that we may be entering dangerous regions. Since the Fed meeting, the US yield curve on the section between the five- and ten-year yields has been reversed for a short time. In our view, as the markets try to analyze the Fed's communiqué, the inversion in this area will consolidate and could lead to an even greater inversion in other parts of the US yield curve. In historical terms an inverted yield curve signals the possibility of a recession within 12-18 months. However, there is a risk that an economic downturn will occur much earlier, and even before the inversion occurs.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response