The oil market facing inflation

As Poles, we like to complain about what is inherent in our national temperament. Nevertheless, complaints about rising fuel prices are no longer the result of even stereotypical perceptions of reality by our nation, but a real cause for dissatisfaction. I think most of us perfectly remember the day when last year's trading oil in the US fell below zero. Few believed then that the market would be able to rebuild the entire congress within the next few months. However, investors did so. Together with Bartłomiej Chomka, an analyst from TeleTrade, we looked at the impact of inflation on the commodity markets and the outlook for the near future. We invite you to a casual conversation that we had and whose conclusions I put on the proverbial paper.

Can oil continue to grow?

It is not hard to believe that real inflation (not the one shown in the indicators) is much higher than the one central banks tell us about. It is enough to remember how much fuel cost around March 2020 and how much it costs today. Of course, there are many more factors that affect fuel prices and it is more about the concentration of this market. The three main producers account for about 70% of world production (of course, we are talking about the USA, Russia and OPEC). Thanks to this, maneuvering the supply of crude oil is much easier than when the production would be divided into several hundred smaller raw material suppliers.

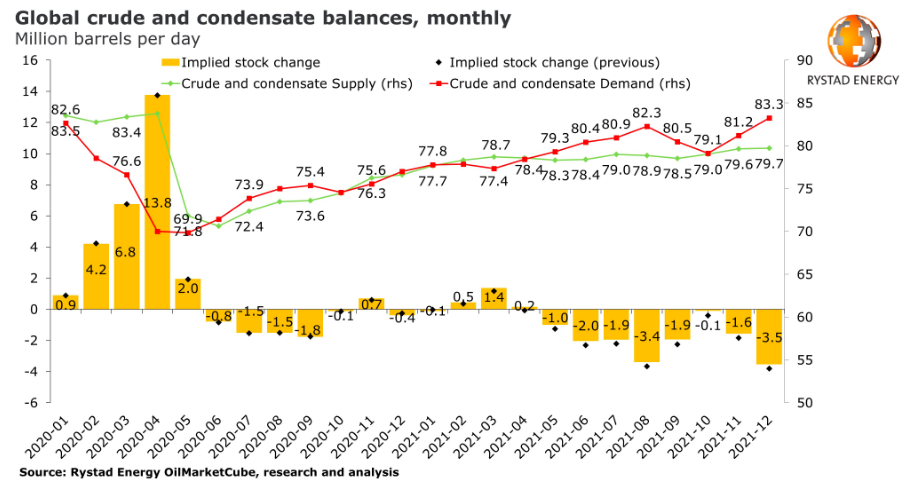

The Covid-19 pandemic devastated oil demand in 2020, creating huge oversupply and filling stocks, causing producers to cut back production to keep prices somewhat profitable. This junction between supply and demand is perfectly illustrated by the chart below provided by Rystad Energy.

We are primarily interested in the green (supply) and red (demand) lines. We can see that the green line ranked high (a large number of barrels available on the market) while the demand was scrubbing the proverbial bottom. The crude oil decreased, so we could pour cheap fuel into the tank at the turn of March and the next few weeks. How does it look today and why is it so expensive? Just look at both lines again. What can I say, when some lose, others gain. Just look at the financial reports of mining companies. The rebound in prices has helped to significantly improve the cash flow of crude oil producers since the second quarter of last year. In the US in particular, the price rebound - even before WTI hit $ 50 a barrel - helped shale producers generate record-high free cash flow in the third quarter of 2020.

Inflation and oil

Inflation it is undoubtedly correlated in some way with the oil market. Concerns about price increases are justified, however, they should be calibrated by one important parameter - time. Central Banks they run an incredibly expansive policy. As part of supporting the economy, money is also deposited into household accounts. However, in order for inflation to run freely, it is necessary to return to pre-pandemic habits (it is worth watching retail sales indicators, consumer spending and moods). Another factor influencing inflation is commodity markets, including, of course, oil. Its price may already influence increased inflation expectations, as the quantity supplied is predetermined in order to maintain profitability of production.

While waiting for a recovery, it is worth bearing in mind that the inflation minimum is already behind us, and in line with the business cycle, the time of commodities comes right after the profitability of investment in shares. We are then dealing with the so-called the inflationary phase of the economic recovery. Increased demand pushes prices up, which is reflected in inflation. The commodity markets, including the oil market itself, will play a significant role in the process of its formation. So perhaps what is currently happening at WTI is just the beginning of bigger gains.

What will inflation look like in the near future?

I tried to answer this question with Bartłomiej Chomka. In our conversation, several conclusions related to the increase in prices emerged, which we will talk about in a moment.

Bartłomiej Chomka sums up the current situation:

- US CPI inflation increased to 1,7% YoY from 1,4% YoY, however core inflation (excluding prices of food, fuel and energy) fell from 1,4% y / y to 1,3% y / y. The prices of natural gas (6,7%), food (3,6%) and electricity (3,2%) were the most expensive. Markets read the data positively as 10-year bond yields started to decline, and it is their increases that are driven by higher inflation and economic growth expectations. The market bar against high inflation has been suspended quite high since July 2008.

- The defrosting of the US economy may increase the mobility of Americans, which in turn may increase the prices of hotel accommodation and airline tickets. Inflationary pressure has so far been concentrated in the face of higher oil prices. Low prices in March 2020 may have an impact on the base effect and on an annual basis inflation may break the level of 2%. The higher average temperature in the US, combined with vaccinations, could stop the increase in Covid-19 cases (which will help with consumption and higher inflation in the spring and summer). The last quarter of 2021, another flu period, that will verify the effectiveness of vaccinations and show whether the society will be immune to potential new strains of coronavirus, may be key to the sustained economic recovery and higher inflation in the US. An important element contributing to higher inflation will still be the condition of the US labor market, and more specifically how much time the economy will need to rebuild the millions of jobs lost. Treasury Secretary Janet Yellen said in a recent statement that unemployment will drop to pre-pandemic levels at the beginning of next year (which may be a very optimistic assumption). M2 money supply in the US increased by as much as 20% over the year, but the pace of money circulation is close to historic lows (Q2 2020) and it is one of the key factors that may determine whether the Fed's average inflation target will eventually be met . "

Summation

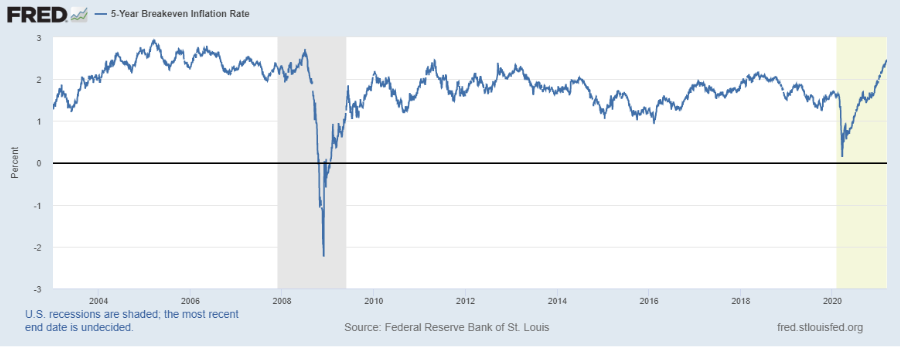

What lessons can be drawn for the future? First of all, that inflation expectations from the angle of yields will be much higher in the coming months. Just look at a simple indicator of inflation expectations. It may not be accurate, but nevertheless it indicates the sentiment and direction the market may follow in the near term (long-term).

These expectations are largely influenced by oil prices, which may continue to climb due to OPEC's actions. In the long term, other sources of alternative energy may pose a significant threat. However, this is such a distant topic that it is not worth discussing it in the context of the energy market yet. The American market is reviving a bit, as Bartłomiej said. As a result, there is a real prospect of consumers returning to their old purchasing habits, which may significantly affect inflation in the coming months.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response