Saxo Bank cuts the margin requirement to $ 2

Saxo Bank, one of the leading Forex brokers in Europe, announced today Fr. lowering the minimum deposit required from $ 10 to $ 000. This is good news for many retail traders with limited funds. However, there are more changes to the advantage.

40 instruments in one place

Saxo Bank It stands out from the competition, offering access to an alarmingly large number of instruments from various categories. The investor has at his disposal spot transactions, shares, CFD, futures, ETFs, ETFs, bonds, currency options and stock options, investment funds, as well as ready-made investment portfolios (here, however, separate deposit requirements apply). Sounds unimpressive? The shares are available from as many as 37 exchanges around the world, and in total we have a choice of about 19 companies (+ nearly 000 CFD per share). In total, traders have 40 instruments at their disposal (!). And all this within one trading platform.

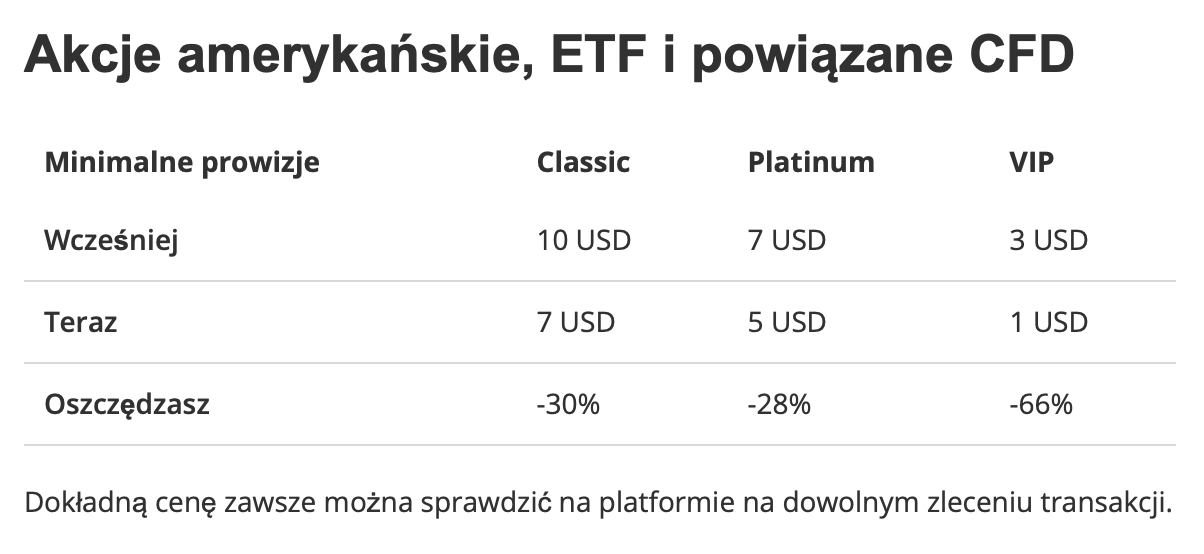

However, to encourage new clients to try the offer, the broker also decided to lower transaction costs for all types of accounts for selected groups of instruments - details below.

The minimum deposit required for Platinum accounts is USD 200 and for VIP accounts is USD 000.

Commissions, Leverage and Saxo Bank

Looking at the table above, there is no mention of a change in the value of the commission itself, but only a reduction in the minimum commission. Most Forex brokers have a minimum commission level that they set, which imposes a certain profitability threshold on the clients for the transaction. The reduction will primarily benefit traders who made trades of lower value, i.e. those operating on accounts Classic.

However, please note that Danish bank it is subject to the same regulations and leverage restrictions as other European brokers. Therefore, despite the wide range of instruments and the lowered requirement of min. Deposits, some of the assets that require high hedging requirements (high transaction value, low leverage), may turn out to be unavailable for trading with a low margin level. It should also be remembered that Saxo Bank can absolutely offer all instruments (and higher leverage) only to clients with professional status (an experienced customer is not available). For retail traders, access may be limited based on the availability of KID (Key Information Document) depending on the country.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response