A weaker USD is a necessity for a deleveraged global economy

In the Saxo Bank forecast for QXNUMX, we reiterated our arguments in favor of a long-term weakening of the US dollar, with the important caveat that sometimes strong yield growth and an upward trend in the US yield curve in anticipation of the envisaged wide-ranging fiscal stimulus may provide support for the US currency and a source of frustration for dollar bears. To quote the forecast for the first quarter:

"Thus, we have come to the potential problem of facilitating the depreciation of the dollar despite the convincing foundations for the weakening of the USD as outlined above: an upward yield curve and a further rise in US long-term bond yields, which broke above key thresholds - such as 1,00% in the XNUMX-year benchmark. treasury bonds - in the first week of 2021 ".

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

In fact, the sharp acceleration in US bond yields towards the end of QXNUMX triggered a significant dollar reunion, particularly considering that the Federal Reserve appeared dissatisfied with the move, with President Powell merely saying that the move had "attracted ( his) attention ”. The most intense increase in yields was due to the chaotic auction of seven-year US Treasury bonds, accompanied by signs of market dysfunction and significant differences in bid and offer prices. A combination of many factors was at fault here, including problems with the capacity of the financial system as US banks collided with limits on the volume of government bonds that they were willing or able to subscribe to. At the same time, the US Department of the Treasury closed its account in Federal Reserve (where it raised over $ 1,6 trillion in pandemic spending last year), disrupting the high end of the yield curve and in the US money markets.

At this point, the fastest route to a resumption of the USD depreciation would be if US long-term bond yields had cooled down somewhat for a while and did not rise significantly above the cycle highs set in QXNUMX, even if risk appetite and the opening of the economy continued to show solid economic activity and improvement in employment in the second quarter. Ultimately, yields took into account some of the inflation potential of the upcoming stimuli and the base effects of last year's price declines, which will translate into very high inflation readings in the summer months. The US Department of the Treasury also has sufficient savings to survive until the end of the year before having to significantly increase emissions, which would increase profitability due to the supply-demand imbalance.

Alternatively, the implementation of a fiscal stimulus could whiten the US economy so markedly in the coming months that US long-term government bond yields will pick up quickly and begin to exert their negative impact again with the stronger US dollar. In our opinion, however, this process is limited by itself, because with a certain level of increase in long-term yields, and even the USD exchange rate, the Fed (and most of all the Treasury Department) will have to react. In the long run, this is a fundamental question about the US dollar - how will the treasury finance itself? In Q2022 and XNUMX, unless Americans decide to drastically raise their already high savings rates and / or unless US Treasury bonds find new foreign buyers, it will be necessary to fill the issuance gap, otherwise it will drive out investment in other areas and push real interest rates to unacceptably high levels.

Many people, including the author of this study, agree that the next natural step, given the volume of upcoming government bond issues, will be for the Fed to control the yield curve. However, upon further reflection, we came to the conclusion that the Fed is willing to control yields up to three years; it should be noted that this sentence is shared by the Australian Central Bank. Controlling the entire yield curve is far too drastic, both in terms of the scale of intervention in the financial market and the fact that controlling so much of government bond yields is supporting the current government's political platform - too drastic for the Fed. This does not mean that the yield curve control will eventually fail, but it will be at the behest of the US Treasury, not at the discretion of the Fed. The next quarter is definitely too early for such a turn of events.

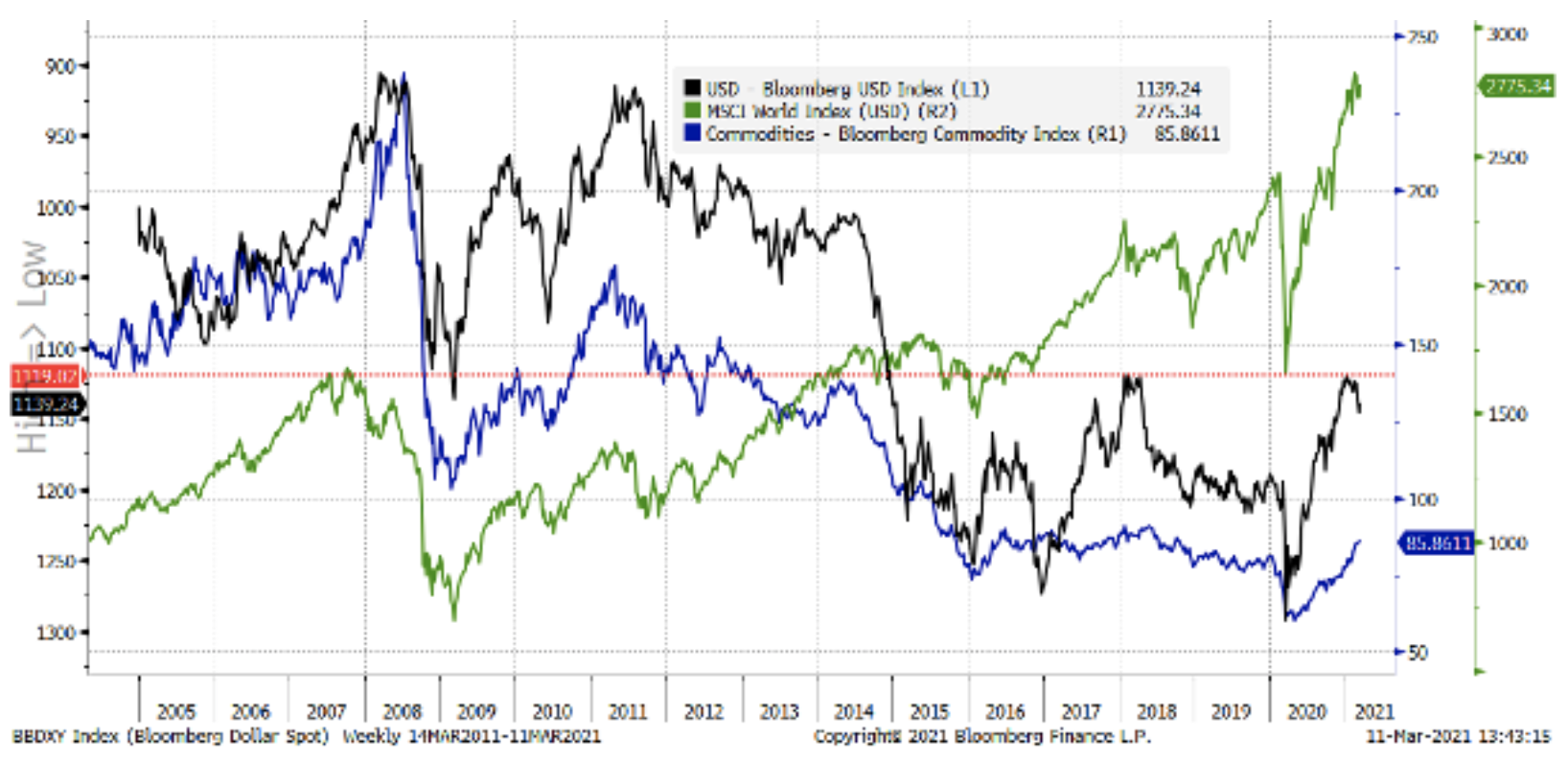

Chart: USD and world stocks and commodities

The chart below clearly shows that the weak US dollar is critical to world asset prices and real growth as it is the de facto global funding currency. Note the significant directional sympathy for commodity prices vis-à-vis the US dollar, and with it the generational minimum in commodity prices (in USD) in the worst months of the pandemic, as this index even fell below the 1998 low (not marked). Finally, it should be remembered that a commodity index is a series of nominal prices. World nominal GDP in US dollar terms has almost tripled since its 1998 minimum on the Bloomberg Commodity Index. Commodity related currencies should perform well in relative terms over a generation.

Meanwhile, the dollar bear streak continues: the United States provides the most fiscal stimulus of any major economy, and as it accounts for the largest share of global demand, due to huge twin deficits, the US dollar must eventually depreciate again to keep the global economy on track. the path of reflation. A hefty USD is just too toxic. The US dollar is likely to pounce again in the second quarter, even if the above issues trigger further two-way volatility on the same basis as in the first quarter.

Other currency issues in the second quarter

Commodity currencies will be won

For both emerging market currencies and G10 currencies, we are optimistic about commodity prices in the long term, given the drastic underinvestment in this area, exacerbated by the pandemic - in particular in the fossil fuel sector. While the QXNUMX immunization program will translate into the global economy as expected, we expect that for oil-related currencies such as the NOK or, to a lesser extent, the CAD, and for those with a high risk tolerance, the Russian ruble (RUB). ), there will be supporters of "down shopping" (buy the dip). The Australian dollar should continue to record its best performance in the coming quarters.

Asian emerging markets dominate European emerging markets

Central European currencies seem to continue to offer negative real interest rates as far as the eye can see, as we also saw in the pre-pandemic period as new populist fiscal stimulus programs spike inflation well above the interest rate response across the region. The EU will also make the shift towards "fiscal dominance" at the latest, which has already taken place in the United States and the United Kingdom, thus fueling less demand for the EU economy, and at the same time, under the new seven-year EU budget, it has reduced allocations for the Czech Republic, Poland and Hungary by about 25%. In Asia, average demographic profiles are healthier and real gains are likely to turn out higher as China - the center of the region - keeps its currency strong and stable compared to the risk of volatility for the US dollar from radical US policy shifts.

EUR and JPY - yield curve control?

In the first quarter, the euro was relatively weak and the Japanese yen exceptionally weak as both currencies suffered from very low yields amid rising expectations for yields and growth. JPY has long been very sensitive to long-term profitability. The sharp spikes in yields at the long end of the government bond yield curves in other countries have had only a weak echo in the bond markets of these two key economic powers; the reaction was interesting EBC i BoJ for these slight increases. The ECB showed the first signs of anxiety even before the 0-year German bond yields approached XNUMX%. In turn, in Japan during the March policy review of the central bank, the BoJ has to decide on its political mix after ten-year bond yields briefly broke above the upper end of the 2016 range (at just 18 basis points).

If global yields and commodity prices continue to rise at a rapid pace and the EU and Japan do not allow a similar increase in yields, this could prove to be a decisively negative signal for their currencies. The only thing that offsets this risk is the traditionally large current account surpluses that these economies tend to hold, even though they will be offset in the event of soaring commodity prices. The EU is a particularly difficult case, given the difficulties of the fundamental error of establishing a single currency and a central bank with the simultaneous operation of many national sovereign bond markets. Coordinating the transition to 'fiscal dominance' will be the most problematic here and could lead the EU to lag behind - or worse - in terms of growth in the long term.

The pound will reach cruising altitude?

The pound sterling may continue the strengthening started in QXNUMX, although we suspect that in QXNUMX the pace of change will slow down as the positive factor in the form of early vaccination success will lose its relative importance. The UK appears to be isolated in terms of trade relations, and after Brexit it has problems with relations with Europe that will be difficult to resolve. Now that the post-Brexit situation is clear, the UK will see a significant inflow of investment capital; on the other hand, it will have to finance its enormous budget deficits and the still high trade deficit.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response