The economic slowdown is not an obstacle to rising commodity prices

The commodity sector shows little sign of negative price effects from worries about global economic growth. In fact, the Bloomberg spot commodity index hit a new record high over the past week, climbing 38% yoy, with most of the gains being driven by soaring oil, gas and fuel prices. Under normal circumstances, an increase in raw material prices triggers a producer response to increase production, which ultimately drives prices down through increased supply. In this article, we discuss the reasons why this time might be different.

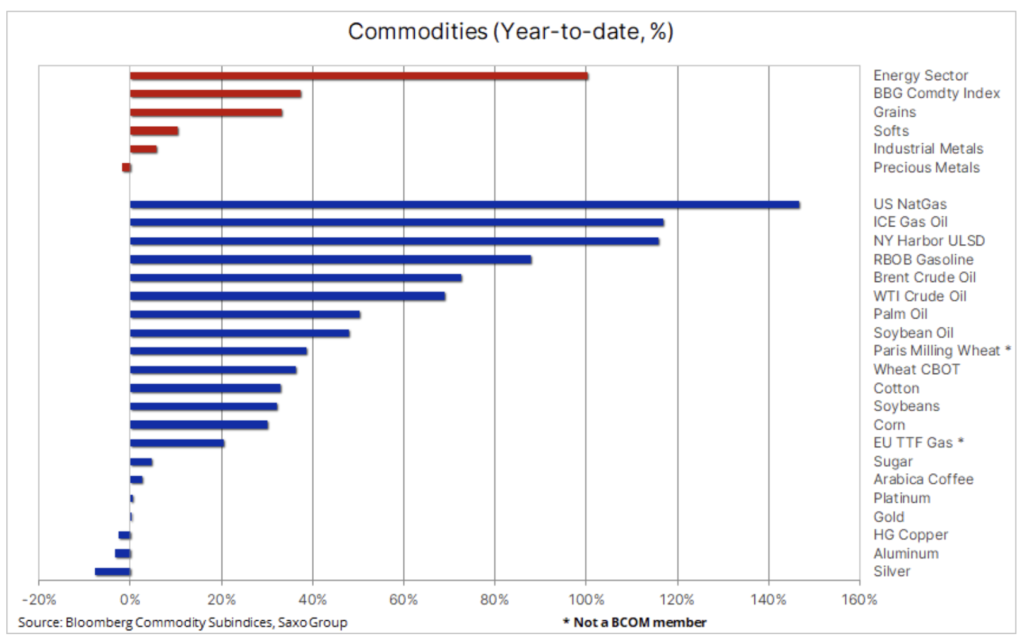

The commodity sector shows little sign of a negative price impact from worries about global economic growth. In fact, the Bloomberg spot commodity index - which monitors a basket of major commodities - hit a new all-time high over the past week, climbing 38% yoy. The growth is still mainly driven by the energy and grain sectors, which grew by 102% and 33%, respectively, year-on-year. The industrial metals sector, which fell 25% between March and April as the Covid-19 outbreaks caused lockdowns in parts of the Chinese economy, has made an attempt to strengthen in recent weeks. However, information about the next lockdowns in Shanghai emphasizes the risk of a slower than expected recovery in demand from the world's largest consumer of metals.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The spike in demand for consumer goods during the 2020-2021 lockdown period, supported by government aid and historically low interest rates, contributed to a decline in the supply of many key commodities, from metals to energy. In addition, unfavorable weather conditions and the war in Ukraine, which provided turbocharging for wheat and cooking oils prices, reduced the plentiful supply of key food products that had been maintained for many years. These and other phenomena caused inflation to rise to its highest level in 40 years. As a result, central banks around the world are now raising interest rates to reduce liquidity and drive prices down by lowering economic activity.

As a result, forecasts for global economic growth are in question - even in the United States, where monitored by Federal Reserve GDP indicator high frequency signal is now showing an increased risk of zero growth in the second half of the year, potentially leading to a technical recession when economic growth in the next two quarters is negative. Moreover, last week the World Bank lowered its forecast for global growth, warning against '70s-style stagflation.

In this context, the question naturally arises as to when the phenomenal boom in commodity markets that started when the 2020 Covid pandemic hit a bottom will arrest. Under normal circumstances, rising commodity prices trigger a producer response with an increase in production, which ultimately drives prices down due to the Covid pandemic. greater supply. Moreover, the problem of high prices is usually solved by the prospect of a slowdown in economic growth and demand.

The reasons why we believe such market reactions may not happen this time are due to a number of factors - the most important of which is less investment pressure from major energy and metal producers. Other factors include the fact that in certain sectors some producers are close to the maximum level of production, the demand related to the green transition, the restrictions on investors and loans due to ESG and the increased pressure to reduce dependence on Russia - a country increasingly perceived as untrustworthy.

Petroleum

Prices oil reached an almost three-month high, with the nearest expiry WTI and Brent futures trading above $ 120 per barrel. The latest strengthening follows from China's recent attempt to reopen its largest cities after the Covid-19 lockdowns, which is likely to boost demand from the world's largest importer at a time when global supply chains remain strained by the war in Ukraine. In addition, the Secretary General of OPEC announced that most members had increased production "to the maximum", which explains why OPEC +'s recent decision to increase production by 50% was ignored by the market, which was aware that the group (already producing 2,5 million barrels) per day below target) will continue to struggle with the problem of increasing production.

In its monthly short-term forecast for the energy market, the US Energy Information Administration (EIA) maintained its forecast for production in 2022 at an unchanged level of 11,91 million b / d, corresponding to current levels, while increasing the forecast for next year production by 120 thousand. b / d to the level of 12,97 million b / d. She also warned that production in Russia could fall by 18% by the end of next year. Refineries around the world are working at their limits to replace sanctioned Russian barrels, and with such limited supply, prices will likely have to rise to curb demand, thereby supporting the painful process of rebalancing the market.

NATGAS

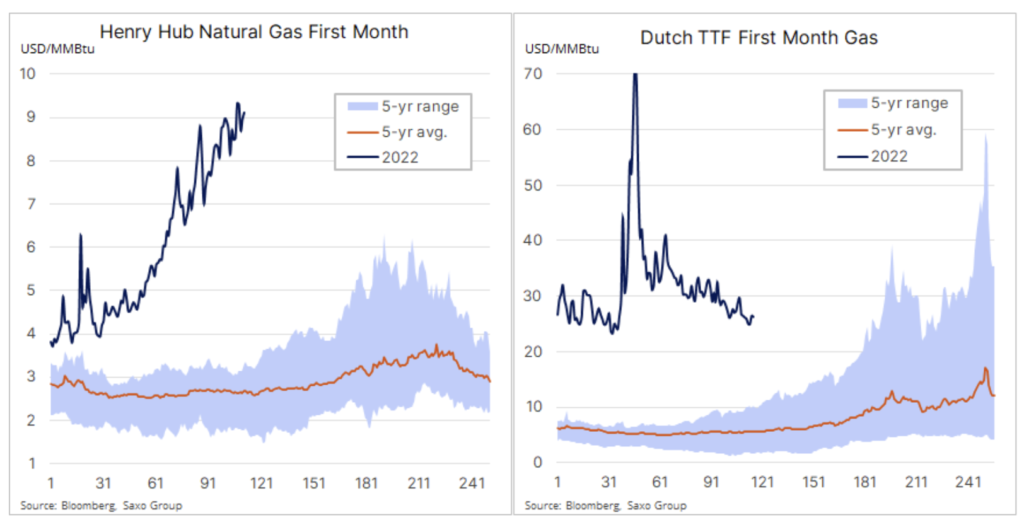

Natural gas remains one of the most volatile futures markets, and although the European market has experienced some nervous stabilization, the US gas market is still highly volatile due to strong hot weather demand and dynamic export growth, not accompanied by rising production. As a result, the price of the gas contract with Henry Hub reached a thirteen-year high last week, after which it underwent a temporary sharp correction. Following a fire at the LNG export terminal in Quintana, Texas, US fuel prices fell briefly, and the Dutch TTF contract rose from the three-month low.

The plant in Freeport, one of the seven US centers exporting gas to foreign markets, will remain closed for at least three weeks, thus holding back nearly 20% of the overall US LNG export potential - most of it goes to willing buyers from Europe, where the race for reducing dependence on supplies from Russia.

Gold

Gold, in the range for more than a month, it fell after the US released another strong inflation reading of 8,6%, the highest level in 40 years, compared to an expected 8,3%, and after the ECB announced that it would start raising rates from July, thus joining the rest of the central banks struggling to fight the rise in inflation. However, the less aggressive result of the meeting contributed to the decline in the euro against the dollar, which increased the downward pressure on the gold.

The prospect of an increase in US Treasury yields, and therefore a stronger dollar, remains the main reason why some investors are reluctant to invest in gold as it diminishes its potential as a hedge against inflation and the ongoing turmoil in the bond and equity markets. We reiterate the view that gold - at least in relative terms - is doing very well this year, particularly with regard to non-dollar investors. While gold valued in Euro generated a return of around 8%, an investment in ETF broadly understood EU government bonds or stock index Euro Stoxx50 would entail a loss of around 13%. The dollar trader saw a relatively modest 1% return on gold this year, while the S&P 500 index fell 15% and the ETF monitoring long-term bonds lost 23%.

We maintain a positive outlook for gold and silver as soon as industrial metals begin to appreciate again - and we believe they will. The main premise is the growing risk of a political error on the part of the central bank, which may raise interest rates to a level that inhibits economic growth.

For now, gold remains within the range, and leveraged traders in the futures market and ETF investors are showing little enthusiasm - positions in both markets have remained within the range for a month. For that to change, there must be a clear break above $ 1 - the key resistance level.

Resource actions - the leader of the thematic baskets Saxo

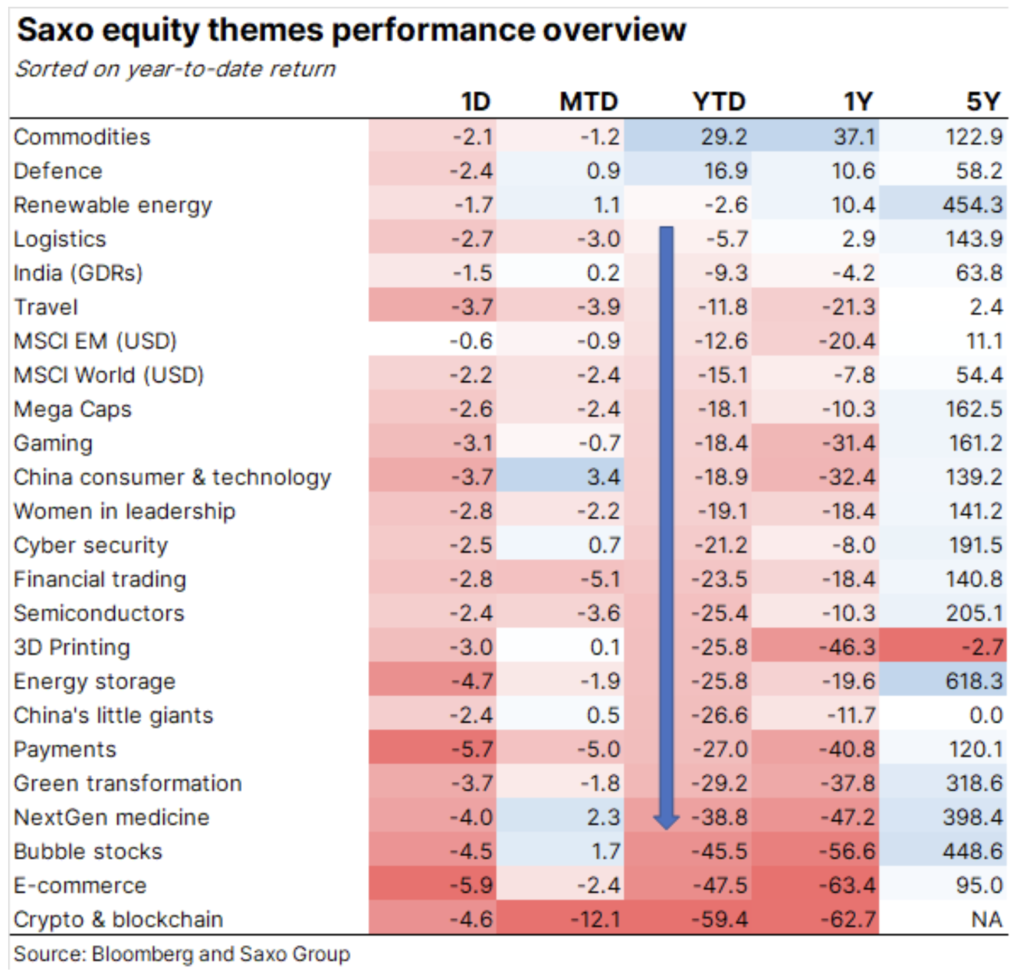

The 20 companies in our commodity stock basket continue to demonstrate a high degree of resilience to the stock market storm. Previous topics preferred by investors such as cryptocurrencies and blockchain technology, e-commerce and the so-called "Bubble stocks" have seen declines of over 45% since the beginning of the year, which underlines the importance of maintaining exposure to the so-called the old economy, where limited supply and high prices are likely to deliver high levels of profitability.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response