Forex strategy "At the end of the day". Summary - week 21 and 22

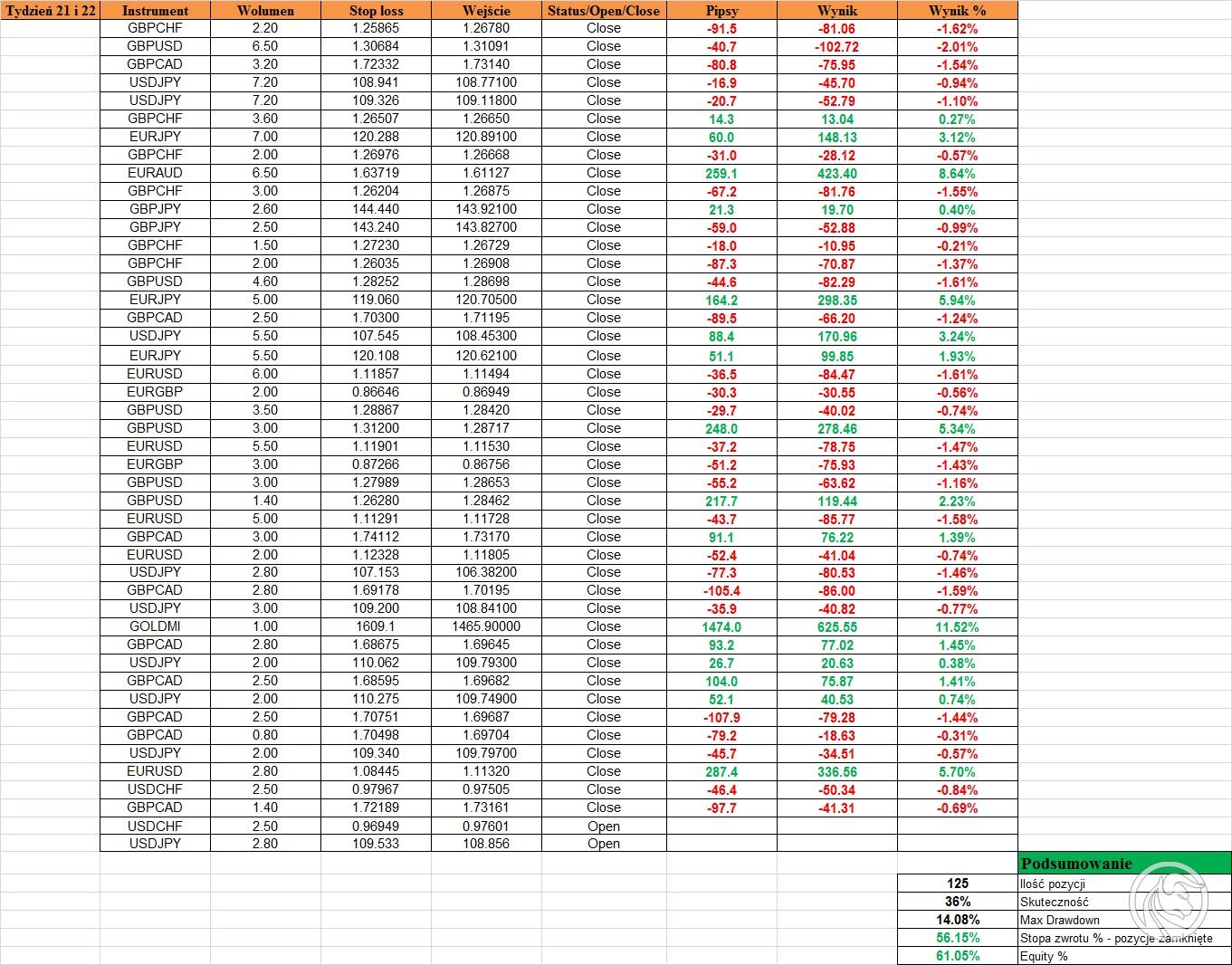

Behind us another two weeks of trading at the "End of the day" strategy. We are slowly approaching the full six months of the test. I will now discuss what has happened on your account in the past two weeks. This period was a bit calmer, there were fewer positions, but there were still quite a few pairs. As always, I will start with profitable positions, later I will discuss those losses and those that are in the game at the moment.

Check it out: End of the Day Forex Strategy - Description of the methodology

Profitable transactions

You do not have to open many items every day to consistently increase your account balance. As I mentioned at the beginning, the past two weeks were a bit calmer, but I still managed to add a few percent to the account balance. By far the best position was short on EURUSD. I also mentioned this couple on the forum.

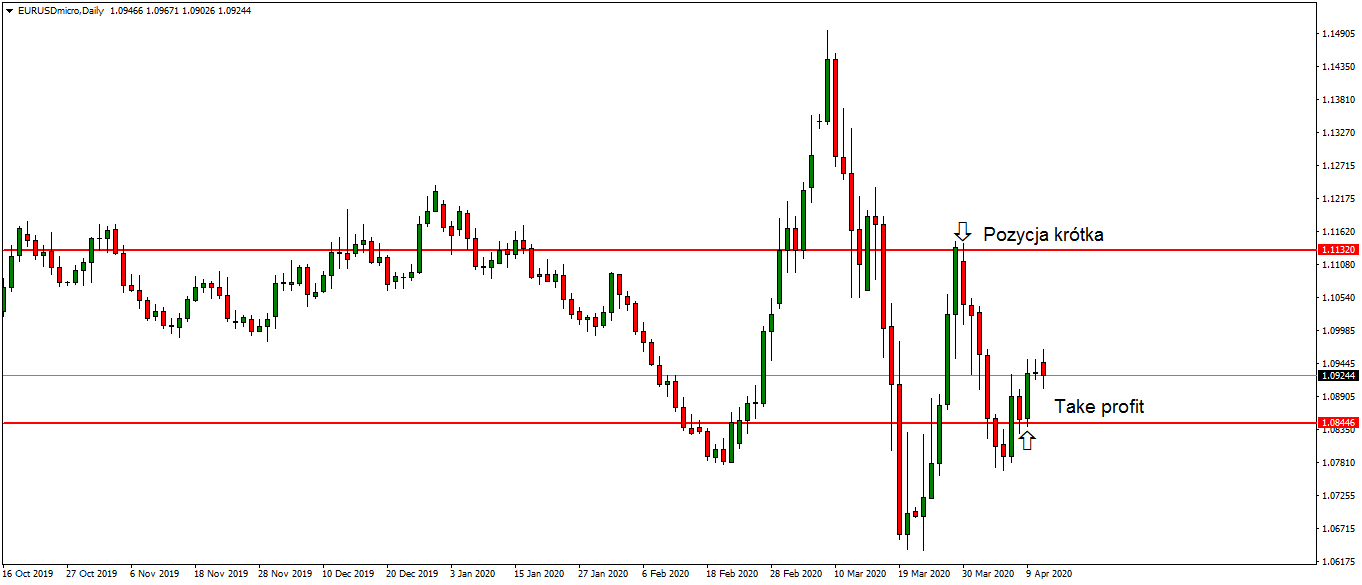

After an upward rally, the price reached an interesting resistance zone in the area of 1.11500. What is very important, the candle after which I decided to open the order was in demand, there is no doubt about it. However, the key when opening any position is closing. Even though demand (very strong at the time) managed to raise the price in these areas without any problem, it was impossible to beat them and it was a very important signal for me. In this case, I opened the order from my hand. The price realized the scenario, and after a few downward candles, the profit was also reached (level 1.08446) after upward correction.

Short position. EUR / USD chart, D1 interval. Source: MT4 XM

Lossy transactions

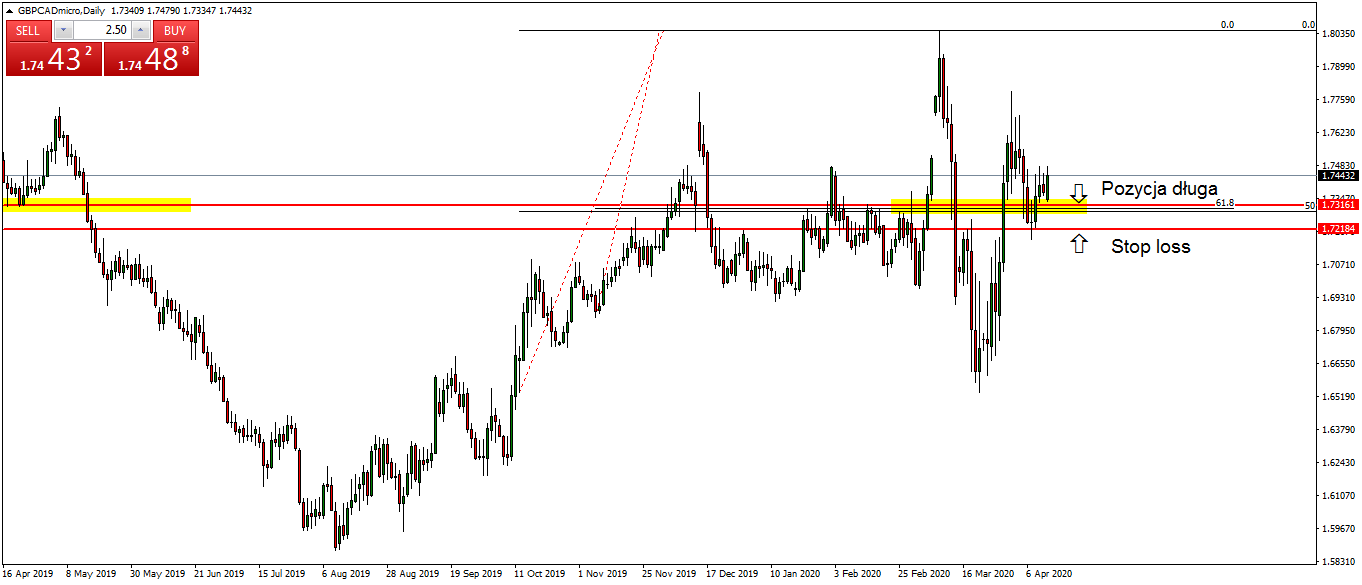

Regarding loss positions, here, as in previous weeks, I also tried to play GBPCAD. I still think that the pair is in an upward trend. I was looking for a place where I could join this movement. The first such zone may have been around 1.72950. This is a local support zone, further strengthened by Fibo 50% and 61.8%. The price made a downward adjustment and the buy limit order was opened. Unfortunately, the correction went lower than expected and the upward rebound took place when I was "kicked out" on the market. Currently, the price has already departed from the discussed zone but it is possible that I will set one more buy limit in these regions.

Long position. GBP / CAD chart, D1 interval. Source: MT4 XM

Regarding currently open positions, we have two. They are short on USDCHF and short on USDJPY. I also described both qualities on the forum (day 06.04 and 07.04).

At USDCHF I have already moved take profit slightly lower, but I left some room for the price for a possible correction. In the case of USDJPY, also take profit is moved above the last candle. We will see what the next days will bring on these pairs.

Summation

To sum up, at the moment the rate of return on closed positions is equal 56.15%, and the Equity status, including open positions, fluctuates around 60% - 61%.

The whole and the live results are available of course at MyFxBook profile. The current situation is presented on an ongoing basis forum.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Stop Loss hunting - who is hunting our SLs? [Video] stop loss hunting](https://forexclub.pl/wp-content/uploads/2021/10/stop-loss-hunting-300x200.jpg?v=1632996842)

I read with interest somewhere from the 5th article. As I saw the tables in red, I thought that the account would be cleared. And here you get a nice rate of return.