SyncTrading TeleTrade - We choose traders [TEST # 1]

In the previous text about SyncTrading TeleTrade (which you will find here), which is an introduction to our platform test and the copying project of experienced traders, I presented the assumptions that we will follow when selecting traders. Therefore, today we will focus on the practical aspects of the entire project. Taking the theory from the previous publication as a basis, I would like to show you how to read the indicators placed in traders' descriptions, where we will find information about the risk level, how to connect (step by step) a trader to your account and supervise his work from the level of the Personal Cabinet. I invite you to read.

CHECK: How social trading and copying transactions work

Traders at SyncTrading

De facto in the previous publication we have already seen what the ranking looks like and where to look for information about traders. Now is the time to choose, in line with our assumptions, three "representatives" of the ranking and attach them to them prepared and supplied with the amount of 5 thousand. USD (USD 15 in total) trading accounts. Before we proceed to the practical connection of traders to our account, let's analyze the indicators that are important to us from the point of capital management and risk diversification. We will also outline the expectations for each of them. We will base our analysis on information about the trader, which is available in the ranking for each account.

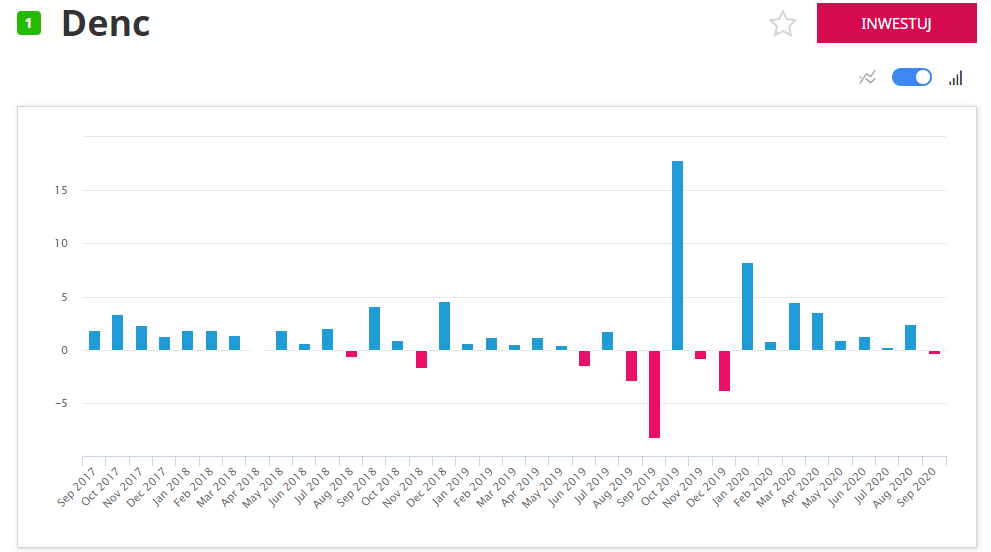

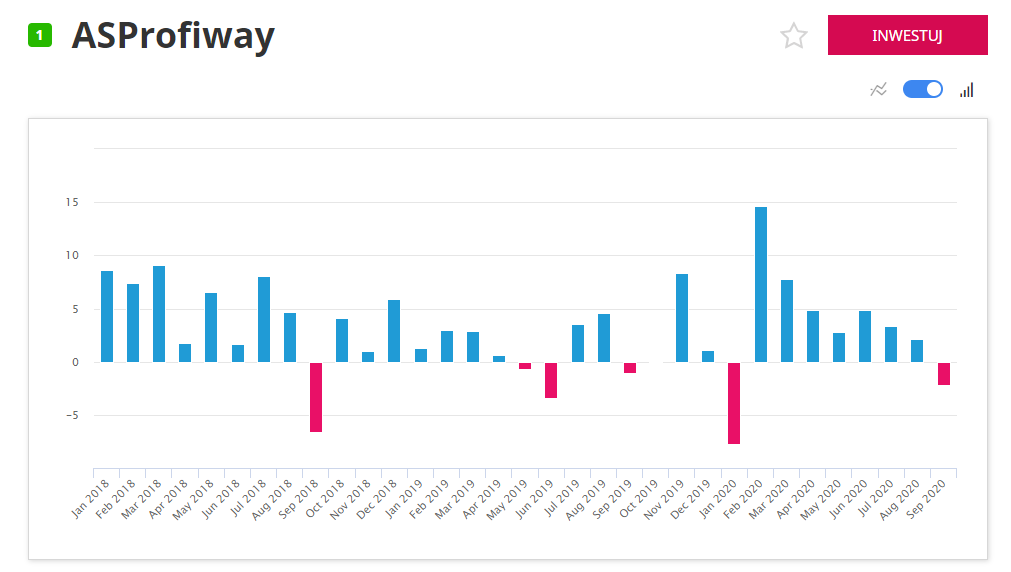

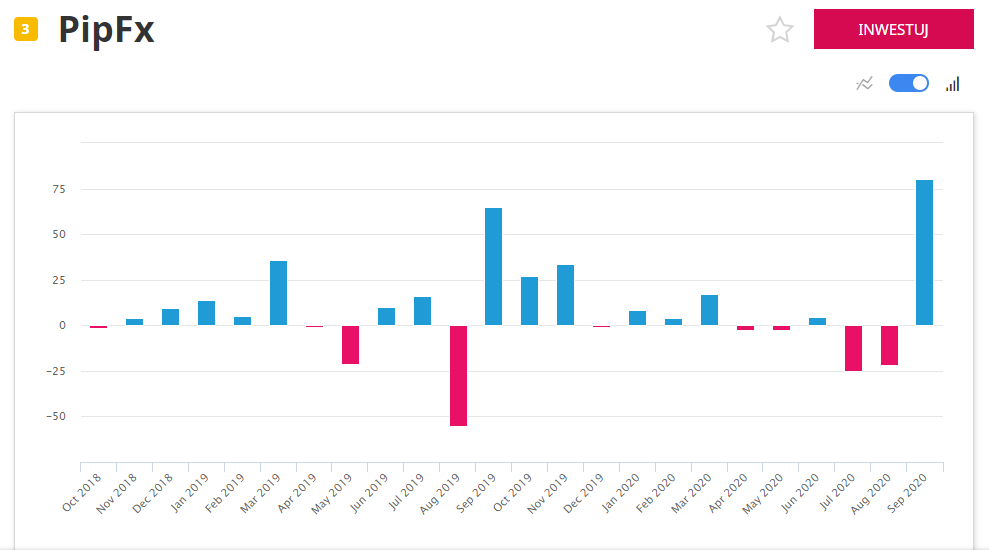

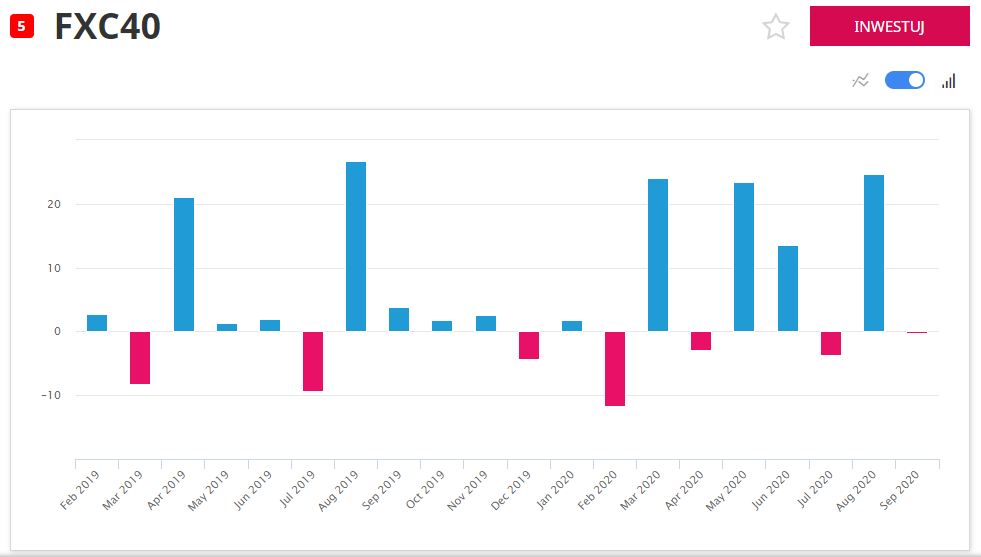

When opening the window of any trader, at first glance, we see a chart with the rate of return generated in recent months. From our (ie the investor's) point of view, the pink line is more important, it represents the growth of the account. The blue chart, on the other hand, shows the changes in the capital that the trader uses to trade. For some, it may not be very clear if we wanted to check the rates of return for individual months. There is a way too. It is enough to move the slider in the place marked by us, so that we can view the results broken down by months.

We then have bar charts in front of us, as shown in the graphic above. In the opinion of the trader, they are useful to tell with the naked eye (without delving into the indicators) the overall profitability level of his trade. From the more important information at this stage, we will also find the risk level associated with the trader. The scale that is available in the SyncTrading project is between 1-5. One is the judgment of a trader trading calmly, generating small but stable rates of return, and five is high risk.

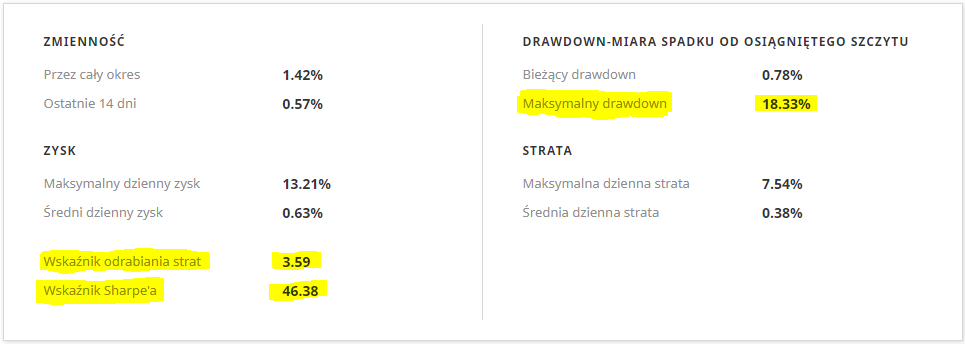

Especially important from the point of view of our test will be three indicators that we have available right under the trader's trade chart. Of course, each of them can be analyzed separately. I, on the other hand, want to focus on Sharpe, maximum drawdown and catching up.

Be sure to read: Drawdown or refund rate? Set your priorities

In the first text, we assumed that the drawdown will not be that important when choosing more aggressive traders. On the other hand, the other two indicators will help us decide which of them we will "employ" while working on our capital. Having a choice of two with a similar degree of risk, from a rational point of view, we will choose the one that recoups losses faster and the one that offers a higher premium for the risk (Sharpe index).

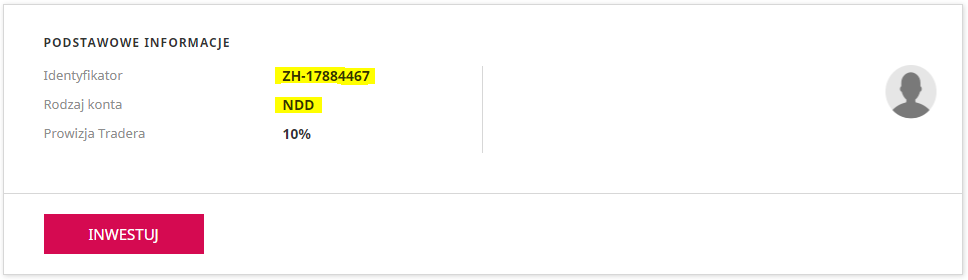

In the last part about the trader's account, under the name "basic information", we will find some additional, equally important information. Apart from the aspect of the commission that the trader charges due to the profitable transactions generated for us, we will also find his ID needed to connect and the type of account. At TeleTrade, we have several types of account available depending on your trading needs.

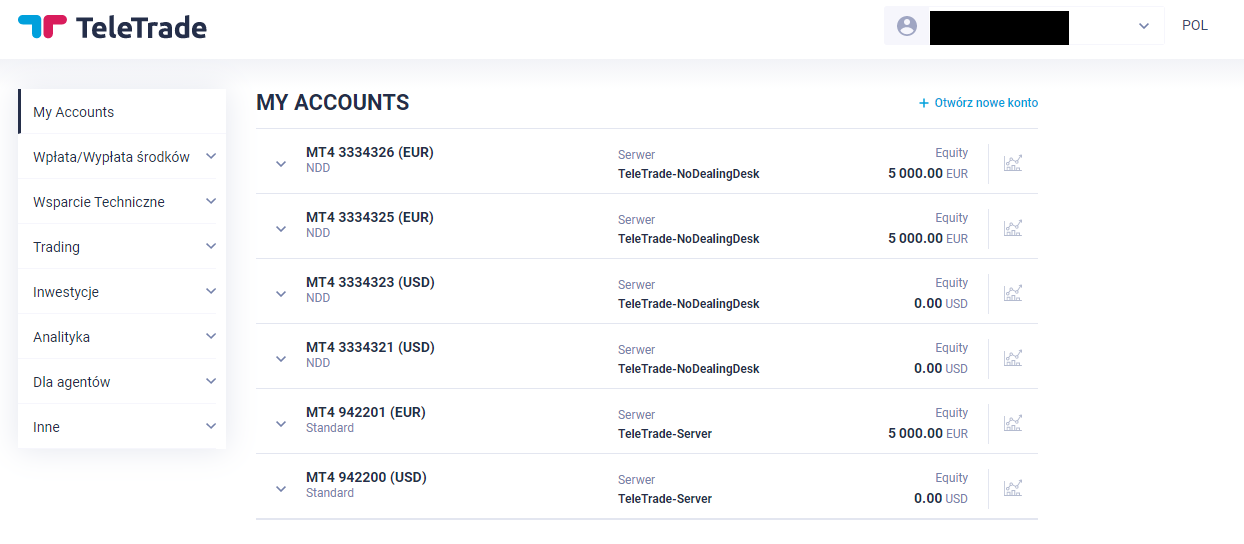

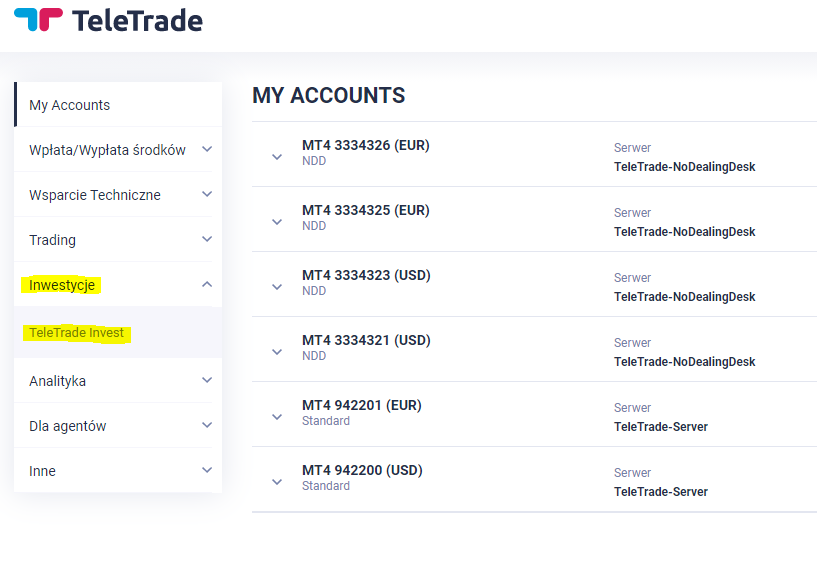

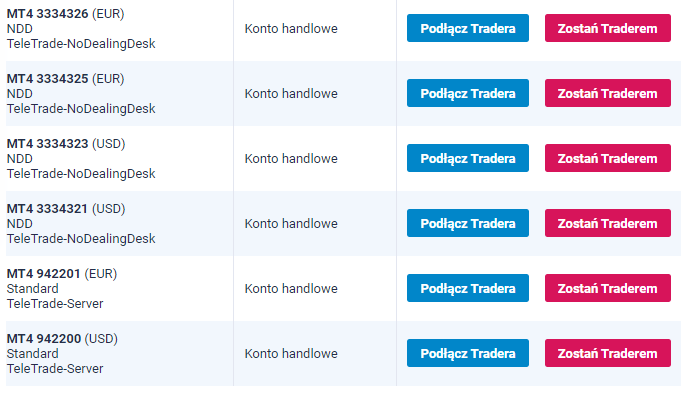

If we would like to connect to this trader, we must have an NDD account prepared for it, i.e. one that the trader has at his disposal. Importantly, one account allows us to connect only to one trader. If (as in our test) we want to diversify our investments into three different traders, we must have three accounts. These accounts in our office will look like this:

Choosing a trader with different degrees of risk

Now let's move on to a brief overview of the traders we selected for the first test phase. If they meet our assumptions regarding their participation in diversification, they will remain with us until the end of the test.

The trader is safe

- risk: 1

- is to generate a stable return of 3% -5% per month

- expectations: generating short-term profit

- low level of current drawdown (up to 6%)

Our choice: ASProfiway

Moderate trader

- risk: 2-3

- it may be lossy in the short term, we are looking to profit in the long term

- profit about 10% per month

- when comparing traders, we pay more attention to the recovery rate

Our pick: PipFx

Aggressive trader

- risk: 4-5

- we hope that it will generate a high rate of return in the long term, approx. 2 months

- we are counting on profits above 15%

- when comparing traders, it will be important for us to choose the Sharpe indicator to choose the highest premium at high risk offered by traders

Our pick: FXC40

From less risky traders we will expect more "clear" rates of return. However, in the case of the last, most aggressive one, we take responsibility for any losses, as a result of FXC40's riskier trading at the expense of a higher return on investment. Our goal is to actively manage the "portfolio" of employees. We will inform you about any possible changes and the reason for this change in weekly updates.

Connection in a personal office

Connecting to a trader in a personal office is quite intuitive. Select the tab in the side menu Investments -> TeleTrade Invest.

This tab takes us to the synchronous trading project. It is from this level that we decide whether we want to make our trade available for copying or connect to the trader. Due to our test, we choose the "connect a trader" option, taking into account the type of account we wrote about above.

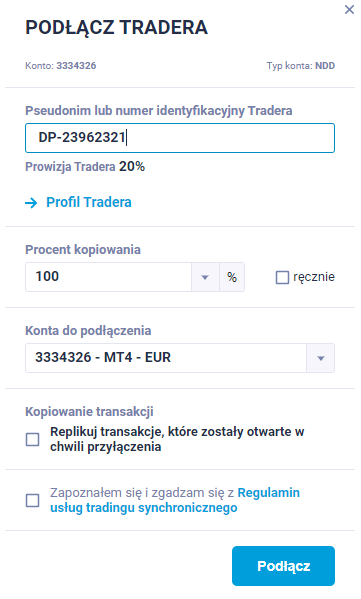

Then a window pops up in which we have to enter the trader's code available in the basic information that is in the ranking. We can manually set the degree of copying, remembering, however, that the platform does it automatically, taking into account the funds we have on the account. Therefore, it is worth finding out in advance what style the trader is trading. If it contains a lot of small positions and has much more capital than us, it may turn out that by copying it in proportions, for example 1:10 (we have, for example, USD 1 in the account, and the trader USD 000) may not be enough deposit resources for the next transactions. Therefore, it is worth consulting your choice with the appropriate department in TeleTrade and ask for additional information about the trader.

We do exactly the same with each trader we choose.

The test has officially started. We will keep you informed about the results!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![SyncTrading TeleTrade - We choose traders [TEST # 1] synctrading teletrade test 1](https://forexclub.pl/wp-content/uploads/2020/09/synctrading-teletrade-test-1.jpg?v=1601361410)

![SyncTrading TeleTrade - Another week with profit [TEST # 3] synctrading teletrade test week 3](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-tydzien-3-300x200.jpg?v=1602656245)

![SyncTrading TeleTrade - First positions, first profits [TEST # 2]](https://forexclub.pl/wp-content/uploads/2020/10/synctrading-teletrade-test-2-300x200.jpg?v=1601987632)

![SyncTrading TeleTrade - We choose traders [TEST # 1] trading central indicators](https://forexclub.pl/wp-content/uploads/2020/09/trading-central-wskazniki-102x65.jpg?v=1601302045)

![SyncTrading TeleTrade - We choose traders [TEST # 1] special purpose acquisition company spac nikola](https://forexclub.pl/wp-content/uploads/2020/09/special-purpose-aquisition-company-spac-nikola-102x65.jpg?v=1601370314)

Leave a Response