Six reasons why interest rates will continue to rise in 2022

There are more and more arguments for an increase in bond yields, which is why the MOVE index goes up. Inflationary pressures will persist in 2022, and Federal Reserve will adopt a bit more hawkish rhetoric after Bullard, George, Mester and Harker become voting members. This means that expectations of interest rate hikes will have to rise, and demand for US Treasury bonds will continue to decline as asset purchases continue to shrink. Addressing the debt ceiling will also remove resistance to long-term profitability.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

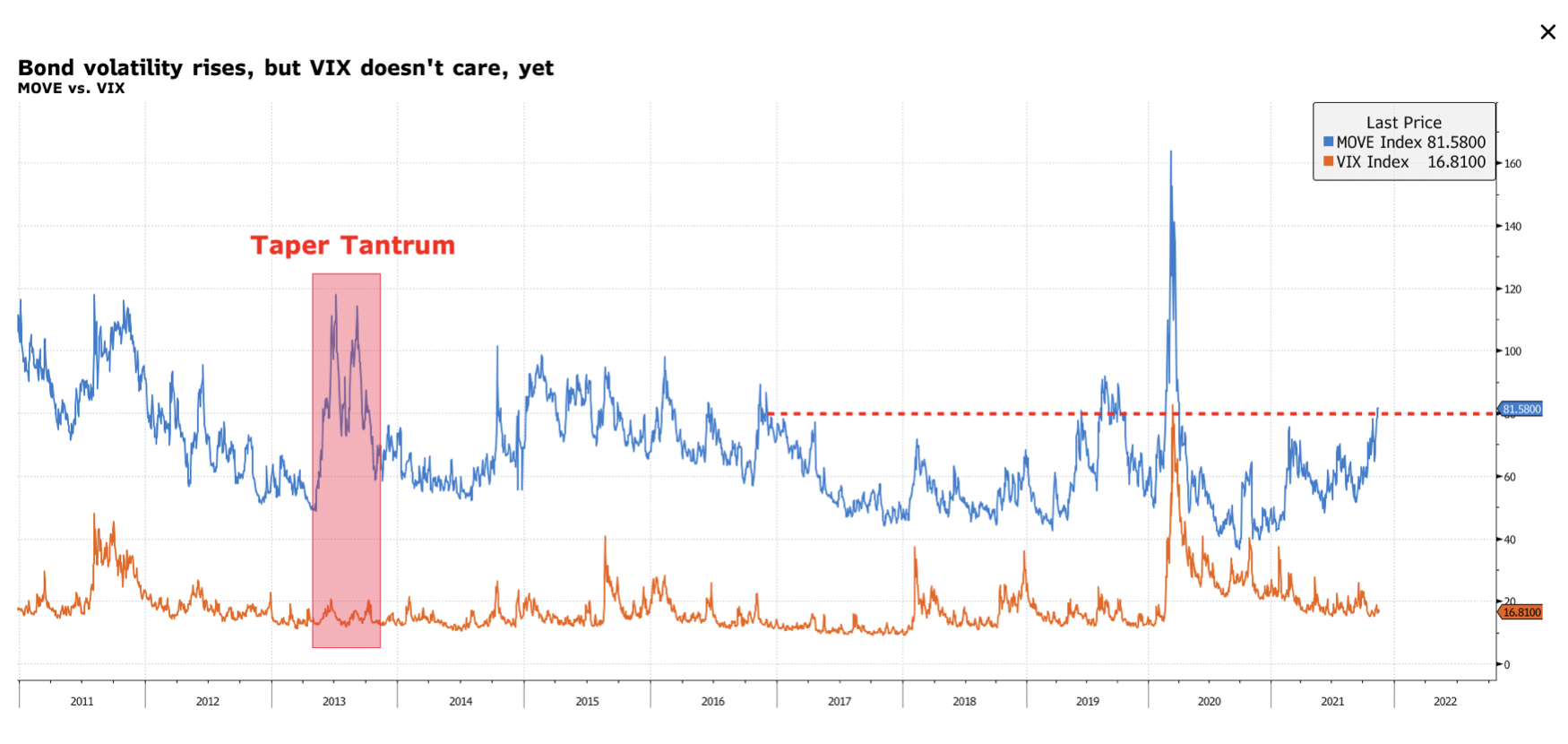

Bond market continues to hedge: watch out for the Move index

Despite the fact that the yield on 1,40-year bonds remains in the range of 1,70% -XNUMX%, something is going on below the surface. The MOVE index rose to its highest level since March 2020, co points out that bond market investors are hedging against interest rate hikes. Overall, investors are not comfortable with the current profitability levels for the reasons listed below.

Even more worrying is the growing discrepancy between the MOVE and the VIX. It suggests bond investors are becoming more cautious while the stock market continues to take high risks. However, the stocks will have to adjust to the movements in the bond market.

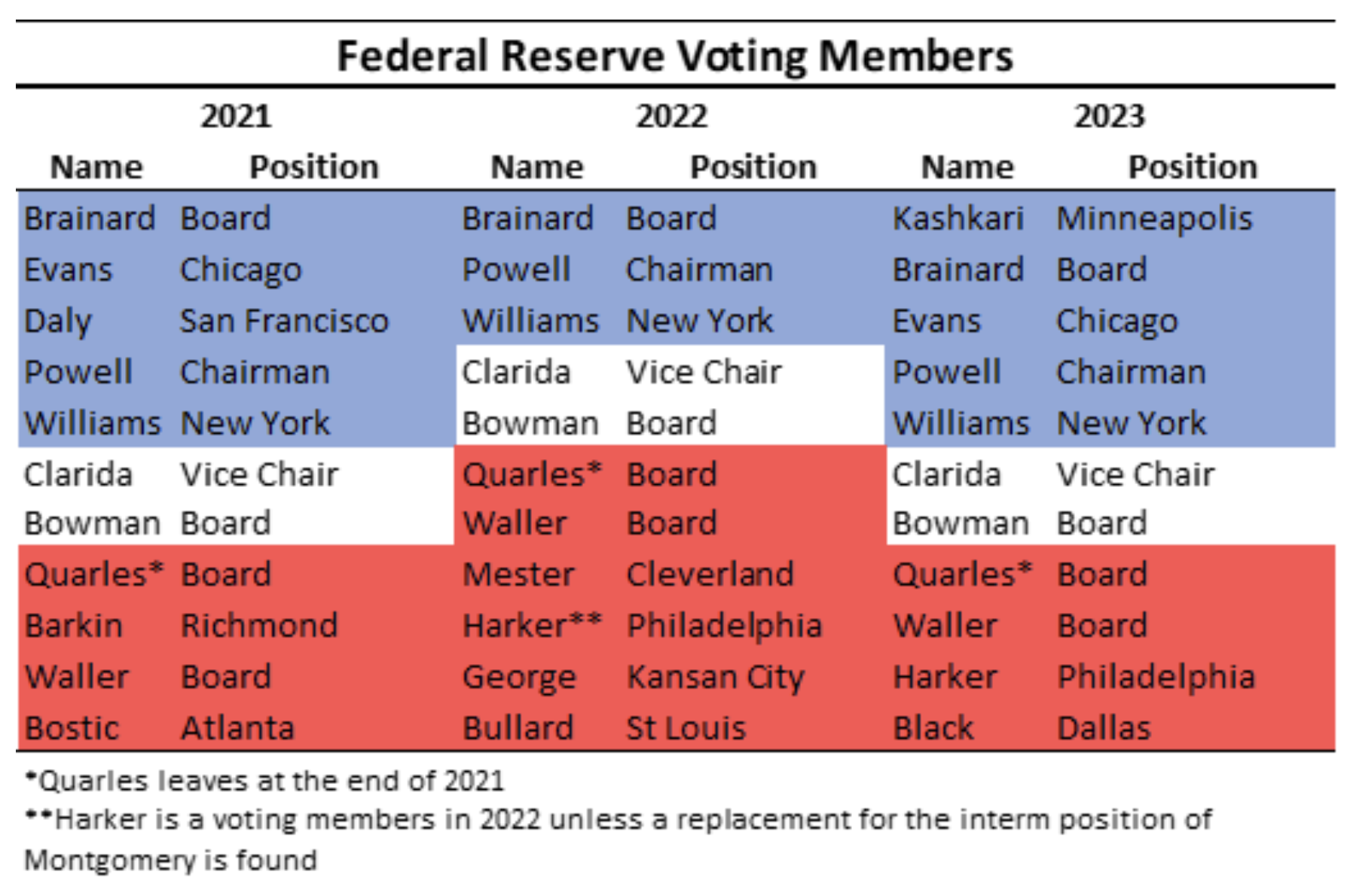

Federal Reserve: More Aggressive Rhetoric in 2022

Now is the time to take an interest in the comments made by the Federal Reserve ultra-hawks.

This week, James Bullard, the Fed chairman of St. Louis, called for a more aggressive policy to cool inflationary pressures. He put forward interesting arguments, incl. that early increases in interest rates may allow the central bank to hike fewer hikes, that it is still possible for the central bank to raise rates before the end of curtailment of bond purchases, and that balance sheet liquidation may begin immediately after the completion of this bond purchase.

This comment did not go unnoticed and at the time of Bullard's statement, yields on five- and ten-year bonds rose by around 3 basis points. However, just after the CEO's interview for Bloomberg, these yields fell, which indicates that the above-mentioned hawkish comments ultimately did not bring any effect.

However, they may soon gain importance as Bullard and another five major hawks gain voting rights at FOMC meetings next year. This is a clear shift towards more aggressive rhetoric compared to the dovish Fed policy of 2021.

The implication of such a change is crucial for the bond market, because while the Federal Reserve has felt comfortable adopting a reactive approach to inflation risk so far, it may change next year.

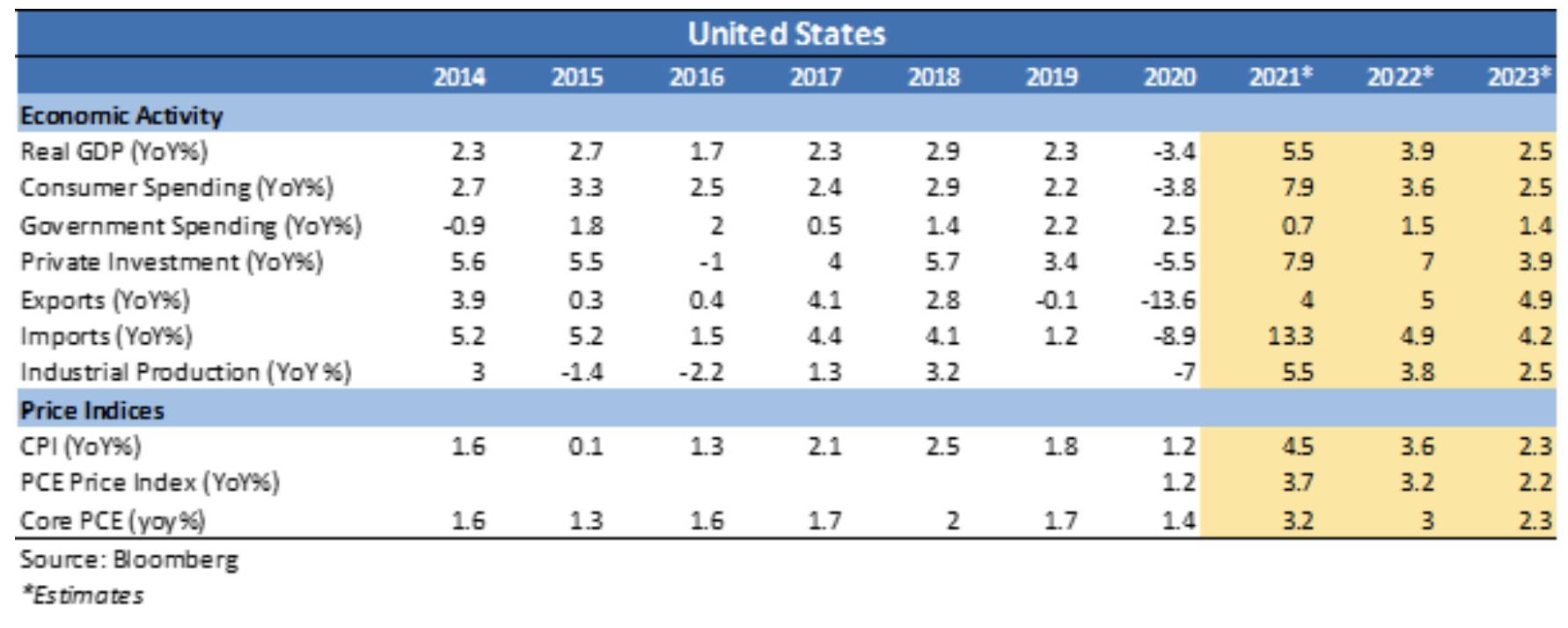

The macroeconomic environment is likely to remain inflationary

As we have emphasized many times this year, there are signs that inflation will remain high for an extended period of time. The shortage of investment in the physical world (energy and mining), disruptions in the supply chain, sustained demand in developed countries and increases in rents all point to higher inflation than the Federal Reserve's 2% target for all of 2022. The question remains, however, are we witnessing a change? of a structural nature that will keep inflation above 2% for an extended period of time. According to many CEOs, it is likely that we are seeing a structural shift in price pressures as wages have increased significantly and are not expected to decline in the near future. However th the temporary dilemma will become, in a sense, irrelevant to bonds, when there is no longer any question of high inflation calculated in months, but in years. This should be taken into account even more when the economy continues to grow above the trend line. All indicates that bonds are currently mis-priced. Hence, yields need to increase significantly to match the current macroeconomic picture.

Even if one believes yields will remain stable, holding US Treasury securities does not make sense at current levels, because the downside risk is much greater than the upside risk.

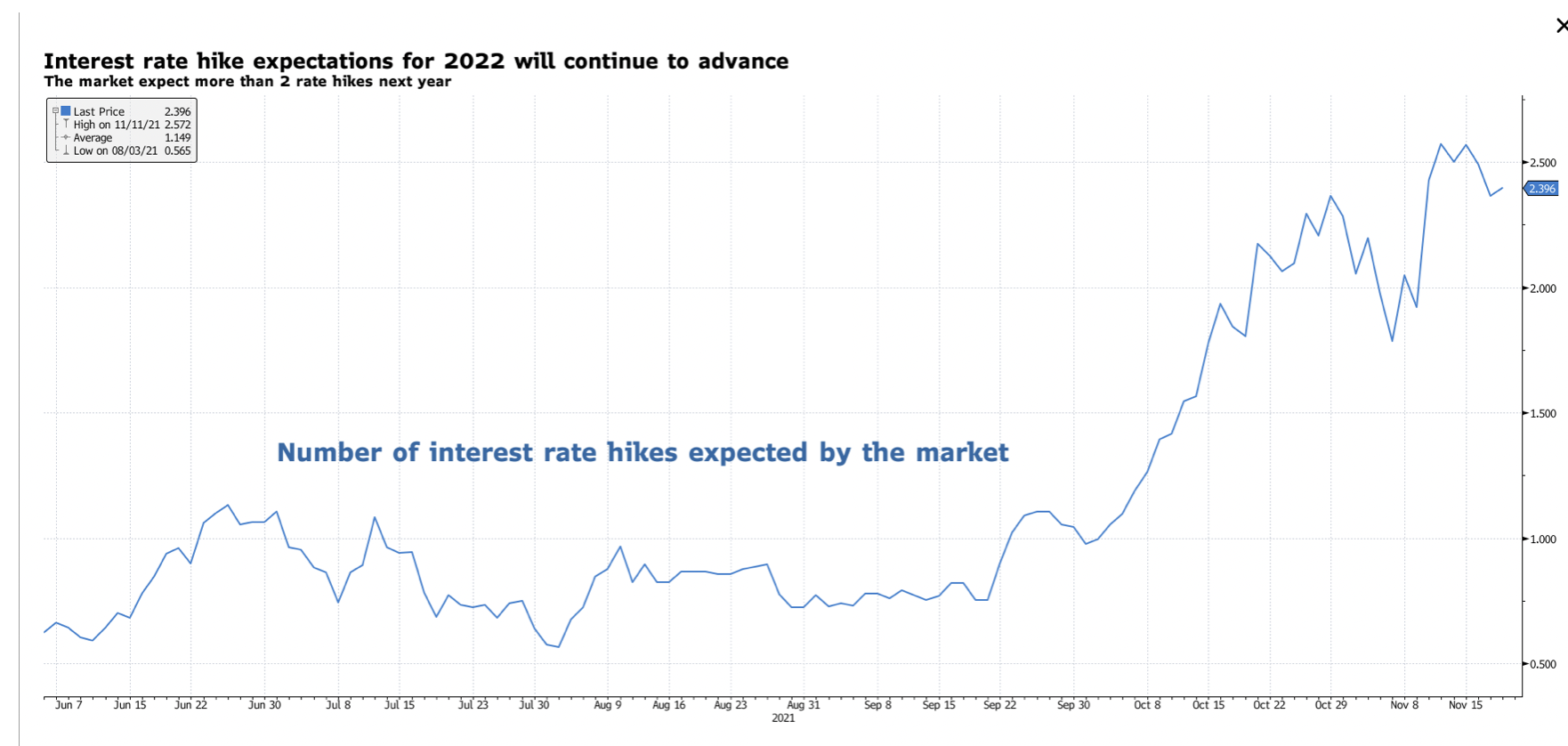

The expectations regarding interest rate hikes will have to increase

In connection with the above arguments, expectations regarding interest rate hikes will have to rise. So far, the market has priced more than two rate hikes by the end of 2022. However, as inflationary pressures continue to increase, the Federal Reserve's policy will become increasingly aggressive. Hence, there will be a bearish flattening of the yield curve. Long-term yields will also have to rise, albeit slower than in the front part of the curve.

Demand for US government bonds is weakening: watch out for auctions

As the macroeconomic environment remains inflationary, demand for US Treasury bonds is declining due to their strongly negative real yields. We saw it last week at the disastrous 5,2-year bond auction, which saw the biggest tail ever for this tenor (10bps). This week, we expected another unfortunate bond auction - this time for 22,5-year bonds - but policymakers may have just escaped a catastrophe. In fact, the US Department of the Treasury limited the scale of bond sales. At the same time, the Federal Reserve was buying the same number of bonds with maturities ranging from XNUMX years to XNUMX years, despite the commencement of restrictions on purchases under the quantitative easing program.

A modest 1,4bp tail on the sale of 10-year bonds was enough to boost demand from 20/30/XNUMX tenor traders, which depreciated significantly after last week's sell-off.

However, we expect demand for US Treasury bonds to weaken as asset purchases are reduced, which will pave the way for yield increases also at the long end of the yield curve.

The debt ceiling may still lead to volatility in the money markets

In our analysis, we need to consider the last point: the debt limit crisis and its impact on the yield curve. Recently, Janet Yellen said the US Treasury Department's cash flow would run out shortly after December 3. The money market reacted with an increase in treasury bills yields with maturities at the end of the year above the Fed's contingent sale rate. The debt ceiling crisis also affects a long part of the yield curve. Should volatility in the money markets increase, the ten-year US government bonds will most likely act as a safe haven, lowering yields on the long side of the yield curve.

However, it should be remembered that this problem must be resolved by the end of this year. After its dissolution, the pressure limiting long-term yields will disappear, which will allow interest rates to rise freely next year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response