A Perfect Storm in the Gold Market - Weekly Commodity Markets Overview

News related to the Covid-19 virus and its potential risk of spreading across Asia and beyond continue to be the main driver of commodity markets. China, already suffering from the economic and health effects of the coronavirus, is struggling to restore its normal functioning. The attempt to revive the markets of key raw materials, such as copper or crude oil, in the last few weeks was based, among others, on on the narrative that the economic impact of the virus will mainly affect the first quarter. As the virus continues to spread beyond China, this narrative has given way to new concerns about its continued negative impact on the global economy.

Coronavirus and economic effects

Goldman estimates that the effects of non-working days in China due to the coronavirus may correspond to the consequences of a two-month unplanned downtime in the entire US workforce. The scale of these distortions is beginning to be felt not only in the Middle Kingdom, but also in other countries, increasing the risk of further short- and medium-term pressure on growth-dependent raw materials until demand begins again to contribute to price increases.

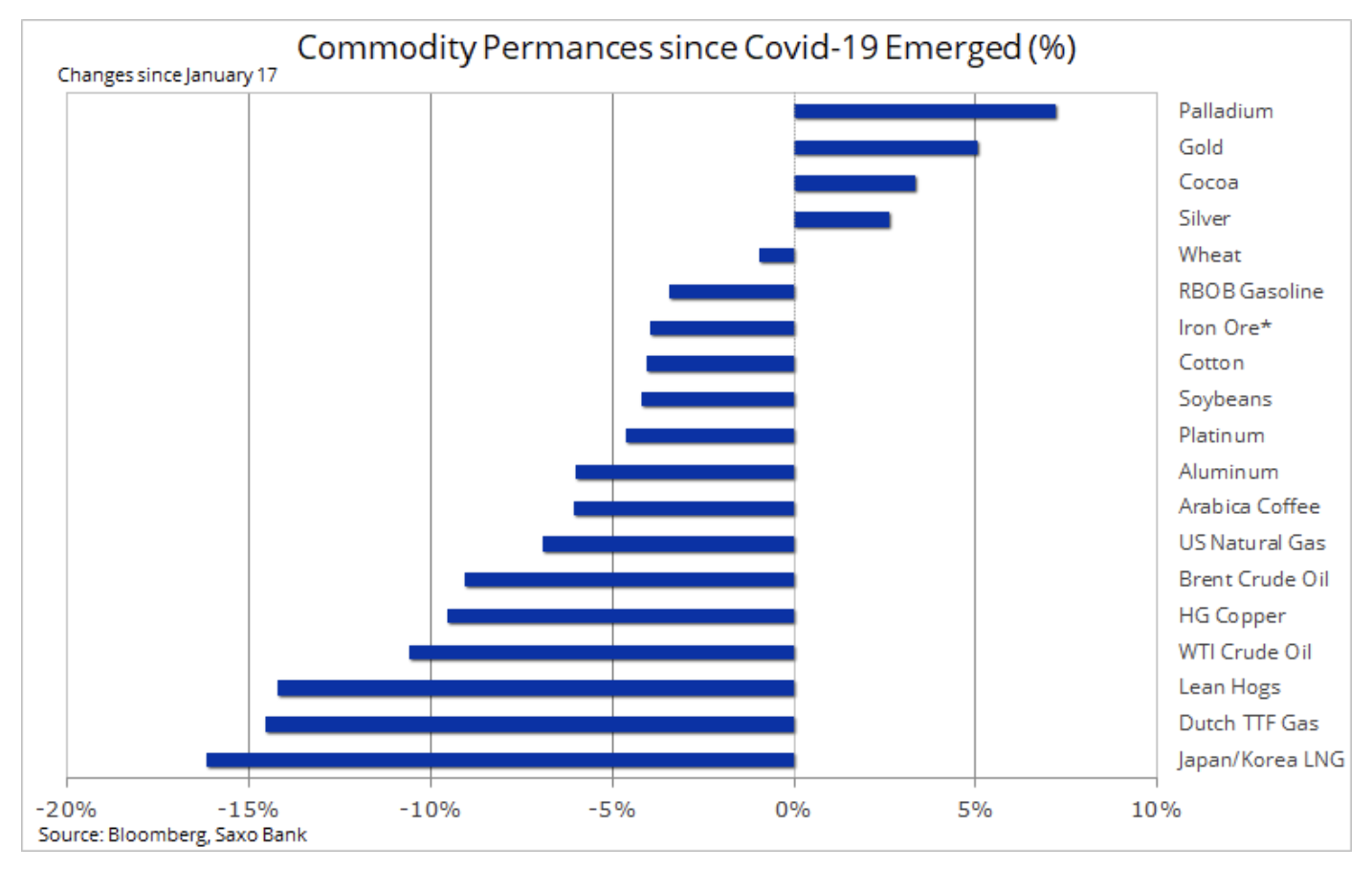

The table below showing the price development of major commodities clearly shows that the demand-driven markets in China were the hardest hit. Raw materials with limited supply chains, such as palladium and cocoa, avoided the effects of this storm, while the need for safe investment continues to drive demand for silver and, above all, gold.

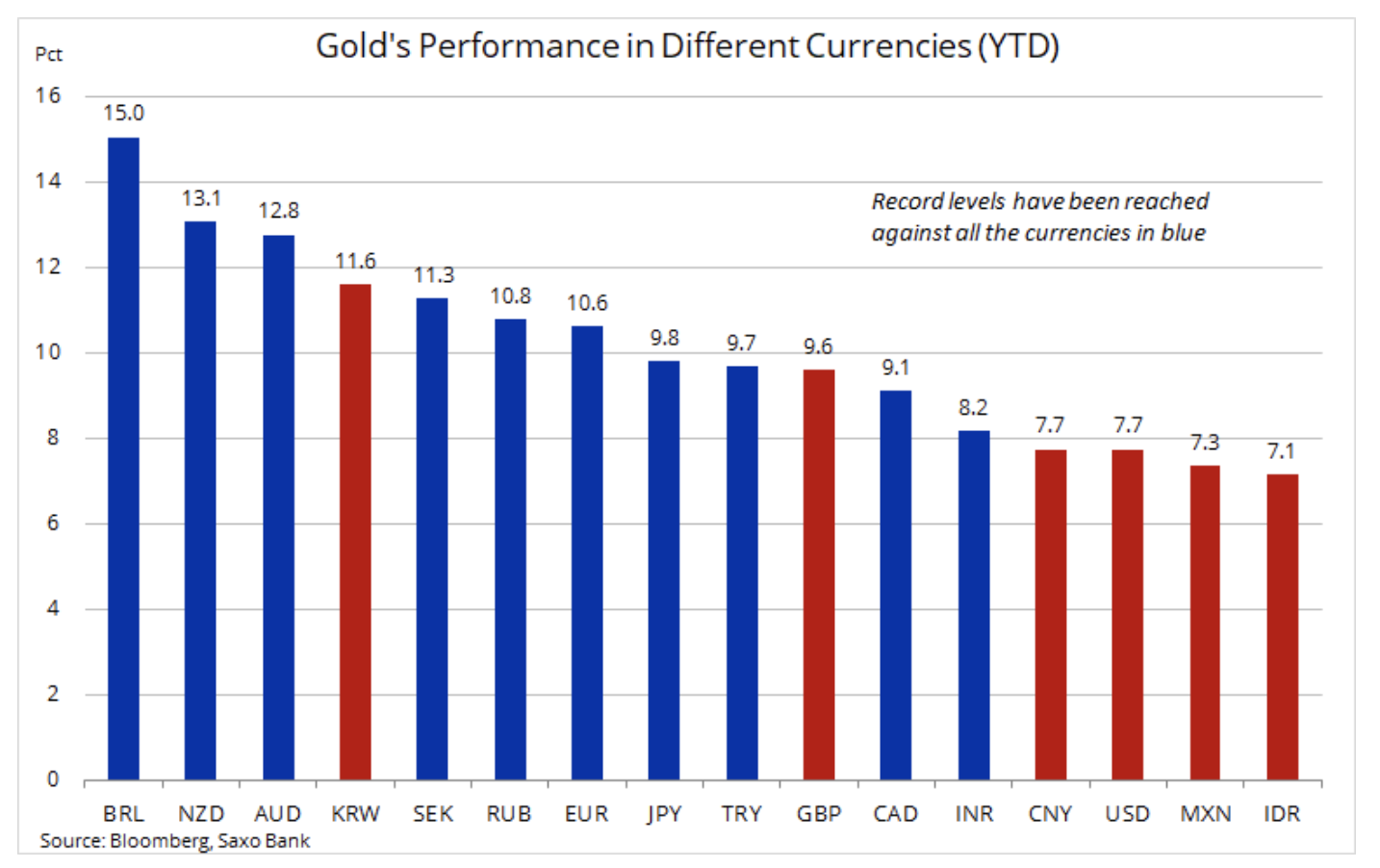

An almost perfect gold storm is underway, contributing to a strengthening in prices. Most importantly, the past few weeks have proven gold's ability to gain an advantage even despite the dollar appreciation. The usual negative correlation was broken, leading to significant gains against most major currencies. Record highs have recently been recorded against 10 of the 16 major currencies, with gold priced in dollars still farthest from the 1 record at $ 921 / oz.

Recently, gold has continued its impressive bull market, reaching a new seven-year maximum after the highest profit on a weekly basis for over six months. As we have already mentioned, this last move was particularly admirable due to the fact that it occurred at a time when the dollar strengthened against many key currencies. The appreciation of the dollar was particularly noticeable in relation to the euro, which fell to almost the lowest level in three years, while gold valued in euro recorded a new record, exceeding EUR 1 / oz, thus reaching the next stage of the bull market started at the end of 500 slightly over EUR 2018 / oz.

Be sure to read: Precious metals break records

So where is the demand for gold coming from while US stocks continue to hit record highs and the dollar is gaining in value? We believe the combined impact of additional interest rate cuts, more fiscal stimulus, negative US real bond yields - which have fallen to their lowest in seven years, down to -0,15% - and increasing concerns about future corporate earnings will continue to contribute to increase strategic diversification and demand for safe investments. In addition, there is a clear risk that the virus outbreak could have much longer lasting and more severe effects.

January was a particularly worrying month for markets due to tensions between the United States and Iran and the outbreak of the coronavirus outbreak. In January, the volume of gold-backed equity funds held by investors rose by an average of 1,3 tonnes per day. In February this volume, despite the aforementioned appreciation of the dollar and the revival on the stock exchanges, has so far increased by 1,9 tons per day.

While Goldman Sachs estimates the price of gold will hit $ 1 / oz, Citi Bank maintains that the increase could reach $ 750 / oz in the next 2-000 months. After reaching the 12 target ($ 24 / oz), the price of gold is likely to rise further as a result of the coronavirus outbreak, as it is difficult to estimate what at this stage could halt or inhibit the boom, perhaps apart from its own success, which has led to over-buying in the market in the short term. From a technical perspective, using the Fibonacci rollout, the next target is $ 2020 / oz with support at $ 1 / oz.

In our last weekly review of commodity markets We mentioned that resources better than stocks illustrate the real impact of the virus epidemic. In particular, this applies to the fact that the epicenter is in China - the country that is the world's largest consumer of raw materials. On this basis, we remain concerned that the full impact of the slowdown in China and elsewhere on other markets has not yet been properly factored in.

Situation on the stock and commodities market

The stock market has seen a strong recovery after investors have increasingly become resistant to obvious risks. They focused on support in the form of low inflation, low interest rates and central bank activities, primarily the US Federal Reserve, which continues to provide liquidity injections to the market.

Copper and oil have given investors some relief in recent weeks, catching up some of the major losses recorded in January. Oil has found additional support in the form of exacerbating supply disruptions in Libya, US sanctions against Rosneft in connection with the group's support for Venezuela, and hope for additional production cuts from OPEC +. At the same time, copper has responded positively to the activities of the People's Bank of China to support the economy through lowering rates and providing additional liquidity.

So far, however, from a technical perspective, the recovery in the markets for these commodities is relatively small. Both copper and crude oil struggled to hit the 38,2% retracement of the last sell-off. Based on this, we believe that short-term risk is again tied to a decline. Our opinion is influenced by further fears that the further spread of the coronavirus will overshadow hopes for mitigating its effects in the face of the biggest demand shock since the 2009 global financial crisis as a result of China's fiscal stimulus.

Source: Ole Hansen, head of department of commodity markets strategy, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response